Market Update: Waiting for Policy Action

The summer is nearing its end and with it the return of the more typical English late summer climes. It may feel as if markets have taken a hint with their 5-day downdraft, although most outsiders will look at the week’s media frenzy and blame the tumble on the truly intimidating outlook for energy bills during the winter heating season.

It hasn’t helped that while unacceptable cost shock pressures have become very apparent for households and businesses across all of Europe, very little concerted action has been announced in response. While the European Union (EU) is held up by the complexity of the matter itself paired with the structural slowness of policy makers to make any decisions. This leaves businesses and households feeling more vulnerable than perhaps necessary. The energy supply shortfall that needs to be overcome by lower demand is estimated to be around 10-15%, which at current price levels will be massively overshot and lead to an unnecessarily excessive economic and mental health burden to everyone across wider Europe.

Markets’ price mechanism is an incredibly effective tool to bring supply and demand back into balance, but in this case, it seems to deliver more than is actually required. Governments will need to devise a policy framework that combines the incentivisation that the price mechanism provides with means of soft (incentivised) energy rationing that achieves the same supply-demand equilibrium, but without the hardship that unnecessarily excessive price signals would cause for households and businesses.

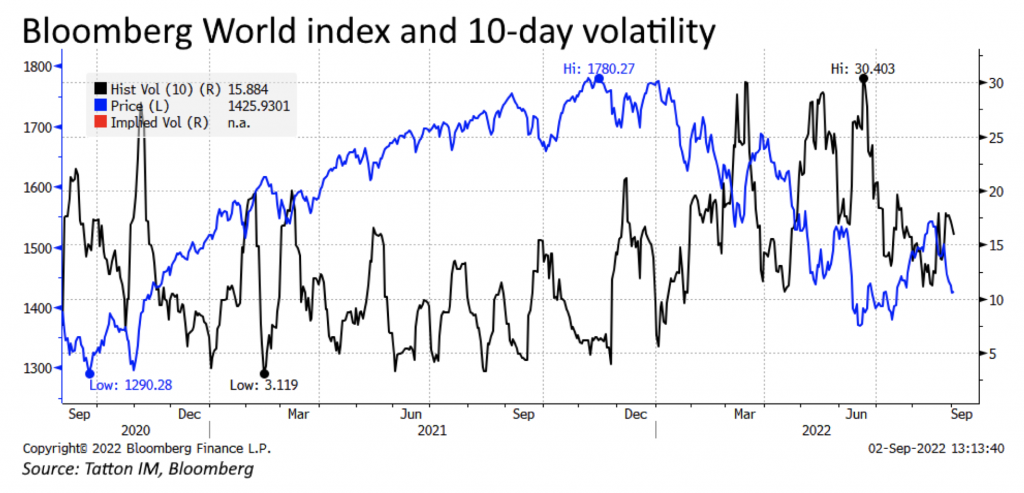

Turning to recent market action in more detail, we observe a certain peculiarity in recent equity market moves. Usually, when markets fall, intraday volatility also rises. When markets rise, those small intraday ranges are generally quite low; markets creep higher and bounce down from time to time.

The past few days have seen markets fall and daily volatility has picked up, but to a much lesser extent than during the falls of earlier in the year. The chart below shows the Bloomberg World equity index and its 10-day volatility (the blue is price, black is volatility):

The falls in equity markets have been accompanied by falls in government and corporate bonds, much as when happened at the beginning of 2022 and again in June. However, because of the reduced intraday volatility levels there is much less of a sense as back then that monetary liquidity is draining. Indeed, the US retail investor sellers of that period appear to be either less important or less scared.

Looking ahead, seasonally, September is the most difficult month of the year. Investors will therefore not be holding their breath for a reversal of August’s falls – even though past seasonality trends have not provided particularly helpful guidance during 2022. However, either way, we are not pessimistic. In fact, this brings us back to what we mentioned at the beginning, which is that one of the main sources of equity market weakness this year has been the rise in US bond yields. Last week, those yields bounced back up after the Fed said it remained more concerned about labour market tightness above anything else. As a result, the US survey of new jobs created (non- farm payroll data) remain the most-watched metric for investors. Of course, bad employment news (as long as not very bad) will be good news for equity prices, since it is a necessary condition for the Fed to become less hawkish. August’s data showed a rise of 315,000 jobs, still well ahead of the average 185,000 jobs per month of the 2010-2019 decade. This is an ‘improvement’ over July’s 528,000 new jobs number, but indicates that the Fed is unlikely to pivot on near-term policy anytime soon.

For Europe, energy prices remain the focal point and this week we finally had some good news. First, oil prices moved back towards the lower levels seen before Russia’s Ukraine invasion. This is probably not because the G-7 finance ministers pledged to try to cap the price paid for Russia’s oil – the pledge actually coincided with a short rally. The overall fall was more likely due to the deteriorating short-term economic outlook and the prospect of access to Iran’s oil should the Biden administration succeed in negotiating a nuclear deal.

But it is not oil that matters so much for Europe. Russia (officially Gazprom) shut down the flow through the Nord Stream pipeline and blamed sanctions and Siemens for “maintenance” issues. A Gazprom statement said: “maintenance of the units must be carried out approximately every one-and-a-half months. As a result, new repairs may be required as early as mid-October. However, the cessation of gas pumping is likely even earlier in the event of turbine breakdowns due to increased load”. As Andrew Bishop of Signum Global Advisors tells us, that is a pretty clear indication of what Russia is intending to do – needle Europe’s public with continued supply disruption holding prices high, while not shutting of the gas supply completely to retain the leverage over European politics.

Yet, gas and electricity prices both managed to fall meaningfully this week, leading to stabilisation in both the euro and European equity markets. Germany’s second floating liquid natural gas terminal is set to come online in the Autumn. The move towards another three terminals is underway and Robert Habeck, Germany’s Minister for Economic Affairs and Climate Action, hinted there may even be another one. CNBC and the German power industry association BDEW report that during August, Norway has become Germany’s biggest supplier of gas, providing almost 38% of German consumption. The Netherlands is now the second-biggest supplier, delivering roughly 24%. Russia has fallen to about 10% (from 60% a year ago). Seasonally, August has the lowest gas consumption of the year, and this stepdown in consumption has been important in reducing dependence on Russia. By June, Eurostat data shows that Germany had reduced its consumption by nearly 20% still. On our calculation, if the cut in absolute consumption was maintained even as consumption rises into the winter months (rather than being proportional), this would still be a 12% reduction. With further supply increases, it might be enough to mean no more price rises for businesses, the key metric for equity markets.

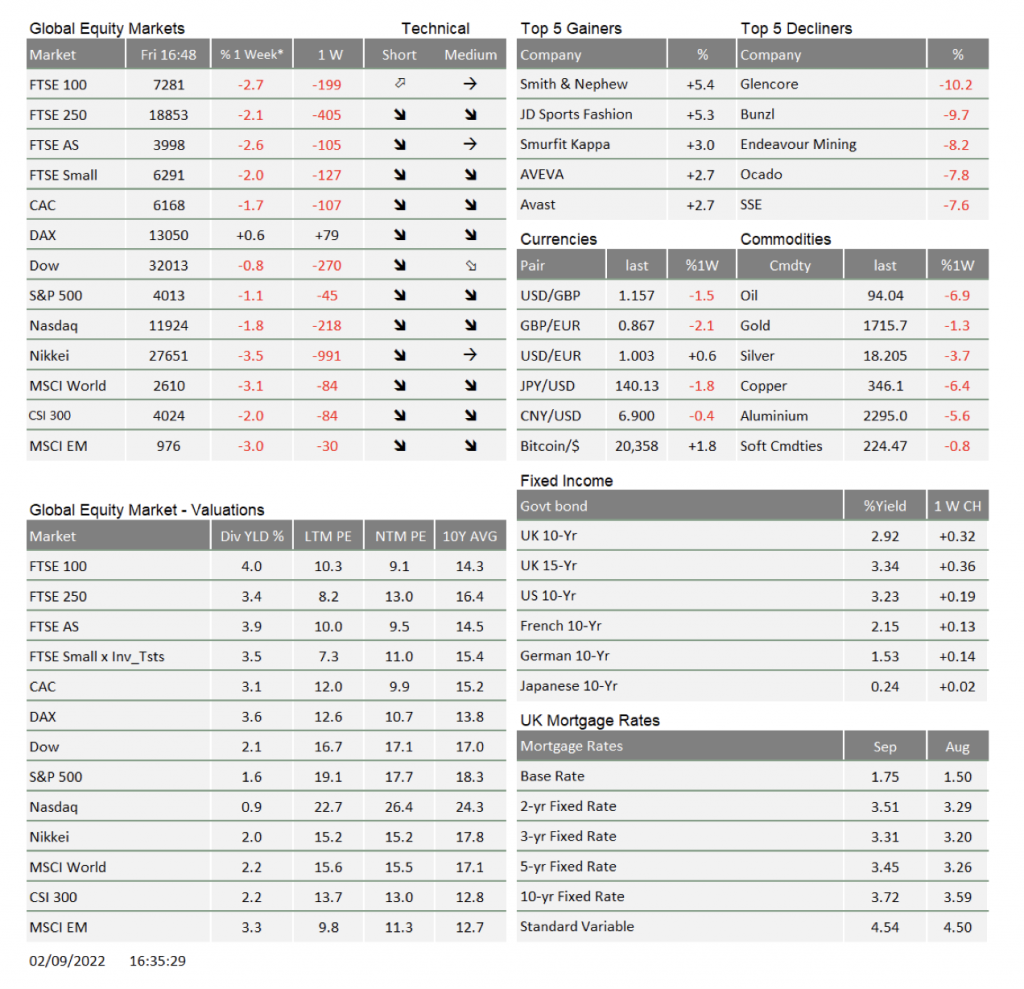

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.