Market Update: Higher for shorter on the horizon

Price shock reversal

For investors, November made up for October on the back of faster than anticipated inflation decline – can it last?

UK inflation exceptionalism

The nation may be better at putting itself down rather than having genuinely different inflation.

Wind of change for renewables

The boom in renewable energy investments seems to come to an end when the planet needs them most.

Price shock reversal

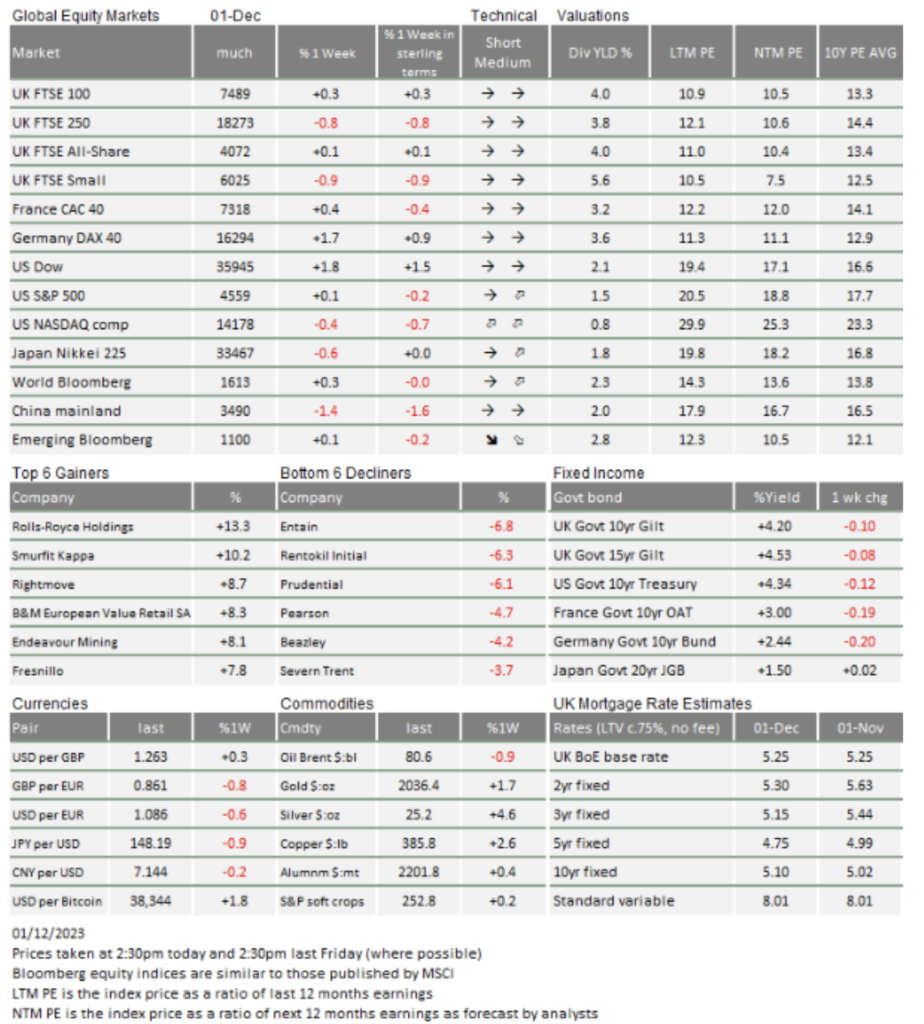

November brought investors the opposite of October and turned most portfolio returns into positive mid-single-digit numbers for the year.

As we have written here over the past weeks, the distinct turn in sentiment that drove markets in November was, once again, mostly about central banks and the likely path of interest rates. After October was about ‘higher for longer’, early November transitioned to ‘no more rate rises and the next move is down’, when inflation came down far more than most had expected. In this past week, we have heard discussions of Eurozone rate cuts in time for Easter.

This followed the release of provisional European inflation data for November that surprised on the low side for the third month running. Overall consumer price inflation came in at a just 2.4% year-on-year rise in November, less than half its pace as recently as August.

Markets now fully discount a European Central Bank (ECB) rate cut in April and economists are catching up with this view after penning their 2024 outlook reports as far back as October. Admittedly, most ECB participants are yet to say they agree even after Thursday’s data.

In the US, even though inflation there is still between 3% and 4%, some central bankers are validating these ‘next move is down – earlier than thought’ expectations. US Federal Reserve (Fed) member Christopher Waller is noted for similar views to those of Fed Chair Jay Powell, so markets reacted quickly when he said diminishing inflation would naturally allow the Fed to cut rates. Clearly, it is no longer too early to talk of cuts.

Looking at the source of the changing inflation picture, by far the weakest area of pricing power is now in goods and energy. While rate setters tend to ignore short-term moves in energy prices, the experience of 2022 showed that a price shock precisely in those areas can have significant second-round impacts on more ‘core’ goods and services. A shock can be a rise but it can also be a fall, so the current fall in oil prices is worth having a look at.

OPEC+ finally met last week in a videoconference, having delayed the session from the previous week. A cut in production was rumoured and a cut of 900,000 barrels per day (bpd) was announced. A statement on the OPEC+ website said Russia, the United Arab Emirates (UAE), Kuwait and Iraq made a “voluntary” pledge while Saudi Arabia would continue its unilateral one million bpd cut until April next year.

Despite these supply cuts, oil prices fell back to the previous week’s lows and so it appears that OPEC+ is losing its grip of the supply side. The group is defined by a shared reliance on fossil fuel revenues so one might think they all want to maximise oil prices. However, they have differing timescales for when they need the revenues and that disparity is heightening the internal competition for current sales. The dramatically strong global growth seen in the post-COVID bounce in 2022 made for an ideal environment to squeeze supply. Demand was huge and immediate; supply could be squeezed for a few weeks resulting in historically high oil prices.

This year has seen more normal levels of economic growth and demand remained at fairly solid levels through the summer and into early autumn. However, signs are that growth slipped during October and November. It’s not disastrous by any means, but a return to pre-COVID normality is on the cards and the resulting slow energy demand growth is probably not strong enough for some of the OPEC+ members.

Most of the problems for OPEC+ are driven by potential global oversupply. Supply from outside OPEC+ is increasing. US production had a notable boost recently after shale gas extraction increased again lifted by the higher price levels. New fields are opening in in Brazil (which has been invited to join OPEC+). They produced 3 million bpd last year and are targeting 5.4 million bpd by the end of the decade – a level of output which would see them rise from the 9th largest oil producer to the 4th. Guyana’s production is also increasing sharply. Meanwhile, Saudi Arabia is trying to bring Iran back into the fold as well. Iran is talking about production rising to 4 million bpd next year, a level they’ve not approached in 20 years.

Even within OPEC+, supply is increasing, although perhaps quietly. While the main middle-eastern producers have become long-term in their outlook – despite shortfalls in government finances –Russia has become absolutely reliant on cashflow. Last week, it was announced that Putin had signed the 2024-2026 budget which returns Russia to its late Communist-era levels of defence spending. It has limited access to funds other than through the sale of fossil fuels. Thus it has to keep revenues up by selling as much as it can at the price available. Its commitment to a cut is necessarily voluntary and always short-term. It is notable that natural gas pipeline flows through Ukraine have not changed in recent months.

Most oil analysts do not see faltering demand as a major issue and most were predicting mild oil price increases. However, the fall back in oil prices has occurred in the past few weeks amid signals of slower industrial output. In particular, China continues to look weak and that position has continued for far longer than we anticipated. As mentioned in the week before last, we could be at quite a critical juncture for global growth, given the lack in demand from China and elsewhere seems to be leading to an extended inventory drawdown that delays new orders. While global manufacturing sentiment indices such as the purchasing managers’ index (PMI) surveys are not deteriorating greatly, they are yet to signal a return to growth. The venerable US Institute of Supply Management’s manufacturing index is one of the longest and most respected of economic indicators, and that remained at 46.7 (a sub-50 reading indicates a contraction), disappointing consensus expectations of a small rise.

Service sector PMIs, which are demonstrably more important for employment and remained expansionary, have been slowly deteriorating since the summer. The announcements of layoffs by banks such as Barclays signal that big companies may be increasingly trying to defend margins. As we head into the New Year, it will be important for economies and wider corporate profits that we don’t swing into a faster round of service sector cost-cutting.

The fall back in energy prices might signal growth worries, but lower energy prices are at the same time a growth spur for the wider economy. The right price is one which stabilises the supply/demand balance, and we should be grateful we are in a period where prices are moving gradually and bearably. This suggests that while we may be experiencing weaker growth now, the likelihood is that costs will be cut naturally and we are in the final stages of a welcome return to normality.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.