Special Market Update: Russia Invades Ukraine

Putin’s Attack on Ukraine Changes 2022 Market Parameters

Given the devastating news yesterday, we would like to express our utmost concern for the people of Ukraine and of course, our thoughts and wishes are with them. It is our duty as advisers to comment on the economic and financial impact of geopolitical news, but we do so with the utmost respect for the broader context and the devastating impact the current situation is having on people’s lives. Against our expectations, Russia has launched a broad assault on Ukraine. Previous thinking was that Russia’s Putin would not dare an outright invasion of its neighbour in light of the likely cost of lives of Russian soldiers and economic hardship for Russian society at large.

Vladimir Putin’s decision of a large-scale invasion of Ukraine marks the end of 50 years of political understanding that large scale land war is no longer a political option in Europe’s political theatre. As such it will have marked a major paradigm shift of European politics towards Russia. The West has to accept that our dependency on fossil fuels has provided Russia the currency reserves and economic prowess that emboldened them to attack their neighbour and accept the risks of otherwise crippling global sanctions the war on a significant European neighbour brings.

As a consequence, Europe will not only want to end energy dependency on Russia but also cut them off from further funding for any more territorial expansion aspirations. More importantly, perhaps, Russian aggression will provide European policymakers with the public support necessary to significantly ramp up government debt-financed investment in the CO2 energy transition through regulatory change, cushioned by fiscal support. This leads us to expect a reversal of the waning prospect of continued fiscal support in the post-pandemic environment, especially in Europe. Indeed, a policy acceleration in this direction has the potential of providing a significant catalyst for growth over the next three to five years.

Turning to the more immediate impact of Russia’s hostile actions on capital markets it is worth noting that while significant, market action this year has arguably been driven more by the prospect of central banks’ monetary tightening agenda. This headwind is now likely to ease as the impact of the likely very significant package of western sanctions on Russia has the potential to slow growth prospects enough to quash any concerns of an overheating economy in the shorter term.

Nevertheless, the most notable impact of such sanctions for the broader public will inevitably be further price rises in the energy sector, with fuel prices at the pump quite conceivably moving from £1.5/l towards £1.75/l. Similarly, the prospect of receding heating prices towards the end of the year is looking increasingly less likely. For the US, the immediate energy impact is naturally likely to be lower. However, given the monocausal driver of price rises being energy shortages, rather than demand increases across a wide range of goods and services, we can also expect a different reaction function from central banks, again especially in Europe. A cost shock weighs on growth and so slows inflationary dynamics. Announcements to the effect of monetary policy flexibility returning are a reasonable expectation in response to a market liquidity shortfall first (as markets sell off for cash) and possible growth shock later.

It is important to note that today’s market shock is of an entirely different, and much less severe, nature compared to what we experienced two years ago with COVID-19. In 2020 markets came to realise that the pandemic would have an unprecedented, and entirely uncertain impact on the global economy. Russia’s war on Ukraine will have an impact on 2022 energy prices and trade with Russia which is far more limited and introducing less uncertainty in its potential impact on the global economy.

After two years of successfully mobilising every part of society to overcome a common enemy in the form of a virus, mobilising western resources towards fundamental change to face off the more familiar threat of a largely isolated Russia may prove far more achievable than before the pandemic precedent. As a result, there are likely to be aspects of this terrible humanitarian event having a more positive economic and market effect than it may feel at the moment.

How has this affected portfolios?

We have very limited exposure to Russia or Ukraine in our portfolios with none of them holding more than 1% and balanced portfolios in general holding around 0.5%. In more general terms our portfolios invest across different types of investments (assets) and geographic regions to benefit from diversification. However, as you would expect, portfolios with a greater allocation towards equities are most affected by sudden market movements.

With such unpredictability in the situation in Ukraine and the wider economic impact being more sector specific, in energy costs for example, we will not currently be making any immediate portfolio adjustments. We believe our current positioning is appropriate for the current environment. We want to keep our portfolios invested at levels that will allow them to participate and benefit fully when the extent of the conflict is more apparent.

While we continue to monitor our portfolios as a whole, we are constantly reviewing their individual component parts. It’s our job to ensure that the underlying funds that make up our portfolios perform as anticipated through the prevailing market environment. We expect our active managers to be taking advantage of the recent volatility in markets, but we want to ensure they remain committed to the philosophies for which we selected them in the first place.

What are we doing to preserve the value of your investments?

In times of heightened levels of uncertainty just like when the pandemic first hit, everybody feels the collective instinct to ‘do something’ to try to take control of events. As investment managers, we face the same pressure to sell during times of volatility and war in Europe creates great humanitarian and economic concern. However, it’s our job to resist such pressure and to persist with our long-held investment beliefs. We know that holding well-diversified portfolios helps to cushion the impact of market falls, especially when compared against holding equities directly. We also know that it’s important to have our portfolios positioned in ways that will allow us to act swiftly and decisively when good buying opportunities present themselves.

We have recently started offering our Discretionary Portfolio Management Service to clients. This allows us to automatically update your portfolio within your agreed risk profile based on our ongoing research, strategic asset allocation models and recent market events. If you would like to take advantage of this service and immediately update your portfolio in line with our current views, please email your adviser for more information.

Is now the right time to buy?

Market uncertainty and a fall in the valuation of stock markets can present buying opportunities. However, it’s worth remembering that we are still in the early stages of this conflict and its quite likely that there will be market volatility over the coming weeks. Markets are not behaving irrationally but there is considerable uncertainty as to how long and how widespread the conflict will be. As responsible guardians of your money, we still take the view that ‘timing the market’ is a high-risk gamble and that ‘time in the market’ is the best way to build long-term investment returns.

How can I keep up to date on my investments?

We will continue to send updates on market developments and all our market updates are available to view on our website. If you have any concerns or wish to talk over the current developments, feel free to call your Adviser. They are familiar with your personal circumstances and will be best placed to discuss your investment with you.

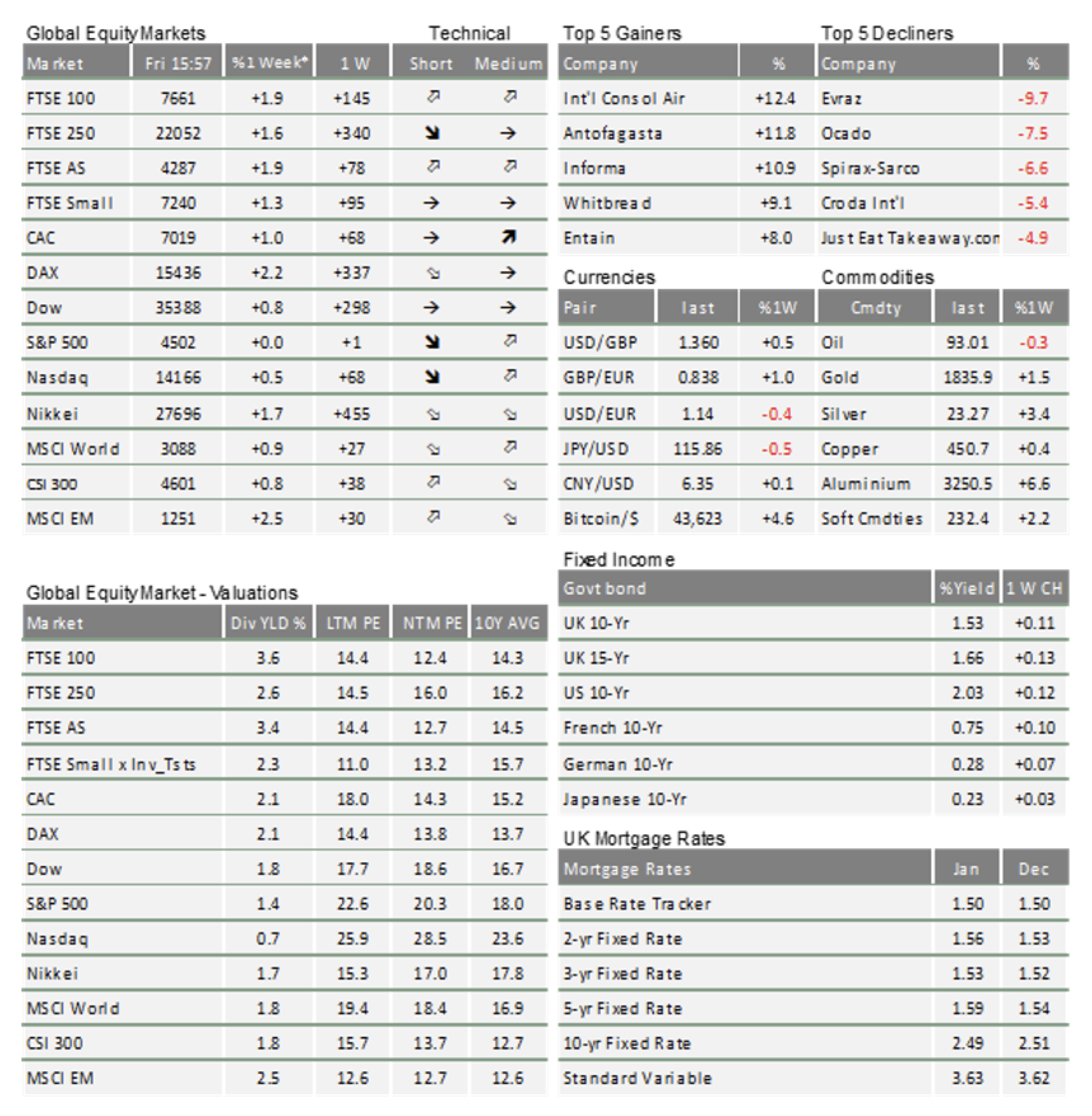

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.