Market Update: A challenging week brings investors back down to earth

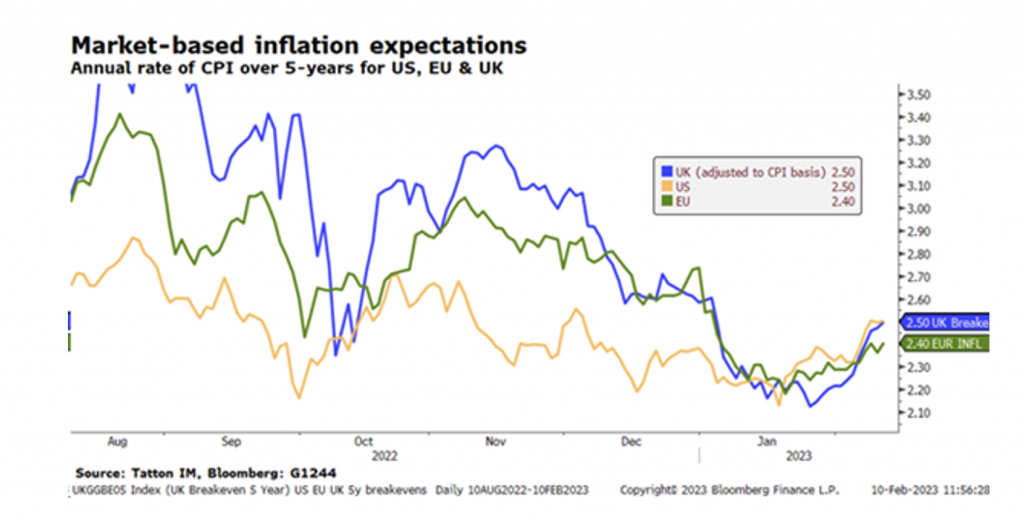

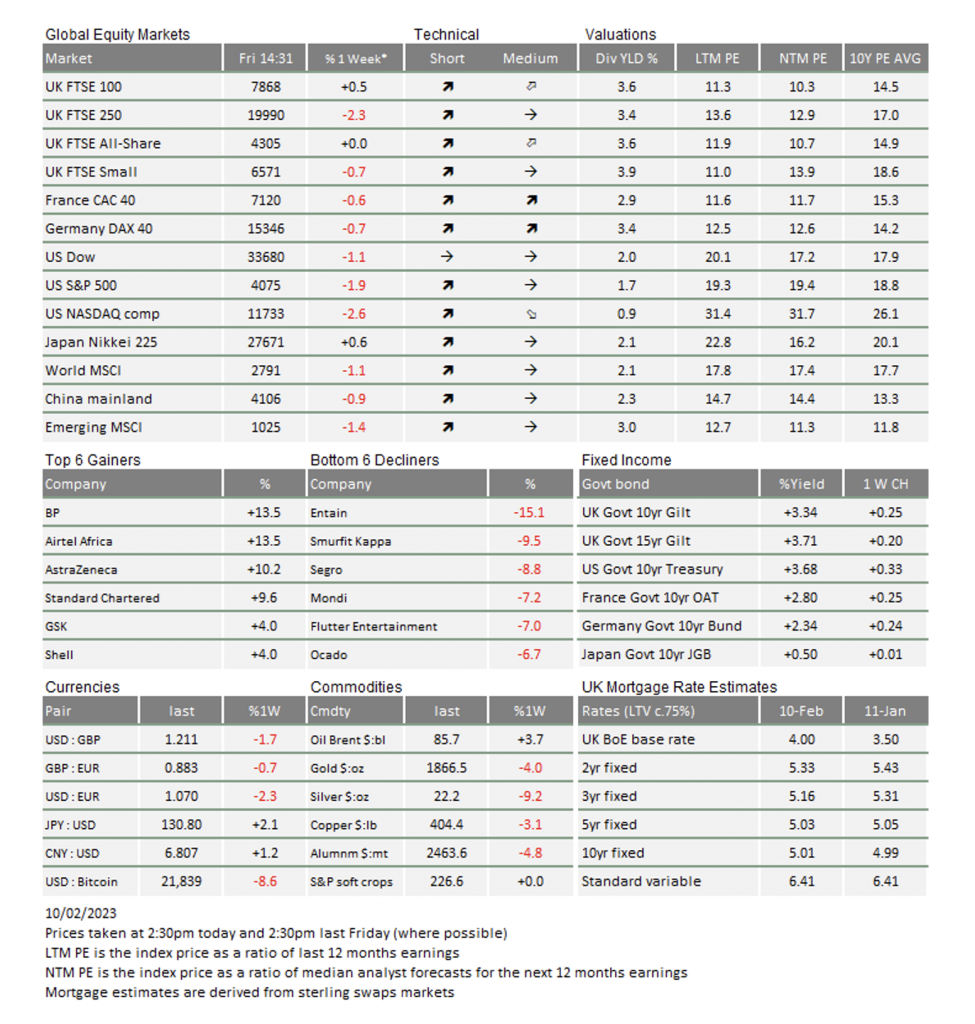

Overall, UK bond and equity markets slipped back last week, despite the FTSE 100 edging higher until Thursday lunchtime when it reached a new all-time price high of 7494.57. Since last week’s US employment data, the asset market rally has had a key component weaken. In January and early February, investors had spied a decline in longer-term inflation pressures, but investors have become less sure in recent days. In turn, expectations that central banks would move relatively quickly into neutral gear also declined. Catherine Mann, an independent member of the Bank of England’s Monetary Policy Committee warned that there were still more rate rises to come in the UK. Meanwhile, in the US, Federal Open Markets Committee members also told us that while the pace of rate rises may have slowed, the end is not clearly in sight.

These announcements were a major factor in halting the previously helpful rally in bonds. Shorter maturity yields have risen more than longer maturities, but yields are up (and so bond prices are down) somewhat.

For sure, this move is nothing like the sell-off in bonds of 12 months ago, when western economies were still roaring ahead. For most investors the question is whether growth this year and next year will be slow but steadyish, or will it be “too strong” and therefore forced to slow more dramatically by ever-tighter monetary policy? If we want an early path to lower interest rates and an early path to stable steady profitable growth, it is preferable to get weaker economic data now.

The UK’s 2022 fourth quarter gross domestic product (GDP) data could not be described as strong although, contrary to expectations, it did not show a contraction. The quarter showed no real growth at all, while the mix was a little surprising with services weaker than expected while manufacturing was stronger. Indeed, it looks like the woes of auto-related industry may be less than feared. New car registrations in the UK are up by around 20% from last year’s dire figures and, more importantly, aided by a similar bounce in the much larger European market.

As we come to the last part of the Q4 2022 earnings reports, the most notable outcome has been that analysts have become less positive about company earnings for this year. Compared to the last 12 months, for the S&P 500, the next 12 month’s earnings per share (EPS) are expected to grow (on average) by less than 4%. In Europe, the STOXX 600 EPS growth is expected to be 2.1%. For both markets, the next 12 month’s EPS is 11% higher than the rolling last 12 months.

One might say this provides quite a lot of comfort for equity investors. A normalisation of the relationship might imply that equities can rally as the markets’ EPS estimates are not building in any real growth.

We need to look at stock price as well, since that tells us what we’re paying for those expected earnings. There is certainly room for analysts to revise their estimates up but current valuations are expensive (after we factor in last year’s rise in global bond yields). In both the US and European Union (EU) markets, on our calculation earnings would have go up by about 15% from current estimates to get close to average. So, even if analysts do make upward revisions, a move back to an 11% growth for the next year would still mean expensive equities.

A sharp bounce in EPS growth is most likely after a sharp EPS fall, and those falls happen in recessions. While there’s been much talk of an imminent recession, it hasn’t occurred yet and many now think that any recession will be shallow at worst. But developed markets’ EPS are not likely to grow significantly in the current environment, even if we think that China could produce much stronger demand as it comes out of lockdown.

While a fall in equity markets is a possibility, valuations are not a great guide to near-term market performance. We feel it leaves markets in a position that’s more vulnerable if any shock were to come along. That said, one of the reasons why markets have rallied is that we haven’t had any nasty shock for some time – Russia’s invasion of Ukraine was the last serious one.

Markets could therefore plod along, eking out steady but small returns, while firms improve their cost bases amid slowish revenue growth alongside slowish economic growth. As we said at the start, further declines in bond yields and inflation expectations would be a big help.

Economic growth positivity has recently centred on China. Last week, the release of January’s lending data was even more positive than buoyant expectations. Both companies and consumers have resumed borrowing, and this looks set to continue into the warmer months. While the spy balloon incident(s) will hopefully blow over, it does remind us that investing in China can be problematic. China continues to try to smooth its relationships with the rest of the world and is actually currently involved in a big diplomatic push in Australasia, so we do not expect there to be serious repercussions at least for the moment.

Lastly, a quick mention on energy prices. There is still a possibility of cold weather for this winter, but gas storage levels remain very high across Europe in comparison to past years. In France, the main gas supplier estimated it will have storage at 40% capacity by winter-end, unless there are extremely freezing conditions substantially above normal. Gas and electricity prices continue to fall for next winter’s contracts and are now only double the price of winter 2021, before Russia removed supply. That still may sound terrible, but to end this rather sombre leader on a more upbeat note, a return to near-normality now looks increasingly feasible.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.