DPMS Portfolio Commentary

2024 had a relatively rocket start with inflation coming in higher than expected across developed markets driving bond yields upwards and capital values down, the Purchasing Manager Index (PMI) surveys showing relatively weak results and geo-political instability in the Middle East unnerved investors. However, recent weeks have seen a reversal of this with some strong Q4 earnings results, improved consumer sentiment and optimism towards the first interest rate cuts since 2020.

![]()

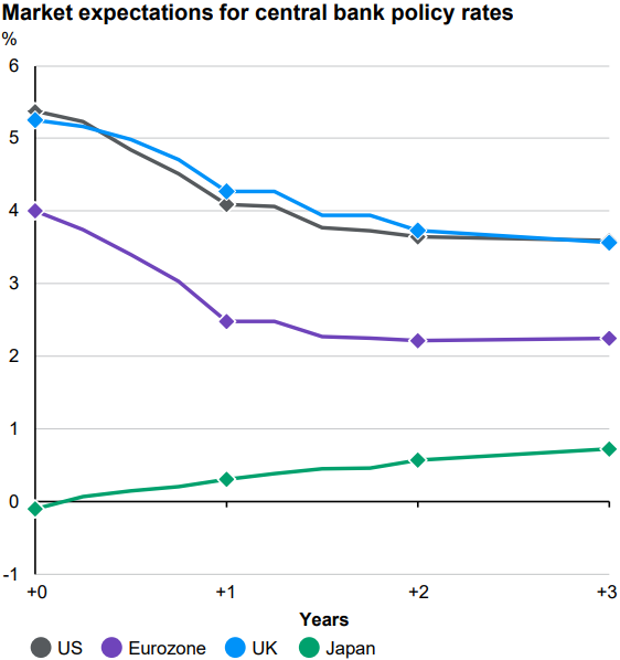

Rate cuts are at the forefront of economic discussion with Central Banks now looking to ‘reward’ investors for their patience in the face of some of the highest interest rates seen since 2008. The question for rate cuts now seems to be ‘when’ instead of ‘if’ and how large the cuts will be. Central Banks remain elusive on providing any timeline and insist on following the latest inflationary data as their guidelines. This surge in rate cut optimism led bonds to their strongest performance in Q4 2023 since 2009 with US Growth equities soaring, led by ‘The Big Seven’ which benefited from the continued future prospects around Artificial Intelligence (AI). We expect the US economy will remain well supported with the US Dollar maintaining its strength, despite concerns around oil prices and their effect on the Dollar.

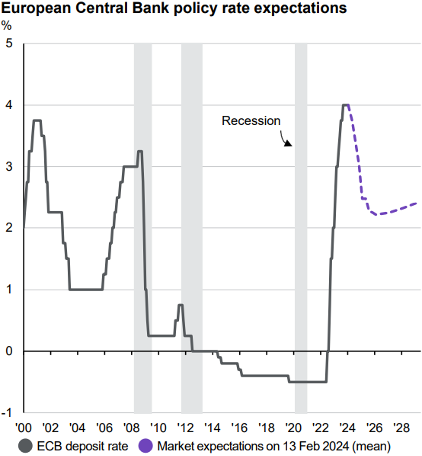

Market performance was weaker for the Eurozone and the UK as higher interest rates continued to press down on corporate earnings but the optimism around rate cuts was still warmly received. Corporate earnings will continue to be placed under pressure and possibly revised downwards if weak sentiment and PMI figures continue. A technical, but shallow, recession is possible for Europe but we remain relatively positive about this as we expect rate cuts and falling yields to be more severe.

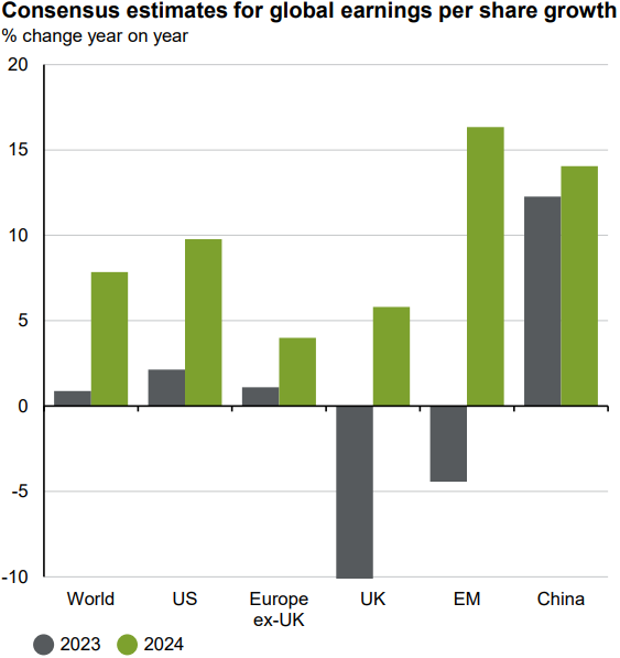

Given the inflationary pressures from 2022 and 2023, these increases have largely been passed on to the consumer which is expected to result in significant earnings growth in 2024 as shown below. Although global growth may be fairly anaemic in 2024, company profits are expected to increase which when combined with expected interest rate reductions could result in positive market sentiment as we move through the year.

![]()

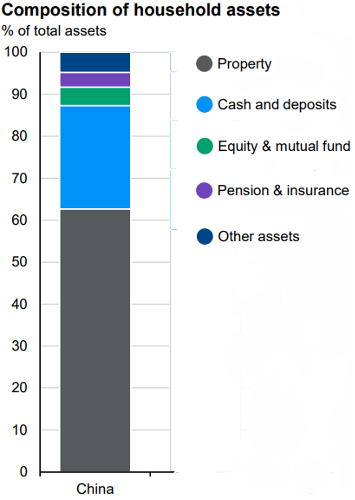

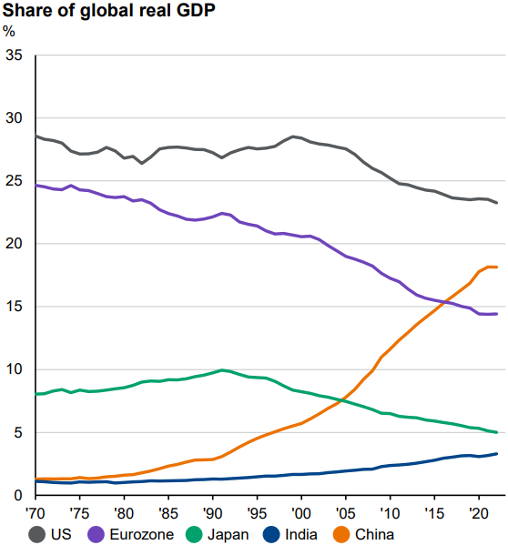

Asian equity performance remains mixed as China’s domestic growth and property region woes continue to mar the region. Whilst the country is still struggling to find its way in the post-COVID world, valuations are very cheap and, should a solution be found to salvage the property sector, a strong recovery may come. Indian equities have been a strong beneficiary from investors moving away from China, showing similar structural dynamics with a fast-growing population & middle class and do not tend to suffer from global supply chain issues.

![]()

![]()

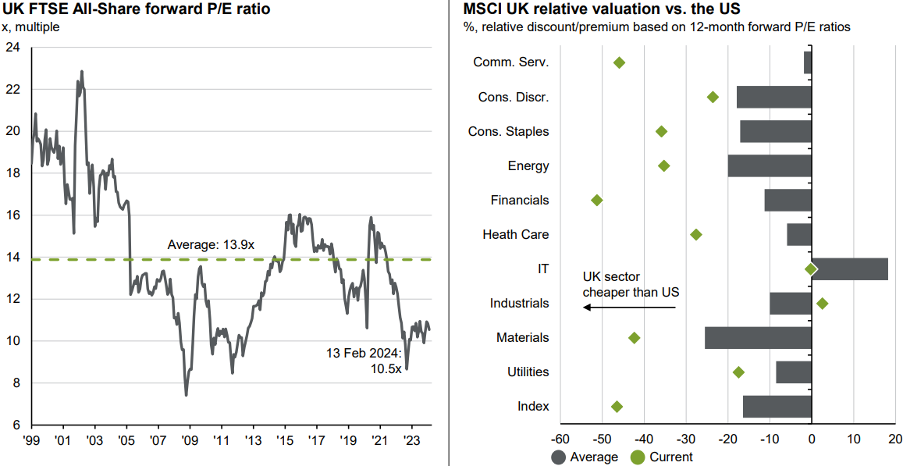

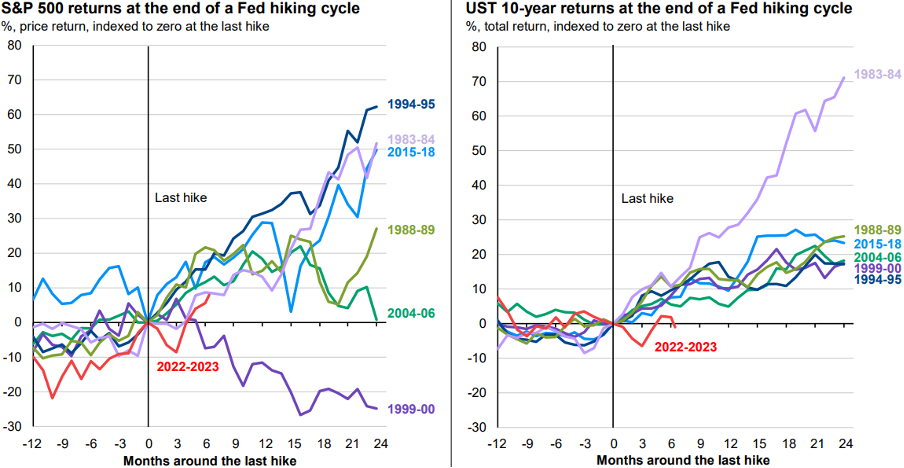

Based on the above expected interest rate reductions in 2024, the Vizion Wealth Investment Committee has agreed to slightly increase medium and long duration bond exposure and reduce equity exposure. In periods of rate cuts, bonds have more reliably outperformed equities and provide a reasonable level of protection in periods of corporate earnings or economic downgrades. We have also agreed to re-introduce a UK flexi-cap fund through the introduction of the JOHCM UK Dynamic fund, that allows the manager full flexibility of investing into across the full market cap spectrum. Mid and small-cap equity valuations remain extremely attractive given their difficulties over the past couple of years and present a good buying point with possible interest rate reductions expected which should assist economic recovery throughout 2024.

We are also reducing exposure to Asian equities in favour of Indian equities. Long-term growth prospects for India remain very strong with a low correlation to developed market equities which may suffer from corporate earning recessionary pressures. Finally, we have replaced the L&G Strategic Bond with Invesco Monthly Income Plus in the Sterling Strategic Bond sector. The fund has an extensive and successful track record across different economic conditions with the flexibility to invest into different grades and durations of fixed interest instruments. The fund also has a great exposure to medium and long duration bonds, that are expected to provide more upside potential in the event of interest rate reductions.

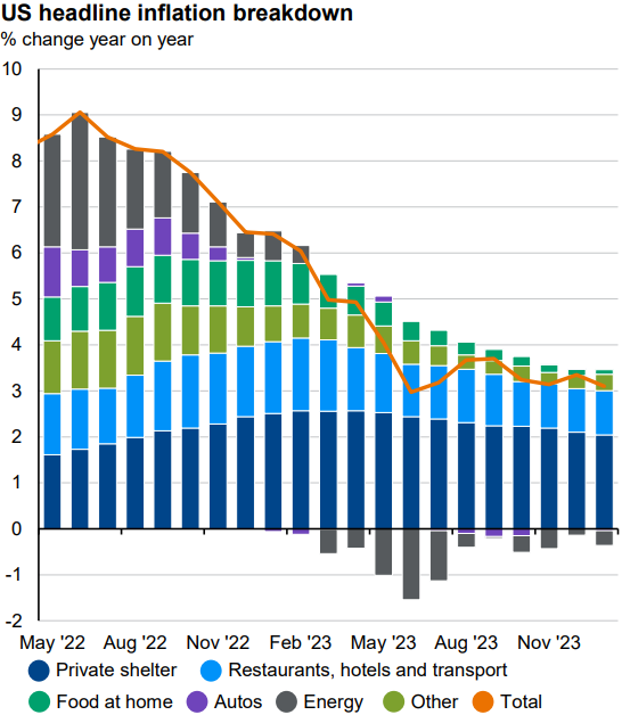

As mentioned, US Equities have seen a period of strong performance due to its overall Tech and Growth bias in a period of optimism around AI and rate cuts. Inflation has fallen from its heights of c. 9% in July 2022 down to 3.4% in December 2023, generating hopes of rate cuts from The Federal Reserve in Q2 of 2024. The US Central Bank continues to assess rate cuts in line with inflationary data and has held interest rates at 5.5% for December. We believe that US consumers will continue to be resilient and bolster their economy, though eroding levels of personal savings, higher mortgage rates and geo-political risks may cause some difficulties. Therefore, we are retaining our preference for Larger US companies with an overall Growth bias to avoid default risks and protect against earnings downgrades whilst capturing the momentum a rate cut may provide. US mega cap valuations remain high which could result in future volatility despite the recent AI rally.

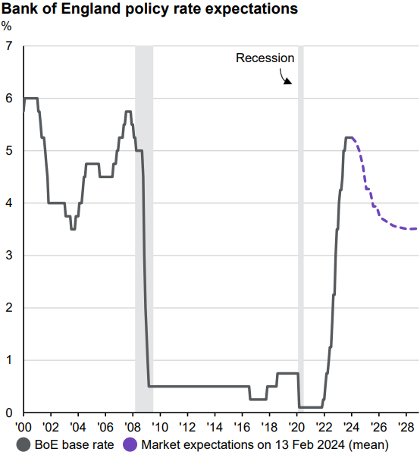

![]()

The UK’s easing inflation helped to provide some relief to equity markets, particularly for mid and small-caps due to strong domestic demand and a strengthening Pound. Concerns do remain over the ‘higher for longer’ interest rate regime, particularly over mortgage debt, and weakening Manufacturing PMIs but valuations remain attractive for the ‘unloved’ UK market. We have therefore decided to increase exposure to mid and small-caps due to the attractive entry point and recovery potential in 2024. Many UK companies have global market exposure with overseas earnings and present attractive opportunities for investors due to their historically low valuations. Our preference for Value remains in the UK due to the strength of traditional Value sectors, such as Financials and Industrials, although we are starting to increase exposure to Growth Equites through the Flexi Cap fund in line with possible base rate reductions in Q2 of 2024.

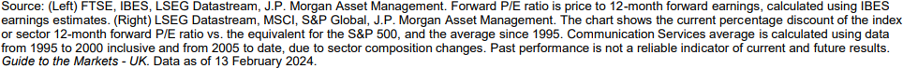

The Eurozone’s position continues to look similar to the UK but inflation continues reduce at a faster rate. It is possible based on current market data, there could be a shallow recession in Europe, but we expect this will lead to quicker and larger rate cuts. We also expect Europe to benefit significantly from the deployment of EU Recovery Fund grants which are expect to accelerate in 2024. Because of this, our preference for Growth-focused equities remains and we expect to see a strong recovery for the region once rates start to fall.

![]()

China continues to cast a shadow over wider Asia as policy designed to stimulate domestic growth failed to deliver and property debt woes continue to cause difficulties for the property sector. With the majority of the middle class’s investments remaining tied in property, which remains largely inaccessible for the time being, the sector needs to be rescued before investors can access their capital and stimulate domestic growth. Given the focus on a longer term economic growth plan, we expect China to refocus its domestic market to work toward a strong recovery at some point in the future.

![]()

India continues to look attractive as its continued momentum has delivered strong stock market returns. The country’s fast-growing population and strong domestic demand makes it a very positive prospect whilst generally steering clear of global supply chain worries. To benefit from this continued momentum, we are introducing the Jupiter India Select to portfolios, which has identified very strong Growth opportunities in India (and surrounding countries such as Sri Lanka and Bangladesh), which tend to show strong performance when India is in favour with investors.

![]()

Japan continues to attract attention from global investors following its significant shift towards western business standards. The country offers access to global companies and Asian consumers but has also benefitted from the exodus of investors’ funds away from China. We continue to maintain an overall balance towards Style across Asia, Emerging Markets and Japan whilst pinpointing the strengths of each economy from Stylistic and Geographic diversification.

Corporate and government bonds currently offer attractive risk return prospects in the near future with rate cuts now on the agenda for investors. A glimpse of this was seen in Q4 2023 but has reversed slightly due to December’s inflation print coming in higher than expected. Prospects still remain that capital values will soar as yields fall in line with rate cuts throughout 2024, with Central Banks expecting to start cutting rates in Q2. Rates are currently expected to fall by 0.50-0.75% in 2024.

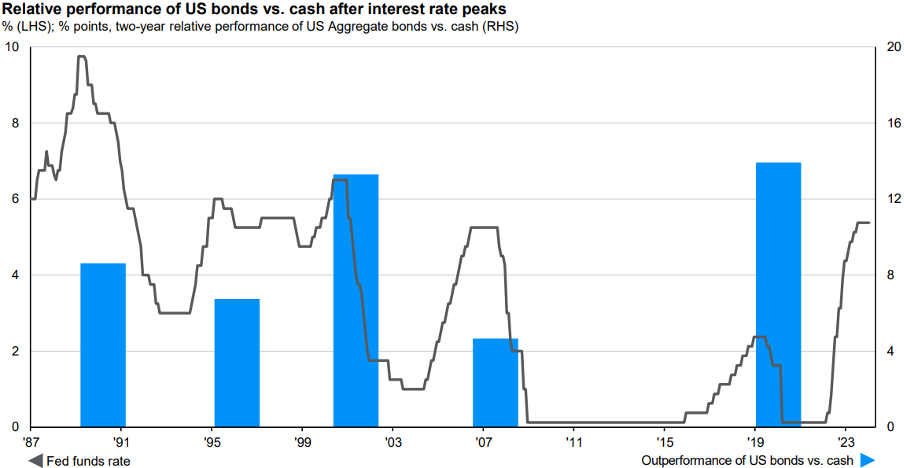

Given this expectation, alongside the defensive characteristics of fixed interest versus equities, we have decided to increase allocation to fixed interest instruments in favour of sustainable energy-focused equities. As mentioned above, fixed interest more reliably outperform equities after peak interest rates and are currently providing high yields with a good level of downside protection. Sustainable energy equities are facing some difficulties as new projects have been sidelined due to high up-front costs. We expect that the ‘higher for longer’ rate regime will cause difficulties for this, despite the funding gap required to be filled for sustainable energy to meet Net Zero targets by 2050. We retain a reasonable exposure to sustainable energy and similar sectors through our Infrastructure exposure.

![]()

Whilst Cash rates continue to be high, we do not consider it to be worthy of a larger allocation in the long term. As explained in previous updates, if economies are resilient and perform better than forecast, we would expect equities to outperform and offer a greater return than cash as we enter recovery. With inflation and bond yields expected to fall, this should translate to receiving good levels of bond yields along with potential capital upside that should offer a greater return than cash which is expected to become less attractive as base rates fall.

![]()

That said, banks do remain competitive in their offerings of around 4-4.5% for instant access accounts, around 4.5-5% for 1-year fixed rates and around 4-4.5% for 3-year fixed rates. Transact, as our platform of choice, are the only platform in the market to pass on all interest on overnight client cash earned from 7 major banks and this returned 4.88% AER for instant access cash savings in January (offering full FSCS protection for each bank), please let us know if you wish take advantage of this. We do not charge any fees on cash within designated cash wrappers.

Overall, the changes to the portfolios have tilted towards a higher level of optimism for medium and long duration fixed interest funds compared to equities. We retain our tactical biases towards what we deem to be stronger sectors within each geographical region as we look beyond peaking interest rates. Our portfolios remain well-positioned for long-term growth by focussing on potential opportunities in both the equity and bond sectors. As always, if you would like to talk to us about any aspect of your investment portfolio or risk profile, feel free to contact your financial adviser.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

DPMS Portfolio Commentary February 2024

2024 had a relatively rocket start with inflation coming in higher than expected across developed markets driving bond yields upwards and capital values down, the Purchasing Manager Index (PMI) surveys showing relatively weak results and geo-political instability in the Middle East unnerved investors. However, recent weeks have seen a reversal of this with some strong Q4 earnings results, improved consumer sentiment and optimism towards the first interest rate cuts since 2020.