Market Update: US slows, Europe’s winter outlook improves, UK back to start

The most turbulent October experienced by UK bond markets since 2008 is drawing to an end and one could easily get the impression nothing of significance happened. Sterling is back to where it traded just before that fateful 23 September ‘fiscal event’, and bond yields are likewise roughly back to where they started in Autumn. This is good news: it shows the UK still has effective institutions capable of reversing errors and preventing major collateral damage. Unfortunately, though, some of its credibility in international capital markets has been lost. As a result, the government’s fiscal headroom of what it can and cannot do when the absolute need arises has most likely reduced.

Rishi Sunak’s new government is seen as one where the Treasury is firmly in charge and fiscal prudence, rather than fiscal experiments, dictates the agenda. For evidence of this, the ‘interim’ Chancellor retained his job, and the old Chancellor is now Prime Minister. The next balancing act will be to not overdo the other side of fiscal policy, namely austerity A difficult winter still lies ahead for consumers and businesses as higher prices, and an ongoing energy price shock, stretch budgets to breaking point. Should the energy price shock prove temporary, then under these circumstances only the government can soften the blow through time-limited support measures. We have dedicated our second article this week to an assessment of the UK’s newfound (old) position.

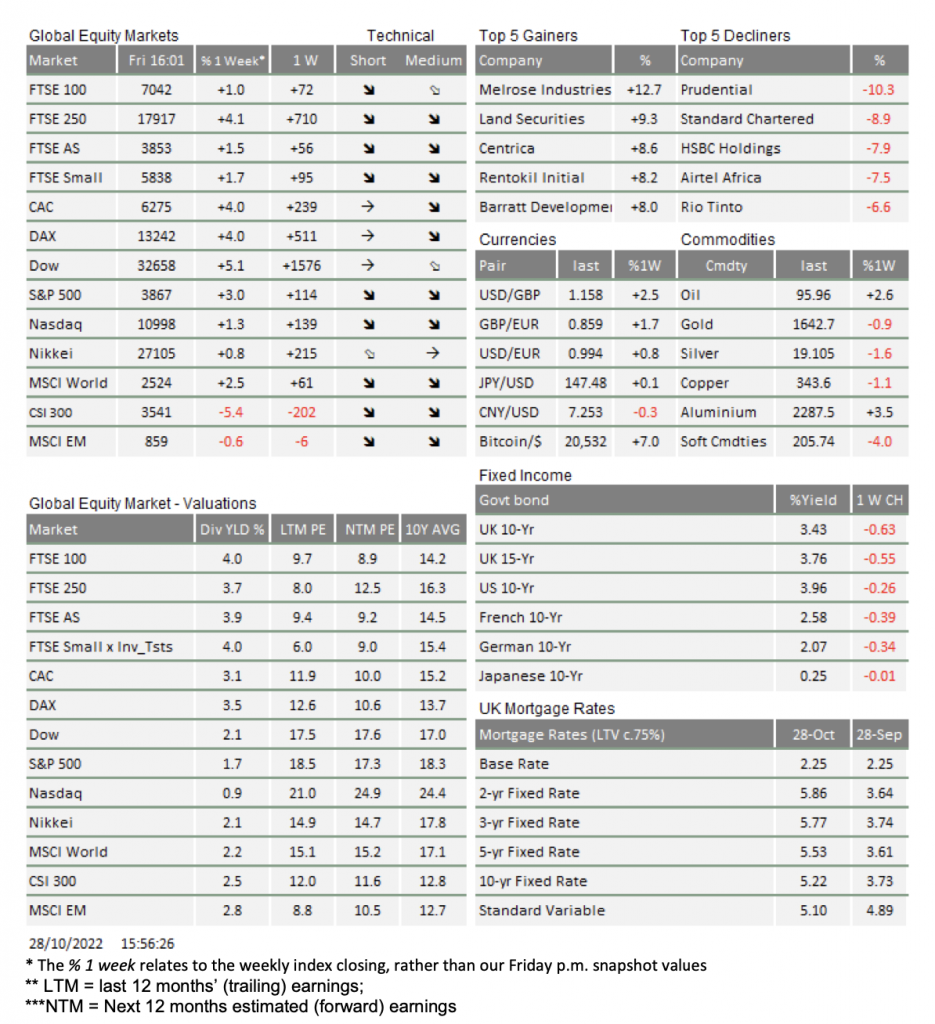

On the energy price side, in the early part of last week, equity markets and corporate bond markets on both sides of the Atlantic were buoyed by near-term energy price falls. European and UK corporate bond credit spreads (the additional yield over government bonds) declined quite sharply, which was welcome relief.

Last week, gas spot prices staged a mini-repeat (if only for minutes) of the negative oil prices seen in the US in April 2020 and for the same reason – completely full local storage – while LNG tankers were waiting outside harbours to unload.

Stores are full because there is not a lot of storage for liquified gas in the first place, and the current warm weather has reduced the need for heating. We are not out of the woods yet, as a colder than average winter would substantially reduce those stores, given even fully-stocked, pan-European storage capacity covers only two months of use.

We should not be too dismissive of the fall in gas prices, however. The influx of tankers shows that the redistribution of global gas to cover the loss of Russian supply has been achieved sooner than most had expected. Full-year 2023 gas price indications (as per forward contracts) now stand at EUR 79 per MWH. This is still three times what they were last October, but down 20% since the end of September and half the peak price from the end of August.

Last week’s economic data, however, painted a gloomy picture – albeit with some mildly positive growth surprises and no further deterioration in outlook. Europe’s consumer sentiment is depressed but perhaps by less than feared. Business sentiment, as measured by the ‘flash’ purchasing manager indices (PMIs) for October were generally below 50 for both services and manufacturing, indicating likely contraction in the next few months. France was the only notable exception. European services were slightly better than manufacturing. Service surveys tend to track consumer confidence more closely and it appears European consumer confidence is holding up despite the buffeting of energy price moves. This may also explain why flash Q3 GDP figures for Germany and France showed a slight expansion rather than the expected contraction. The economic resilience of the past months is encouraging.

However, US consumers seem to have grown pessimistic, and more so than in Europe. This is despite quarterly GDP growth unexpectedly increasing to 2.6%. This was mostly due to the impact of energy exports, while the demand across businesses and consumers declined. The Conference Board’s highly-regarded index of Consumer Confidence slipped, as did the service PMI. The tight employment picture of plentiful jobs may be easing, although the reduction in households’ perceived wealth from sliding stock markets may have had quite an impact as well. We saw a similar situation in the Spring.

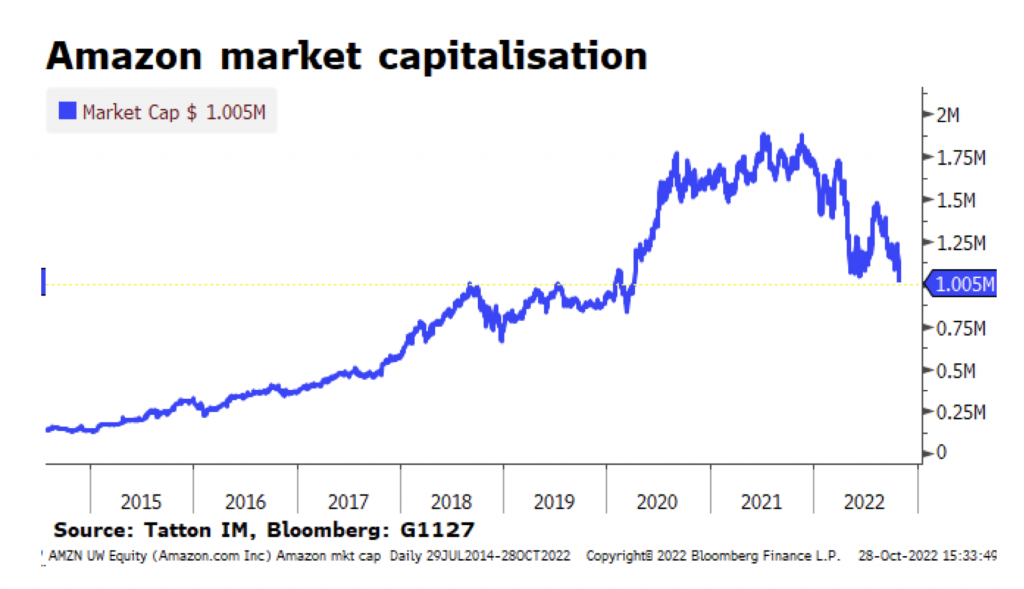

But perhaps the biggest indicator of a US slowdown came from Q3 corporate earnings announcements this week. Microsoft said both business and consumer demand for PCs was declining after the two bumper pandemic years. Perhaps most importantly, Amazon spoke of rising costs and slower economic growth. Its margins have come under strong pressure and now sales are growing at a tepid level. The days of ripping competitors to shreds have gone. Amazon opened Friday’s trading down 11% from Thursday’s close, its market capitalisation now hovering around $1 trillion.

And yet mid and small cap US stocks have been faring better, helped by a cheapening of finance. Indeed, the dynamic of the slowing of exceptional US growth has allowed 10-year US Treasury yields to fall below 4%, having traded at 4.33% a week ago. And, despite the European Central Bank raising rates by 0.75% yesterday, European and UK bond yields have also fallen by similar amounts.

The European/US growth imbalance appears to be easing (at least in terms of perception). And the US dollar, after weeks of rising against other major currencies, has slipped back, giving some prospect of easing global financial conditions. However, worries about this imbalance will not disappear just because of a few datapoints. As noted earlier, we had a similar situation in the late Spring months – but perhaps there are more indicators of US slowing than was the case then, particularly in the earnings reports.

We ended last week at a slightly odd juncture; that a fall in one of the world’s largest companies is actually good news. For US equities, the environment is one of declining medium-term earnings expectations but improving valuations. This occurs more often in the midst of recession rather than before the start, but the old adage reminds us that history does not repeat itself, but it often rhymes. Over the coming weeks, we cannot expect news of inflation and economic headwinds to recede at once, but with the growing signs of the transatlantic misbalance narrowing, the outlook is no longer deteriorating. In our world, this is similar to saying it is darkest just before the dawn.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.