Market Update: Market quiet on the Middle Eastern front

Limited signs of intelligence, Ben Rich, 18 April 2024

Market quiet on the Middle Eastern front

Capital markets have corrected at the same time as the conflict in the Middle East intensified, yet the asset price dynamics tell a different story.

Real yields, real growth?

Inflation adjusted bond yields are a brain teaser at the best of times, however, understanding what they are telling us right now is very helpful.

Mexican peso going strong

An outlier amongst the non G7 economies, Mexico’s currency strength reveals much about the growth of its economy as it does America diversifying supply chains away from China.

Market quiet on the Middle Eastern front

The Middle East is dominating world news again, as the awful moment has come when Israel and Iran have engaged in open and direct conflict, albeit at great distance. That the warfare is across considerable distances makes it different to close conflicts like the Ukraine war, and introduces a clear danger that war could spread across the Middle East – a region that is still of great importance to the global economies’ oil supply.

However, currently neither side has a quick-win strategy or indeed any interest in deepening the conflict. It appears that Iran and Israel have reached a point where punctuated aerial attacks are likely to be the maximum level of conflict. Mistakes are possible and Gaza and the West Bank still remain the focus of Israeli attention, and Israeli public support. Gaza’s population is in a dire condition and remains the greatest issue. Israel feels that it must remove the ongoing threat but can only make slow progress. Even then, the cost is dreadful and causes terrible suffering.

Israel’s allies are much more powerful and committed than those of Iran, but do not want any expansion of the conflict. Iran’s regime is weak in many ways, especially in its popular support. While war can be a means of bolstering support, it is not likely to be effective for most Iranians.

The acts of the past couple of weeks might not be described as the opening shots in a full scale conflict, but according to some observers, they were designed to be ineffective, indicating powerfulness but causing little actual damage or loss of civilian life. The retaliations assuaged internal critics but were designed to make sure external parties remained uninvolved. In a sense, therefore, the actions from both sides in the past days offer more hope than concern.

Inevitably, it is our job to consider what effects the conflict has on investments and markets. It may surprise readers that the market downdraft we have experienced for the last few weeks was only partially influenced by the hostilities in the Middle East and the risks to global oil supplies that these bring.

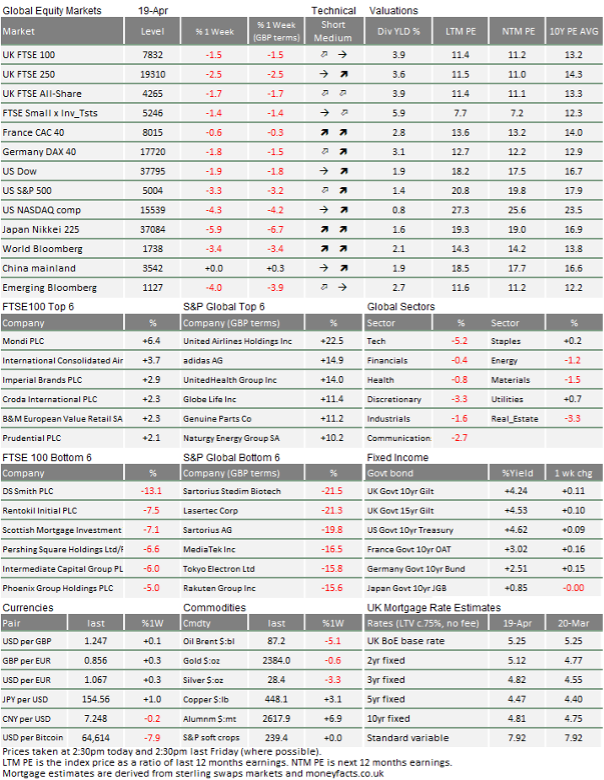

Through the course of this week, the US dollar strengthened and equity markets weakened again, showing that investors’ risk appetites have ebbed. This is because a broad range of factors have changed, compared to the more upbeat first quarter of the year. Perhaps unsurprisingly therefore, the assets most under pressure are the best performers year-to-date, suggesting that investors are keen to book profits. Japan’s Nikkei 225 Index fell the most among the majors, -6% in Sterling terms, having still been the outperformer last week. Tech stocks were also hit hardest among sectors, with Apple having falling 6% on fears about Chinese sales and Tesla continuing its very poor run, down 12%, despite announcing a major cost cutting plan.

In currencies, the Mexican Peso fell back 5% against the US dollar following its very strong run. We write about the Peso’s background below and what it tells us about changing investment opportunities beyond the economies of the G7 group of nations. Major currencies like Sterling, Euro and Yen were only slightly weaker, but notably remained stable when Israel’s alleged retaliation strike on Iran occurred today.

Government bond yields went higher (and so bond prices were lower) during the first half of the week, after Iran’s drone and missile strikes. However, it was notable that real yields – i.e. what remains of bond yields after subtracting the expected rate of inflation – did not move much. The exception was in the US, where real yields almost matched the rise in nominal bond yields.

One might have expected oil prices to surge, but the pricing of Brent crude oil futures has been very stop start. Brent hit a high of $92 per barrel on Friday morning, before slipping again ($87 at the time of writing) as they did on each day last week, despite or perhaps because of the news from the Middle East, as we discussed above.

Risk appetite and growth optimism are strongly linked together (our chief economist says one might draw a theoretical distinction but it’s almost impossible to distinguish in practice). Weaker markets clearly suggest that investors’ growth optimism has shrunk in the past few days. That almost certainly has to do with changing expectation about near-term interest rate cuts, and how these may influence both bond yields and global growth this year.

We noted in the past few weeks that stubborn inflation pressures were putting central bank decision makers under pressure to become less dovish, and Jerome Powell duly delivered that message on Monday. While he did not say that rates might go up, he indicated that they would probably have to wait longer for the first rate cut than previously expected.

Interestingly, Andrew Bailey was faced with similar questions last week after the higher than expected UK inflation data (at 3.2% year-on-year for March, versus expected 3.1%). He chose to downplay this, appearing mildly dovish. Investors still expect a rate cut in late summer and Bailey made it clear that we wouldn’t necessarily have to wait for the US to act.

Bond markets appear to be in a bit of a dilemma. Inflation is potentially more embedded than thought. Yields rose over the first quarter because both inflation and growth dynamics were stronger than expected, especially in the US. Now, expectations of growth are being challenged and bond investors are having to discount the possibility of relatively tighter policy, at least for the short term.

Still, it seems the biggest change is coming in risk markets. Higher bond yields may reduce growth expectations, but the biggest issue is that equity analysts have already forecast strong enough growth to generate a 10% jump in S&P 500 earnings per share in a year’s time. The external risks challenge that optimistic outlook.

And, investors have been even more optimistic than the analysts, pushing the price-to-earnings ratio valuation on those optimistic analyst forecasts up to historically expensive levels. Last week, the ratio actually fell to 20x from the above 21x level seen at the start of the month. Nevertheless, the 10-year average is 18x.

The recent tendency for investors to back trends also seems to be adding to the current picture. Trend-following funds were active last week, but this time selling rather than buying. These types of fund are much more prevalent in the US and that’s adding to the volatility and rising sense of risk.

Worrying about overoptimism does not mean we should give up on optimism about the medium-to-long-term picture, given the risk and expectations of meaningful recession have all but disappeared. The current volatility is very normal, indeed more usual than the unremitting daily gains of the earlier part of the year. Markets may well get less expensive relative to expected earnings, but that doesn’t mean earnings will fall.

In fact, it may well be that a little less exuberance in markets could help reduce inflation expectations more broadly. That should help central bankers get back to thinking about cutting rates. And then, the rate driven growth cycle can begin again.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.