Market Update: Bond yield volatility has markets guessing

Source: Guy Venables, 16 October 2023

Bond yield volatility has markets guessing

While we hold our breath over the Middle East tragedy, markets return to interpreting if bond yields are just enough to eradicate inflation or if their volatility points to something bigger.

Chip cycles and tech bubbles

Tech is not just AI driven growth resilience – the coin’s flipside is computer chip cycles reminiscent of traditional manufacturing over and undershooting.

How far can Americans run down their savings?

Dipping into savings only works while consumers feel they can afford it, with significant knock-on effects if they can’t – is the US consumer at a tipping point?

While the human suffering in the Middle East conflict worsened as expected last week, it has not yet spread further across the region. Therefore, and as we wrote a couple of weeks ago, markets have not particularly acknowledged the rise in geopolitical risk temperatures beyond the slight increase in oil prices that was already under way over a week ago. Nevertheless, the extraordinary volatility in long bond yields continued as the global benchmark US 10-year government yield yo-yoed between 4.5% and 5.00%. This in turn impacted equity valuations and hence this increase in the bond term premium (risk premium for accepting fixed yields for longer periods) remains at the centre of talk at Wall Street and the investment community at large.

For example, Goldman Sachs researchers wrote: “We are exiting the abnormal era of cheap capital, a focus for growth and a reach for yield. That path to normalization will be (has been) bumpy. It will come with false bottoms and fake rallies. Stil, Covid-period ‘cash and dry powder’ remains available. The delayed effects of that saving creation has been felt in the resilience of the consumer and consumption habits… for how long that lasts is one big question with increasing signs of belt tightening.”

Part of our job is to try to find some indications of how the near-future might look. To do that we look back to find other periods which share similarities in some way. Of course, turbulent times are the most fully recorded, so there is a tendency to compare now to the most difficult situations. Professor Niall Ferguson is a well-read and known historian and his 15 October article in The Times drew some very daunting parallels with the 1970s and the 1930s. On reading the article, investors would and should now want to be paid more of a premium than before for locking up their money for fixed time periods.

But history cannot be a science because there are just too few comparable periods and our recording is biased; we remember less well the times when things looked horrible but then nothing happened. Moreover, these periods are not ‘homogenous’ – only certain aspects are similar. So, Professor Ferguson’s words should not be treated as a prophecy, but as a statement of downside potential and a spur for action. And the greatest urgency for our leaders is to try to make sure we learn from history, so the mistakes of the past are not repeated. Biden, Scholz and Sunak are to be commended for their diplomatic visits to the troubled areas.

Still, investors now want more reward for any new investment beyond cash. What’s been interesting in the past weeks is that the biggest relative change in required risk premium (that incentive of extra expected return) has been in the assets generally described as the least risky – government bonds. The 10-year US Treasury yield traded at 4.992% on Thursday. Some of this rise is attributable to rising inflation fears although (oddly, given the oil price rises) not in the near-term – the fears seem to be more visible in five years’ time.

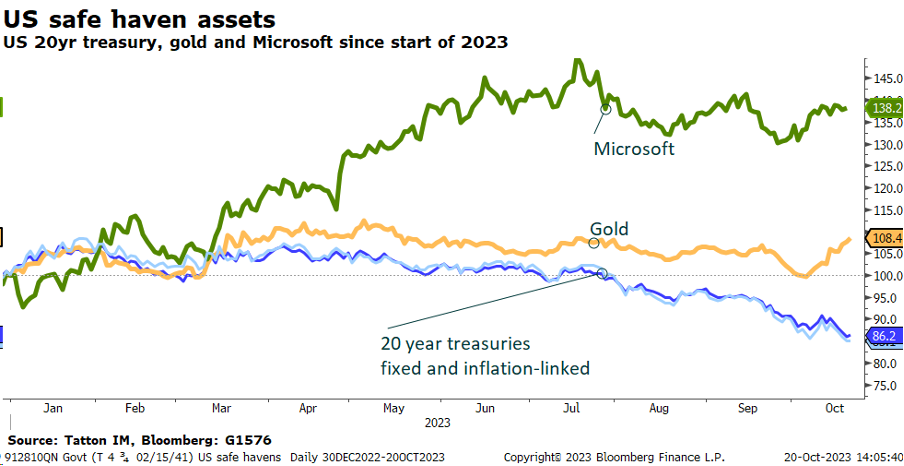

It seems that investors hear the words ‘risk-free asset’, but perceive long-term US Treasuries bonds as one of the riskiest of defensive assets, and perhaps it’s not just about the losses these securities inflicted on holders in 2022. The last few days have been particularly instructive. Gold has rallied quite hard, up 8.5% since the Hamas terrorist attack. Usually, gold price movements move quite closely with inflation-linked bond price movements. This time they are moving in opposite directions.

US investors are not the only holders of risky US assets, of course. Oil producers and manufacturers of goods earn lots of US dollars and generally ‘store’ a good proportion of the proceeds in US dollar financial assets. However, in the current situation, they might find their ability to liquidate those assets without the risk of short-term losses being substantially constrained.

In terms of incentives for other external holders of US financial assets, the US policy of imposing financial sanctions may well be starting to rebound. Earlier last week, US data showed that China has been disinvesting from US dollar assets since mid-summer. Now, the Middle East oil producers may be doing the same, and putting the proceeds into the safe haven asset they have trusted for even longer than US bonds.

In our long-term measure, gold has been relatively expensive to bonds for some time but our measure depends on the view that you can sell the asset and get your money with equal ease, and it may well be that some people don’t believe them to be equal now. (Interestingly, crypto currencies do not seem to be benefitting nearly as much, despite this being an environment that seems made for them).

The case is being made by some commentators that US bonds are being hurt by the possibility of a worsening in the US fiscal deficit, amid the conflicts in Israel and Ukraine, while the rise in interest cost is also a factor. However, at the moment, they are trying to ration the volume of new borrowing. Neither side of the political divide is proposing emergency spending. As we know from our experience here, markets take serious fright more when politicians feel fiscal discipline is not necessary.

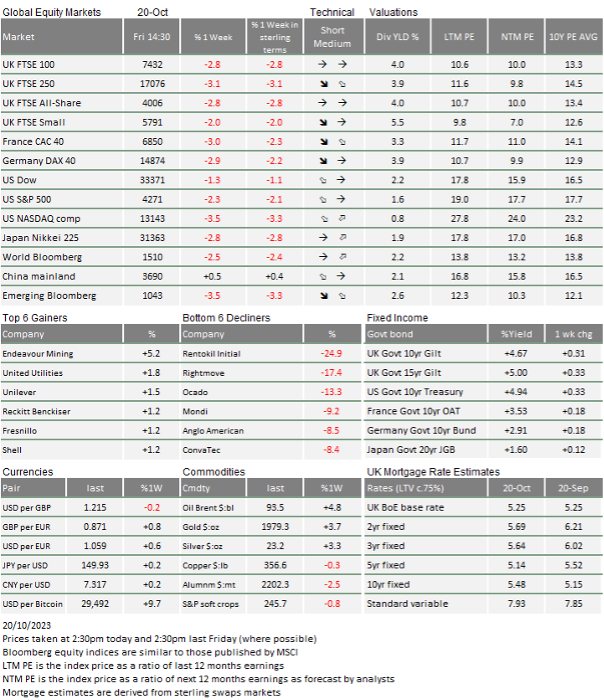

So the shift upwards in bond risk premia may just be about bonds. While non-US investors have exposure to equities, it is significantly less important. But neither should we be complacent either. We are in the full spate of third quarter earnings announcements which are unsurprisingly full of positive surprises, albeit with some negatives (such as Tesla lastweek). Still, the theme of larger companies holding up but smaller enterprises being stressed keeps coming through.

US Federal Reserve (Fed) Chair Jerome Powell gave an even-handed assessment of monetary policy last week and acknowledged that the rise in long bond yields was tightening policy without the Fed having to change anything. The markets took that as indicating interest rates were not likely to go any higher than one more 0.25% rise. We would note that one-year yields are still at the same level as the end of June, not brilliant since it means that the expected first round of rate cuts has moved out by the same amount of time, but this is not catastrophic either.

The danger for investment assets is that the further tightening of financial conditions leads to a downswing in earnings expectations. To some degree, this has already happened in smaller firms’ estimates but it has not particularly hit the larger ones. Nevertheless, they are not immune either as we saw around the end of last year and US households have been able to keep spending partly because their financial assets have done fairly well. A fall in equity prices therefore has the potential to create a slowing in spending, rather than slowing spending causing a fall in equity prices.

Credit spreads as indicators of recession fears rose in the derivatives markets but less so in the cash traded actual bond markets, something which tends to indicate precautionary hedging but not disinvestment. At the same time, the fall in equity prices last week wiped out the gains from earlier in the month but, as yet they are not signaling a change in investor belief in earnings growth.

Meanwhile, the yield moves in Europe have been notably less than in the US. Growth is weaker, which is not great for assets but keeps a lid on yields to a large degree. The key risk remains around gas and electricity prices, which currently are reasonably well behaved. UK gilts were hit harder last week, which will hurt our softening economy further, although mortgage providers are doing their best to hold fixed rates from going much higher.

To sum up, it may be reasonable to draw as a conclusion from the raging debate about the reasons of the term premium moving bond yields that this inflation fighting tightening cycle may have indeed reached its nadir. Therefore, the emerging crunch point is whether the higher rates and yields are slowing activity just enough to declare victory over inflation (so we get away with an economic soft landing over the coming months), or whether the additional dynamics introduced by the ‘collateral damage’ of the high yield environment leads to an acceleration in the slowdown – or even possibly trigger a credit default cycle – all of which causes central bank tightening to turn into a policy error outcome that leads to a hard landing recession.

We continue to watch credit spreads and stories related to default stress, which have increased but not to worrisome levels. Market liquidity remains good and intraday volatility well within the usual boundaries. This can all change quickly, but currently give little reason for concern, but equally the conditions are not tempting us to declare and position investor portfolios for one outcome or the other.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.