Market Update: Stick to the plan

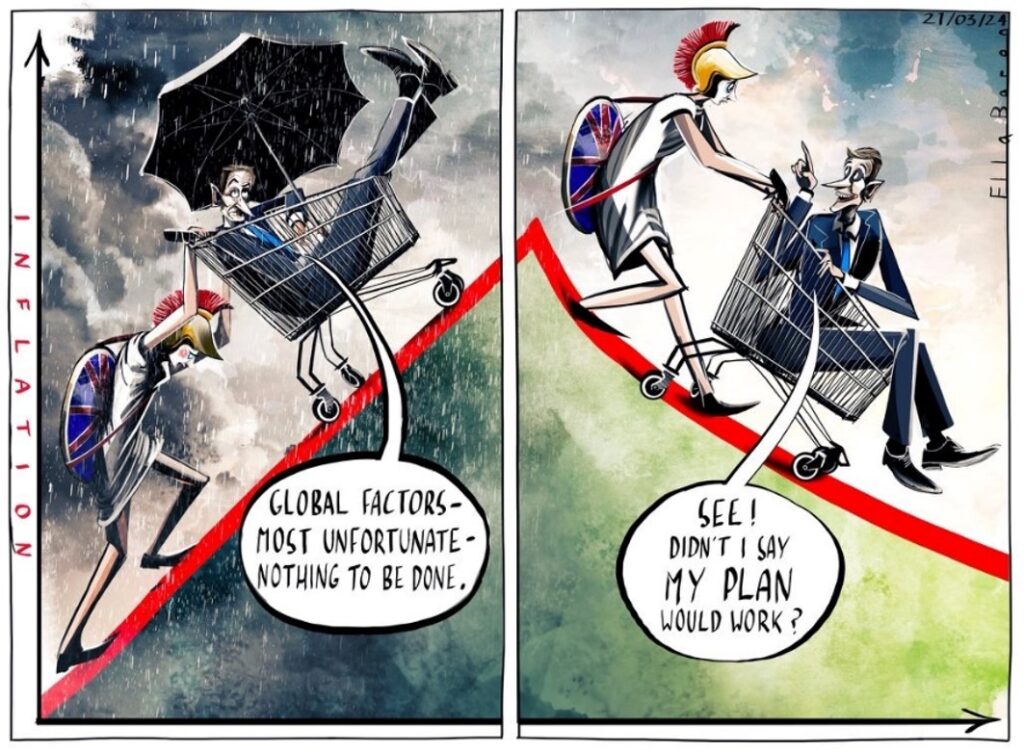

Managing inflation?, Ella Barron, 21 Mar 2024

Stick to the plan

Following their policy meetings, the big central banks presented the calm message that their plans are working, and markets are inclined to believe them.

Japan’s rates are up – and so are markets

For the first time in nearly a generation the Bank of Japan has increased interest rates – it’s not big, but it might be clever.

Neom and the Saudi Line

Building a beacon of sustainable living for the world’s largest oil exporter is a very expensive way to create a future without its black gold.

Ahead of the Bank of England’s Thursday meeting, traders were already pricing interest rate futures on the basis (they have ‘discounted’) that rate cuts would begin in in the late summer. Following the meeting, the traders brought forward the first cut to May or June. The reason was the dovish Governor Bailey, who told us in his press conference and in a Financial Times interview that “monetary policy has done its job”. In this case, he means that the Monetary Policy Committee has had a restrictive policy to combat inflation and that “global shocks are unwinding and we are not seeing a lot of sticky persistence [in inflation] coming through at the moment”.

That allows them to pursue a less restrictive policy. Indeed, it ought to mean that they can move interest rates into line with economic activity. That probably means (in our calculation) rates of about 3.0% to 3.5% in around 18 months. Markets currently discount rates settling at 3.5% in 24 months’ time.

On the UK’s Monetary Policy Committee, the hawkish “external” members Mann and Haskel, stopped asking for more rate rises, while the more dovish external member, Dhingra, continued to ask for a rate cut. The internal Bank of England (BoE) members remained voters for no change but clearly the plan is that rate cuts will ensue as long as the growth and inflation data remain low.

Indeed, the speed with which inflation has declined suggests that inflationary behaviour has dissipated significantly. If businesses and consumers are faced with price rises, they buy less stuff. Encouragingly, retail sales data for February showed a slight rise in volume numbers of 0.2% from January. That was stronger than expected, but the consumer price inflation data was lower than expected. All in all, overall money being spent is rising slowly, rather than rapidly.

The BoE’s wait-and-see approach is coming to fruition. The hawks wanted higher rates, but if they had their way, we would have had a sharper slowdown and, probably, a longer recession. Currently the BoE has overseen the economy sliding into a mild recession in order to bring inflation into line, but one with gratifyingly few job cuts. And, as the increased dovishness shows, the bank now thinks persistently low growth is a greater risk than inflation staying too high.

The economy has some spare capacity and the FT’s interview with Governor Bailey suggests a lot of scope for the internal members to vote for a cut by May, since year-on-year inflation should slip below 2% in April.

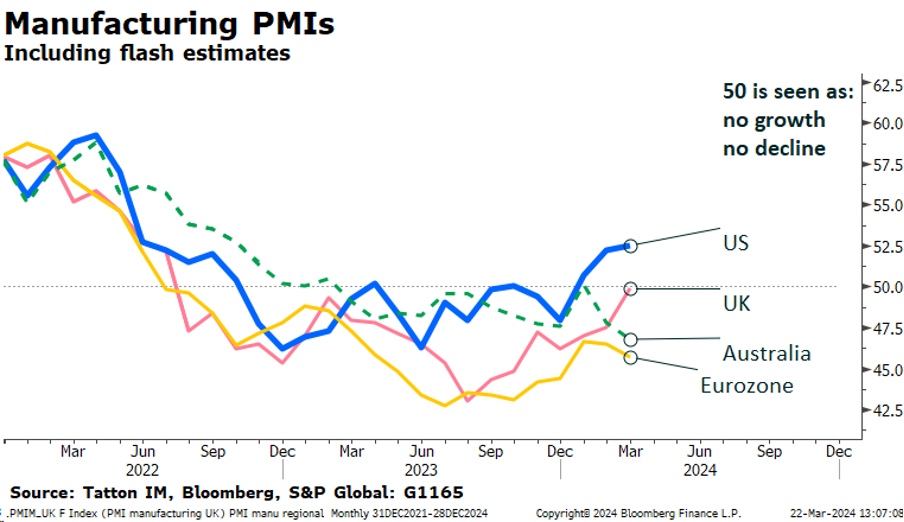

Europe also has spare capacity and could cut rates at the same time. The European Central Bank met at the start of the month, held its operational framework meetings the week before last and, last week, spread its message at the “ECB Watchers” conference that “rate cuts are coming”. March purchasing manager survey data indicates that manufacturing has failed to sustain its slight bounce. The Eurozone manufacturing Purchasing Manufacturers Index (PMI), an indicator of business confidence, unexpectedly slid back to 45.7, as the chart below shows:

Services remain much stronger and jobs are not being cut noticeably but, as in the UK, inflationary behaviour is not evident, allowing inflation to decline. Switzerland also supported the idea of likely Eurozone rate cuts by unexpectedly cutting their short-term rate last week. The strong Swiss Franc is cited as the main reason, causing Swiss manufacturing to remain weak.

The Bank of Japan also delivered a dovish message. What is remarkable here is that they raised rates!

China remains at the heart of global manufacturing weakness and a global disinflationary impetus. The hopes of a swift rebound have been supported by a mild upswing in commodity and energy prices, but other indicators are less positive. The Australian manufacturing PMI (which is heavily focused on mining and materials, shown in the chart) has also slipped back to the lowest level since the 2020 pandemic dip.

The Chinese offshore Renminbi fell in value last week, after a period of stabilisation. This has coincided with falling government bond yields and strong hints of more monetary policy action from the government.

Lastly, we turn to the most important central bank decision machine; the US Federal Reserve Open Markets Committee. Wednesday saw no change in rates, no change in the prepared statement, and Chairman Powell downplaying the recent uptick in inflation, saying, “It is still likely in most people’s view that we will achieve that confidence and there will be rate cuts.”

Commentators focused on the growing certainty of rate cuts, pointing out the fact that nine members expect three rate cuts in 2024, up from five in December, perhaps forgetting that the additional four had all expected more than three in December.

We did not expect a less hawkish tone from the FOMC. Although, at the margin, the economic expectations were a bit higher and the doves were less dovish, there is a growing confidence that the US economy is in balance. Manufacturing is stronger than in the rest of the world but services confidence has eased amid signs of a jobs market that has become less ‘hot’. And, since import prices remain weak, the domestic economy can run a little stronger without causing a worrying resurgence in inflation.

So Jerome Powell can stick to the plan, just as the other central banks appear to be doing. However…

The US economy has become stronger in the first weeks of this year, despite the stories of declining wage pressures. Unlike most other regions across the world, we think there is little spare capacity in the US, despite high levels of labour productivity (it may be that good productivity growth is because there are few available workers). US monetary policy is not restrictive in comparison to the current activity levels. The US may end 2024 in line with the Fed’s expectation of +2.1% real growth and inflation at 2.4%, but it will have to slow from current levels in order to do so. Current activity is rising rather than falling and now we estimate it to be at or above the 5.25%-5.5% Fed policy rate.

The central banks are rather revelling in a rare moment, when they can say they were right and everything is on track; economies are growing but not so much that inflation is going up (much), while jobs remain reasonably plentiful. They can say they saw it coming and they are going to stick to the plan.

Our caveat about policy is not a bearish one for markets either. If the Fed is a little lax, it should be good for profits in the near-term. We should only worry if inflation starts to move demonstrably higher and policy shifts from rate cuts to rate hikes. That’s not likely for some time.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.