Market Update: UK not growing really, not growing nominally

Bad timing for a technical recession, Christian Adams, 15 February 2024

UK not growing really, not growing nominally

The UK has had no real growth for two years but last week’s 2023 Q4 GDP data confirms a slight recession. Should the Bank of England respond?

The anatomy of asset bubbles

Only hindsight can distinguish between a bubble and justified price rises. But we might be able to tell if there are ingredients which might lead to a mania. Is the AI driven tech sector a case in point?

UK tax cuts now but the fiscal bind tightens

Fiscal headroom may have declined over the past weeks with the rebound in government bond yields. No matter, the chancellor will still get his tax cut giveaway. When do the chickens come home to roost?

UK not growing really, not growing nominally

As regular readers will know, we tend not to comment on UK matters as much as some, partly because the investment portfolios we manage for UK clients are quite globally focused. But the UK as our home is important to us and last week we had an enormous amount of important domestic information. And, of course, the upcoming Spring Budget and General Election potentially later this year will affect us all.

The UK is in a technical recession, defined as two quarters of real growth contraction (‘real’ = after subtracting inflation). There is much discussion about whether this is really a recession, what that means for public policy and, of course, what it means for the election.

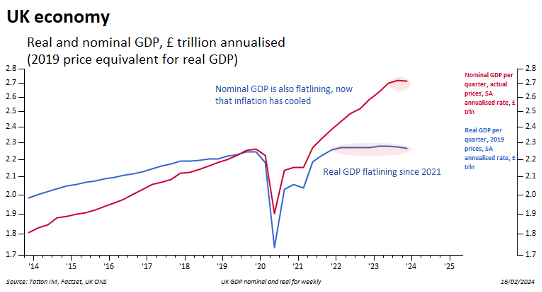

October-December gross domestic product (GDP) came in at -0.3% quarter on quarter, or an annualised -1.4%, worse than the consensus of -0.1%. The previous quarter’s growth rate was unchanged at -0.1% and that means economists talk of a recession. The most recent data is skewed down by health worker strikes (exacerbated by the problems of accounting for the value of public sector activity) and other one-offs (we hope), like bad weather hindering construction, but growth has been weak for a year. From a 12-month perspective, the 2023 Q4 GDP value has now fallen below the 2022 Q4 GDP reading, confirming a flat-lining 2023 UK economy.

Sam Tombs of Pantheon Macro – a well-regarded UK economics consultant – tells us that GDP will return to a rising path in 2024, and that the Bank of England’s Monetary Policy Committee (MPC) needn’t panic about collapsing activity. He calculates that households have started to save more after wild swings during and immediately after the pandemic, and thinks this comfort buffer will push up consumer demand as wages will be rising more than inflation.

Sam has a point. This same dynamic appears to be underway in the US, where robust households have been a big component of the continued resilience of their economy. Meanwhile, last week’s release of UK jobs market December data showed surprising tightness. The unemployment rate fell back to 3.8% rather than the expected rise to 4%.

We have mentioned before that the quality of official UK economic data has worsened but not because the Office of National Statistics is doing a bad job. Firms, agencies and people are not responding to requests for data as they did in the past. We can all come up with reasons why this might be the case, but it doesn’t alter the fact that we cannot rely on at least some of the ‘facts’ as we used to.

Both labour force data and GDP data are suspect, but price data are a bit more reliable and that leads to another point. The measure of prices used to compute GDP data on a real basis is called the deflator and differs from the more usually quoted consumer price indices. Last quarter’s deflator growth was very low at less than +0.7% quarter-on-quarter annualised, indicating that nominal growth is now very weak as well.

This marks a change which we think the MPC will (or at least, should) take seriously. The base rate is at 5.25% and has looked high relative to near-constant 0% real growth; the GDP level of about £2.2 trillion (in 2019 money) has not changed for two years – in other words, real growth is at zero. Indeed, the real level is now below that of a year ago, not just two quarters. The high base rate was justifiable only when total current activity growth (‘nominal’ which includes inflation) was growing strongly. Now, nominal growth is barely changing and has been nearly the same level for the past three quarters.

Research through the past 20 years has suggested that a central bank reaction function should not be ‘symmetric’ in the face of an economic contraction. Compared to growth-phase tightening, a contraction-phase easing should be quicker or more aggressive or both. That’s easier said than done because evidence tends to be of lower quality as contraction begins (such as now?) and also committee-based decisions tend to be slow unless there is strong leadership.

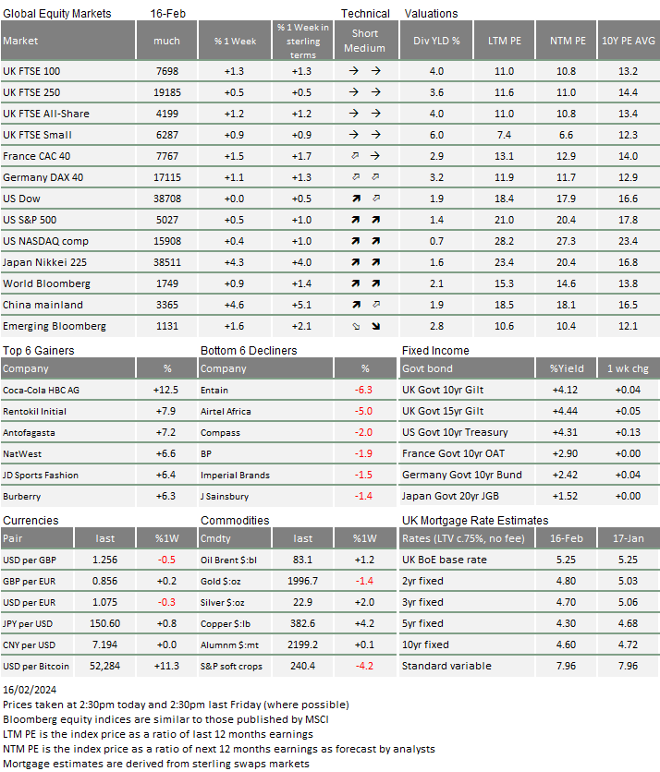

The market is pretty convinced that cuts will have happened on or by the 20 June MPC meeting. There are meetings beforehand on 21 March and 9 May. As you can probably tell, we think there is enough fuel for a rate cut now but the dynamics of the MPC are not conducive for a 0.25% cut, but it is possible. In the 1 February meeting, two MPC members voted for a rate rise, one for a cut, and the other six for no change. There is a high probability that tax cuts will happen on 6 March and that the ensuing small fiscal boost might lead the MPC to delay.

A number of emerging market central banks have already started easing rates but developed markets are being dominated by the path of US rate expectations. Perhaps the similarities in tightness of labour markets in the UK and Europe might cause one to think this is reasonable. Yet the paths of domestic inflation and money supply growth are differing enough to suggest that the European Union and the UK will have to forge their own path, and that the US be stuck at higher rates.

Aiding this view, the European Commission published its forecasts on Thursday (15 February) which were downbeat. The Eurozone is now expected to grow just +0.8% for 2024, down from +1.2% in its autumn forecast. Inflation is expected to fall from +5.4% in 2023 to +2.7% in 2024, lower than the autumn forecast of +3.2%.

The Financial Times quoted Paolo Gentiloni, the EU’s Economy Commissioner, thus: “The rebound expected in 2024 is set to be more modest than projected three months ago, but to gradually pick up pace on the back of slower price rises, growing real wages and a remarkably strong labour market.”

Meanwhile, for Europe and the UK, energy prices are a big factor in business input costs. The rise in oil prices might make one think things are going badly, and that energy costs are rising. The good news is that natural gas prices continue to decline and that is a decisive factor in the downswing in electricity prices. This will benefit manufacturers as long as demand holds up. Signs are that manufacturers are feeling less awfully negative, but there’s a long way to go to get to outright positive. Part of the story ought to be that central banks recognise the declining inflation environment and don’t allow real interest rates to become higher through neglect.

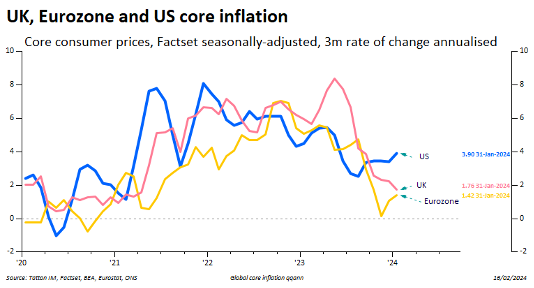

The divergence in US and European paths picked up some more evidence with the US January inflation data. US inflation surprised on the upside with core inflation rising again and by nearly 1% in three months resulting in an annualised rate of just under 4%. This compares to Europe and the UK where we calculate the three-month annualised rate of change to be less than 2% for both as the chart below shows:

This divergence is at the heart of yet another rebound in 10-year US Treasury bond yields to above 4.3%, while Europe and the UK yields are more static. But because most of the rise is due to inflation expectations, US real yields have risen only slightly. We tend to think that equities are most impacted by changes in real yields, so this episode of rising US yields is not having much effect on the equity market.

Indeed, as we approach the end of the quarterly corporate earnings season, analyst expectations of earnings growth have taken another step up and the S&P 500 has now more solidly broken above 5,000. The good news is that despite the differing real yield dynamics other equity markets are following suit with the FTSE 100 at 7,700. Even China managed a substantial gain of 5% during the start of the year of the Dragon. Happy New Year!

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.