Market Update: A bit of a downer

A bit of a downer

For investors, December has started in a mildly positive although some of the market moves are not such a great signal for growth

November review

Capital markets were positive across virtually all regions in November as inflation fears faded.

Xi goes to America

The Chinese economy has a stubborn underlying weakness, volumes are high but margins are low, will a goodwill visit to the US do enough to boost confidence?

A bit of a downer

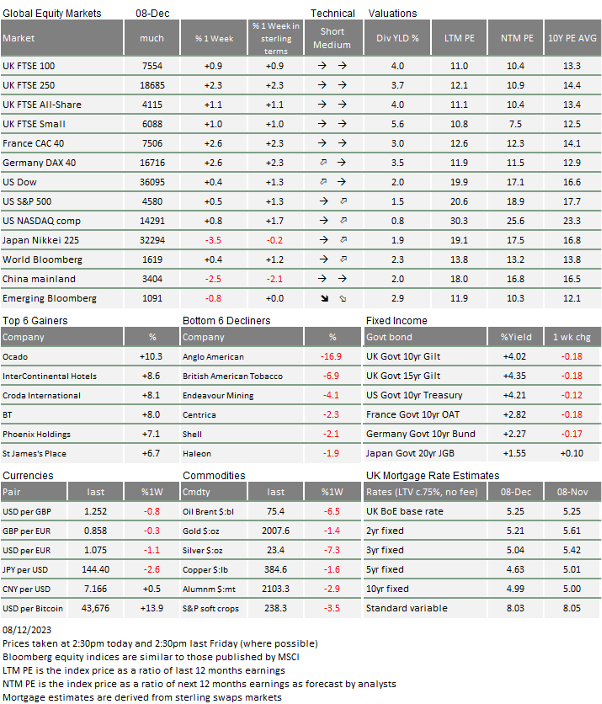

We review November’s cheery asset performance below. Early December is also currently on a positive track and trading volumes have been higher than November’s averages generally, suggesting quite a bit of capital is being put to work by investors.

Global bond yields have fallen yet again (meaning bond prices have risen). This has been driven by a round of some indications of weaker employment data in the US and soft (but not awful) purchasing manager survey indices, combined with dovish noises especially from members of the European Central Bank (ECB).

The US employment report surprised economists by showing a reasonable level of job creation and a very surprising fall in the unemployment rate. Rate expectations have fallen because the policy setters at the US Federal Reserve (Fed) appear be more focused on inflation declines than worrying about what level of unemployment is too low for comfort. However, bond investors had expected the US unemployment rate to worsen to 4% at least and November’s data does not allow for any rate cuts without some other factor impinging. Equities saw some softness (especially in the raw materials and energy areas which we discuss below). However, the US ‘Magnificent Seven’ had a good bounce after enduring some fears about their exposure to softer consumer demand.

Over the course of last week, there was some notice taken of a rise in the “Secured Overnight Financing Rate”, a well-used interbank market. In truth, the move was small but participants are sensitised to such arcane indicators, particularly around the turn of the year. Holidays and book-closings can make things difficult for more stressed institutions.

While US bonds ended the week unchanged from the week before last, European and UK bonds have done well, as our performance table (always to be found at the end of the full copy) shows. The softness in global growth is being signalled in both economic data and in commodity market prices. The week before last, we talked of how OPEC+ had shown its relative lack of cohesion and how that inability to act together has led to ineffective supply cuts. We said then that demand need not necessarily be weak in order for prices to fall.

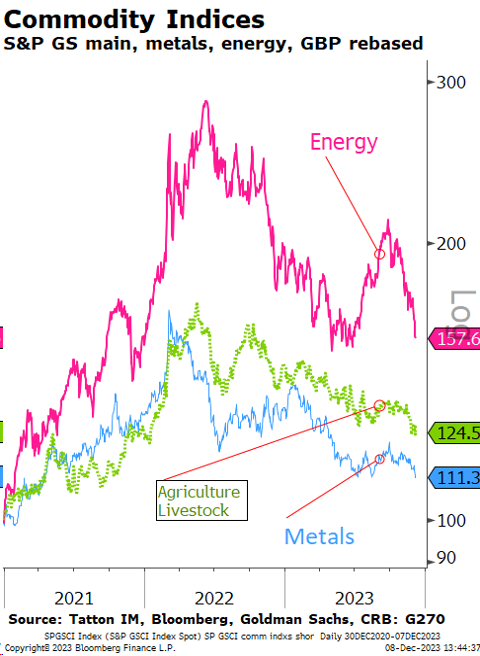

However, last week we saw more oil price falls, continuing the pace of the previous week. In addition, global industrial metals and agricultural prices have moved down as the chart on the left shows. They are less volatile than energy prices (mainly because energy stores are always relatively low compared to ongoing use) so the lesser decline is still significant.

As COP28 came to a close last weekend, the deliberations have been neither a help nor a hindrance to asset and commodity prices, nor perhaps should they be. COP28 president (and oil executive) Sultan Al Jaber took the opportunity to swing the debate towards responsible fossil fuel policies. Each of these meetings becomes more embroiled in detail and runs the risk of losing any momentum for meaningful change. Still, ultimately, progress on dealing with emissions will be in the enactment of detailed policy, so perhaps this is good news. The conference is also turning its attention to the loss of the natural world, which many will think is a good refocusing.

Commodity prices are still a higher than they were 2021 but the decline from mid-2022 is clear. In the past 15 years, the biggest demand swing has emanated from China and there are all sorts of signals that the world’s second-largest economy is not providing the growth leadership that the largest economy in the world has given us. Chinese economic data don’t appear so bad and GDP estimates from JP Morgan are running at about a 6% annualised rate. Yet equity prices fell again over at the start of the month, which doesn’t align with signals coming from markets.

Last week, China’s Politburo met and affirmed a significant fiscal push next year. There is also an exception to the commodity signal; domestic iron and steel prices are picking up when usually they would face seasonal downward pressure because of year-end inventory run-offs.

Among the policies being swung into action, the People’s Bank of China (PBOC) has introduced something that looks very much like quantitative easing (QE), or the buying of bonds. This policy can work in different ways but one of its possible implications is that financial market liquidity improves, which can then feed through into rises in risk asset prices.

The lack of foreign equity buyers has generated much comment but the similar lack of domestic equity buyers has also been notable. Probably, therefore, the first indication of a turn in sentiment will come from the equity market itself and then the dynamic could be quite strong.

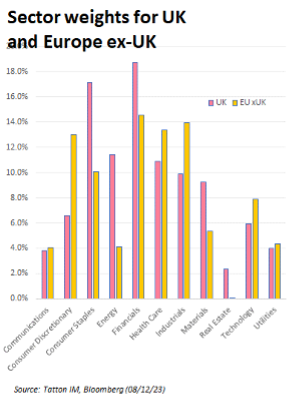

Energy and materials equity and credit sectors have been understandably poor performers in recent days. By market capitalisation, the UK has more than 20% in the combined sectors while Europe has less than 10%. The predominance of such companies in the UK stock market has sent the FTSE 100 to the back of the class in global terms.

We still have a slightly bigger weighting in financials, and the sector has done quite well amid declining financial pressures. However, UK financials were up about 2% last week, while materials and energy are down almost 2.5%.

Europe is also doing well courtesy of a bounce in luxury goods, which may be a signal of China confidence returning. These stocks were strong performers in the post-lockdown bounce earlier this year.

Both the Nationwide and Halifax (now Lloyds Bank/S&P Global) house price indices have shown a small rise in prices. This week, we get the Rightmove and Royal Institute of Chartered Surveyors reports. The fall-back in rate expectations has helped mortgage demand pick up a little, and it will be interesting to see whether this improves the estate agents’ mood.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.