Market Update: A dose of realism creeps in

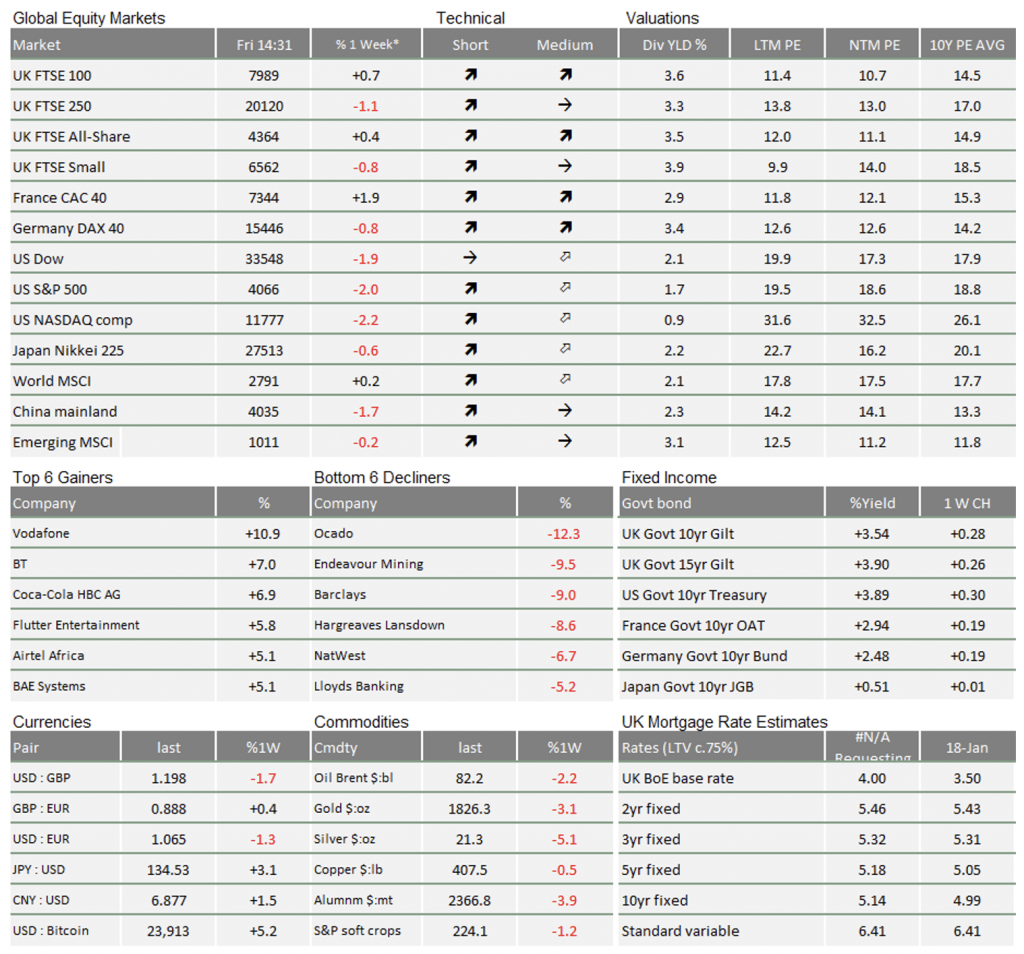

Last week, the UK’s leading stock market index, the FTSE100, finally passed the psychologically important threshold of 8,000. And yet, after the strong start to the year in January, February has brought consolidation rather than a continued uptrend. The prevailing ‘Goldilocks’ market sentiment of not-too-hot (growth, inflation), not-too-cold (rates coming down again soon) was replaced by a somewhat more realistic view that rates will in all likelihood have to stay higher for longer than previously hoped. This is because inflation is proving more persistent, despite goods and energy/commodity price rises indeed having proven to be transitory. However, tight labour markets have carried so-called second-round effects from last year’s price shock into the ‘stickier’ areas of service and goods with a high service production component (e.g., food).

Commentators from the US Federal Reserve (Fed) and the European Central Bank (ECB) added further evidence to this view, as both said this week that they need to do more in their fight against inflation and they did not see any clear end yet. This came after US consumer price index (CPI) inflation data had both good and bad news, whereas the producer price index (PPI) inflation data showed a worrying uptick. Worrying, because falling raw material and energy costs were not enough to counterbalance price rises from rising labour and other input costs.

Global government bond yields rose quite sharply after the central bank comments. They are not yet making investors fear recession is imminent though. Credit spreads – for us the best indicator of fears of a recession – rose slightly last week, but are still close to the lowest levels of the past six months.

The slowly changing perspective for how soon or rather how long until rates and yields stop rising – and central banks will come off the growth ‘brakes’ – has not necessarily changed the long-term picture of a relatively benign economic slowdown.

What the past weeks’ data points have done to market sentiment is inject a dose of realism. Beforehand, the equity markets pricing implied that the negative current earnings recession proves to be a very short-term phenomenon, and that aggregate profit growth resumes by, at latest, the second half of this year. Last week’s rise in bond yield levels may push the resumption of profit growth out towards 2024, which makes equities once again look relatively expensive and therefore vulnerable to corrections.

This means that while we remain optimistic for the 2023 central scenario, we admit to being a bit more cautious for the near-term and are taking the opportunity to lock in some of the attractive yields this period of uncertainty has brought.

Other markets had a decent enough week, but price action still feels directionless. Again, underlying profit expectations are not strong yet and investors are unlikely turn optimistic again until central banks have clearly reached a point where tightening is done.

When stock markets as a whole are providing only limited upside perspective, actively seeking and tilting portfolios towards those areas that thrive under the changed circumstances is the job of investment managers like us. Last year’s rotation from growth to value was a case in point.

One fund manager in question is Steve Eisman, who gave an interview on Bloomberg TV last week. He has the honour of being the real-life Mark Baum, New York City character played by Steve Carell in the 2015 film The Big Short, one of the perspicacious fund managers that identified the problems with the mortgage-backed securities markets before the Great Financial Crisis of 2008. Steve has not always been right, but he is always worth listening to.

He believes that the investment world is entering a new paradigm, a model of understanding (or beliefs) of how investors will view the future of company structures and profitability. He thinks we are changing our judgment on the shape of likely future winners; some of the past winners will turn out to be also-rans. He reminds us that, in the 1990s, Jack Welch’s General Electric Company (GE) was the darling; the S&P 500’s no.1 in 1996 but now only 88th by market capitalisation.

His thoughts are particularly relevant now. In the past few weeks, ‘growth’ stocks have performed well after more than a year of underperforming ‘value’. That performance coincided with a fall back in long-term yields. However, the correlation of growth stocks with yields has been less strong in recent times. Perhaps, for the now-dominant winners, their business models have reached a natural end; their growth was achieved by gaining market share from older-style rivals while having better margins than those rivals. As we discuss in one of our in-depth articles below, margins now appear to be under pressure. This also comes at a point where gaining market share is more difficult and costly since there are few obvious remaining rivals to pick off.

Perhaps this is a reminder that the ‘style factor’ approach to investment needs constant attention. Five years ago, we labelled certain companies as ‘growth’ but now they no longer fit the label. That also means that one person’s list of stocks in the growth and value camps can differ substantially with somebody else’s.

The business models that are likely to be sure-fire sources of growth are now not obvious. Everybody uses social media advertising. Meanwhile, the platform companies such as Alphabet (Google) face real questions over their size, much as GE did back in the 1990s. The political discussions on profit margins have grown much louder, just at the point where their very size creates organisational problems.

These are circumstances which may not favour a passive market-capitalisation investment approach while such a transition takes place. It might instead favour approaches based on other more complex fundamental metrics such as return on equity, which also suggests it might favour active stock selection.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.