Market Update April 2020: Negative Oil Prices and the Wait for V or U Shaped Recoveries

Stock markets have been fairly resilient over the past few weeks to claw back some of the losses made earlier in the year. Since late March the MSCI World equity index has recovered circa 25%, with US companies leading the charge.

Investors appear to have been focused on the post covid-19 opportunities, encouraged by the news that Asian nations are slowly getting back to work. In addition, positive data has indicated that the European outbreak has passed its peak. In Europe Germany, Norway, Poland and the Czech Republic have relaxed their lockdowns measures this week.

These optimistic investment decisions, perhaps fuelled by FOMO (fear of missing out) have been made despite the rather concerning economic backdrop. The recent risk on environment clearly represents some investors’ willingness to expose themselves to short and medium-term volatility in the search for attractive longer-term returns. It seems that many investors believe that we are starting to reach the peak of the pandemic and gradually we will start to see an improvement in our day to day lives, both socially and economically and we hope this is the case. However, we are conscious that we do not yet fully understand the duration and severity of the global COVID-19 crisis, so it is important to recognise the potential risks to certain businesses and the sacrifices and changes they will need to make to survive a changing world with prolonged lockdown and/or social distancing measures.

In stark contrast to the improving investor sentiment, troubling data continues to emerge. This week alone we have seen early indications that S&P 500 profits are likely to contract by circa 14% in the first quarter relative to a year ago, as well as witnessing a historic crash in the oil market as oil futures for the month of May turned negative for the first time in history as a lack of consumption stalled demand for “black gold”. Never before have oil traders been willing to pay to have delivery contracts taken off their hands. For many, how this could occur is somewhat confusing. International tension also returned with President Trump warning Iran that he has instructed the U.S. Navy to destroy Iranian gunboats if they continue to harass American ships in the Persian Gulf.

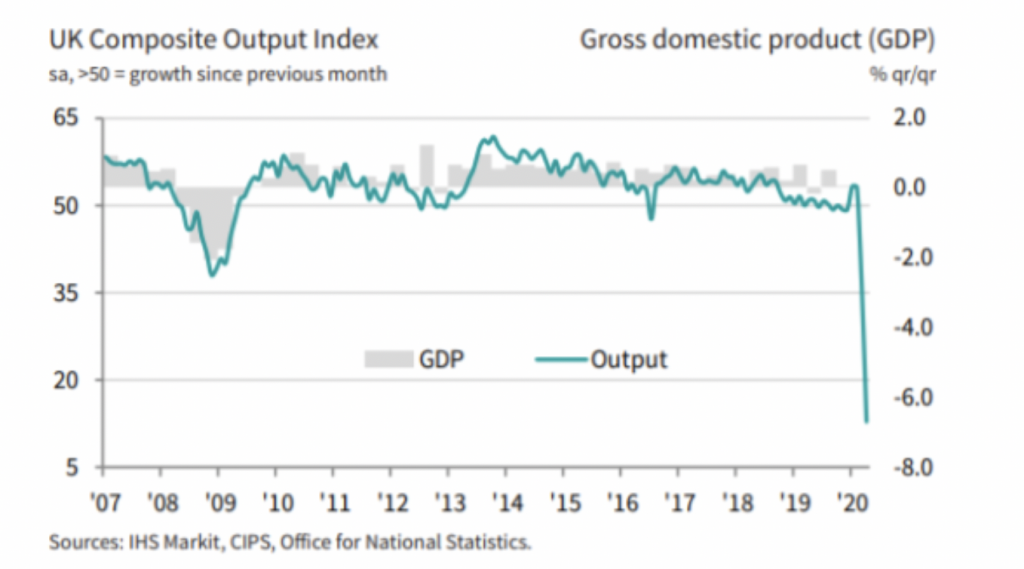

Closer to home, UK PMI data was released indicating that economic activity was much worse than even the most pessimistic forecasters predicted. The startling figures showed a slump to just 12.9 for April, down from 36 in March which was the worst reading since Markit started recording this data more than two decades ago – to clarify, anything below 50 shows a contraction. Investment banks are currently forecasting a strong recovery in the global economy in Q3 which is sustaining current stock market prices.

With markets climbing alongside the release of poor economic data, investing in the stock market may appear to be an intimidating prospect. However, it is important to remember that the stock markets are prone to swings in both directions based on sentiment and this recent sell off appears to offer an opportunity for the longer-term investor.

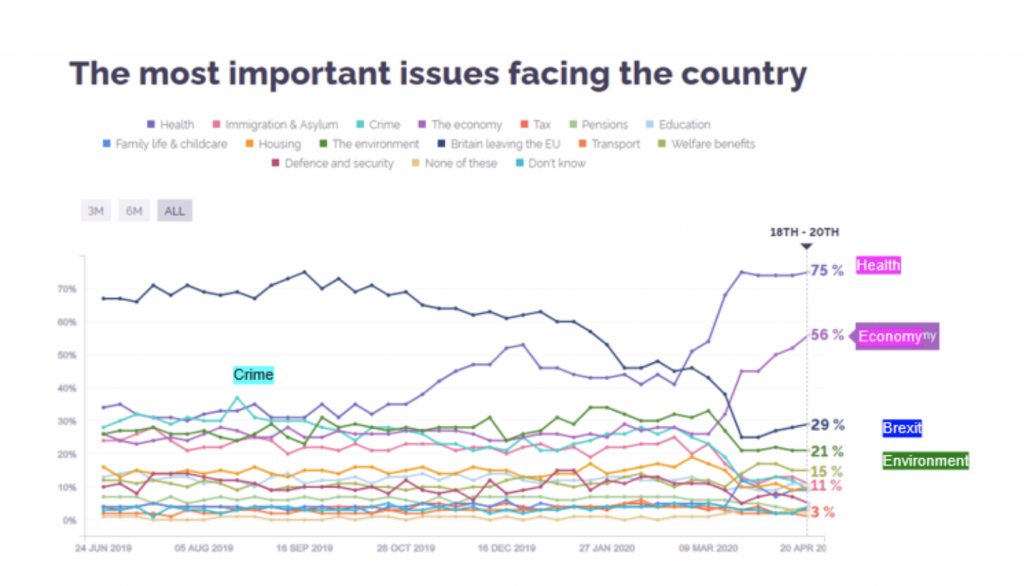

A view of ‘peak lockdown’ appears to have replaced ‘peak virus’ as the most discussed topic. As daily news registers falling fatality numbers and healthcare systems coping without the need for ‘triage’ decisions by hospital staff, attention appears to be turning towards the economic damage versus loss of life trade-off that was initially accepted with very broad support. The fast-increasing focus on economic concerns shown in the YouGov chart below is not limited to the UK and has created the impression that we have passed the peak of global activity lockdowns.

While many have warmly welcomed the idea of a gradual relaxation of the strictest lockdown constraints, for those working hard at assessing the probabilities for a fast and sharp recovery (the V-shaped version) versus a protracted slowly-slowly return of economic normality (the less popular U-shaped version) it has been a week spent comparing what can best be described as ‘trial and error’ national approaches.

The comparisons offer a range of different scenarios. China is clearly ahead and their fast improving economic indicators tell us they have managed to turn their economy back on. However, this is focused on the manufacturing sector, while any part of the service sector that involves close human to human proximity remains dormant. The reason for this is a very strict “track, trace and isolate” policy, based on a mobile phone app that regulates individuals’ ability to access places outside their home depending on previously-recorded movements and encounters. Any accidental encounter that was more than a mere passing in the street with anybody who later tests COVID-19 positive means going back indoors into strictest 14-day quarantine.

This ‘hiding from the virus’ approach has proven highly effective in preventing higher fatality rates, but comes at the cost that unless a cure or vaccine becomes available in short order, society remains exposed to the risks of a second wave and therefore has to remain in an economically painful soft lockdown for the time being.

Sweden and some Developing World countries have deliberately chosen a different path. This approach has aimed for self-immunisation through infection, also referred to as ‘herd-immunity’, by allowing the virus to spread slowly and thereby paying the price of a higher fatality rate amongst – in particular – the elderly and vulnerable. Clearly, once a population reaches ‘herd-immunity’ the risks – to public health and the economy – of a second wave disappear.

Most western industrialised nations, including the UK, find themselves somewhere between China and Sweden. Should effective anti-viral drug treatment prove impossible in the near term, and mass vaccination roll-outs arrive only in 2021 as predicted, the Swedes’ herd immunity approach could turn out to have been the winning strategy, as long as they can maintain public backing by keeping fatality rates to levels no higher than elsewhere in Europe.

Should COVID-19 suddenly disappear in May – as SARS did back in 2003 – or the pharmaceutical industry wins the race, then the Chinese approach of buying time through quarantine would be deemed to have made the most reasonable balance between the human and the economic cost.

Politicians everywhere will be following the relative success of both approaches very closely over the coming weeks. That, together with each countries’ ability for mass infection and antibody testing will inform their decision making. It would appear each countries’ speed and ability of returning to pre-virus activity levels will determine whether their recoveries will follow the V or the U recovery pattern. The increasing focus on the looming economic consequences amongst western societies leaves us wondering whether politicians will soon find their ability to take decisions severely hampered. It is therefore not inconceivable that ‘peak-lockdown’ has passed, no matter what warmer temperatures and pharmaceutical progress may hold.

Over the past few weeks we have noted the friction between the resilience of stock markets against the backdrop of truly shocking – down to levels never recorded before – economic dataflow. We suspect that the growing determination to countries ‘get back to work’ has to do with this resilience. Stock markets may also possibly be bolstered by asset price inflation, given the inflationary tendencies of the extraordinary monetary support measures that have been enacted over the past six weeks, and with the prices of goods and services suffering a deflationary demand and supply shock. This at least was what we observed and learned during the post financial crisis rounds of central bank QE.

Written by Andrew Flowers and Lothar Mental of our investment partners Tatton Investment Management.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.