DPMS Portfolio Commentary

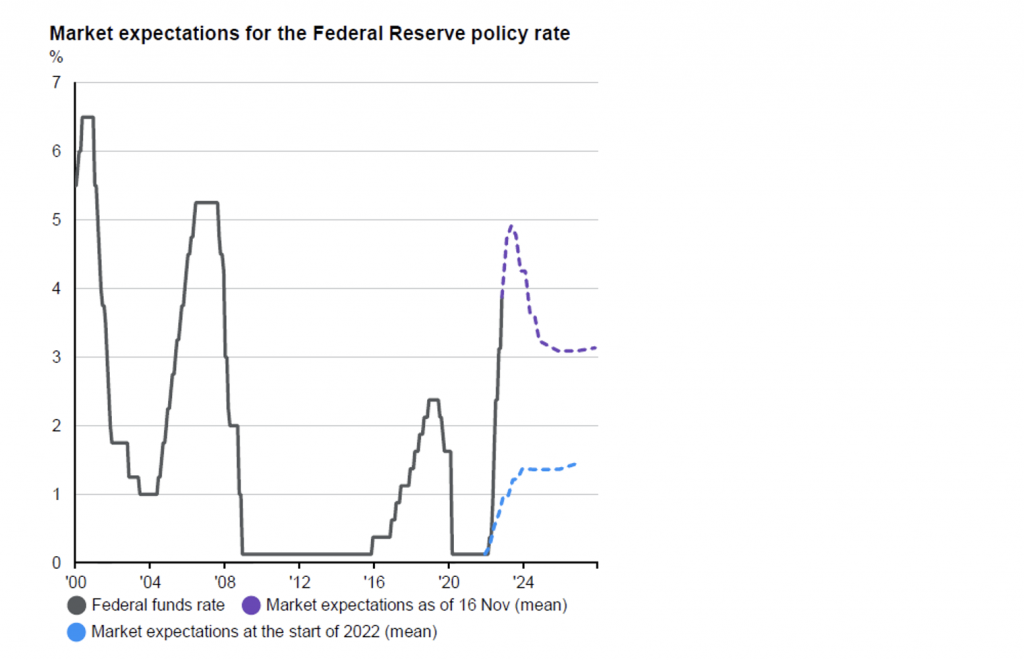

So far, Q4 of 2022 has been more positive than some anticipated with better-than expected American inflation data and hopes of The Federal Reserve easing rate rises, a less severe beginning to Winter for Europe, hints that China may begin to ease it’s zero-COVID policy and the return of traditional fixed interest as an attractive long term investment following Jeremy Hunt’s reversal of the mini-budget. This all comes despite Central Banks continuing to raise interest rates and warnings of recession across the globe.

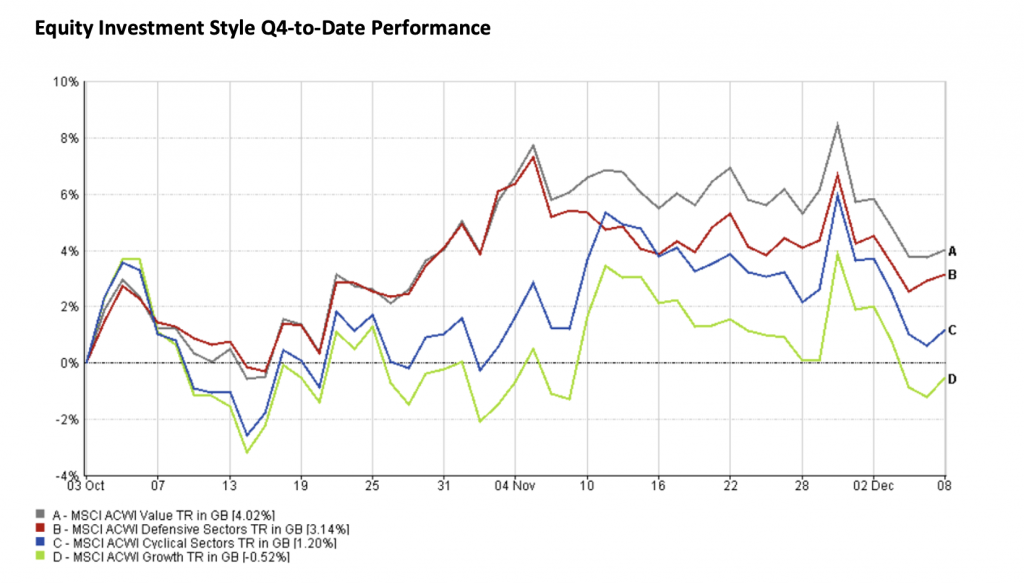

Value and Defensive equities have continued to outperform so far in Q4 due to key sectors such as Energy, Financials, Materials and Consumer Staples that have shown strong revenues and maintained good levels of ongoing dividends. However, there is a general expectation if global inflationary data continues to ease, this may help in bringing Growth equities back into favour. UK mid and long duration fixed interest instruments have been a favoured investment in the quarter, after the reversal of September’s mini-budget which improved the UK’s outlook in the markets. This impacted most mid and longer duration fixed interest instruments which saw a strong rebound as fund managers locked in higher yields after September’s major bond market sell off. We increased exposure to these fixed interest instruments across all our portfolios after the September sell off which has resulted in some strong growth in this aspect of the portfolios. We expect to see this trend continue throughout 2023 as the yield curve moves from inverted towards a normal curve.

Given our more defensive stance within the Vizion Wealth portfolios in Q4, we have so far slightly underperformed the benchmarks since October, however, this comes after a period of significant outperformance in Q3. We remain confident that this is the correct positioning as we look to the future with concerns for economic growth across developed economies, further rate rises to come and the likelihood of recessions remaining high.

Looking forward, all eyes remain on The Federal Reserve to set the way forward for Central Banks into 2023, with the labour market and inflation data expected to be the main driver of their decision making on the severity of further interest rate hikes. We continue to see the US economy in a positive light with their economy expected to recover from the threat of recession first. We expect US inflationary data will provide key guidance on the expected direction of future global inflation. When global inflation starts to reside, this could signal a path for Growth style equities to potentially flourish. In the meantime, Value will still play an important part whilst rates and inflation remain high.

The Chinese government have begun to pivot on their messaging surrounding its zero-COVID policy following swathes of protests on the lockdown measures in place. This has led to some positive news for the markets but the path ahead remains rocky for the country’s economic targets to be met. We will continue to monitor this closely as China remains a higher risk region with some volatility expected on its road to economic recovery.

We will also monitor how new prime minister Rishi Sunak makes changes to UK government and policy amidst a period of difficulty for the economy through strike actions and protests regarding real-term pay rises for public sector workers and the cost-of-living crisis. Any changes to the war in Ukraine will also be key for energy prices as the UK price cap is set to rise again, offset by the government’s Energy Price Guarantee.

We remain cautiously positive on the outlook for the start of 2023 and continue to encourage patience. History tells us that market drops tend to be followed by subsequent significant recovery periods which offer an opportunity not only to recover short-term losses, but also to take advantage of new opportunities to help protect and grow your wealth.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

DPMS Portfolio Commentary December

So far, Q4 of 2022 has been more positive than some anticipated with better-than expected American inflation data and hopes of The Federal Reserve easing rate rises, a less severe beginning to Winter for Europe, hints that China may begin to ease it’s zero-COVID policy and the return of traditional fixed interest as an attractive long term investment following Jeremy Hunt’s reversal of the mini-budget. This all comes despite Central Banks continuing to raise interest rates and warnings of recession across the globe.