Market Update: US economy slows to our pace

A measured pre-election Autumn Statement budget, Source: Matt Davies, 21 November 2023

US economy slows to our pace

Data from the US undershoots economic forecasts as Europe and China beat theirs, creating a more balanced global economy, for now.

The AI governance dilemma

The drama at Open AI publicly exposed the conflict between altruism and profit in Artificial Intelligence – with such massive benefits and dangers, should we worry who is controlling its development?

Can radical Milei bring stability to Argentina?

Argentina’s president-elect might have the right economic policies, but there are big questions whether this ‘anarcho-capitalist’ can deliver them.

US economy slows to our pace

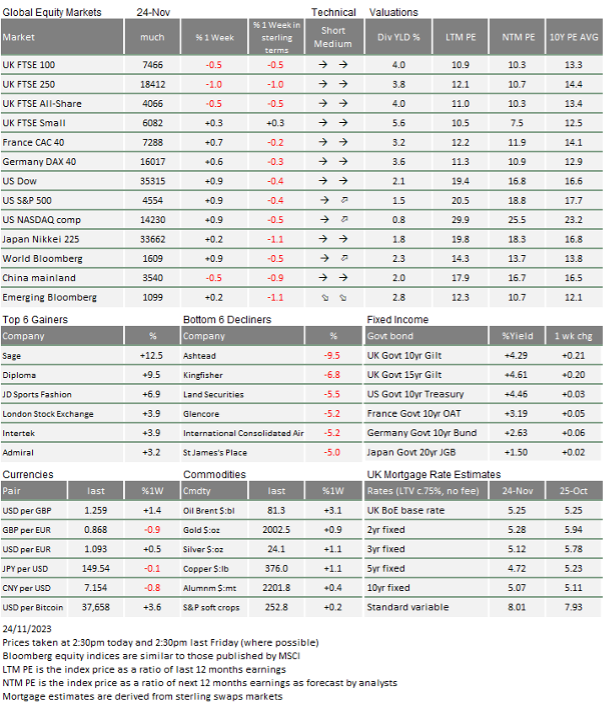

November remains a positive month in capital markets, although equities had a neutral week and longer bond prices have fallen back. UK government bonds (Gilts) have been the best performing bond market in the past few weeks, but the tax cuts announced in Wednesday Autumn Statement, although relatively minor, were enough to push the ten-year Gilt yield back up above 4.25% (rising yields mean falling bond prices).

Although it was a busy time for UK news, the US-centric nature of global markets means Thanksgiving week tends to be quiet. Things should pick up this week, but markets will likely be decreasingly busy over the next four weeks. However a decline in trading activity doesn’t necessarily mean quiet markets, particularly if a group of investors decides to move things around. If they want to buy, we can end up with a ‘Santa rally’. If they are stressed and need to raise cash levels, we can get a nasty sell-off, such as what happened in 2018. It all depends on how investors perceive risks and opportunities evolving in the New Year.

Risk appetite wobbled in the run-up to the end of October, driven by falls in bond values, but right now there are few signs of stress after bond and equity market rallies. Price volatility has declined across the board, and option volatilities (a measure of expected volatility) have come down to low levels. The risk of owning market-traded assets has declined and that slow process tends to lead to a gentle rise in risk asset prices.

But, as we mentioned last week, there is a potential problem with an environment where rising low-risk bond prices (and falling bond yields) are a driver of higher risk asset prices. Falling bond yields are mostly associated with some sense of a slowing economy and it appears that, on balance, the global economy may indeed have eased back. The good news is that although growth may be slowing somewhat, this phase may prove to be better balanced.

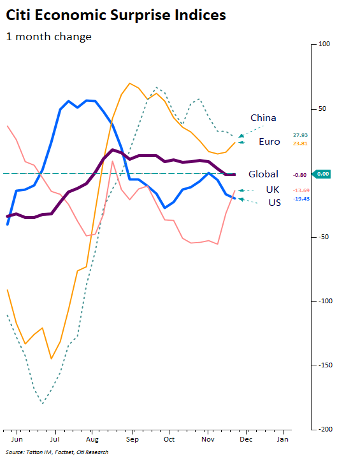

One way of discerning change is to compare economic data to economist forecasts. If things are picking up, economists will have underestimated the data; vice versa if things are slowing. Citi Research produces ‘Surprise Indices’ for each major area, and we show how major areas are tracking in the chart below:

Our version of the Citi indicators emphasises the rate of change by looking at index change over a month. Above zero is associated with acceleration, below zero with deceleration.

The US was pushing on in the summer months, but the impetus has fallen away during autumn; steady through October but having entered a slightly weaker phase again.

At the same time, the Eurozone and China have seen their impetus go from negative to positive and are hanging on. The UK remains disappointing but may be showing signs of heading to stabilisation.

Overall, growth changes are becoming similar and the US is much less out of kilter with the rest of the world. This has allowed US bond yields to fall back, taking the pressure off other bond markets.

Another big impact has been the follow-through in currencies. The US dollar has had another week of decline against most major currencies. Essentially, this reduces stress on companies and governments outside the US that have borrowed in US dollars (of which there are many) as it becomes easier and cheaper to get dollars to service those debts.

Another positive has been that commodity and energy prices are edging lower. They are lower in US dollar price terms, which also means cheaper prices in euro and sterling terms. It’s not huge but every bit helps. It also helps Ukraine marginally that Russia will be getting less revenue.

Lastly, the truce between Hamas and Israel will be short term, but things have not gotten worse.

We mentioned that UK bond yields bounced on Thursday. Before the Autumn Statement, UK purchasing manager indices (PMIs) were better than expected. However, we shouldn’t overstate their strength. An index level of 50 denotes zero growth, and manufacturing was at 46.7, services at 50.5. The composite was at 50.1. It represents an improvement but not growth.

Still, as FactSet’s StreetAccount reports, many economists revised their interest rate views after the fiscal statement and better PMI data. Capital Economics said the Bank of England (BoE) would remain uneasy about the stickiness of inflation. Goldman Sachs highlighted policymakers might worry that the cut to National Insurance and rise in minimum wage could raise pay growth. They reiterated their view that a rate cut is more likely in the third quarter of 2024 rather than the second quarter, while Citi Research moved their expectation of a rate cut from May to August.

We suspect that the tax giveaways are not likely to be that influential. Barclays announced lay-offs this morning and a slowing of the employment market will have a greater impact.

The Autumn Statement was notable for its focus on changes to Individual Savings Accounts (ISAs), welcome for almost all UK household savers. None of the changes seem contentious and should improve the environment for savings. The more important change to come is pension reform and that remains in the consultation phase. It’s true that the UK needs a much better private sector pension structure and getting change broadly right is very important. Given the proximity of a General Election, cross-party support will be essential. Fortunately, the Sunak government and a putative Starmer government may well be reasonably aligned, so this consultation phase stands a good chance of resulting in beneficial change reasonably soon.

It was a week when right-wing politicians gained some notable ground. And in the Netherlands, the Dutch electorate has also brought a right-wing prime minister to power, although Geert Wilders is less of a fan of relinquishing currency sovereignty. Elsewhere, the German government is dealing with a court ruling imposed an across-the-board budget freeze which could significantly compress its ability to spend, and could be as large as €800 billion. While this ruling will probably get sorted in due course, It may cause a shock along the lines of the recurring US debt ceiling issues.

Almost lastly, a reality soap opera drama unfolded surrounding OpenAI, the company that released ChatGPT and made generative artificial intelligence (AI) the biggest theme of 2023. This time it made headlines after the board ousted Chief Executive Officer (CEO) Sam Altman, but the drama only got more outlandish from there on. But this story is not just about AI, it is also about the G of ESG investing: Governance.

Really lastly, China’s leaders are intent on rekindling economic vibrancy. Beijing has said it will allow banks to offer unsecured short-term loans to qualified developers for the first time. That list includes Country Garden, the largest and definitely most important developer, and a company that some had accused China’s leadership as being intent on destroying. China and other Asian markets including Japan were the best performers last week.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.