Market Update: The resilience narrative comes under pressure

Source: Matt, 24 October 2023

The resilience narrative comes under pressure

US mega tech stocks came under pressure last week, leading to commentators wondering whether this signals a more sustained wind of change.

Oil Majors double down

With big oil multinationals on an acquisition spree, is the green transition at risk of reversing?

Is the ECB turning dovish?

The European Central bank has flipped from markets thinking it’s the least likely bank to cut interest rates, to its being the first – what has changed?

A potentially meaningful change in correlations happened last week. In recent times, a fall in yields (and therefore a rise in bond prices) would go alongside rises in equity prices, particularly the mega-cap growth consumer-related techs like Amazon, Alphabet (Google), Microsoft and Apple. On Thursday, US Treasury long maturity yields started to retreat from highs but, this time, US stocks carried on lower. It was not just equities which weakened. In the credit markets, despite higher government bond prices, corporate bonds were flat to weaker, especially among the more indebted companies. If this new dynamic continues, it may signal a change in investor expectations regarding the resilience of US sales and earnings growth.All through this year, the developed world’s economic growth has been surprisingly robust, led by a remarkably resilient US. Indeed, the pace of growth actually picked up. US growth for the third quarter was strong. Real gross domestic product (GDP) growth came in at +4.9% (annualised and seasonally adjusted). The Atlanta Federal Reserve ‘nowcast’ had growth as high as +5.4%. Europe and the UK have been stronger than expected as well, but the third quarter has proved less positive.

The quarter’s corporate results give us a different prism on recent growth and the outlook. Aspects of the results and company guidance suggest the near future may not be quite as positive (and it’s noticeable that a number of companies have declined to publish any guidance at all).

In particular, concerns are growing that the US consumer is running out of steam, or perhaps rather their confidence to run down their savings further. Market commentators have borrowed the name of the great film ‘The Magnificent Seven’ in referring to the largest seven (tech) growth companies in the S&P 500: Apple, Amazon, Alphabet, Microsoft, NVIDIA, Meta (Facebook), and Tesla. Slowing advertising suggests a slowing macro backdrop.

The July-September results at Amazon, Meta and Alphabet were seen as good but gone. Investors worried that the digital ad market is slowing. Meta disappointed (shares dropped more than 4%) after its executives warned of softer advertising spending and whinged it was at the mercy of an uncertain economic environment. Alphabet slumped 9.5% on Wednesday. As its dominant search business matures, the cloud computing unit needs to take the lead on growth but the business line posted a smaller-than-expected profit. Meanwhile the smaller but previously high-flyer social media company Snap said it had limited visibility into revenue for the rest of the year.

Although Amazon now gathers most of its profit from cloud computing arm AWS, it remains classified as a global consumer discretionary company because its sales platform revenues still dominate. North American platform sales accounts for over 60% of total revenues. Its major swings in revenue and profit come from this area, making it a good bellwether for US consumption. In its results last week, Amazon also displayed a healthy past quarter and yet the positive surprise still leaves the stock down on the week and -17.5% from this year’s 13 September high. To us, this seems an indicator of waning investor confidence in US consumption.

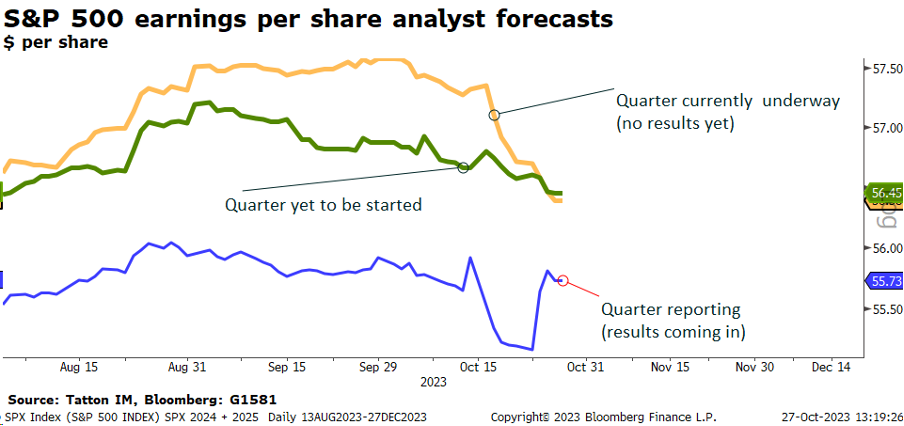

The early days of this reporting quarter have seen a marked decline in expectations for the quarter currently underway (Q4 2023) as the yellow line in the chart below shows:

An ‘earnings recession’ is where reported earnings (on a quarter versus same quarter of the previous year trailing basis) start to decline. The S&P 500 last had such a period in the summer and despite the declining outlook (yellow line), it is highly unlikely that a return to an earnings recession will occur during this reporting quarter or, for that matter, the next quarter. However, the S&P500’s current valuation builds in at least normal (as in non-recessionary) profit growth and that parameter of the valuation matrix feels like it may be coming under threat. The index valuation, by our rough calculation, is about 10% above the norm after accounting for (the risen competition from) bond yields.

The dominance of the Magnificent Seven over global equity markets also highlights a potential weakness. It is unsurprising the companies that have fared best in stock markets this year have had a large slice of the most robust part of the global economy, US consumption. Other parts of the world have been significantly lacklustre in comparison. We could see a period where US consumption retrenches somewhat while other areas become relatively stronger.

To that end, China’s announcement on Tuesday of a finally huge fiscal expansion could be very important. Policy urgency, rather lacking through most of 2023, seems to have become almost panicky. This comes amid signs that the private sector remains under the cosh, especially in getting hold of US-dollar based financing given the now lofty yields that come with it.

While the developed world’s stocks slid through last week, China’s markets bounced substantially and, this time, not because of government ‘guidance’ to Chinese institutional investors to buy. We have seen such bouts of rebound after the many policy announcements through the year, all of which have fizzled out in a few days. This policy shift is undoubtedly stronger. We await to see if it will be enough to turn investor sentiment for more than the short-term.

The European Central Bank (ECB) met on Thursday and left rates unchanged. The meeting felt unremarkable in many ways; no rate or other policy changes, no change in the mantra that sticky inflation remains the main risk. And yet the underlying tone was much less strident. Interest rate markets now see that the ECB’s policy is on hold and that the next move will be a cut as and when inflation is close to target and very likely to be well before the US Federal Reserve (Fed) starts to cut.

The other global rate setters of the Federal Open Markets Committee and the Bank of England (BoE) meet this week. The stalling of the oil price and other energy price rises also should allow the rate pause to continue. All ears will be on the respective statements and press conferences. We expect dovishness from the BoE given the slowing inflation environment, the easing of employment tightness and the weak house market.

That last component seems set to continue. Bloomberg reported that financial advisory firm Cornerstone Tax had surveyed 2,081 landlords and tenants, with the results indicating that UK landlords are feeling the squeeze from higher rates and more bureaucracy. They may be set to sell properties at triple the pace of two years ago. About 15% of rental property owners appeared likely to leave the market this year. The biggest headwind is higher borrowing costs as low interest fixed-rate deals expire making buy-to-let properties unaffordable.

The survey, one of the few tangible pieces of evidence, suggests supply of properties coming to market might increase. House prices have fallen about 5% from the peak so far and many expect a further 5% drop. Properties to let will decline, however, and keep rent at elevated levels.

What we take away from last week is that a certain level of realism took hold in the markets. This realism has displaced what seemed at times almost blind conviction that the resilience of the US consumer would mean that the top seven stocks of the US market would over most timeframes constitute the better return alternative to 5% yields from government bonds, regardless of the risk profile of the punting retail investor. While this has taken some shine off the ‘Magnificent Seven’, we should be clear that they are still in aggregate up 50% since the beginning of the year, while the rest of the US stock market has been flat.

It may not in itself constitute the beginning of distinct stock market correction such as experienced 25 years ago when the dot.com bubble burst. However, what it does potentially tell us is that the leadership of just a few market darlings is waning and a focus on real company earnings – rather than imagined future earnings – is taking place. That is not necessarily a bad thing for markets as long as there is the prospect for decent earnings on the horizon, as there currently is for 2024. The risk is that it leads to a more significant correction across those Magnificent Seven stocks and beyond, then US consumers (shareholders) could suddenly feel a lot less well-off, which has the potential to slow consumer demand much more quickly than required to stamp out the remnants of inflationary pressures. This would force central banks into slashing rates to stabilise the economic demand-supply balance much earlier than anticipated. This scenario is not the central one, but even with just a slowdown it does mean that the high long bond yields that have been locked into clients’ investment portfolios will begin to shine a lot more than with just their yields.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.