Market Update: Economic resilience is about to be tested

US government shutdown looms, Source: Matt Davies, 26 September 2023

Economic resilience is about to be tested

Bond yields going up because of growth, not inflation, should be a good thing, right?

US heading towards another shutdown

The news of a shutdown is neither new or extraordinary anymore, but this time the timing has many concerned for the US economy.

US mega techs vs. modern antitrust law

Given their behemoth size and power, it felt overdue for competition regulators to take another look, and now markets can see risks for Amazon and its fellow tech giants.

Economic resilience is about to be tested

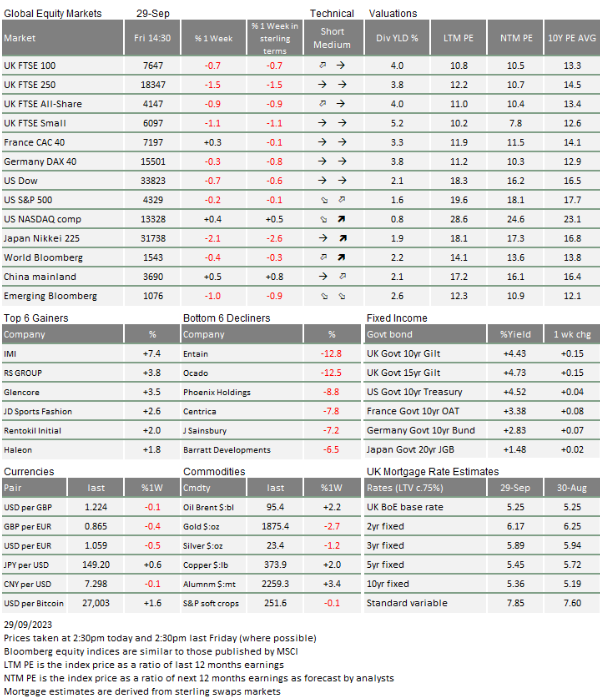

Historically September has on average not been great for investors, and as it turns out this year is no exception to that norm. Both equities and bond valuations have declined and even though equities have not materially moved up or down when looking across the past four months, there is increasing sentiment that the 2023 market recovery is running out of steam or may even be turning.

This may seem somewhat surprising to some investors when we observe that the rate of inflation (until recently, the main market headwind) has been steadily declining. Indeed, this has been happening in many areas, more than many economists had thought possible. Meanwhile, economic growth and corporate earnings have proven far more resilient in the face of the hugely increased cost of finance and consumers being battered by the cost of living crisis.

But here is the rub. Market expectations of economic stress to come led to expectations that the high interests rates would have to come down in fairly short order, i.e., early next year. That in turn led to lower long bond yields, low enough to allow large companies to borrow and, because credit spreads (yield risk premium companies have to offer above the government rates to raise funds) remained at lowish levels, at rates that were difficult but justifiable in terms of the resilience of their businesses.

In addition, especially in the US, government subsidy support via the programmes like Creating Helpful Incentives to Produce Semiconductors (CHIPS) and the Inflation Reduction Act (IRA), have meant that they borrowed to spend rather than borrowed to pay down other debt. All this has added to near-term economic activity, surprising economists and central banks with just how resilient the economy particularly in the US had been to the most aggressive rate rise campaign for decades, and wondering whether it might all be about time lags in their effect, rather than lasting resilience.

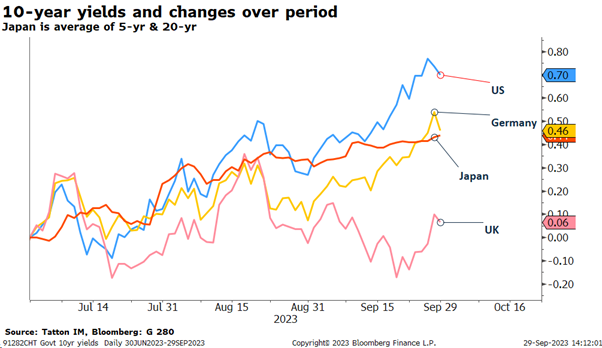

This is where this quarter has seen a change in investor perceptions in terms of what long-term rates are sustainable, encouraged by central bankers telling us that short term rates will be “higher-for-longer”. As the chart below shows, 10-year rates have risen in Europe, Japan and especially the US. September’s rises have outstripped July and August.

Now, on the face of it higher rates and yields on the back of higher growth expectations are much better market news than rising yields as a consequence of rising inflation expectations as we had last year. However, there is a rub again in this as well, namely that if the cost of finance stays high for longer than anticipated, then there is a much higher probability for companies breaking under the weight of rising costs of debt than if it’s just a matter of a short episode. Anybody faced with the prospect of having to renew their mortgage in the foreseeable future will relate.

And, indeed, for the first time in some months, higher government bond rates have not been seen by investors as an opportunity to buy weaker-credit-rated bonds with even higher yields. Rather, credit spreads have widened, whether it’s in corporate bonds or in Europe’s peripheral government bond markets. That suggests underlying government bond rates have shifted back up to uncomfortable, stress-inducing levels.

But, when we look at equity markets, the shift in financing rates has yet to impact analyst earnings projections. Indeed, for the US analysts, the signs of reasonable economic growth have underpinned continued rises in the earnings expectations for the next twelve months. UK and Europe analysts are less positive but expectations remain stable, at least in Sterling and Euro terms.

The shift up in credit spreads is not yet enough to indicate a serious re-estimation of analyst general outlooks. However, today marks the last day of the third quarter and the circus of earnings releases and new guidance will resume in mid-October, with banks among the earlier reporters. They will be closely watched, especially for indications of debtor stress.

However, as we mentioned earlier, the nature of lags is such that the next quarter’s US earnings are more likely to continue to show resilience than weakness. Employment has clearly remained strong through the summer and that should mean that consumer spending also remained fairly stable. This makes us expect a generally solid third quarter – but company outlooks looking further out may be less so.

We have flagged Europe’s difficulties in past updates, and in this respect Germany stands out, experiencing a decidedly slower economy than its neighbours. Indeed, France seems to be doing quite well by comparison.

For the UK, our higher interest rates have compressed growth, especially around housing and construction but, even so, the Office for National Statistics left second quarter gross domestic product (GDP) data unrevised at +0.2% quarter-on-quarter. The housing market’s downturn has led to some weakness in growth, but this is being offset by business spending, driven by (we think) labour shortages spurring investment into productivity enhancements.

Meanwhile, inflation rate declines across wider Europe are still coming through – German consumer price index (CPI) inflation surprised with a drop to 4.3% year-on-year on the European Union’s harmonised measure. Near-term electricity prices have risen somewhat in the past month, alongside gas prices, but the good news is that longer-term gas prices are declining again, so the medium-term inflation pressures are still waning.

Perhaps the UK’s travails give us some clue to wider global outcomes, especially for the US. Our mortgage market is structured in a different way to the US, but that does not mean to say it is totally different. The interest costs are fixed via different maturity benchmarks (ours are shortish two-five years, theirs are 30 years) but different to the US in the UK they are usually renewed every two years, so households here get hit by rate changes more quickly. As a result, our consumer demand side is affected with less time lag by rate changes than across the Atlantic. But they both impact affordability for new houses, so we and the US have seen substantial hits to the rates of housebuilding. The US is experiencing even more of a slowdown than us now, since there anybody moving house has to remortgage. A house move is therefore likely to take a household’s mortgage costs from 3% previously to the current rate of nearly 8%. Not surprising then, that new housebuilding permits in the US have plunged to (relative) record lows.

We mentioned that investment grade companies had recently decided to raise finance (at least in the earlier part of the third quarter). Smaller, less credit-worthy companies have also strengthened balance sheet management over the past few years, but have not had the same straightforward access to bond markets. Many decided to wait for lower rates and quite a few have been waiting since rates started to rise early last year. Now though, with rates at new highs (instead of falling as many had expected), and with the higher for longer narrative, the cost of refinancing is likely to become more pressing for growing numbers of businesses around the developed world. Stress levels could reach breaking point, especially where it becomes paired with revenue weakness.

All-in-all, this latest round of increased interest rate costs has the potential to have a quicker impact than previous rounds, because it has been so unexpected and because it leaves less time for those awaiting refinancing.

A last observation: some of last week’s market volatility can be attributed to the effects of higher oil prices. After a push to nearly $96 per barrel (pb) on Brent crude spot, it fell back to $93.5pb. Nevertheless, this is 15% higher than the 2023 average leading into September. While oil price rises may not have directly led to bond yield rises, investors (away from BP and Shell fans) and politicians will be happier if oil prices slip back. To this extent, we may see further political efforts to allow Venezuela and Iran to officially re-enter global oil markets. Beyond that, it still holds that in case of supply side manipulation price rises like this one, the best remedy against high prices is high prices (which lower demand).

And so the ‘lags’ and resilience narrative of the past 18 months may well face its most substantial test yet. Against this backdrop it may no longer be so surprising that central banks in the US and UK paused in their rate rise cycle this month, despite core inflation measures still well above their 2% comfort level. Indeed, certain derivatives of the straight forward bond yields, for example highs in the levels of real yield (what’s left after expected levels of inflation) and the term premium touching 0 for the first time in a long while tell us that markets anticipate that central banks have already gone further than warranted or necessary to bring inflation back under control.

None of this implies economic disaster looming over the last quarter of 2023. What it does mean though is that the ‘Goldilocks’ environment of the past two quarters is likely to end. This may result in an uptick in market volatility and a return of the same ‘between hoping and dreading’ narrative of autumn last year. It also raises the probability that long-term bonds at the yield levels they touched last week may prove to be rather good value for investors with a longer-term perspective.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.