Market Update: Dovishness proves contagious

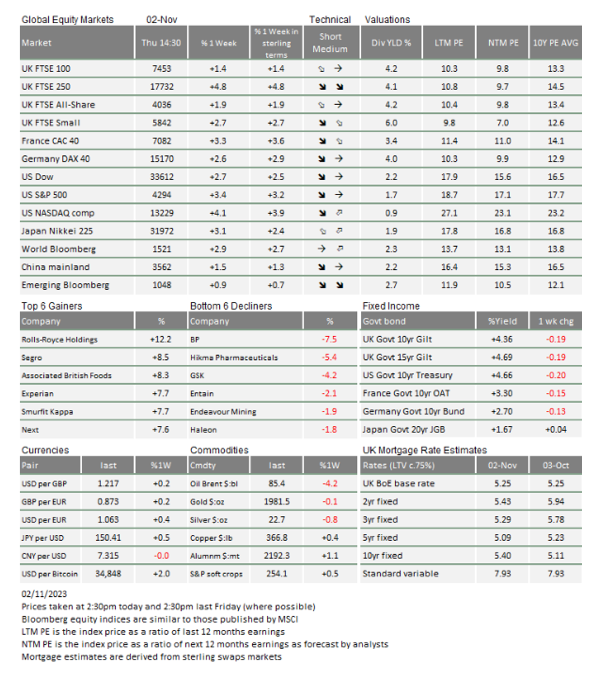

Just how much change a week can bring to markets was amply visible during the last seven days. Last week, we wrote about how negative sentiment in stock markets can turn into a self-perpetuating destructive force for an entire economy as the investing public feels the heat of being poorer (at least on paper). At the end of last week, we look back at pretty much a reversal of the previous week’s perspective after stock markets staged an impressive bounce back. Monday’s rally was still dismissed as an entirely predictable trading-based short-term reversal from oversold levels. However, by the end of the week the bounce has proved far more substantial and persistent than anyone had dared to suggest would be possible or probable previously.

So, what has fundamentally changed? Well, it is not the economic data, where there has been no significant changes from the previous ‘not as bad as expected’ string of releases. What did change though was that – contrary to expectation – the US Federal Reserve (Fed) seemed to adopt a similarly somewhat dovish tone to the European Central Bank (ECB) last week. Why this matters for sentiment is because history has shown that loading up on equity risk at the point of peaking rates and yields has historically been a very good formula for achieving outsized returns, as risk asset markets have staged recovery rallies thereafter.

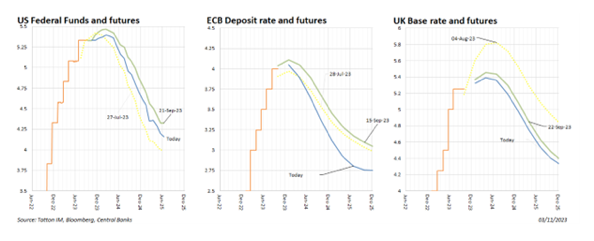

Last week’s swing in the perception of central bank policy into 2024 begs the question: Is dovishness contagious? As we reported the week before last, the ECB led the way on 26 October in leaving interest rates unchanged. President Christine Lagarde’s press conference was distinctly dovish, as we noted then, and that already constituted a distinctive change from previous months – albeit not entirely unexpected given how much weaker Europe’s economy has been compared to the US. However, into the beginning of last week, most felt the other central banks would be reluctant to cast aside their hawk costumes.

The Bank of Japan (BoJ) announcement on Tuesday appeared to confirm that, when Governor Ueda told us that the 10-year rate would be allowed to go above 1%, but leaving its rate at -0.1%. The prospect that yields might be allowed to go higher might seem hawkish, but when the government announced a fiscal package designed to boost growth a day later, it was clear the monetary and fiscal policy mix remains accommodative. As if to validate this conclusion, the Yen traded weakly after the BoJ announcement, a clear indication that investors saw the BoJ move as covert dovishness.

The main event of last week though was the Federal Open Markets Committee (FOMC) meeting. Few were expecting any interest rate move this month, but a majority of commentators thought another 0.25% move in December likely given next month’s meeting has more research inputs. September’s FOMC meeting yielded no rate change but in the press conference after, Fed Chair Jerome Powell intimated we should expect further tightening. Thereafter, 10-year bond yields moved from below 4.5% to trade above 5% while the S&P 500 fell and credit spreads widened as the ‘higher for longer’ message seemed to at last reach markets’ attention. As a consequence, cost and availability of finance tightened considerably, without central bankers even having to raise rates.

Some members of the FOMC said over the month that this “tightening of financial conditions” was equivalent to a rate rise and hinted this would obviate the need for further rate rises, which set the path for forecasts of no rate rise – at least for this month.

After Wednesday’s meeting, Powell effectively backed that view, giving the strong impression that the FOMC is becoming convinced their work is done; that the employment market is becoming less heated, wage growth is calming, and inflation is set to come back towards target. It felt like the opposite of the September message and the market reacted accordingly.

In comparison, the Bank of England (BoE) is still in more of a bind. Its Thursday meeting concluded with the same ‘no rate rise’ decision as their US and European counterparts, while the BoE’s statement acknowledged the stress in the UK economy, with interest rates hurting many. Nearer-term measures of inflation in the UK also are helpful at the margin but the BoE’s biggest worry remains and differs in that that measures of wage inflation are still uncomfortably high.

“It’s much too early to be thinking about rate cuts,” Governor Andrew Bailey said in a statement released with the decision. “Higher interest rates are working, and inflation is falling. We need to see inflation continuing to fall all the way to our 2% target. We’ve held rates unchanged this month, but we’ll be watching closely to see if further rate increases are needed.”

It is redolent of Hamlet: “The Governor doth protest too much, methinks” (with apologies to Shakespeare). Investors will be entitled to ask why he is drawing attention to what he is not thinking about. At an Oxford Economics morning conference last week, Michael Saunders, recently departed from the Monetary Policy Committee, mentioned that the BoE sees the average weekly wage data as flawed (the response rates have declined markedly among other problems). Other indicators suggest wage inflation has been slowing to a ‘normal’ pace.

In all but the BoJ’s case, investors took the past two week’s post-committee press conference tone to mean that the central Banks are increasingly of the opinion that rates are now at their peak and that inflation can be brought back towards 2% without the need of a recession. Their work is done, was what markets took away from it.

Even in the BoE’s case, another rate rise is only partially priced in. Most importantly, investors now see US rates on hold before a cut in the second half of 2024.

The BoJ aside, the Fed and the BoE – according to forward pricing of rates by markets (see charts)- would be among the last to begin a retreat from high rates. Last week, Brazil cut rates again. Meanwhile, pressure is growing on Central European central banks to cut rates given that their previously high inflation rates are subsiding quickly amid very slow real growth.

Indeed, overall the mix of monetary and fiscal policy globally has already begun to shift to accommodation. The fiscal supports from China announced a couple of weeks ago, and Japan last week, are substantial and added to investor perceptions that the investment environment may be about to become friendlier.

Of course, much depends on the US. We’ve repeatedly seen that bouts of equity market positivity have supported households and businesses with already strong savings balances. The tight US financial conditions leading up to the FOMC meeting have been loosened in only two days. Following relatively weak US employment figures today, FOMC members have to believe that the easing in the US labour market is more than seasonal if they are to hold on to their new-found dovishness.

What last week’s market moves also suggest is that institutional investors have been short of risk assets, both in equity and bond markets, while private households have been diverting money into their savings rather than investment accounts. This type of rebalancing flow may be ‘short-term’ but it can still go on for some time. Nevertheless, this past week’s market action informs us that the ‘higher for longer’ rates perception that only just sunk in over October may have already reached its expiry date given central bankers’ unexpected dovish tones. It may be way too early for a ‘Santa rally’ but November and December are seasonally bad months for weather but brighter months for investments. It will be nice if things feel less soggy.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.