Market Update: Diverging paths accompanied by seasonally scary messages

Considering the gloomy news last week from central banks in the US and UK, investors enjoyed a decent enough start to November. Following on from the rebound over the second half of October, it has been welcome news that capital markets no longer seem to overly mind when central banks push through yet another set of jumbo rate rises, accompanied by a continuation of gloomy outlook statements. Whether this is because economic growth has proven resilient or that the messaging raises the prospects that this sequence of steep rate rises is coming to an end is not entirely clear and to be discussed.

In the UK, the 0.75% rate rise announcement from the Bank of England (BoE) came as no surprise but Governor Andrew Bailey delivered a dovish outlook, suggesting interest rates would likely not have to rise as high as markets had anticipated and therefore that mortgage rates can be expected to come down from their current heights. This guidance was enough to send sterling lower, even as prospective UK home buyers will have sighed with (some) relief. It does suggest though, that the Autumn Budget announcement from the UK government ( we have to assume the rate setters had sight of its content) will likely see a swing from fiscal easing to some fiscal tightening of at least a magnitude that gave the BoE comfort Downing Street would not undermine their inflation busting efforts by fanning demand.

The messaging from the US Federal Reserve (Fed), two days earlier was the opposite. While the statement similarly seemed to indicate that the intensity of rate rises would likely moderate over the coming months the Fed Chair’s press conference conveyed the message that “the ultimate level of interest rates will be higher than previously expected”. US stock markets reacted to this news with a two-day sell-off, although somewhat counterintuitively resumed their upward movement when job creation numbers for October, on Friday were reported higher than expected. This suggests that the US labour market remains strong and therefore extends the danger of persistent inflation through the self-enforcing dynamics of the wage price spiral.

Before suspecting that markets have lost their fear of higher interest rates all of a sudden, we need to extend our horizon Eastward. Persistent rumours about the nearing of an end to China’s zero COVID policy had gotten investors very excited, and led to a 10% rebound in Hong Kong’s stock market during the week. This reminded us of the strong market rally that accompanied the post- COVID re-opening phase in Europe and the US in the Spring of last year.

This positive momentum had already spilled over to European markets, further buoyed by better than expected (or less bad) corporate earnings numbers. Meanwhile back in the US, once the gushing profits of the energy sector are subtracted, earnings declines have accelerated. Half-way through this quarter’s corporate earnings announcements, it must be acknowledged that the global picture confirms that recent worldwide economic weakness has hit earnings and will continue hitting revenues through the next few months at least. While not great news in terms of that fundamental underpinning of stock markets, this undeniable sign of slowing activity also tells investors the drivers of persistent inflation are abating, and with them the pressure on central banks for more tightening.

This would explain the diverging central bank messaging on either side of the Atlantic. In the US the economy and the jobs market have proved resilient enough to discourage the Fed from easing- off its pressure in the interest rate brake. Meanwhile, across Europe and the UK, household’s higher energy and mortgage expenditures are increasingly seen as potentially destroying more discretionary demand than may be necessary to bring inflation back under control. Judging from the BoE statement, concern is also making the rounds that the economic contraction may become so painful it could hamper its ability to keep public support for its actions onside.

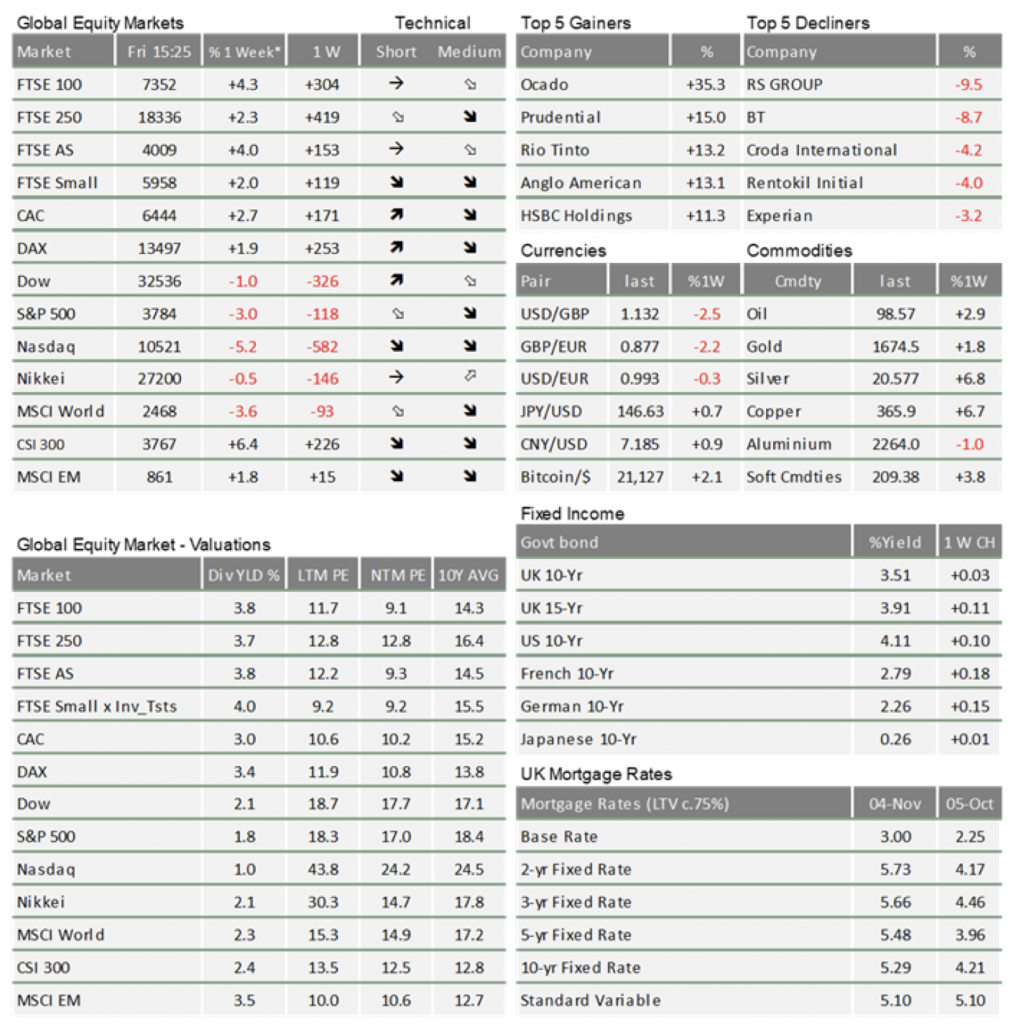

The divergence of central bank policy after the extraordinary policy convergence since the beginning of the year, makes forward market assessments ever harder, because it is likely to keep the US dollar on its upward trajectory, or at least stronger for longer. At the same time, the prospect of a return of Chinese consumers to the global demand equation has to be an overall positive, even if oil prices rose in the wake of the good news. We also note the divergence between the US mega cap tech darlings of the pandemic period and the non-tech sectors in the US, with the NASDAQ being the only index to have persistently lost recently.

The coming months are going to be tough for the global economy, as central banks raise rates incrementally and energy prices remain too high. Markets are beginning to spot the tell-tale data points of historic triggers of market sentiment turning point. However, even if these data points cause temporary market sentiment upswings, as long as this weaker growth picture remains accompanied by inflation driven by more than just higher energy costs, we are not out of the proverbial woods.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.