Market Update: M&A activity sets growth against value

Matt, 21 February 2024

M&A activity sets growth against value

Consumer confidence is yet to catch up with business sentiment which is now driving a flurry of value seeking mergers and acquisitions.

Into the Questverse: Is AI analysis changing market patterns?

Unsurprisingly, investors are now asking AI to help them make better decisions. Might that fundamentally change how markets react to events in the future?

Uranium goes nuclear

We look at the factors fuelling the recent rally in the price of Uranium, the world’s most controversial commodity.

M&A activity sets growth against value

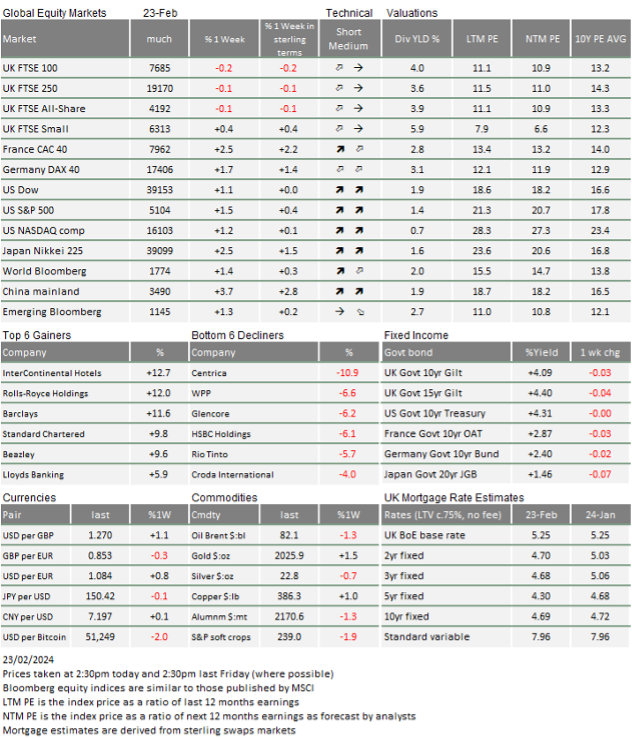

Equities have moved higher again last week, with gains made across global markets. Even China put in another week of positive returns, following the largest ever-cut to the five-year housing loan prime rate (admittedly only 0.25%). Government bonds have not done so well, with yields rising slightly after a small rebound in general economic growth optimism. Corporate bonds fared better as yields remained broadly unchanged, on the back of that optimism leading investors to judge that credit risks are likely to recede even further.

The week before last, we gave a fairly downbeat update about the potential for near-term UK economic growth after the release of the gross domestic product (GDP) data for 2023. Last week, some economic data reinforced the story that the UK remains in the doldrums. GfK released its consumer confidence survey results for February, showing that the long-running Consumer Confidence Index fell from -19 to -26, while all measures were down in comparison to January.

Joe Staton, GfK’s Client Strategy Director, said, “This is the lowest headline score since January 2021, one of the worst points in the Covid crisis. While all measures have fallen this month, the two forward-looking indicators tapping sentiment over the next 12 months on personal finances and the wider economic situation are showing the biggest falls – these are down 12 points and 11 points, respectively. There’s clear anxiety in these findings as many consumers worry about balancing the household books at the end of the month without going further into debt”.

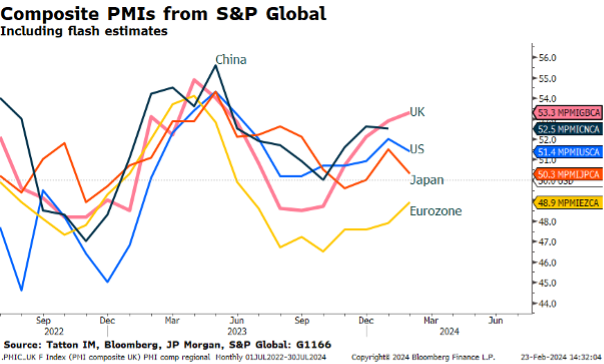

And yet… UK business confidence is picking up! Many investors, including ourselves, put a lot of store in the Purchasing Manager Survey Indices (PMIs) and the February interim ‘flash’ PMI estimates showed services doing particularly well, with manufacturing less well but still better than January. The overall composite had a welcome rise, better than the US and the Eurozone:

So, should we be downbeat after all? The PMI data is definitely good, with companies getting more positive on their outlooks and therefore on their hiring and business investment intentions. Europe, especially France, has also improved. although things are still only getting to be flat. With interest rates still high relative to activity, it’s not so likely that there will be a drawdown of domestic savings and increased consumer demand. The best hope for both the UK and Europe is the resurgence of China. The US has been strong, but not much external demand is emanating from there. Overall, for the rise in optimism to be maintained, we think rate cuts in relatively short order are still needed on this side of the Atlantic. The good news is that China may well be starting to show more optimism as well. We will get its PMI data at the start of March.

Given how much the productivity improvement hopes around artificial intelligence (AI) have elevated investor sentiment, Nvidia’s Q4 2023 results announcement and guidance for Q1 2024 last week was as much talked about as a market driver as we usually only experience for big economic data releases. Expectations were for huge revenue and profit growth figures, and humungous they proved to be.

Nvidia stated that revenue for Q1 2024 will be about $24 billion versus predictions of about $21.9 billion on average. Q4 2023 revenue tripled to $22.1 billion (expected $20.4 billion) from a year ago, and profit after exceptionals was $5.16 per share (expected $4.40). The data centre division, the largest source of sales, was up 409% from the same period a year earlier. Jensen Huang, Nvidia’s founder and CEO, said: “Generative AI has kicked off a whole new investment cycle…Accelerated computing and generative AI have hit the tipping point”.

This will, in his opinion, lead to a doubling of the world’s data centres over the next five years and “represent an annual market opportunity in the hundreds of billions.”

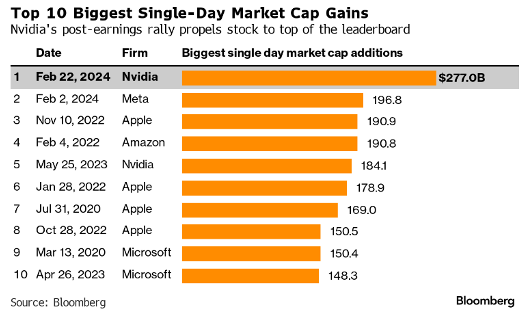

On the back of all this, Nvidia’s share price generated the single biggest one-day gain in absolute market capitalisation of any stock ever – see table below.

And yet, despite the short-term market-moving effect of it, this was probably not the most important corporate news of last week, at least in terms of the next phase of market activity. From our perspective, it was the flurry of merger and acquisition (M&A) news which tells us about a gradual shift in investment sentiment.

Here in the UK, electricals retailer Currys received a cash bid from the activist investor Elliott Partners. The 62p offer was 32% higher than last Friday’s close of 47p. The board rejected it and, subsequently, the Chinese retail internet platform JD.com said it would bid as well, although there are yet to be any details. JD.com is trying to get a foothold in UK retail web markets, and Currys presents an opportunity.

Meanwhile, in the US, credit card company Capital One announced an all-share agreed offer for another credit card and payment system company, Discover Financial Services. For Capital One, the value lies in combining its customer reach with Discover’s payment system, enabling it to compete with Visa and Mastercard. At $35 billion, this deal is substantially the largest this year, although it is not close to being in the top 10 of all time (a deal would have to top $100 billion to reach that accolade).

Nonetheless, Tuesday’s announcement of the deal added value to both companies, with the total market cap rising from about $80 billion to $83 billion. It has slipped back a bit since then, with Discover shareholders happier than those with Capital One.

M&A goes on all the time, so what’s our point? Well, there has been a notable step-up in M&A activity coinciding with the recent market price rises. It appears companies are confident that waves created by the huge rocks of the pandemic, inflation and interest-rate moves are subsiding, meaning that business is stable enough for the near-term for them to look to the medium and long-term. They can see that a well-placed move might enhance investor views of their prospects and bring about a welcome increase in valuation multiples. In other words, investors will pay more for the shares because they expect stronger growth, because a bigger size will help beat off competition.

There is an inevitable consequence when intelligent folk realise that something is happening which they may not be able to explain fully. They stop saying why it shouldn’t be so and simply get on board. The boards of relatively large companies have noticed that being large isn’t enough. They need to be mega, or at least so big that the biggest won’t win everything.

And – different to the historical experience – the very largest have had stronger profit growth. One might argue that these companies are winners because they’ve proved themselves to be the best at growing, and that’s how they get to be the biggest over time. However, it also seems to be the case that being the biggest does confer the probable advantage of ‘owning’ the distribution platform. Businesses and consumers trust the outlets they know and don’t like to shop around too much.

M&A activity has interesting implications for us. Here at Tatton, we are not in the business of picking particular shares (we leave that to the fund managers we select), so we’re not going to try to find bid targets. Rather, the potential buyers are doing what a classic stock picker does. They are trying to find an undervalued, under-recognised company and release value for itself.

From the start of last year, the largest stocks have been the winners, both in revenue and profit performance and in share price valuation terms; the multiples have risen for these ‘quality growth’ companies while they have languished for lesser companies. Now, rising M&A could mean that the ‘value factor’ starts to be valuable. Last week, despite the blow-out performance of Nvidia, mid- and small-cap stocks have marginally outperformed.

The fly in the ointment is regulation. For example, the Competition and Markets Authority is yet to give its opinion on the Vodafone-Three merger deal announced in June last year. Expectations are for this to come at the end of 2024. Meanwhile the Capital One/Discover deal may get done more rapidly in the US, but will still not close until at least the end of this year; a long time and a lot of risk for shareholders.

That is not to say that ensuring a fair and competitive marketplace is wrong, but the process itself does pose some questions, for example:

- How can a regulator block companies from gaining the size to compete when it is unlikely to seek to reduce the size of their larger competitors?

- What should it do when large companies buy thousands of small early-stage companies?

- Should it step in when companies reach a huge size ‘organically’?.

Still, as M&A activity rises, the likelihood is that investors will start to look for value. It will be enhanced substantially if buying companies feel that they want the targets with some cash, especially if they fund it with borrowing. That sends the message that interest rates are affordable.

The wait may be over and ‘Value’ may get a boost.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.