Market Update: A glass half-full half year

Half-way through 2023 and, all in all, things have been fair-to-middling for markets. An assessment of the changing economic and markets landscape over the quarter seem appropriate for this week.

This second quarter ends amid positive sentiment towards global risk assets (UK assets have not fared quite as well), a surprising turnaround given it started with black clouds on the horizon, following March’s US regional bank crisis. March had many investors thinking credit would tighten as banks would surely be scared to run out of money themselves. Looking back now, the evidence seems to be that a shift of client deposits to larger banks, alongside US Federal Reserve (Fed) actions, produced an effective easing. Not only did the Fed push liquidity into the system, but it also reduced risks for investors by expanding its deposit insurance cover terms. Some would say that, implicitly, the Fed told us that its response to possible financial system issues is to be swift and generous. So, if something looks like breaking, the Fed will step in to stop people getting hurt.

Put in those terms, of course no central banker would agree this was a reasonable assertion and reaffirm that they are undeterred in their determination to put the inflation genie firmly back in its bottle, even if this results in pain in some parts of the economy. However, markets no longer seem to wholly believe that to be the case, so during the quarter we have seen the relationship between bonds and equities change from how it was over 2022 and Q1 of 2023.

Back then, falls in bond prices (associated with expectations of rising short-term interest rates) went hand-in-hand with equity price falls, suggesting the process would end in tears for the economy. This quarter saw bond prices still under pressure (as yields rose again) but equity prices generally doing better regardless.

One reasonable explanation is that, globally, equity analysts have been raising their forecasts for company profits for the next 12 months through the course of this quarter. While the results from Q1 were better than initially expected, the track of upgrades was consistently stronger through the quarter. If the global economy was in a parlous state, this just would not have happened.

Somewhat contradictory, manufacturing sentiment (i.e., the outlook from businesses rather than the analysts covering them), has continued to show looming recession. This has been particularly evident in Europe, despite the easing of energy price pressures. However, service business sentiment has indicated reasonably solid growth, albeit most regional indices in aggregate have still shown a relative decline.

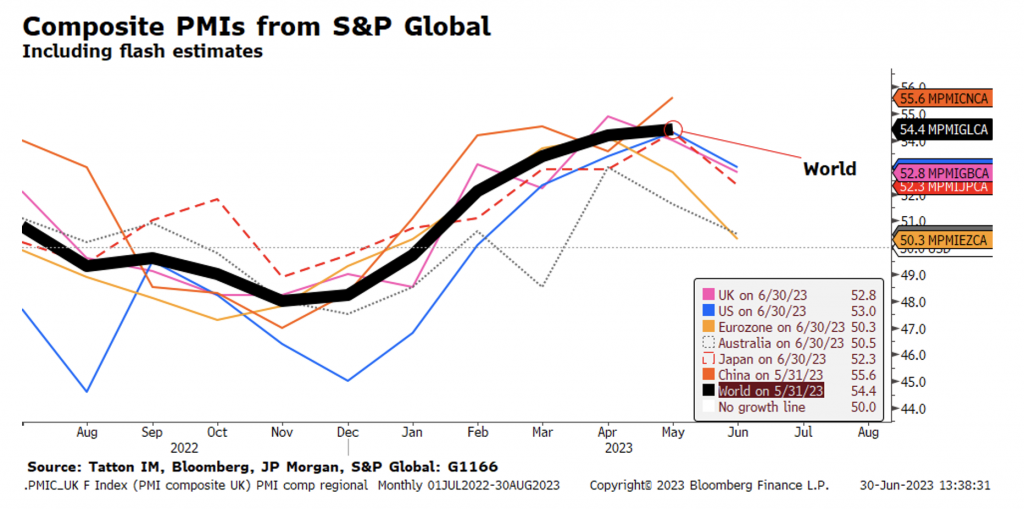

The overall composite indicators are more heavily weighted towards services and show that the global economy has been resilient. It also shows the resilience has been widespread as the chart below reflects, in which 50 marks the demarcation between growth and contraction.

June’s purchasing managers’ index (PMI) data does show a downturn, however. Services are gradually turning less positive and manufacturing more negative. Europe has been notable for quite a sharp decline across the board. China’s June reading is estimated to slide back to about 52.8 which would probably mean a World Composite PMI reading of about 52.7.

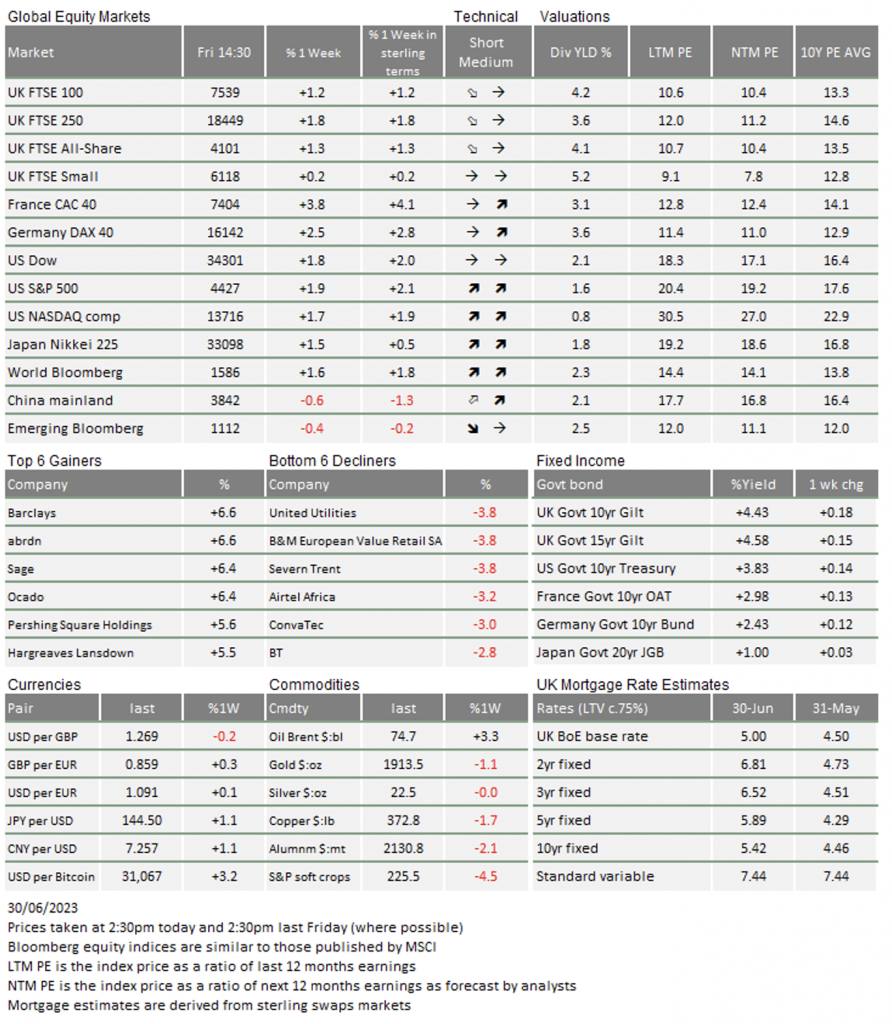

We have mentioned before that markets have responded well to more earnings positivity from analysts, but the biggest change has been in their reaction to valuations. Developed world equity indices have doubled up on rising underlying profit expectations with rises in the price-to-earnings multiples applied on top of those earnings.

This sign of increased investor optimism may perhaps be lack of pessimism, a sense that the downside is protected, following the experience in the aftermath of the US banking crisis. The European Central Bank (ECB) held its annual symposium in Portugal last week and leading central bankers from across the world spoke. The tone ranged from mild to bloody-clawed hawkishness. Bond yields duly reacted and moved higher, yet equities gave the event a ‘whatever’ shrug.

Part of that mood may be coming from the disjunct between ‘hard’ and ‘soft’ economic data. Hard data is derived from actual activity – such as jobs numbers, retail sales or durable goods orders. Soft data (like the PMI sentiment gauges above) is based on surveys of people’s perceptions. The continued resilience of the hard data over PMI readings (manufacturing PMIs have been below 50 for a year now) is an indication that sentiment can be overly pessimistic, especially in times of changing circumstances.

However, that resilience also means core inflation (taking out food and energy) is not coming down noticeably now. Perhaps investors believe that the impacts of inflation may be less problematic for the financial and economic system than previously feared. Perhaps the central banks also think so. They certainly have not been as hawkish as their rhetoric. For example, Fed Chair Jerome Powell said last year that the Federal Open Market Committee (FOMC) wanted US unemployment to rise to 4.5%. Since then, joblessness has moved up only 0.1% to 3.7%. In the UK, unemployment seems locked at 3.8% while in the Eurozone it has declined from 2022’s start rate of 7% to May 2023’s 6.5%.

The words emanating from the ECB’s meeting in Sintra convinced money markets to factor in more short-term rate rises last week. The Fed is expected to get to 5.5% (+1%) by September, and the Bank of England (BoE) to 6.25% (+1.25%) by March next year. The ECB’s hawkishness seems to be refocusing on the pace of quantitative tightening however, rather than raising rates, which is an interesting move. This approach could be followed by the Fed. A faster decline in its balance sheet would pose some questions for risk assets, given it would be likely to push long-term yields higher once more, which as we know should put equity valuations under downward pressure.

The other intriguing aspect of this quarter has been the lack of corporate bankruptcies and default. In the US, following Silicon Valley Bank’s demise, investors were on the lookout for signs of default contagion. Although there were a few, most would say that it did not become a problem.

In the UK, the same could have been said right up until the news last week concerning Thames Water.

The 2021 Bulb bankruptcy was an example of how a utility company can be caught between costs, competition and price caps. Given the circumstances, there was little made of the episode despite its size. Thames Water is potentially of a different order. Few people in London get their water services from another supplier. The perceptions of (reckless) behaviour of private equity actors in the story will be important, especially in relation to the state’s infrastructure funding.

Perhaps most important will be the impacts on the current equity holders, which are generally pension funds. The company was privately held but that doesn’t mean it won’t cause contagion. While the pressure that UK pension funds faced during last October’s index-linked gilt crisis may be seen as a different type of problem, many funds have large exposures to other infrastructure-related assets. It is possible this story will go on for some time and have surprising consequences. In itself, the Thames Water situation is not likely to precipitate a crisis. Nevertheless, large debtors with problems are things we should watch closely, as much perhaps as hitherto deemed ultra-safe infrastructure investments.

The heat of June is forecast to give way to a cooler July in Europe. We hope the relative calm experienced by equity markets in June will carry on regardless of the weather.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.