Market Update: Will the UK Property Downturn Change the Investment Landscape?

In the wake of Kwasi Kwarteng’s ill-received budget, mortgages were the hot topic. Lenders pulled swathes of mortgage products in expectation of sharply higher interest rates from the Bank of England. When those products were reintroduced a few days later, the rates offered were three to four times higher. The potential effects on consumers and households were well-publicised – and the backlash therein was no doubt a big motivator for the government’s partial U-turn.

While news outlets have been understandably focused on the effects on households, damage has also been done to equity markets – particularly to property funds and house builders.

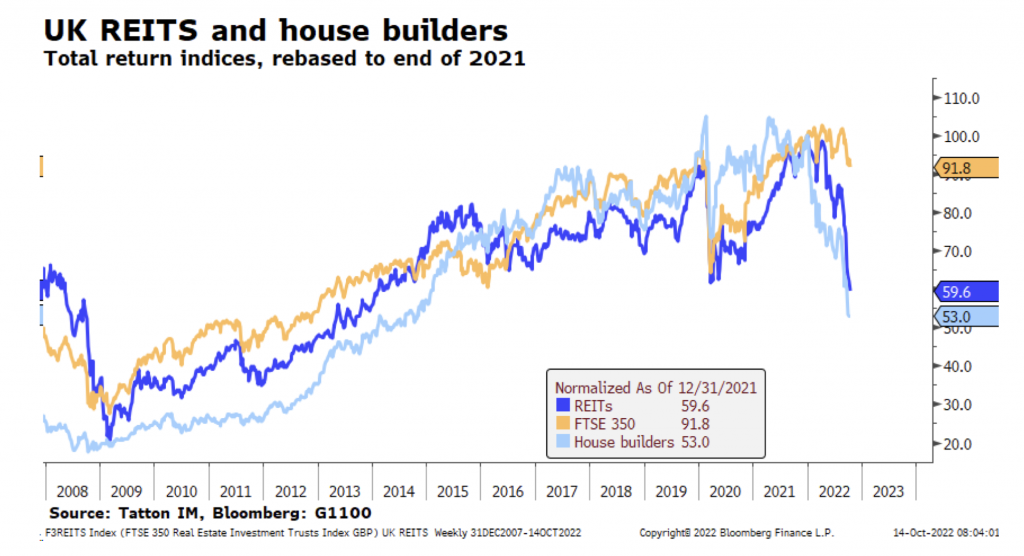

The chart above shows the performance of UK real estate investment trusts (REITs – in dark blue) and house builders (light blue) against the wider performance of Britain’s stock market (yellow). As the difference between these lines shows, both have suffered substantially more than the broader market throughout the year, and the latest drama has precipitated another swipe down. The building sector has nearly halved in value since January, while REITs have lost around 40%.

Clearly, these problems precede the fiscal fallout – though it undoubtedly made the situation considerably worse. Both sectors fared well throughout the pandemic, buoyed by an increase in consumer savings and property deals. But the sharp contraction of monetary policy since the beginning of the year has made conditions extremely difficult.

The property sector is inescapably tied to interest rates and wider financial conditions on the basis that property transactions are almost always geared investments. This is because both individuals and companies borrow to build or buy property, making loan-to-value metrics a crucial factor. Like any leveraged trade, if borrowing costs go up sharply but the underlying assets do not, losses quickly spiral. It makes things worse that the current situation follows a prolonged period of low interest rates, since valuations (particularly compared to rent levels) get pushed higher when capital costs are low, giving them lots of room to fall.

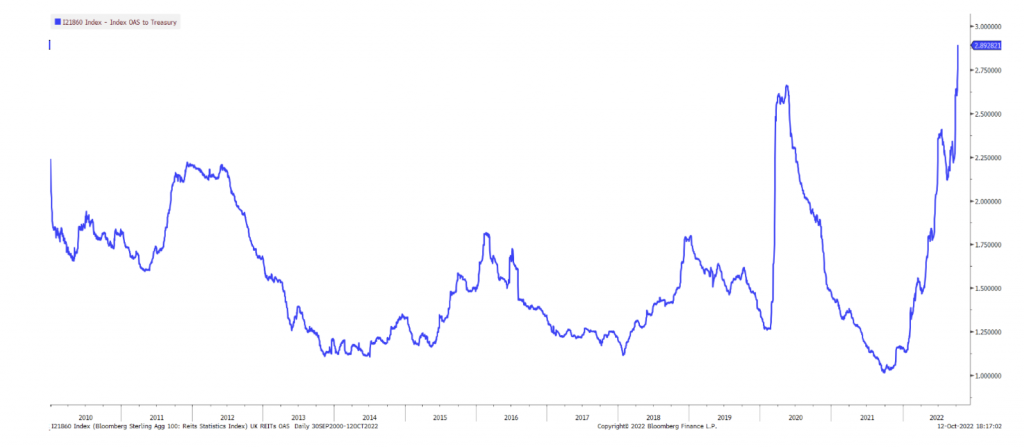

The harsh context aside, we should not underplay the particular damage wrought over the last few weeks. The chart below shows representative credit spreads for the REITs sector – the yield difference over government bonds. While these have climbed rapidly throughout the year, they have catapulted in the last month. Spreads are now worse for REITs than at the height of the pandemic market panic. Bear in mind also, that government bond yields themselves were close to zero back then, while they are now in the mid-single digits. That means overall borrowing costs for REITs have become excruciatingly high.

It is safe to say that some property companies have hit ‘stressed’ levels. On top of higher borrowing costs, property fund outflows have been huge since the end of September. According to a Financial Times report earlier last week, investors pulled more than £100 million out of commercial property funds in the 10 days after Kwarteng’s mini-budget – eight times the amount withdrawn in the previous three weeks. Together with soaring borrowing costs, this means property funds have been all but drained of their available liquidity.

The open-ended property funds that survived after the 2016 and 2020 shake-outs have been sellers of assets over the past year as interest rates have been rising. Over the past two weeks, additional selling pressure has pushed them into a near-ban on redemptions (Investment Week reported that Blackrock has extended the payout period to two years).

Investor redemptions impact open-ended funds, quickly soaking up their limited cash and therefore forcing asset sales. Being closed-ended, REITs do not face investor equity redemptions and so do not need to sell assets in normal times. However, they still face a form of redemption because they borrow to supplement the equity capital. Thus, some REITs have also been sellers through the course of this year.

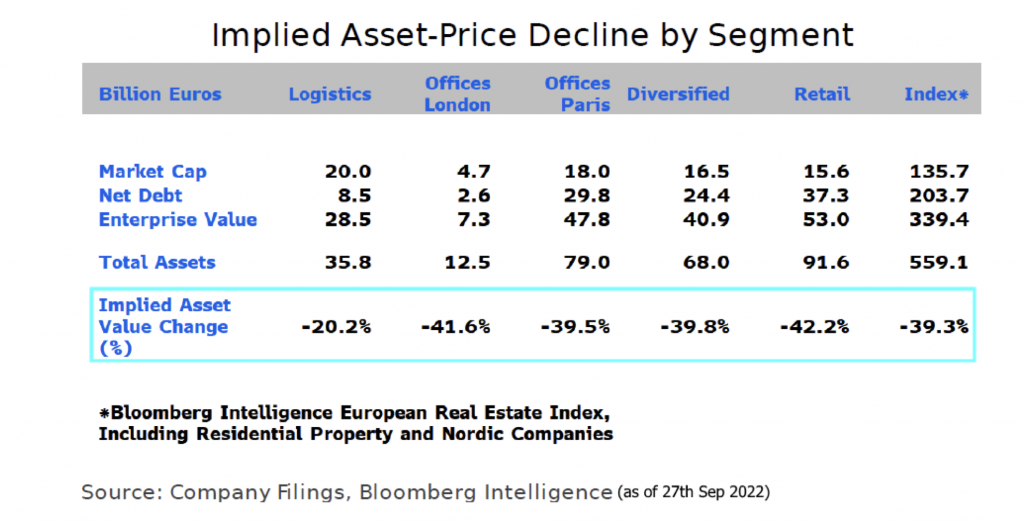

It is no surprise that commercial property is the focal point of this credit crunch. Occupancy levels in offices have never fully recovered from the pandemic as hybrid working has become much more normalised. London-based property is the hardest hit of the bunch: last month, developer Landsec sold Deutsche Bank’s new City headquarters for £191 million less than it had hoped to receive earlier in the year. The table below is from Sue Munden of the Bloomberg Intelligence Real Estate team, and is from the end of September. Sue estimates that the London office segment has declined further to a fall of 42.6% from current asset values on their books.

So, the additional and sudden shift in interest rates means more may be forced into selling assets, putting downward pressure on property prices. For some, it could lead to the ‘doom spiral’ of leveraged assets – falling values and higher costs leading to forced sales leading to even lower asset values and even higher debt payments. But unlike the mini-version faced by some pension funds last week, property is unlikely to be given the same level of protection by the Bank of England (BoE).

With the UK probably already in recession, commercial property is one of the most vulnerable sectors. This would be the case even without the supply-side inflation pressures and fiscal imprudence, since house building and purchasing are extremely cyclical. We are also seeing this stress spread to banks with large property-related loans on their balance sheets – many of which have seen their share prices come under pressure. It seems that, having (somewhat) stabilised the pension fund problem in recent weeks, property is the new site of financial and economic instability.

Unfortunately for many property companies, there is little they can do about the situation. Balance sheet management has improved vastly in recent years, and property funds have made themselves much more resilient. But with the tide turning against them, some will probably fail – barring a shock turnaround in the underlying trends.

“Some” is the keyword here. Improved balance sheets mean many of the larger players – particularly those unrelated to danger areas like inner city office space – will be able to weather the storm. When they come out the other side, they will find a significantly cheaper market ripe for plundering. LXI, for example, has lost just 20% of its value year-to-date, compared with more than 50% for Workspace Group. If that disparity continues, the future could start to look bright for LXI and its better-performing peers.

The discerning investors knows the best time to buy is when things are at their worst – since that is when discount opportunities are at their greatest. Of course, the caveat is that one has to know when things are at their worst, which is why we advise against attempting to “catch a falling knife”, so to speak. Opportunism will surely return, but things are likely to get worse before they get better.

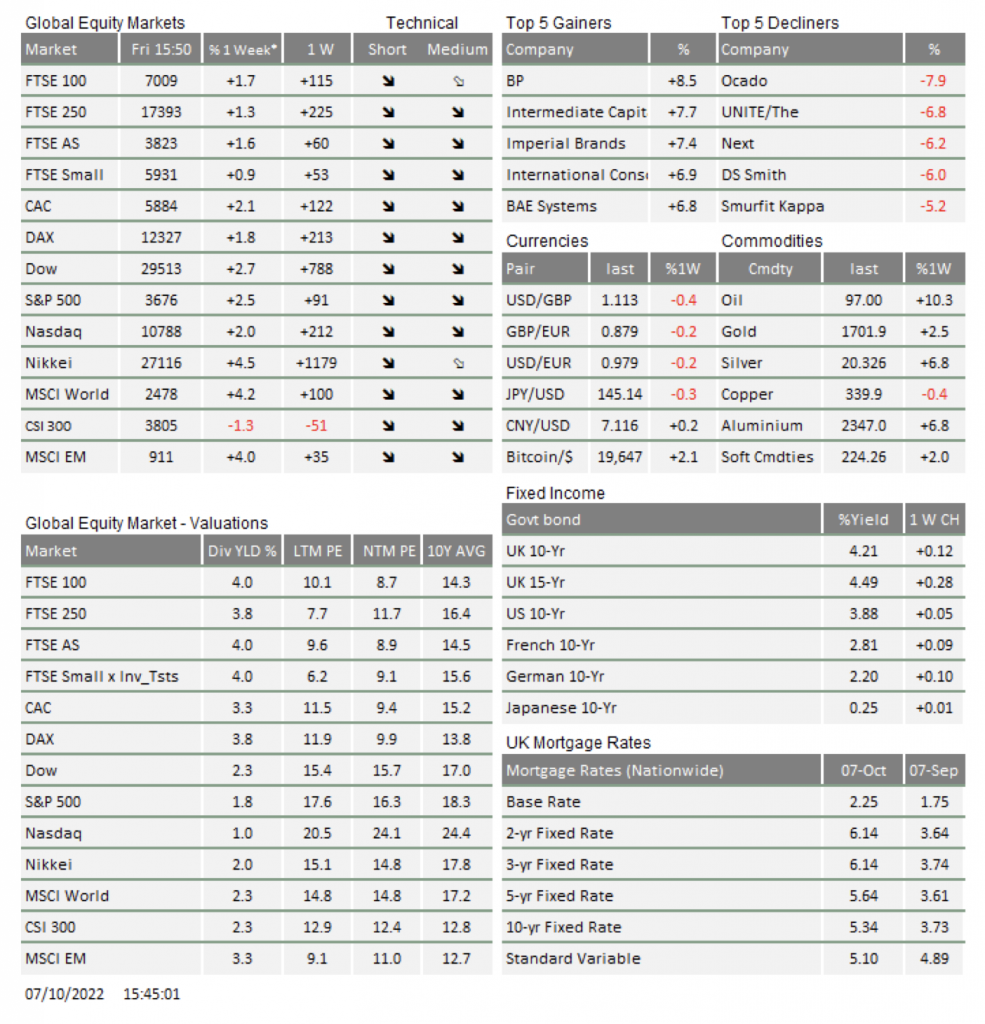

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.