Market Update: US stock market entering bubble territory?

Rachel Reeves imposes ‘Bank of England discipline’ on Labour, Christian Adams, 8 February 2024

US stock market entering bubble territory?

With the S&P500 US stock index breaking through the 5,000 mark for the first time, we discuss parallels to the dot.com bubble from 25 years ago.

Banks & US commercial real estate

Commercial real estate loans turning sour have put US regional banks under pressure again, but real estate challenges are now also a global issue.

Will South Africa decide on a change for the better?

An economy with such potential is hobbled by corruption and its dire impact on public infrastructure provision – the general election creates a chance for change.

US stock market entering bubble territory?

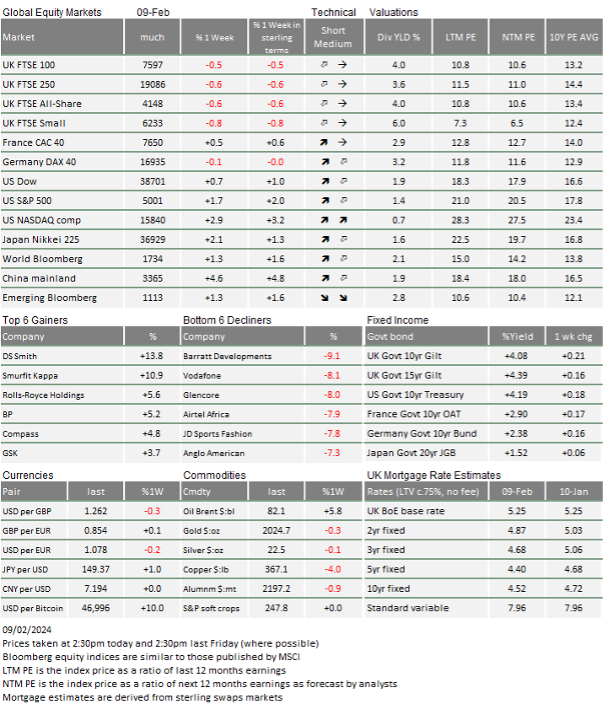

Last week was the week when the US large-cap equity market shook off the rest of the world and marched to yet another new milestone. The S&P 500 traded above 5,000 for the first time on Thursday night. It also shook off another rebound in bond yields, back to recent highs. China managed to generate a gain just ahead of the Chinese New Year with yet more policy action, while Xi Jinping publicly committed to supporting the Chinese economy. Europe and UK stocks and bonds generally marked time, although there were notable exceptions.

For example, the best performing UK-listed company last week will not appear in our table of the FTSE 100 best and worst. This is not an error (on our part, at least). ARM Holdings PLC, nevertheless, is a UK-registered company and world-leading designer of computer chips, which on Thursday saw its share price rise 50%, following its fourth-quarter results. ARM projected revenue for this current quarter to be over $850 million, way above analyst projections of $778 million.

ARM became publicly traded on 13 September 2023, when owners SoftBank of Japan, launched an initial public offering (IPO) for about 10% of the company on the US NASDAQ exchange. The shares are traded using an American Depositary Receipt (ADR), and one UK share of ARM is held in one ADR. At the time, the value of the floated part of ARM was at just below £4 billion, which would have put it around 80th in the FTSE 100 in terms of market capitalisation. If all the shares had been sold, it would have ranked 14th.

From the same 100% perspective, as of last night, it would be the fifth largest, just below BP. For such a large company, a move of this magnitude is remarkable but not without precedent. Nvidia in the US last year saw a similar trajectory, and our in-house tech guru, Sam Leary, tells us that ARM is being seen as the next Nvidia. Both are in chip design (ARM licences all of its designs while Nvidia designs and produces high-end products under its own brand), and both are seen as likely to be at the tech heart of artificial intelligence (AI) development.

In a Bloomberg interview, ARM’s CEO Rene Haas said AI was still in its early stages: “AI is not in any way, shape or form a hype cycle… We believe that AI is the most profound opportunity in our lifetimes, and we’re only at the beginning.”

Meanwhile, Nvidia threatens to overtake Amazon as the fourth most valuable US company. Its market cap is now $1.72 trillion, and Amazon is at $1.76 trillion as of Thursday’s close. Nvidia added $600 billion in the past two months alone, which is about the same as Tesla’s worth.

So is this a repeat of the dot.com bubble? The first thing to note is that contrary to back then, ARM’s rally was based on hard revenue and profit, and both are growing extremely quickly. Nvidia is doing the same. Its expected next 12-month’s earnings are almost four times the level of one year ago, and that was already after the release of ChatGPT demonstrated to the world the potential of AI, and saw Nvidia become the main provider of the required computer chips.

The other thing to note is that, unlike the dot.com bubble, there are few stocks involved. The rally in the ‘Magnificent 7’ has been responsible for almost all of the performance of the US stock market this year. Indeed, the group seems to have become the ‘Magnificent 6’, because Tesla appears to be doing rather poorly.

But even though there is a disparity in performance, it is worth looking at the valuation of the US market as a whole. Our top-down price model of the S&P500 calculates an estimate of price using bond yields and a form of fixed growth estimate derived from the past 25 years. Until recently (beginning of 2022), it tracked and predicted the index very closely. Now, however, the S&P500 is at 5,000, which is 40% higher than the model estimate of 3,500.

The only other time with such a premium was during the dot.com bubble. But we should also note that the S&P500 reached well over 100% of the fixed growth-rate model by the start of 2000. Thus, if we are in a bubble, at least one instance suggests there could be a lot more upside from here, especially if the winners this time around are producing profits – not losses – as back then.

As the Q4 earnings season progresses, nearly 70% of companies have published their results in the US and 40% in Europe (which includes UK companies). JP Morgan Research tells us earnings growth is tracking at +5% year-on-year (yoy) in the US, but is -8% (yoy) in Europe. The difference in current growth outcomes is very likely substantially caused by the economic disparity we have mentioned too often.

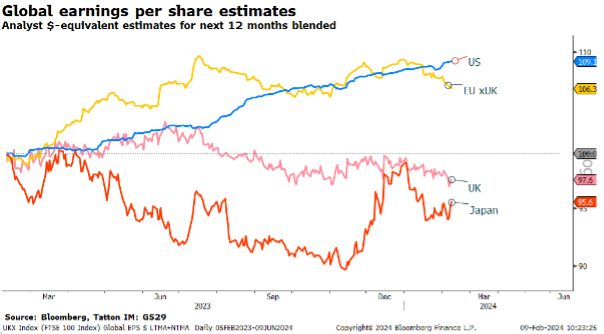

But we have to mention it again, as this week sees the release of economic growth data for Q4 2023 for the UK, Europe and Japan. UK and Europe had very slightly negative growth in Q3 while Japan was -0.7% quarter-on-quarter (qoq). Japan will probably bounce back a bit (expected +0.3% according to Bloomberg), but both UK and Europe are expected to post 0% qoq. If the data disappoints and there are no revisions upwards, we will be said to be in a recession – at least technically. In this light, the disappointing earnings growth is not really a surprise. Below shows the track of analyst earnings estimates (rebased into US dollars for comparability) for the different markets:

Europe’s companies (including the UK) are also priced higher than our Europe model would indicate, but by only 20%, which is unsurprising given the current slower growth trajectory.

Not all US stocks did well last week. Some banks have been under pressure after New York Community Bancorp announced losses.

South Africa is another nation on the verge of a presidential election, at a point where the nation is facing significant challenges. We also write on this below.

Positivity about the mega-caps and AI stocks in the US (and that small number listed outside the US, like ASML and ARM) seems unshakeable, but of course, one might think that this makes these companies dangerous to invest in, given the high valuations. Can earnings growth that is currently expected to be sustained for quite a while justify those valuations? And, even if they cannot – as Tesla is finding out – can people believe for long enough as they did in the late 1990s? What should one do if this is another asset bubble? We will delve into this conundrum further over the coming weeks.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.