Market Update: Core inflation slowdown equals an upbeat week for equity markets

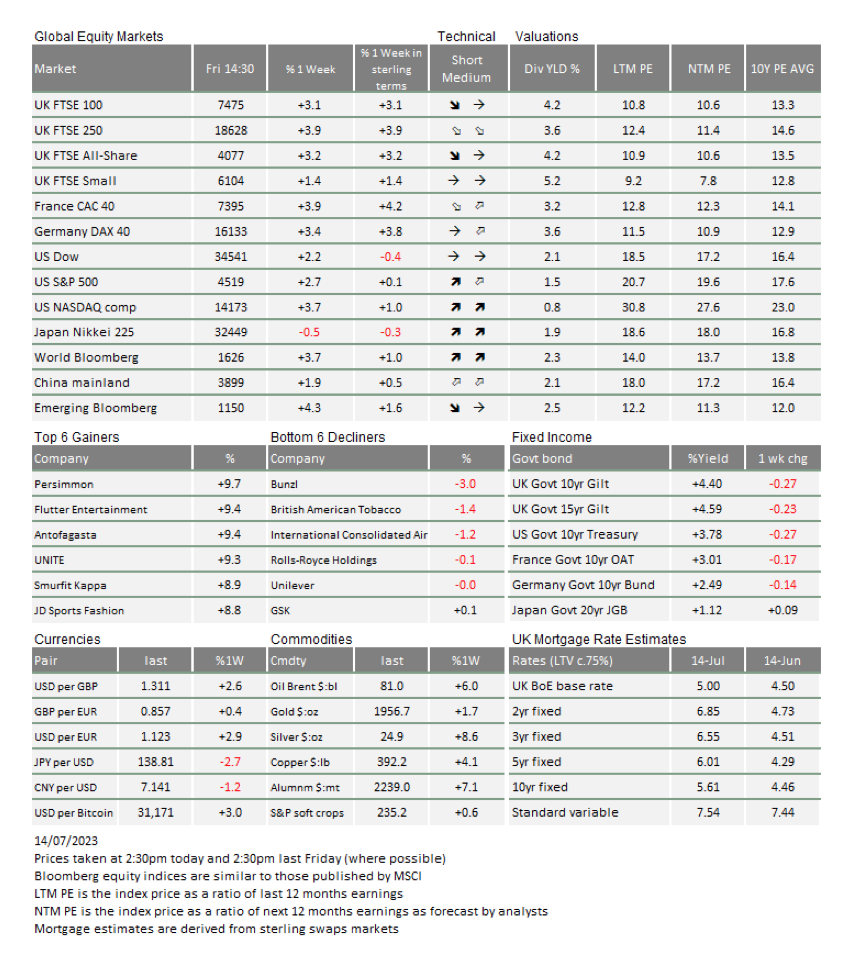

We wrote at the start of last week that markets had come to expect another round of significant interest rate rises from central banks, and that risk assets such as equities were likely to come under some pressure. At the end of last week, however, equity markets have risen sharply, with most more than reversing their losses of the previous week.

The driver of sentiment for both weeks has been estimates of how much central banks will have to move interest rates in the coming months. Those estimates are, in turn, driven by where inflation is and where it will get to over the next few months. Investors were focused on how tight labour markets might keep underlying inflation pressures high, but the actual data published last week paints a rosier picture.

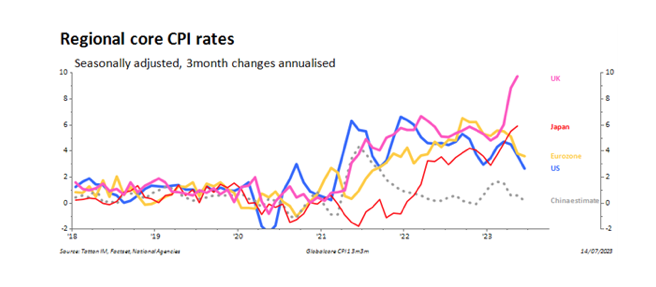

We’ve compiled the above graph to show how regional core consumer price index (CPI) inflation rates have evolved through the pandemic period to now, showing the annualised change in prices on a three-month basis. In Europe and the US, June data show rates growing at their slowest rates since 2021. That’s not so for the UK or, perhaps surprisingly, for Japan. For China, we’ve estimated from the yearly data, and that is tracking to virtually no inflation.

The Q2 earnings season unofficially kicked off on Friday. July is seasonally a better month as Q2 earnings are often as a more consistent guide to company health than earnings in Q1. In the banking sector, earnings reports have been flooding in, and bottom-lines so far look predictably healthy. We write on some wider aspects of banks in an article below.

But earnings were not the reason for the positivity. The catalyst for the US stock market rally was the shift down in core inflation (with energy and food stripped out). Relatively good news had been anticipated after the difficult data recorded for May, but the details were seen as comforting across most components. In addition, cost pressures feeding through the production chain are also declining. US producer prices actually fell.

This is where the weakness in China comes in. Consumer prices are not rising but its producer prices have been falling in absolute terms since the end of the winter. At the same time, weakness in the renminbi has meant prices in sterling or US dollars paid have been declining sharply. Even then, trade data shows pretty weak demand currently for Chinese goods, for a multitude of reasons.

So, for this week, the disinflationary flow of other input costs has offset fears that workers have regained long-term pricing power. The idea is growing that wage demands in the US will slide back towards a 3% year-on-year growth, and towards 2% in Western Europe because workers will be content with a moderate rise in disposable income. The UK experience seems to contradict this but perhaps the US data foretells a better time to come here and Rishi Sunak will be proved right. For investments, quite a lot of consequences might flow from such a benign outcome.

The venerable economist Anatole Kaletsky has long held the view that inflation would be sticky. As befits a thinker of note, last week he published some thoughts about what would happen if he was wrong. First, he noted that there was a stickiness in some US goods (rents, cars, travel costs) not to rise but to remain stable, which might help keep inflation from reaccelerating. He also noted that other more variable components, such as medical costs, were not showing signs of rising now. And base effects would lower the headline year-on-year rate, which might have the effect of reducing pressure from workers for more pay. Should US core inflation drop below 3% year-on-year by the end of this year (without an economic shock to raise unemployment more than about 0.3%), Kaletsky sees this as a very positive scenario. Disposable incomes would be solidly rising, having begun to do so already. He says: “if the worst inflation for 40 years can be overcome with the lowest real interest rate peak since the 1950s, and an economic slowdown so mild that it does not even increase unemployment, then assets valuations should move permanently to even higher levels than they reached in the Goldilocks decade before Covid”.

“If low inflation returns in 2024, then easy money, full employment and fiscal profligacy would have survived a series of inflationary stress tests far worse than anything likely to hit the world economy in the years ahead”.

“So asset valuations that were widely viewed as unsustainable in the long run will likely be priced even higher because the ideal financial conditions of low inflation and near-zero real interest rates would have been empirically established as scientific laws of economics and permanent facts of life”.

Kaletsky says, and one can tell from his tone, that he still thinks the best of all possible worlds is not the most likely outcome, and we have sympathy with his views. However, just as he has done, we continue to question our mildly conservative stance on equities.

For us, the positive scenario is akin to the ‘Great Moderation’ of the early 1990s, a period which saw dividend yields on equities fall substantially below government bond yields as very rapid globalisation gave a huge structural boost to corporate profits. There is an argument that globalisation’s reversal (now often termed regionalisation) – and the consequent fiscal largesse of both US and European governments – is bringing about a similar episode.

Returning to the global inflation picture and some nearer-term aspects, the greater inflationary picture both here and in Japan has generated bullishness over sterling and the yen. The Bank of England (BoE) is already widely seen as being hawkish but, last week, traders spied a possible change in the stance of the Bank of Japan (BoJ). They pushed longer bond yields up, and the ten-year yield is now sitting right on the upper limit of 0.5%. Other bonds are trading at higher yields which makes the yield on ten-year bonds somewhat anomalous.

The yen has fallen below Y140/$, which has got chart technical analysts all excited. Of course the inverse of this, the US dollar’s weakness, has perhaps wider implications for the global economy. A weaker dollar phase eases financing conditions for the rest of the world and, obviously, that’s a welcome respite. Europe especially has shown signs of stress recently, despite the decline in energy prices (to only about 2.5 times where they were in 2019).

One other aspect is that the sterling value of US equity holdings isn’t quite as buoyant as the US dollar price might suggest. We rarely hedge global equity holdings as the companies themselves have global revenues and costs. There are times when one might want to take a currency risk but we don’t think, generally, this is best done by ‘currency-hedging’ equity holdings.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.