Market Update: After the party, the hangover?

Graeme Keyes, 30 December 2023

After the party, the hangover

Following the impressive Santa Rally markets started 2024 on a less euphoric note, is this simply a correction from overbuying, or a genuinely bad start?

December 2023 asset returns review

Against all predictions, 2023 turned into a positive year for investors with most mainstream investment strategies outperforming inflation and cash.

US election: will Trump shake markets?

Politics have much less impact of capital markets than most people would assume. We reflect on whether this will still hold true in 2024.

After the party, the hangover?

The first week of January feeling is eerily reminiscent of one year ago: strikes, endless rain and then everything else that causes the usual January blues. Yet investors in diversified global investment portfolios will get a positive surprise when they look at their end-of-year valuations. All bar the most bond-heavy investment strategies will have not only provided them with positive returns, but even outstripped what was available from cash deposits or what inflation took away in purchasing power. On top of this tidy 2023 Christmas present, this year’s outlook is much less about dreading recession than the real possibility of an economic upswing.

During a year that was for most of it defined by its volatility rather than direction, the last two months brought a welcome change in investor sentiment. We go into detail in the asset returns review for December in the main body last week, but the change came about with the sustained fall in the rate of inflation around the globe, which permitted central banks to put an end to their relentless rate rises as they sensed victory in their fight against the post-pandemic boom inflation.

The resulting rush towards long-term assets pushed bond yields down to a 27 December low point of 3.45% for the 10-year gilt and 3.78% for the 10-year US Treasury, having reached 4.75 and 5.0% highs respectively only a few months ago. Those yields were achieved in the very low volumes between the major holidays.

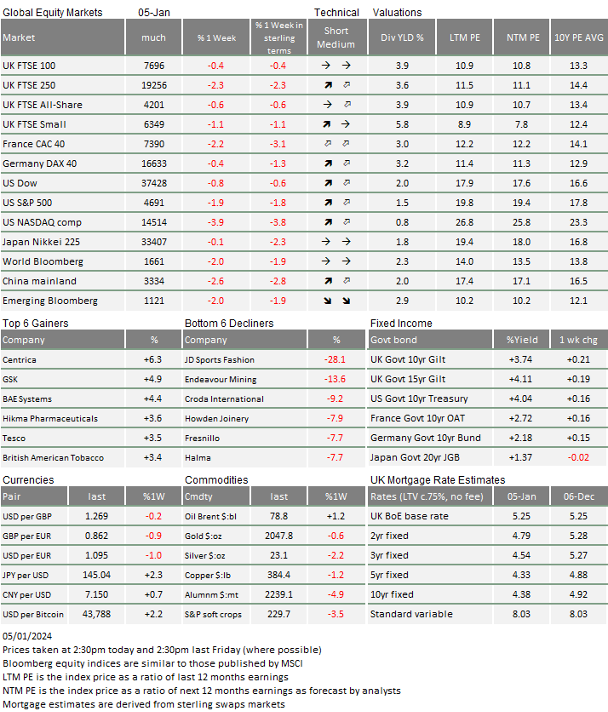

Both equity and bond prices fell back last week as trading volumes normalised. Fixed-coupon bond yields rise when prices fall, and both UK and US yields are up quite sharply, currently at 3.80% and 4.05%, respectively. Equities have also responded in their usual way (at least, usual for the past few years) of falling back some 1%-2% through the course of last week, with some notable underperformance from tech-related stocks.

So, after the Christmas party, January perhaps started with a bit of a hangover. Professional investors, like us, seem to have looked at the lower yields on bonds and larger cap equities and decided to take the near-term profit. In part, this may well be because they are making space in portfolios for potential new investment positions. Companies are seeing the lower cost of capital as an opportunity to finally replenish funds with new bond issues, and equity issues in the form of initial public offerings (IPOs) and convertible bonds. The renewed interest in convertible bond issuance is interesting, and indicates investors find the combination of bond-like downside protection with equity upside appealing.

Contrary to the hangover feeling of investors, however, such behaviour is born of optimism rather than pessimism. Companies want to raise capital because their business can generate a better return than the cost of that capital (even at these relatively higher rates than in the past few years) and investors believe in the new opportunities. It also suggests that capital markets are more in balance now than they were in December, when optimism rose but corporate treasurers wanted to wait until the new year.

Large-cap tech stocks encountered weakness for other reasons last week. Barclays Capital will be heartened by the amount of coverage that Tim Long and his analyst team received after they published a piece saying iPhone sales were stagnating, cutting their recommended Apple position to “underweight”. ASML was hit after it voluntarily halted shipments to China of high-end chip production equipment.

Perhaps the tech story is also about profit-taking. The artificial intelligence theme held sway for much of 2023 while it was difficult to find upside prospects elsewhere. However, when we look through the revisions to earnings across almost all sectors, the past three months have seen a resurgence of optimism. Analysts’ earnings expectations in all sectors bar energy have risen, and that sort of breadth is more usual after an economy exits from a recession. Last year, it was really only the tech sector that saw substantial earnings optimism.

We will enter the Q4 earnings season very shortly. On the back of falling yields and rising equity valuations, financial conditions eased substantially through that quarter and there are few hints of stress. There will be inevitable shocks and companies will tell us that the environment remains tough. At the same time, most will tell us they are doing well relative to their peers and beating expectations. The earnings announcement season should not disturb investor optimism.

The real news of last week was that the narrative of global policy rates being cut sometime in the second quarter took a bit of a hit. European inflation data was in line with, but not below expectations while US employment remains tight. US December unemployment stayed the same as November’s very surprising low 3.7%. Indeed, the evidence is that employment tightened at the end of the year, something that should bolster consumption but will do nothing to reduce robust wage growth.

Economic optimism doesn’t help bonds. Low inflation data may help for this month, and possibly next, but rate cuts in March and April look as far-fetched as we thought they did at the tail end of last year. However, the rise in bond yields occurred in the longer rather than the shorter-dated maturities. By our measure, longer bonds are mildly expensive after the recent yield falls and more vulnerable to issuance pressures even if inflation data stagnates for a while rather than continues to fall. However, given the still calming inflation dynamics, bond yields are not likely to repeat the falls of the end of 2023 in the next quarter.

China continues to behave in a radically different way to the rest of the world’s stock markets, an indication of peculiar stresses and policy differences. Today (Friday 5 January), Zhongzhi Enterprise Group (ZEG) – formerly the largest of China’s trusts for public investment – filed for bankruptcy. ZEG had made its troubles known in the autumn, so this move may not cause more problems directly.

China’s trusts took deposits from companies and wealthy individual investors and companies, often then leveraging this capital to invest in stocks and bonds and to make loans. Known as shadow banks, these institutions accounted for almost 10% of total loans in China in the lead-up to the pandemic, according to Bloomberg Economics.

Their shadow banking activities have been important for China’s private sector economy; firms that can’t access traditional banks having depended significantly on such trusts for loans. They have also been central for domestic stocks, providing a major channel for household equity investment, at least for the wealthy. Perhaps then, it is unsurprising that the malaise among these trusts goes hand-in-hand with weak private-sector loan growth and weak domestic stock market investment.

For Chinese stocks, a lack of domestic investors may mean that profitable good-quality companies are valued cheaply and present a great opportunity for foreign investors. Signs are that foreign investor flows have started to turn positive after a long period of disinvestment. The potential flashpoint of the Taiwan presidential election is on 13 January and the most pro-independence candidate (Lai Ching-te, also known as William Lai) seems likely to win, although it is not a certainty. Perhaps China may look more attractive once we know more about where Taiwan’s politics will lie.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.