Market Update: Central bank scrooges cancel Santa rally

It’s too early for the developed world’s central bankers to say the battle against inflation is nearing an end, even though year-on-year inflation has started to move off the peak. Inflation rates published this week show they may have peaked in aggregate, but consumer prices are still heading generally higher, which is likely to also keep inflation overall higher for longer.

As expected, many major central banks raised rates last week and said they had more to do next year. In our outlook, we suggest markets will be surprised in 2023 by continued central bank hawkishness, but some of that surprise already happened on Wednesday and Thursday.

Wednesday’s US Federal Markets Open Committee meeting delivered the expected 0.5% rate rise with a slightly hawkish, slightly confusing message from the statement and Chair’s press conference. Thursday saw an even bigger hawkish surprise from other central banks’ messaging, rather than rate rise decisions. Again, rates rose as expected by 0.5% in the UK, Eurozone, Sweden, Denmark, the Philippines and Mexico, to name a few.

The European Central Bank (ECB) took its deposit facility rate to 2%. The hawkish surprise was that the ECB’s economic research staff put in an inflation forecast substantially above expectations that is expected to guide rate setters higher in 2023 than had been anticipated. JP Morgan researchers now expect the deposit rate to reach 3.25%, “which is a huge change from the 2.5% terminal rate we had in our forecast until now. The abruptness of this reflects the puzzling step-change in the staff’s [inflation] forecasts and that the Governing Council is taking this fully at face value. We are still minded to see the lower path of the staff’s inflation projections as more likely but, even if we are correct, the data won’t show up soon enough to strongly influence the ECB at the next 2-3 meetings.”

As a response, Eurozone government bond yields shifted sharply higher. Equity markets, which had been buoyed in recent weeks by a decline in pessimism over Europe, also took quite a hit. That followed on from a delayed mark-down after the US Federal Reserve (Fed) delivered more nuanced, but generally more hawkish than expected messages.

In the actual economy, company analysts’ earnings forecasts have stabilised after the falls from last month. However, we should not read too much into this since we are in the quiet festive season. Purchasing Manager Indices (PMIs) indicate that demand for this month remains softish, especially in the US, which will keep a lid on earnings expectations for 2022’s last quarter. Other, harder economic data is a bit more encouraging. Our feeling is that the quarter will be reasonable, now analysts have brought down both revenue and margin expectations following the Q3 results. A positive earnings season in January could prove to be a double-edged sword, since that might encourage more monetary policy hawkishness.

Central bankers have perhaps been Santa’s little helpers for too long and have definitely not helped Santa deliver a rally this year. They appear to have grown up and all become Scrooges. Ah well, those who have followed our thinking over the past weeks will know we are neither surprised nor shocked by this week’s market reaction to the latest rumblings from central bankers. As we said before and laid out in the 2023 Outlook that follows, things are looking up for 2023, but we are not quite out of the woods yet.

This is our last full weekly of the year. We wish you all the merriest of seasons and the best of wishes for 2023.

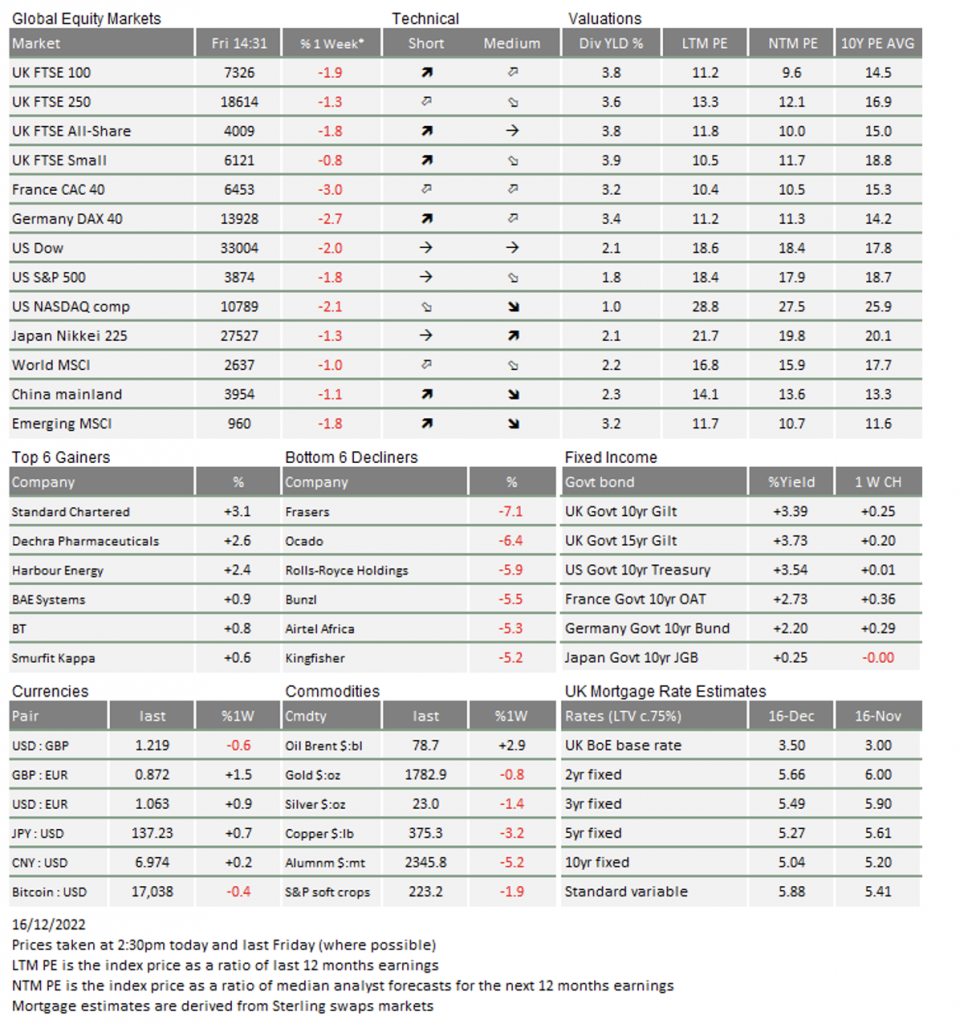

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.