Market Update: Markets sour on news of resilient economy

Last week we commented how the second quarter’s positive stock market returns were driven by a somewhat surprising improvement in investor sentiment. Surprising, because at the end of March there was much fear that the crisis amongst US regional banks would lead to a serious deterioration in lending conditions, leading to a quicker and more pronounced slowdown than had been previously anticipated. Surprising as well, because bond yields rose, while analysts forecasts of corporate profits did not rise much beyond simply anticipating a period of neither decline nor growth.

Over this past week then, markets seemingly abandoned the previous narrative, as positive US job growth data was blamed for a reversal of sentiment, with equity and bond markets falling on rising bond yields. So why did investors suddenly turn negative, even though bond yields did not rise by any meaningful quantum compared to the rise between March and the end of June?

In order to make sense of the latest market action, we should remind ourselves of the determinants of market valuations and their direction of travel. The primary driver of stock markets over the long-term (and also usually over the medium-term of several months) is the expected change in the profitability of stock market quoted businesses in aggregate – improvements in corporate earnings, or just expectations thereof will provide equity markets with upward momentum, whereas a deterioration or expectation of deterioration does the opposite. In the absence of other more immediate drivers, which we will discuss further down, the sequence of the different stages of the economic cycle usually determines the direction of travel of corporate earnings.

Secondarily, the overall level of valuations is driven by bond yields, which most simply put can be seen as the competition to equities, i.e. the higher they are, the higher the equity yield as a function of corporate earnings has to be to justify the same stock market level.

A third element that is interlinked with the first two (the direction of earnings and bond yield levels) is central bank policy, which sets liquidity and interest rates. Central bank, or monetary policy shifts play a large role in whether the economy’s contraction or expansion might be offset. Such policy moves affect not just how much profit businesses are able to generate, they can also determine the length of cycles. A short downswing means businesses can survive; a longer one can mean the opposite. The central bank ultimately determines whether the cost of capital and borrowing is high or low and therefore drives changes in business and consumer demand.

At times it is not just the stage of the economic cycle and cost of money that determines the direction of the economy, but also government spending (fiscal policy) and/or external shocks like the COVID-19 pandemic or an energy price shock can play an even larger role at times. That’s in part because governments can usually borrow when lenders are reluctant to loan money to businesses. Furthermore, the headwinds of cost of capital can be dealt with in a way that has little impact on earnings when growth is on a better footing. Last but not least there is the general monetary liquidity position, which may stem from circumstances in the past. If there is more money circulating than is strictly speaking required, then the extent of the reaction to a deterioration of one of the previously discussed factors can be much less pronounced then when there is already an environment of tight liquidity.

Where the above are the factual parts of the capital market valuation equation, investor sentiment is the proverbial glue that brings all factors together and determines whether there is a positive or negative interpretation of the prevailing circumstances and how heavily the one or other of the four will impact market direction.

The change we experienced over last week was one of sentiment towards the future cost of capital. Up until the end of June there was a growing expectation that at least the US central bank, the Federal Reserve, had, or was close to reaching the peak of their rate hiking cycle and that cost of capital as a result would not rise further and was likely to start coming down over the coming 6-12 months.

Particularly hawkish statements from the Fed chair J. Powell last week at the SINTRA meeting of central bankers began to challenge such expectations and last week’s data flow of continued tightness of the US labour markets which has been driving the second round effects on inflation (wage-price spiral concerns) provided more evidence that the Fed may well not be done with raising rates and keeping the cost of money at the current elevated levels for longer than had been anticipated. This in turn would mean that the other central banks who were expected to be following the Fed in due course, would now be even later.

So, in summary not particularly much deteriorated on the hard data front over the past days, but on the contrary, a surprisingly strong US labour market report disturbed the fragile market balance we have written so often about over the past months. Whether this return of ‘good economic news is bad news for market valuations’ is enough to sour sentiment more permanently, very much waits to be seen. A second set of labour market data on Friday presented much less of an upward outlier, however confirmed that the US labour market remains just as tight as it was last month, with no signs of imminent turning.

As we described above, higher cost of capital can more easily be absorbed and carried by the economy when accompanied by decent growth and good levels of monetary liquidity. Both of these conditions remain broadly in place at the moment, which tells us that markets should continue to carry a higher probability of trading sideways then down over the summer. However, if the other effect of this economic resilience is a slowing or reversal of the recent steady decline in inflationary pressure from the input cost side, then the central banks may see themselves forced not only to raise rates ever higher, but perhaps also to more drastically drain liquidity from capital markets by stepping up their monthly QT (quantitative tightening) program of selling bonds against market liquidity from their still very extended balance sheets.

For the time being positive sentiment may well prevail, but for market stability to remain that way, market participants will paradoxically be wishing for a continuation of the other side of last week’s data flow which presented an environment, where the service sector is gradually starting to follow the manufacturing sector into an economic soft patch. The emphasis though will be on ‘gradually’.

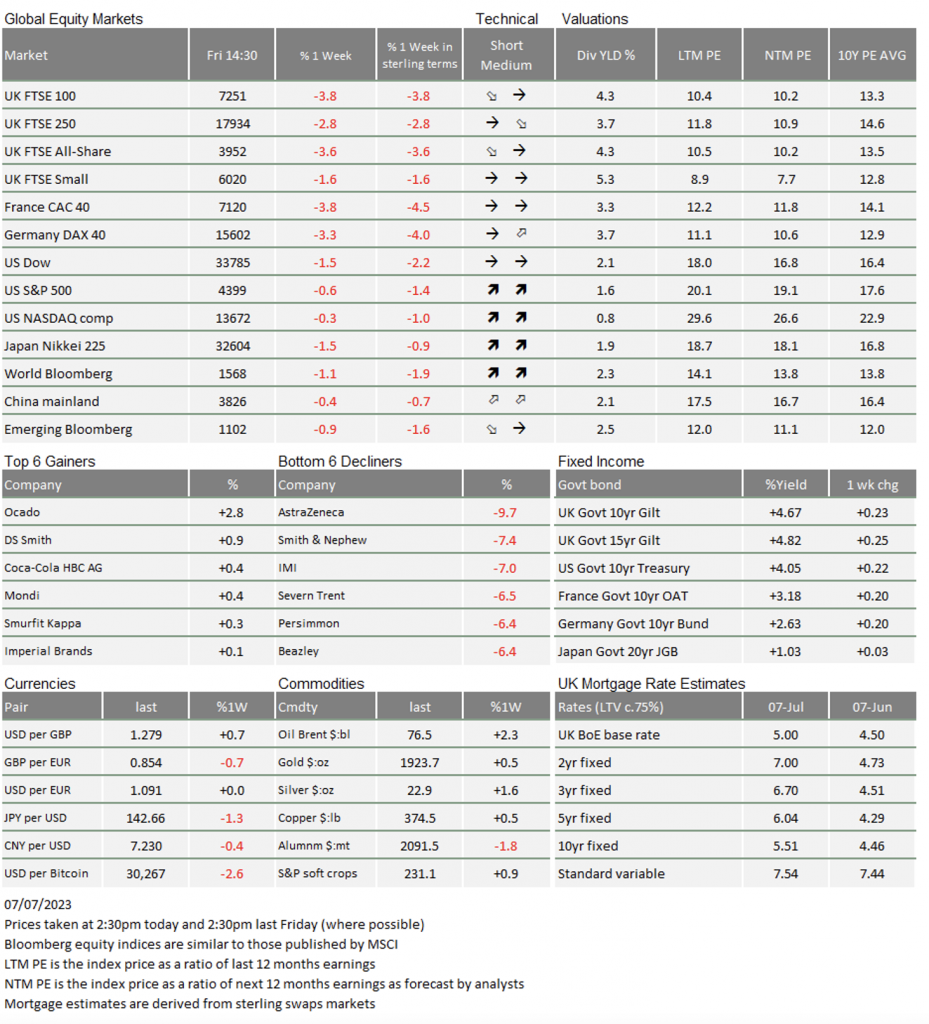

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

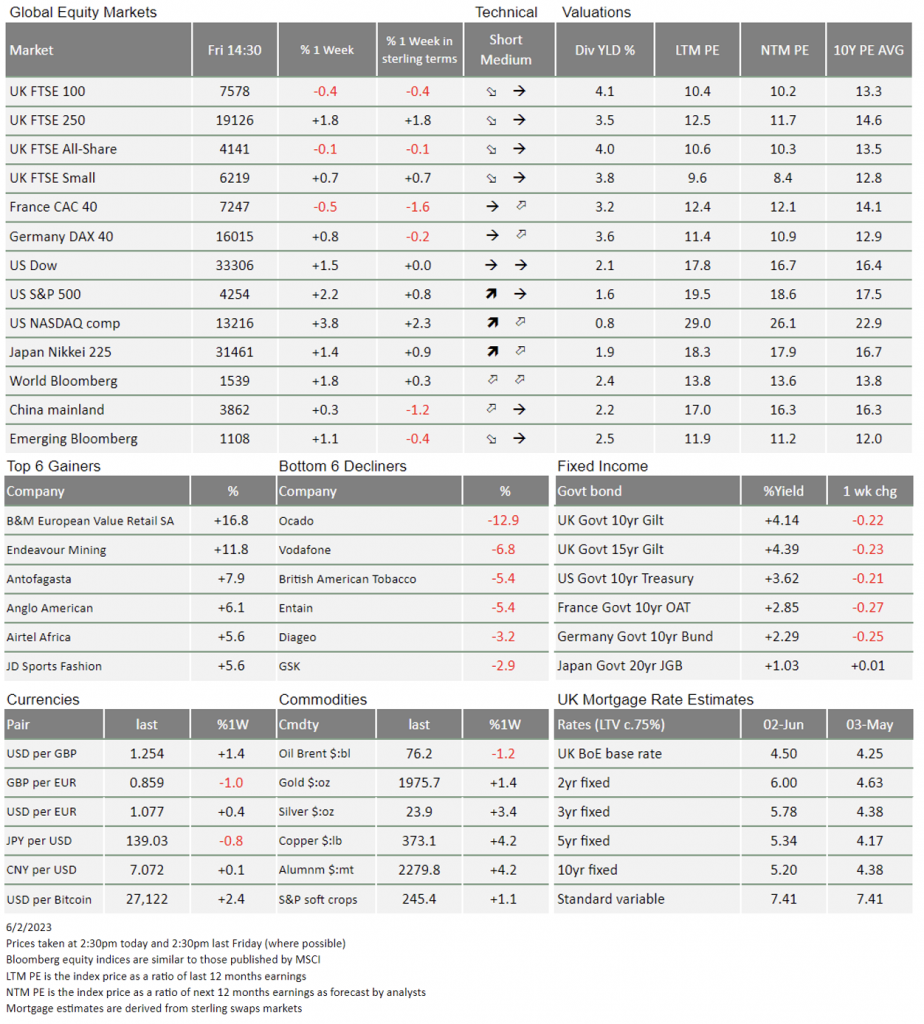

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.