Market Update: The End of Eras

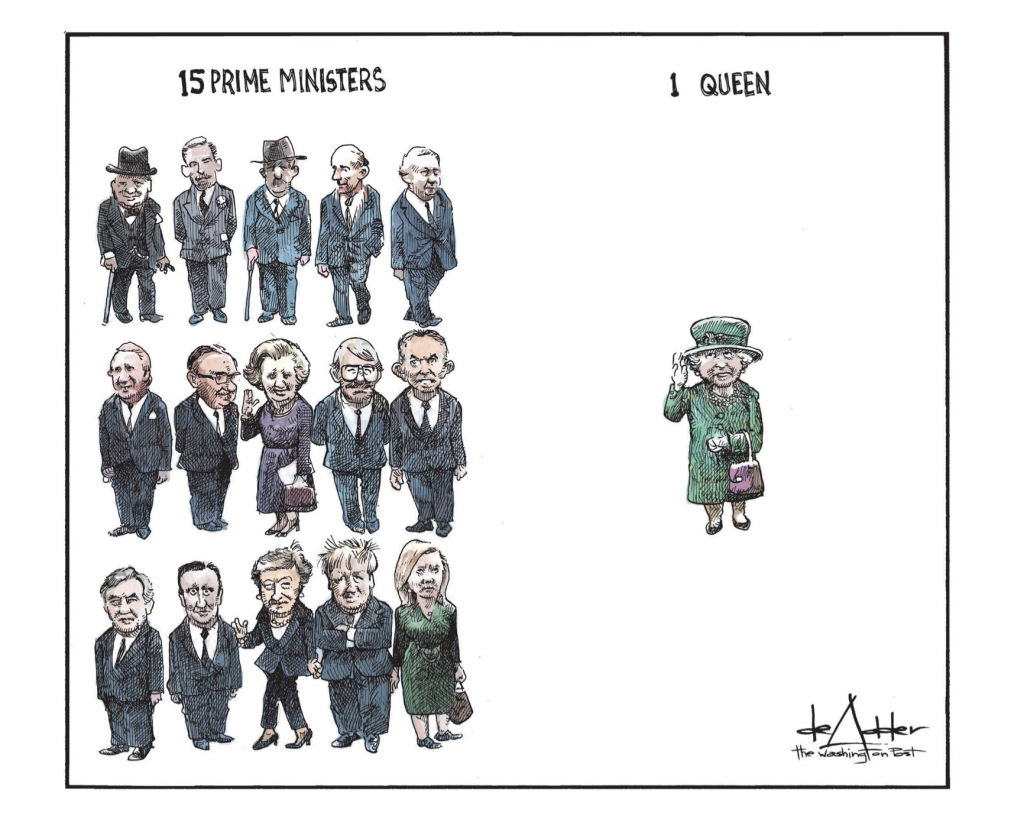

With great sadness, we pass from the second Elizabethan age. Our Queen was a constant during this period of intensely rapid change. Across the political spectrum, we can acknowledge her ceaseless responsibility to her people. She retained her dignity as monarch throughout her reign supported by her faith and her humanity that was obvious to all.

Despite her failing health, her last official act on Tuesday was to invite Liz Truss to form a government, the 15th Prime Minister during her reign. The official pictures show the Queen undertaking the task with a warm smile and a welcoming handshake.

The Prime Ministers are perhaps more signals of change than constancy. Truss has moved commendably quickly to propose action on the energy crisis. Underneath the action is a stronger sense of political principle than under Johnson, May or even Cameron. In this respect, Truss seems to want to emulate Margaret Thatcher in being a strong support for business. Within the energy policy proposals, a six-month energy price cap for businesses will be welcomed by many. We look at the emerging energy policies in the UK and Europe in the article below.

The finance-related cabinet team is also imbued with a radical pro-business deregulatory agenda. Kwasi Kwarteng is said to be focused on policies which create an attractive UK environment for global firms. The current refusal to countenance windfall taxes is such a signal, as is the proposal made (in the Conservative leadership campaign) to cut corporate taxes. The appointment of John Redwood also signals a wish to get back the reforming years of Margaret Thatcher’s premiership.

The immediacy of Truss’s proposals is commendable, but it is also clear that the political need for speed has led to only partially-formed policies. The Institute for Fiscal Studies and the Resolution Foundation both point out that is remarkable for such huge proposals to be costed only in the most sketchy way – the announcements told us about achieving outcomes without any real clarity on how they will be achieved.

This is not to say that the policies will be ill-formed. The aims are laudable but we just don’t know yet whether they will be achieved in a way which solves problems or add to them.

One aspect of this is the growing dissonance between fiscal and monetary policy. Both Bloomberg and JP Morgan Research expect that the Bank of England will still raise rates, although the energy price caps have the effect of lowering consumer price inflation forecasts over the next year, and hopefully go some way to lowering future inflation expectations. Both expect that the fiscal boost will support the economy enough to avoid more than one-quarter of negative growth next year.

This means that both expect rates to peak at a higher level than before. However, neither expect rates to go higher than 4%. The interest rate market was already discounting rates above 4% before they published their research.

The biggest conundrum will be around the new debt that will have to be issued by His Majesty’s Treasury. During the pandemic, the Bank of England bought much of the debt issued. It will be difficult to countenance a repeat of that while inflation and a weak sterling are its monetary problems. Over the past two weeks, gilt yields have risen and the Sterling has fallen. Potentially, they could go further if the details of the policies show open-ended costs.

During her campaign, Truss talked of reestablishing a money supply-led monetary policy, in the manner of the early Thatcher years. However, her fiscal largesse is some way from the economic policies that Thatcher favoured. The era of neo-classical economics may be also passing.

Coping with the Energy Crisis

The post-pandemic inflation boom has taken many turns over the past couple of years and pushed central banks into current aggressive policies. Fading growth and business confidence (outside of the US, at least) have lessened concerns of a wage-price spiral, but the war in Ukraine has kept inflation pressures excruciatingly high. Now, inflation pressure comes mostly from the cost of energy, caused by a severe cost-push around natural gas and electricity – and it is overwhelmingly focused on Europe.

All European economies face serious problems around energy supplies. With a harsh winter looming and no sign of loosening supply, blackouts and gas rationing are expected in Germany and some of its neighbours. Costs are skyrocketing for consumers and especially businesses.

The policy response to this crisis is crucial. Inaction is not an option, but the ‘how’ is difficult. If government aid creates an increase in the aggregate energy demand, the world’s undersupply will grow, and inflation will only get worse.

Finding that balance has led to various plans from politicians. Germany has set out various support schemes for households, with utility companies able to for state support, while new Prime Minister Liz Truss announced a general price cap on typical household energy bills at £2500 and it appears UK companies will benefit from a price cap lasting six months.

This will certainly lower consumer energy prices in the short term and reduce CPI inflation readings that Central banks usually target. The problem is that these do not address the supply-demand imbalance. Without higher energy prices, there is no incentive to reduce consumption meaning price pressures remain.

In mainland Europe, the EU is reportedly planning to change the way the electricity market functions to avoid sudden price rises, aiming to decouple end energy prices from wholesale gas prices – to soften any sudden supply-side shifts – and proposes to redistribute energy companies’ excess profits.

The G7 nations announced that they will seek to impose a price cap on Russian oil, starting in December for crude and then in February 2023 for refined products. While this has primarily been presented as a geopolitical play to hurt Moscow’s finances, it could also have a critical impact on prices down the line. Unfortunately, the cap applies only to oil which is not the key driver of Europe’s price pressures.

In many countries, spending plans or price caps are being financed by (or coming at the expense of) energy company profits. While there is renewed political pressure on Truss to apply a ‘windfall’ tax on energy companies, it appears the current support package will be fully debt financed and debt-financing is a risky move in the current economic environment keeping real prices high and creating inflationary pressures further down the line.

This is likely to put pressure on the Bank of England (BoE) to tighten monetary policy further meaning that we are in a rather “classical” situation where a higher fiscal deficit puts upward pressure on yields. After years of fiscal austerity, coupled with low inflation readings and therefore supportive monetary policy, this is a different framework to operate in.

A tighter monetary policy will push borrowing rates up and weigh on businesses and households alike, but a benefit of the Government’s plan is that borrowing can be more targeted than interest rates. In the best-case scenario, this creates actual wealth redistribution and in the very worst case, it damages the whole economy and creates unemployment.

The Pound has already fallen to its lowest dollar value in decades, and further debt or inflation pressures could weigh on it further. It is therefore vital for the BoE to keep its independence from Government. From a more general political point of view, the UK and the EU are at the cusp of defining Europe’s (energy) future but without investment to sufficiently shift its energy infrastructure disruptions are more, not less, likely.

Global Property Prices Fade

The current inflation spike has hit virtually all parts of the world economy, and property is no exception – according to reports global house prices jumped 11.2% from April 2021 to March 2022 – the first double-digit jump in property prices since the global financial crisis of 2008, The rise was broad-based, affecting both emerging and developed economies.

If this was good news for homeowners, it points to a real stretch of affordability across multiple markets. House price gains have been a big contributor to the cost-of-living crisis facing the developed world. Even adjusting for inflation, global residential property prices grew 4.6% over the twelve months to the end of March 2022 and most likely hits buyers and renters hardest. Adjusting for real wage loss due to inflation we estimate that the surge is around 7%.

Affordability is the key thing to watch and, on that basis, the inflation wage-adjusted figure is revealing. House price rises are paper gains until you move and without a supply of sellers consumers end up being squeezed for housing. For property prices to comfortably rise above inflation indicates how strong the market was – and suggests that house prices themselves are a big contributor to global inflation.

While property prices are certainly a big part of this year’s inflation story, they were on an uptrend long before the current supply-side shocks. Looking back at the twelve years since 2010 analysts at the Bank for International Settlements calculate that real house prices are 29% above where they were after the global financial crisis, and the gains are again unevenly shared: EM residential property has gained 19% while developed markets have jumped 41% over the same period. From a longer-term perspective, this is quite astonishing.

What does this mean currently, and for the future of the housing market? Developed economies have pushed this limit over the last decade, by keeping interest rates at historic lows and pumping markets full of liquidity meaning house buyers could borrow to keep with prices, even if their wages fell behind.

Now, the borrowing environment is entirely different. Central banks have tightened policy to combat inflation, and are signalling higher rates ahead but we are in a severe cost-of-living squeeze and falling real disposable incomes. It is hard to see how demand could keep up with soaring prices. This is not to say a crash is coming – but a slowdown or slight reversal seems inevitable.

More recent signs back this up. After climbing high into the first three months of the year, Australian and German house prices seem to be falling. In the UK, prices are still increasing, but the gains are small and below consumer price inflation, though importantly our housing market no longer likes a source of inflationary pressure.

China – is now a key region in the global property market with the collapse of property developer Evergrande creating severe knock-on effects on the country’s house prices. China has also impacted other nations’ property markets, especially in the cities among new-build apartments.

The main exception to the recent global price stagnation is in North America, where house prices are still rising at or above inflation. During the pandemic and up to this April, US and Canada saw new-build costs rise sharply and now mortgage costs have hit 10-year highs. This removes much of the surge in demand and new build costs are back at pre-pandemic levels. If that helps to reduce some price pressure, the strong labour market continues to give housing prices strong support.

The timing of this price reversal and the difference in the fortunes of the US should be expected. The war in Ukraine has hit Europe economically the hardest making cost pressures more pronounced than in North America, squeezing its consumers more. US energy costs have been much milder, and its consumers have fared better. How much longer that can continue remains to be seen – particularly with the Fed tightening policy. But with winter approaching, we should not expect the outperformance to end in the short term.

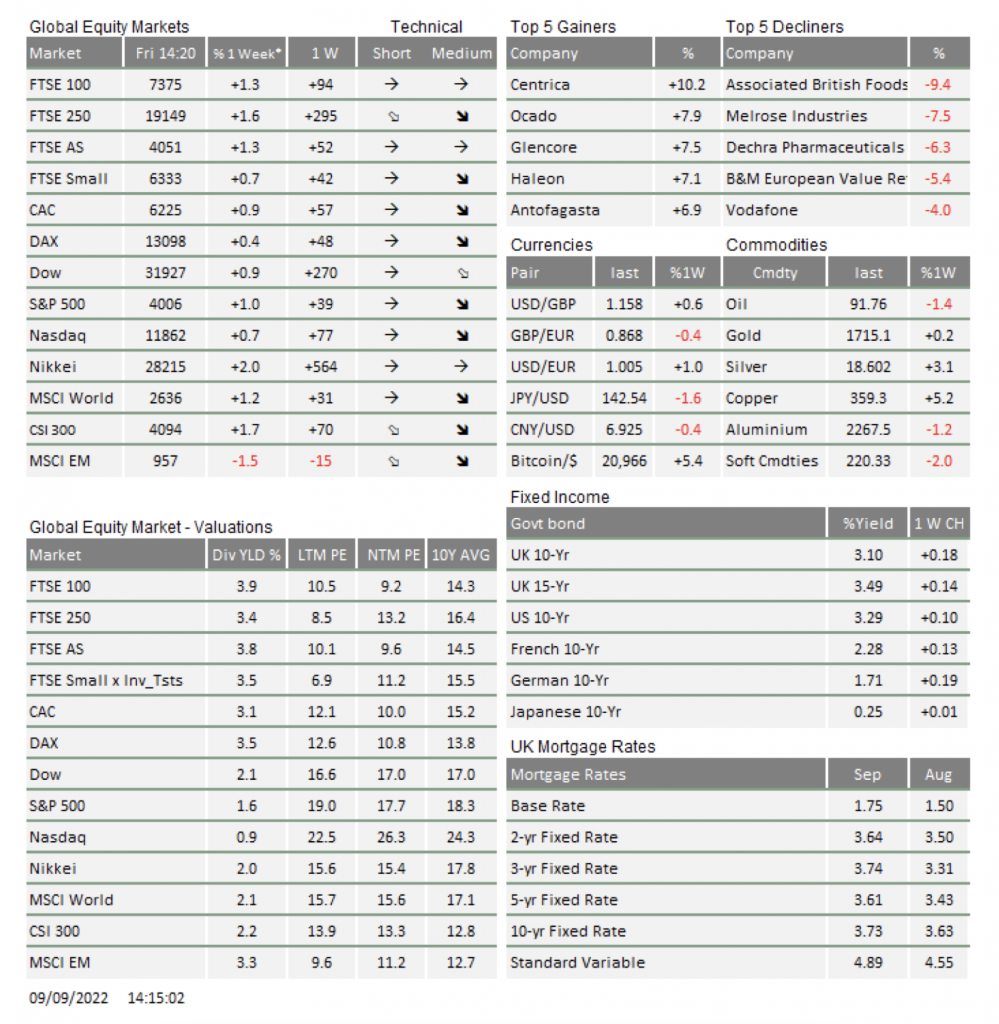

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.