Market Update: Prospects of a warm Spring

Focusing on the UK economy, last week’s data told us that while March was cold, the Spring could be getting economically warmer. This morning’s UK retail sales data for March marked another reduction in volumes, partly due to the cold weather, according to the Office for National Statistics (ONS). Not including fuel, the volume of retail goods sold in March dropped by 1% from February. Food price rises continue to outpace price rises in other goods (nobody is fooled by milk price cuts when the price of bananas rises more than 10%). However, the Chartered Institute of Procurement & Supply indices showed that services are on an upswing. The Services Purchasing Managers Index (PMI) survey rose surprisingly from 52.2 to 53.9. Services new orders are at 55.3 and the services employment index jumped two points to 52.0 to signal a stronger hiring upswing and higher pay settlements.

Manufacturing went in the other direction, with a disappointing fall again to 46.6, although expectations were more buoyant.

Pay settlements are probably a big reason for a substantial improvement in consumer confidence. The GfK Consumer Confidence index rose sharply although -30 doesn’t sound very confident. Historically, a better indicator is the rate of change of confidence and this has sharply improved, from a 40-year low to a 40-year high according to our calculations.

Allan Monks of JP Morgan Research revised up his forecast for gross domestic product (GDP) growth this month to +0.3% (+1.3% annualised). Unfortunately, JP Morgan sees higher growth as adding further to inflation pressures. The labour shortage kicks in straight away, so even a fairly tepid level of growth of 1.3% annualised is enough to keep inflation above the 2% target.

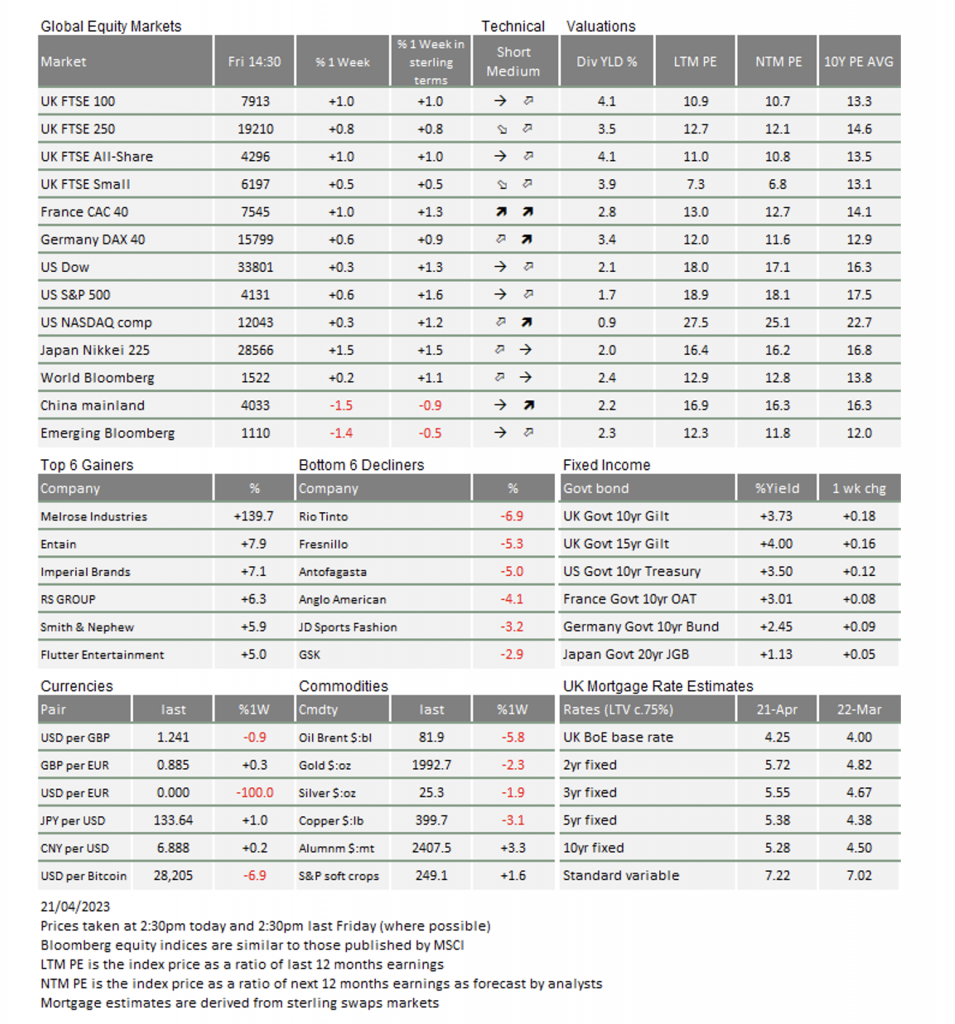

The Bank of England (BoE) had expected second quarter growth would contract -0.35% (or 1.5% annualised), so this week’s run of data will be significant, and probably ensures another rate hike on 11 May. Markets are already factoring in another 0.5% rise, something which both consumers and big businesses appear able to withstand, but which will squeeze smaller companies even further. Small cap indices remain under relative pressure.

Globally, manufacturing has had a hard time and the wider PMIs bore this out today with one exception. At 45.5, the Eurozone index was weaker even than the UK measure. However, the US surprised by bobbing above the 50-neutral level to 50.2.

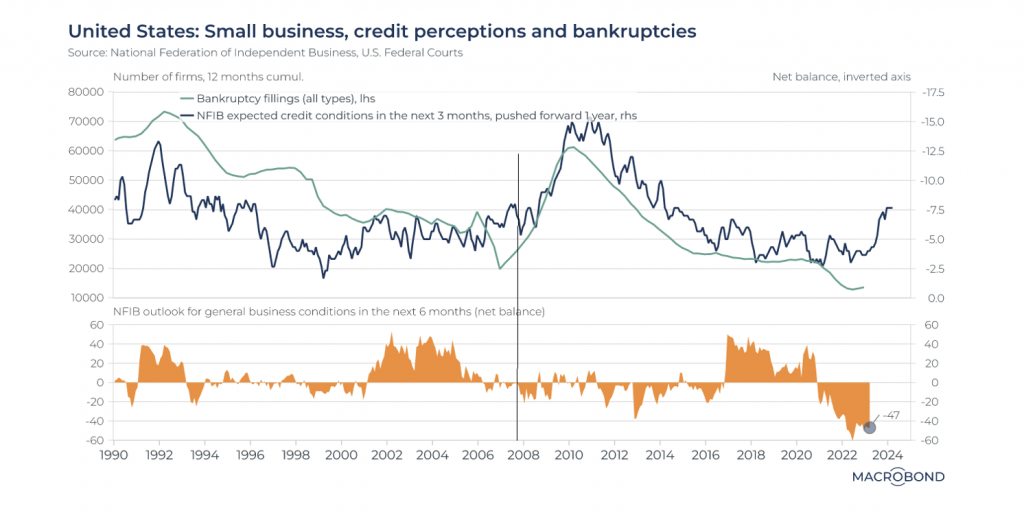

Global risk assets have been grinding higher as perceptions of external risk ebb away. According to the quarterly earnings releases, bank non-performing loans are higher but not at recessionary levels. The stress on manufacturing companies and smaller companies continues, but we’re not getting significant levels of failure. Indeed, in the US, bankruptcy filings are running at 30-year lows. It may be this is a precursor to a sharp step-up in filings as the below chart from Macrobond perhaps indicates. US management sentiment towards access to financing is pretty dire and at a level last seen ahead of the Great Financial Crisis (GFC). However, it should be noted that the change in sentiment is more akin to the early 2000s and that didn’t result in significant failures generally. Of course, ultimately, neither times proved great for markets.

However, the chart also doesn’t help in telling us when the stress might become too great. In the lead up to the GFC markets, the S&P 500 reached a peak in October 2007, at the point where we’ve added a line on the chart. Markets can grind higher even when stresses appear obvious.

Market volatility has continued to decline this week and, as we mentioned, this helps prices to grind higher. One reason is that the general ‘carry’, the current yield from bond coupons or equity dividends relative to the market price, is higher than in the past few years. In low volatility periods, carry can outweigh price movements, which means traders don’t get paid to be short.

For us, until the battle to get inflation under control is won, central banks will keep applying pressure. They’ll raise rates until the stress creates failures. The carry on riskier assets may look attractive relative to the low price movements, but the stress isn’t going away. Thus, this isn’t a Goldilocks environment of low rates, low profitability but low stress. Valuations may get more expensive but the risks are too high to justify being overweight.

Meanwhile, elsewhere, geopolitics remains ugly, but the Russia/Ukraine conflict is not deteriorating much. The US debt ceiling is looming but not imminent, and so all eyes are now trained on whether there are sign that the Q1 earnings decline marks the bottom of this decline cycle. There are signs that it might and others that it might not – more of that in the article below.

We also look at some aspects of US money market funds. The aftermath of the banking crisis is still with us. The US average bank deposit rate is at 0.7% while the average yield on money market funds is about 4.6%. Next week, we’ll look at the UK versions of the money market funds.

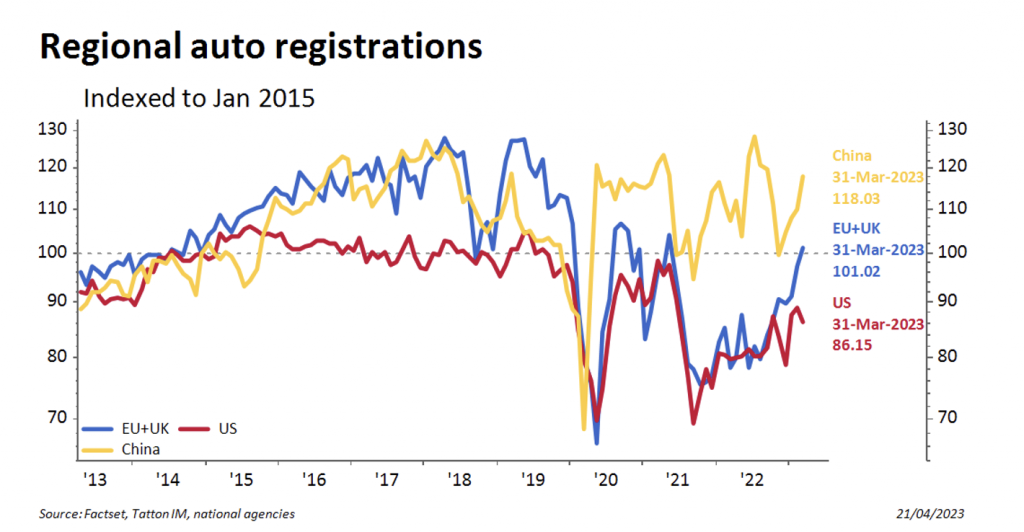

Finally, returning to profit margins, it is notable that some firms have pricing-power and others do not. Where there are few players, such as UK supermarkets, margins can be maintained. There may be a couple of competitors like Lidl but, in general, consumers and suppliers have little effective choice. However, car manufacturers are abundant – at least 38 significant firms according to the Bloomberg Global Autos dashboard. Tesla has announced another slashing of prices, weaponizing its industry-leading margins. It may well lead to price cuts in new car prices and also the start of a consolidation phase in the industry.

Supply chain issues have declined and deliveries have risen sharply. It may also be that demand is rebounding if consumer confidence is growing. The registration data shows positivity in China and Europe, less so in the US, where financing costs remain much higher. The sector is crucial to global growth, so the next few months will be especially interesting.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.