Market Update: UK inflation shocker

Britons got an unwelcome surprise last week. Inflation, as measured by the consumer prices index (CPI), climbed 10.4% year-on-year in February, higher than January’s 10.1% figure and above economists’ expectations. Before this news, things were looking better for the UK economy, albeit only slightly. Falling fuel prices, easing global input costs and a small but consistent slide in monthly inflation had suggested ‘peak’ inflation was behind us, a view even endorsed by the Bank of England (BoE). Market rumours were that the central bank might slow down or even suspend its interest rate rising cycle in response. The latest data poured cold water on those suggestions. To account for stubbornly high inflation, capital markets’ implied rates expectation moved up swiftly after the data release and correctly predicted the BoE’s actual rates increase by 0.25% on Thursday.

Food, drink and clothing were the main culprits for this unexpected rise. According to the Office for National Statistics (ONS), food and non-alcoholic drink prices rose 18% in February, the fastest pace in 45 years. This was despite food prices outside of the UK generally falling over the last few months, suggesting this particular problem is specifically British. Surging food prices are especially damaging for lower income households, who spend a higher percentage of their incomes on food and drink.

Even disregarding the food element though, prices were still higher than expected. Core inflation – which strips out more volatile elements like food and fuel – came in at 6.2%, higher than January’s 5.8%. This is a measure the BoE pays close attention to, as it is thought to be an indicator of deeper, more persistent, ‘stickier’ inflationary trends. Along those same lines, inflation in the services sector rose to 6.6% from 6.0% the month before.

The BoE was concerned enough to raise the base rate to 4.25%. Since prices started soaring, policymakers’ biggest concern has been the threat of a wage-price spiral, where employees react to higher prices with higher wage demands, which in turn cause businesses to raise prices again.

Prices for services are particularly sensitive to wages, meaning its significant increase is a sign of stronger-than-expected wage pressures. But despite the fear around wages, it is significant that we have seen relatively marginal impacts on overall inflation.

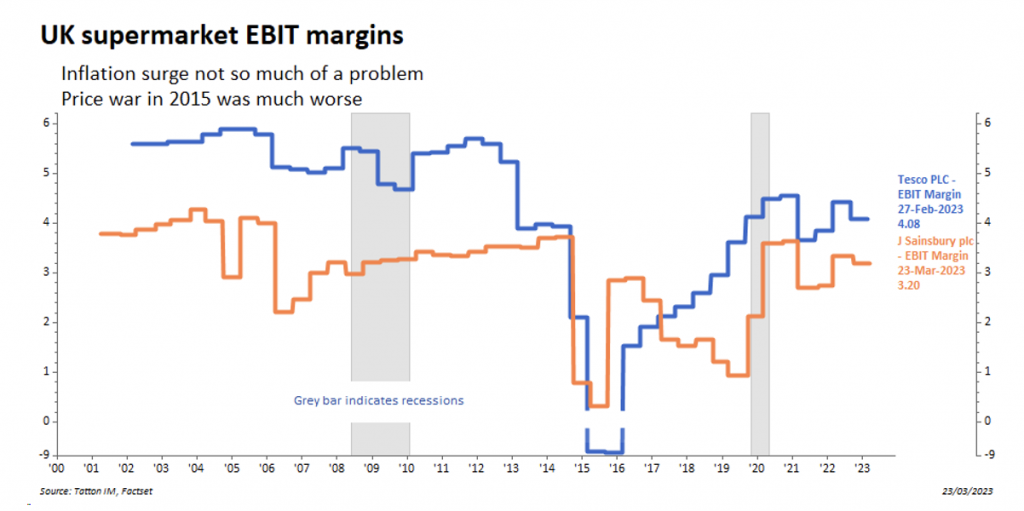

However, the rise in food and clothing prices is notable. Food and non-alcoholic drinks had a mammoth 18% year-on-year rise in February. Before now, price increases for such consumer goods appeared mainly to be the result of input cost pressures, with few goods sellers increasing their overall profit margins. For intermediaries, like supermarkets, the global inflation surge even compressed their margins somewhat, as they were not passing through all input price increases.

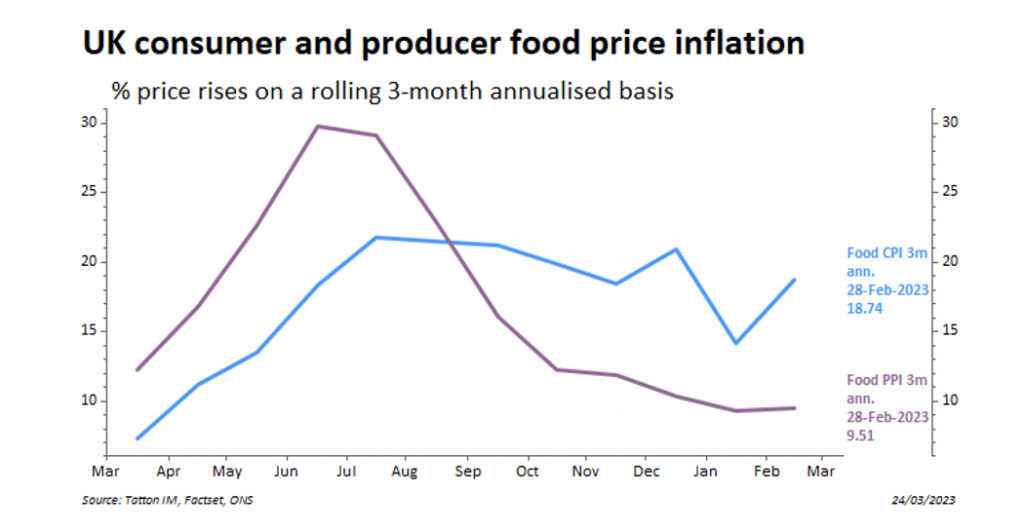

At the same time as the CPI data is released, we get producer price data. The chart below shows a comparison of the food price components for consumers and producers, on a rolling annualised three-month change basis. Both are still rising, but end prices are still surging while intermediate costs are moderating somewhat.

We think this is a sign companies – particularly supermarkets – are taking the opportunity to rebuild their profit margins. The reason they can do this without losing too many customers is that consumers have maintained elevated inflation expectations, thanks to a long period of rising prices.

This may be good news for investors in supermarket shares, but less good news for consumers. If the supermarkets tell us they’re doing well in their next reports, one might expect more than a little pushback.

This is basically the definition of a price spiral: prices rise because prices have risen, because purchasers are primed to accept the increased cost. This concerns the BoE as once inflation expectations have become embedded, businesses, employees and consumers will keep reacting off one another, and the central bank will lose the anchor which keeps prices stable. This part of a central banker’s job is not explicitly stated but is hugely important: dampening people’s expectations of inflation, rather than just dampening economic activity altogether.

Despite the bad news this month, there is some good news. The BoE published its quarterly survey data on inflation expectations over the next year, which shows people are perceiving a slower pace of price rises. This feeds through into price-setting mechanisms, both explicitly in terms of wage negotiations and implicitly for product price-setting. The recently agreed pay deal for NHS workers, which ups pay by 5%, is less than current inflation but perhaps the settlement is a sign these forces are having an effect.

Much of the fall in surveyed expectations is down to falling global input costs, particularly energy. As written before, lower wholesale gas prices will take a while to be felt by households. But when they are felt, there will be a big impact on how people think about inflation. The same is true for housing costs, which are greatly impacted by bond and credit markets. These spiked during the ‘mini-budget’ crisis last October, but have since stabilised in a slight downward trend.

This is reflected in another of the ONS’ inflation measures, the CPI including housing (CPIH). Like other inflation measures, the CPIH unexpectedly rose in February, but the 9.2% figure was below headline CPI. The housing component is detracting from overall inflation rather than contributing to it.

As we say, these figures are important not just by themselves, but because of the way they factor into various different price-setting mechanisms. But a complicating factor here is that many of the official rules for uprating prices (including wages) are done by reference to retail price inflation (RPI), instead of CPI. Whereas CPI is calculated to take account of substitution effects (whereby price rises cause consumers to switch purchases), RPI does not. For that and other mathematical formula reasons, RPI figures are consistently above CPI or CPIH – coming in at 13.8% in February.

In many areas, price-setting bodies are legally required to use RPI as a measure. In a sense, this embeds structurally higher estimations of inflation – thereby putting upward pressure on inflation expectations, and unhelpfully contributing to a potential wage-price spiral. Fortunately, many now use CPI or some variant for these reasons, and RPI is set to be replaced by CPIH in official uses by 2030. That will help the long-term picture for inflation expectations. For now, the BoE has to grapple with the fact that inflation remains stubbornly high and expectations still have to come down. Further rate rises are likely but, given the fragility of the UK economy, it has a difficult path ahead. BOE Governor Andrew Bailey’s appearance on BBC Radio 4’s Today programme on Friday – warning businesses against margin improving price hikes – is perhaps a sign of it stepping up in its role as influencer in the coming months.

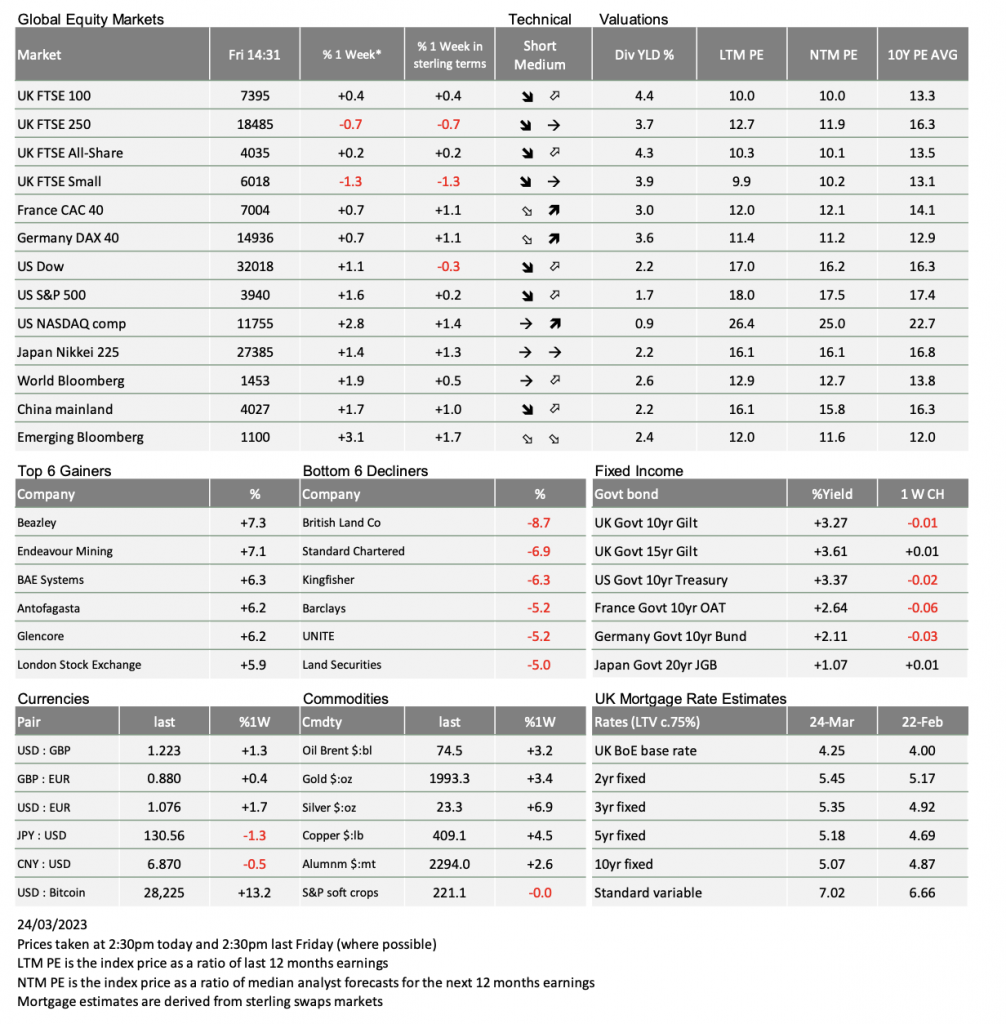

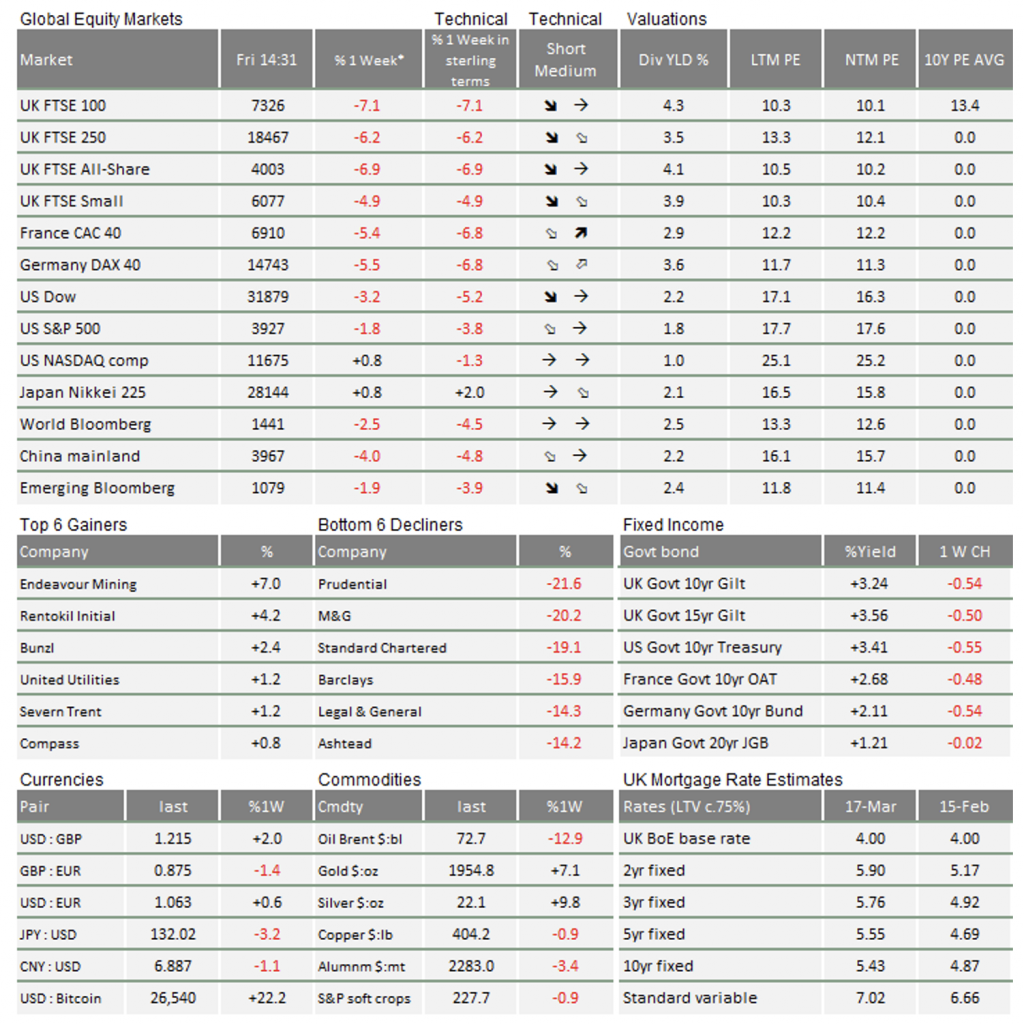

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.