Market Update: Markets put bank stress behind, but challenges remain

The first quarter of 2023 is now behind us, and while March ran run the whole gamut of emotions for investors, we end the month (and quarter) on a fairly positive and quiet note. For the average UK investor who holds their investments in a range of risk profiled portfolios, the quarter ends at levels above, or at worst, fairly close to where they started the year, so not really a ‘down’ quarter after all.

Once again though, it been quite the journey – though nowhere near as epoch-changing as last year’s Q1 invasion of Ukraine by Russia, which is still throwing some shadows at the economic parameters driving the economy and markets.

Turning to the past week, it was oddly reassuring to see a return of a secular growth story, centred on artificial intelligence (AI). After the sheer necessity-driven healthcare and carbon reduction growth stories, it takes us back to the familiar investment paths of the past decade. Significant technological advancements and the change that progress presents are never brilliant for everyone, but investors like the sense of normalisation and prospect.

The bank run fears that caused so much angst and downward volatility over March have quickly ebbed, allowing markets to mostly recover into positive territory for the year so far. We know that if these moments of banking sector stress do not create a domino effect within two weeks or so, then it becomes increasingly unlikely that those less-stable dominoes will be brought down this time. Instead, they will be making urgent attempts to put themselves in a less vulnerable position.

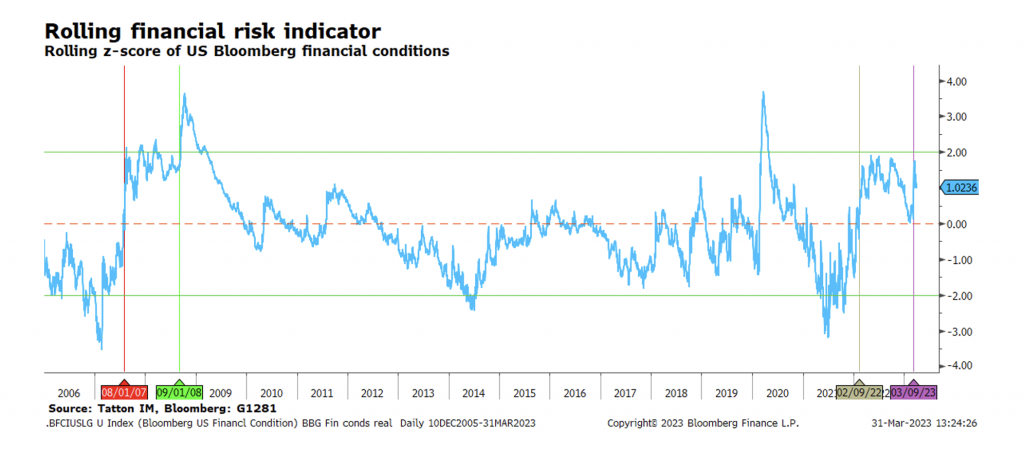

By our tightness measure of financial conditions, derived from Bloomberg’s own indicator, things have actually been tight for 13 months now, since February 2022, when central banks began their tightening path (see chart below, tightness by this definition exists above the red dotted 0 line). Looking back to previous tightening periods, in August 2007 the indicator signalled a similar tightening point, and remained tight through to the demise of Lehman Brothers, which marked the beginning of the depths of the Global Financial Crisis (GFC) in September 2008, some 13 months later. The memory of that timeline still haunts many institutional investors, and so from that perspective it is perhaps less surprising how significant their reaction to March’s news flow was.

However, just because stock markets have proved relatively resilient this time, we should not assume the episode has passed without any further consequences. We must acknowledge from experience that the global financial system’s ‘immune system’ is less strong after each attack and as we know, right now the ‘health’ of the global economy is fairly vulnerable due to the need to slow to get inflation back under control.

The challenge is, that despite the market pricing rate cuts by year-end, the real economy is not yet telling central banks to ease, unlike the months before 2008’s crisis. Western central banks were already cutting rates – indeed last time the US Federal Reserve (Fed) started the cycle in September 2007. Now markets only expect rate cuts (in nine month’s time) and only because of the expected credit tightening in the aftermath of the banking stress, gradually slowing economic growth and thereby inflation pressures – but not because the economy is already operating below capacity.

The prospect of credit default stress is apparent, but the catalyst to cut rates is not coming from the real economy data yet. It could be that the attempts by vulnerable companies to shore up their finances will lead to further cost cuts in demand – and eventually to jobs cuts – but there is still little sign of this happening in any significant way. Indeed, across much of the Western world, the business sentiment indicator, in the form of service sector purchasing manager surveys, has showed a return to growth levels (admittedly, the picture was worse in the capital-heavy manufacturing indices).

Last week’s Western inflation data beyond the UK also showed small hints of decline, but only with weaker energy prices factored in. At the core level, second-round effects of last year’s input price shock still saw prices rise as fast or a bit faster than the month before.

All this suggests the central banks’ squeeze up in interest rates will not come off unless there is another incident which reignites fears of financial instability, which all policy institutions are very keen to avoid. We are therefore left with the slow-burn reduction of activity (and inflation) as we talked about in our outlook for 2023, written just before the year-end. Everyone is fighting to maintain their own margin, whether it is workers asking for pay rises or companies trying to eke out price rises without losing market share. Interestingly, despite the sharp rise in write-down levels likely to come from March’s bank failures, US write-down levels due to bankruptcy remain at lowish levels in comparison to financial conditions – another indication for a slow burn, rather than a fast cathartic turnaround.

The recovery rally in stock markets does tell us that market liquidity remains reasonably healthy. It also appears that the end of calendar quarter rebalancing has provoked some rather reluctant buying back of equities to cover underweight positions. Meanwhile, both government and corporate bond markets have already become eerily subdued as the week has drawn to a close. As such, for capital markets as a whole, next week could be very quiet. Ahead of the Easter holidays, most of us would welcome that.

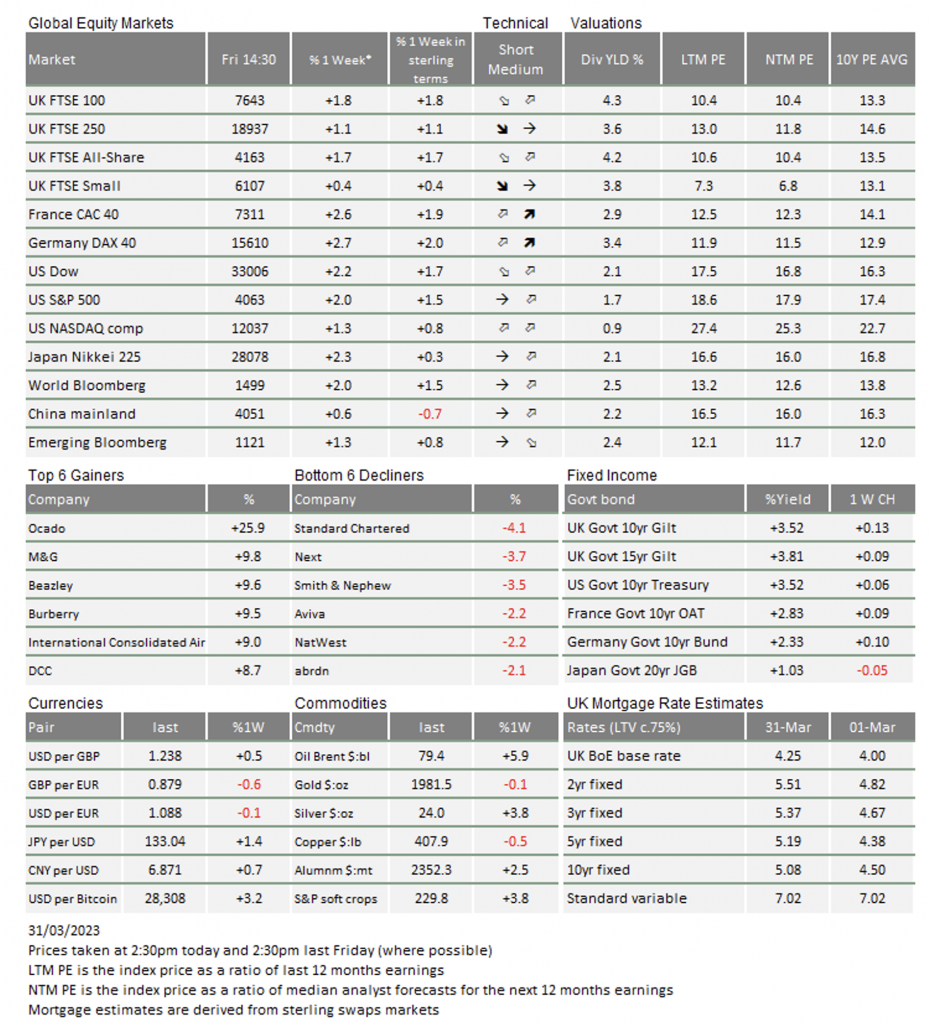

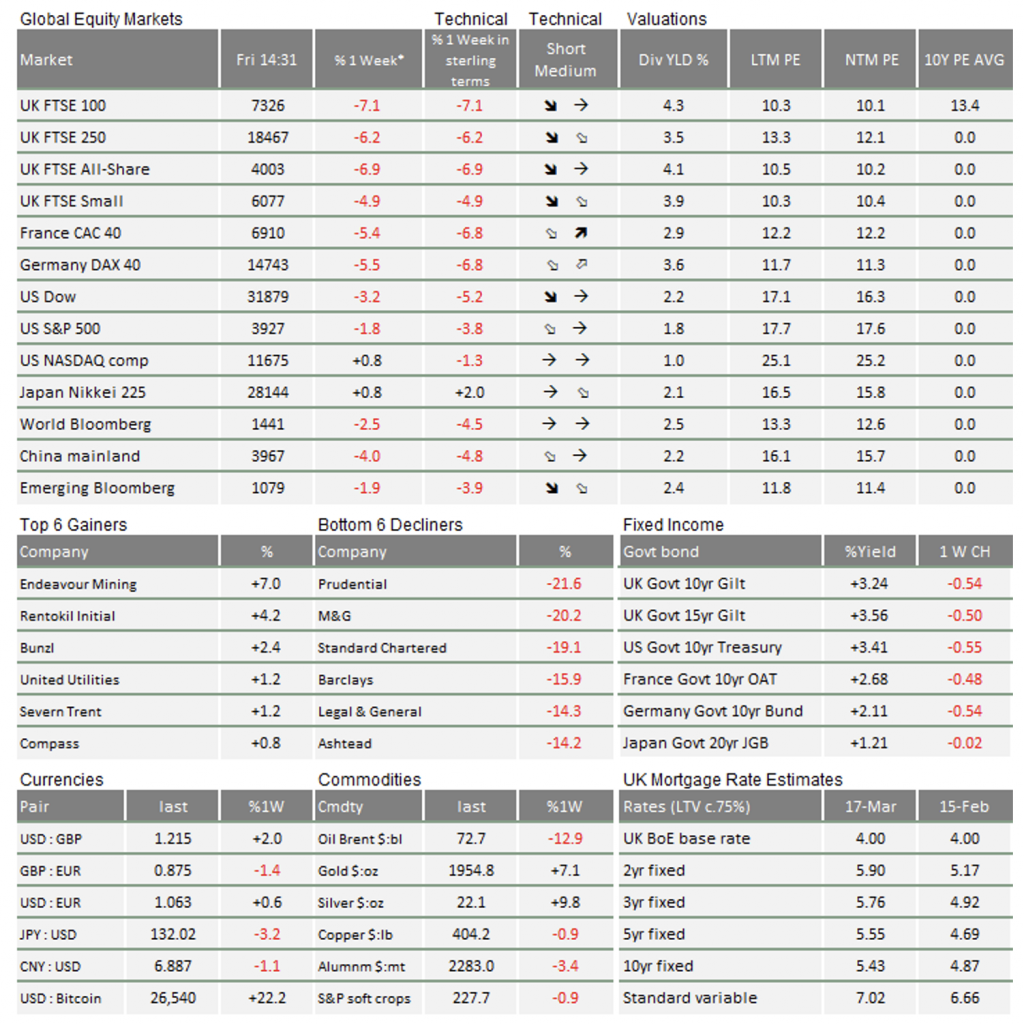

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.