Market Update: Back to the Past

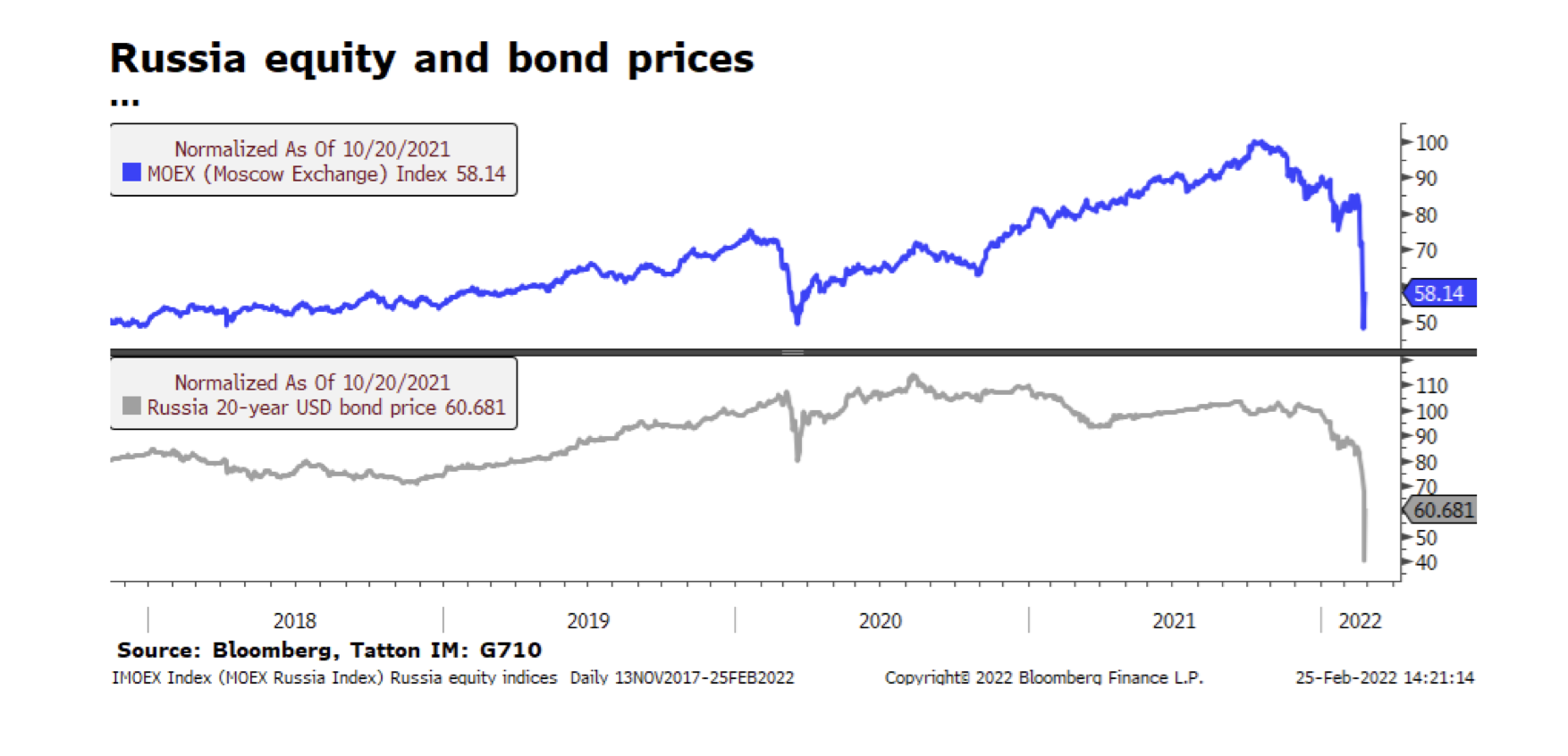

As this week’s title suggests, for some of us it invokes memories of the cold war era of the West vs the USSR in the ‘70s and ‘80s. It is even more remarkable then, that at the time of writing, stock markets have rallied back to roughly where they stood this time last week. The same cannot be said about Russian asset prices, which have roughly halved since last autumn as the chart below illustrates. Perhaps this indicates who markets believe will ultimately pay for Putin’s megalomania.

Our special updates of the last two weeks emphasised that recent history of armed conflict did not foreshadow particularly destructive episodes of capital market performance. This year, of course, we are experiencing an additional and unexpected effect. Markets have been under considerable pressure since the beginning of the year as pandemic-prompted governmental and central bank policy support is wound down. Markets have possibly reacted less negatively to the unfolding situation in Ukraine than one would anticipate because they suspect the external shock of this geopolitical event may slow down or even reverse the withdrawal of policy support for a while longer.

Turning to the negative economic impacts that may necessitate such policy support extensions, the European Central Bank’s (ECB) chief economist Philip Lane said he expects 2022 Eurozone GDP to be lower by about -0.4%, with a severe scenario reducing GDP by close to 1.0%. A mild scenario could even mean events in Ukraine have no impact. His assessment is mainly because of the cost of energy.

The cost of energy in 2022, and possibly beyond, will much depend on the level of sanctions imposed on Russia. In this context, economists talk about ‘moral hazard’, the need for our economic and financial systems to impose costs on people that behave immorally. Unfortunately, those costs are borne not just by the instigators – but will be felt by individuals and companies as well. It can feel wrong but share prices will be higher if the West decides not to impose sanctions too heavily.

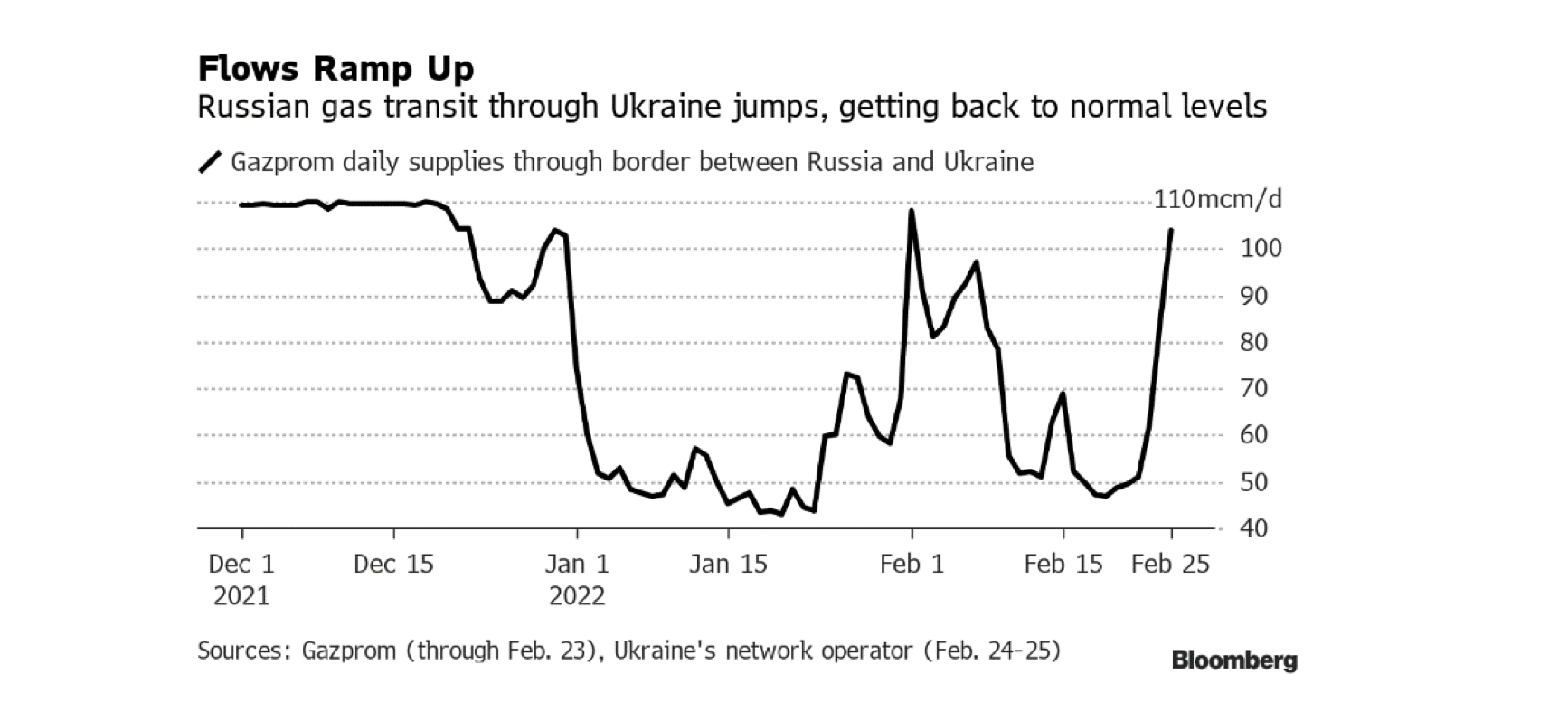

The markets remain focused on sanctions that hint at Europe’s weak spot: energy and metals prices. Putin’s strategy of constraining supply during this winter, thereby creating a cost-of-living crisis, appears to have worked well for him. Current sanctions do not extend to Russian energy giant Gazprom and, perhaps unsurprisingly, gas imports from Russia though Ukraine’s pipelines are up (see chart below).

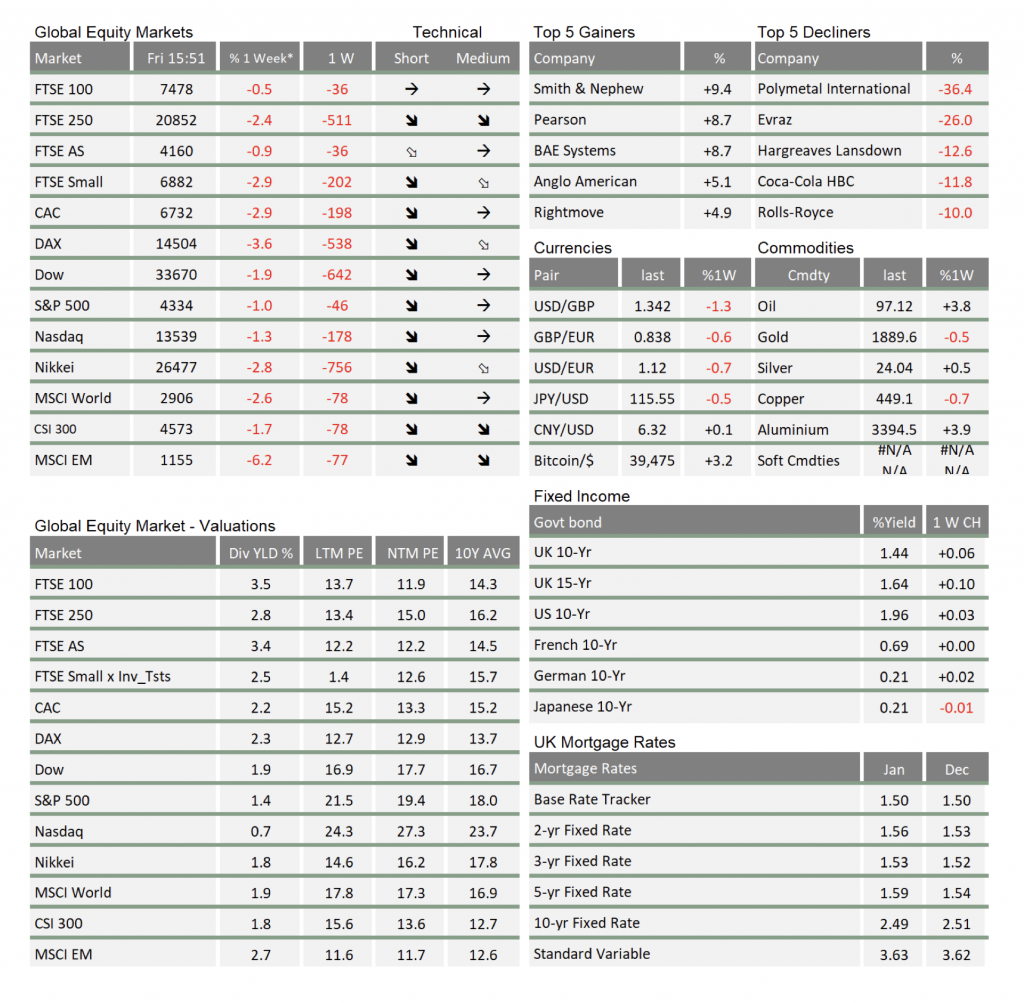

Meanwhile, Brent crude, which rose to $104 per barrel (pb) immediately after the invasion began, fell back to Monday’s level of $97pb. Longer-dated futures have also retrenched. March 2023 Brent is indicated at $83.5pb, down from $86.5pb.

Part of this is because it is likely Iran may be allowed to re-enter the global oil market. The Nuclear Agreement may well be reinstated after former US president Trump pulled the Western world out and imposed moral hazard sanctions on Iran. As a result, and perhaps somewhat bizarrely, we could end up with an anomalous situation: fewer sanctions globally than before the Ukraine invasion began.

We are used to central banks being nimble and governments being lead-footed. Today, things look a bit different. Defence stocks are doing rather well. British Aerospace has risen more than 11% from Wednesday’s close. The rationale focuses on Germany’s reaction to the current situation. Germany is highly sensitised towards Russia’s behaviour, as an actively belligerent Russia changes all estimations of Germany’s defence needs. We should expect that Germany will feel very differently about government deficit expansion and its armed forces in the new scenario.

Yet, Europe’s main defence companies are in Germany and the UK. Throughout the past decade, Europe’s pleas for Germany to save less and spend more have proved unsuccessful. Now things may be changing, and quickly. So, if we have fewer sanctions and fiscal expansion, we could end up with higher, not lower, growth in Europe.

Turning to China – the other main global economic power which could allow Russia to escape the pain of western sanction – has indicated it sees no benefit in sanctions, although it has “paused” oil tanker shipments. While President Xi urged Putin to negotiate with Ukraine’s government, (and ahead of the Russian announcement of talks), there was little mention of the conflict in Chinese media. Much more to the fore was the news that the Xi-led Politburo has vowed to strengthen policies to stabilise the Chinese economy this year. Ahead of annual legislative meetings scheduled for next week, the Politburo called for stronger prevention of financial risks, after a review of the current situation and progress towards government targets. The People’s Bank of China has also been increasing liquidity again this week, and signs are that regulatory pressure is being reversed on consumer tech companies like Alibaba and on residential property builders.

However, Hong Kong is now in the midst of a full-blown Covid outbreak. Today, 21,979 cases were reported, which makes this now a larger outbreak of Covid than the original outbreak in Wuhan at the beginning of 2020. Should China’s leadership decide to stick with its zero-Covid policy, a significant economic slowdown in China may limit the support that may otherwise be extended towards Russia.

Not to lose sight of the wider economic picture beyond the Ukraine shock, our third article covers the encouraging ‘flash’ Purchasing Manager Indices (PMIs) published this week. In the US, direct consumer confidence indexes have been weak, but interestingly, the PMI data suggests consumer attitudes are possibly more buoyant. Today’s personal spending and income data backs that up. US households may be worried about inflation, but they kept spending – and saving less – in January. Another bright spot was that inflation expectations declined (the five-year expectation dipped to 3.0% from 3.1%). The mood of consumers seems to have soured since the beginning of the year, with falling US equities leading to a decline in personal wealth while mortgage rates and prices have been going up. Even so, it appears that unless the jobs markets turn negative, consumers are likely to remain resilient in their spending habits.

The relationship psychodrama that has been playing out between a Putin-led relatively isolated Russia and with much of the rest of the world has been a major step back in terms of global political cooperation. However, the limited immediate options for moral hazard retaliation by the West (because of its gas dependency on Russia) mean that the events could quite possibly at first lead to more positive policy measures for the global economy. This is because the only way to penalise Russia for its actions, prevent it from further territorial expansion and deprive it of the necessary funding, is to significantly increase military and alternative energy supply funding in western Europe. This could indeed serve as a stimulus for Europe’s economy, and restrict the Ukraine crisis to a regional conflict that is unlikely to reverse the global economic upswing taking place.

As investment professionals, weeks like this one require us to remain clear-eyed and objective – often as catastrophic events unfold. We hope that our readers understand that we have used these pages to look beyond the humanitarian impact, to explore the financial implications that our investors require from us.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.