Market Update August: Between Policy Support Withdrawal & Bounce-Back Upsurge

Three weeks since the long-awaited “Freedom Day”, Britons are enjoying a pleasant, if somewhat overcast and dull, summer. The surprise drop-off in virus cases seems to have levelled off, but while the fact that numbers are not increasing is an encouraging sign, it remains to be seen whether this will be sustained. With the UK having vaccinated nearly all of its adult population, the pressures on public health are a fraction of what had been experienced during the first three waves. If this continues to hold, there is little to suggest a worsening in the months ahead. That is good news for the UK economy which, despite widespread complaints about the ‘pingdemic’, is recovering nicely.

Three weeks since the long-awaited “Freedom Day”, Britons are enjoying a pleasant, if somewhat overcast and dull, summer. The surprise drop-off in virus cases seems to have levelled off, but while the fact that numbers are not increasing is an encouraging sign, it remains to be seen whether this will be sustained. With the UK having vaccinated nearly all of its adult population, the pressures on public health are a fraction of what had been experienced during the first three waves. If this continues to hold, there is little to suggest a worsening in the months ahead. That is good news for the UK economy which, despite widespread complaints about the ‘pingdemic’, is recovering nicely.

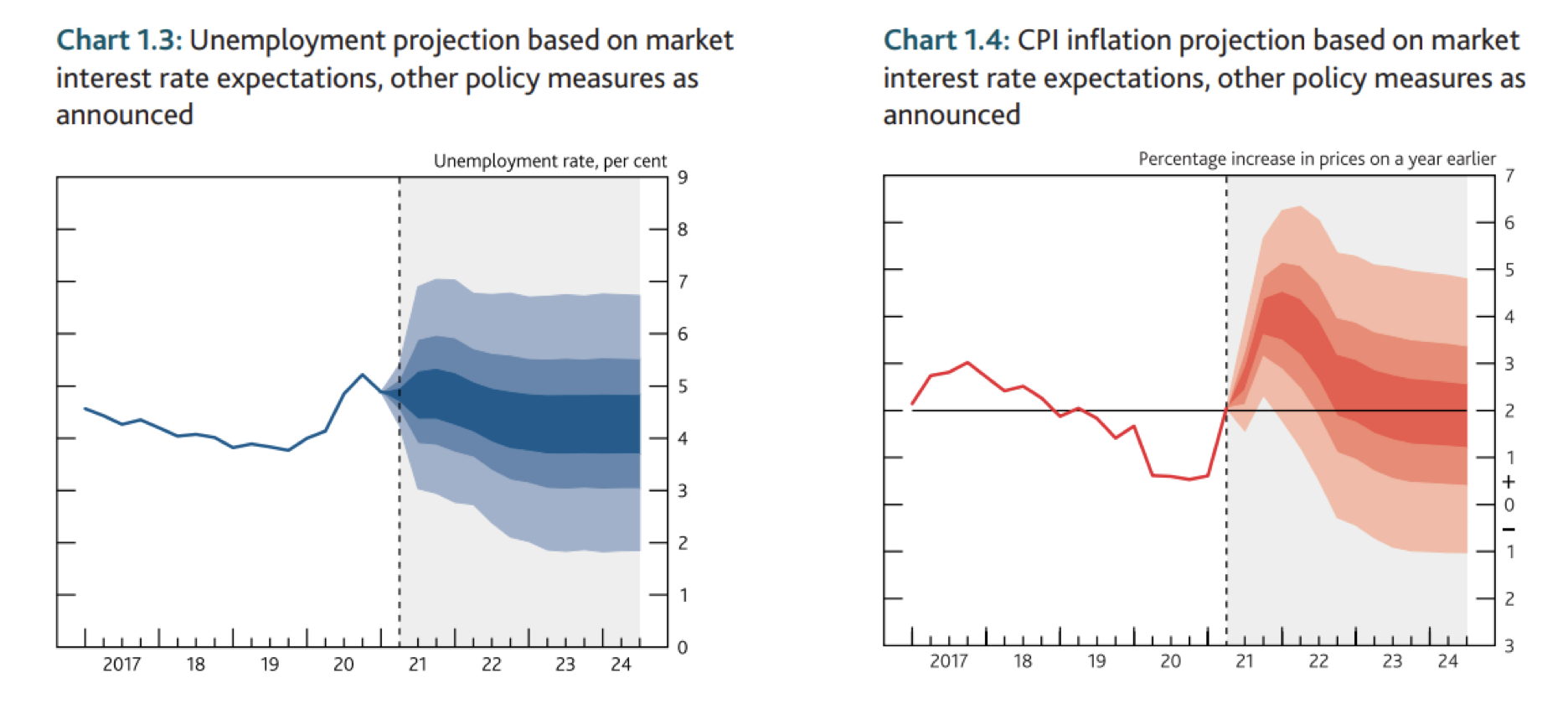

There are major tests to come, but for now UK growth is bouncing back and the path ahead is promising. The Bank of England (BoE) underlined its support on Thursday with its Monetary Policy Committee voting 7-1 in favour of keeping interest rates where they are. In its accompanying report, Consumer Price Index (CPI) inflation is forecast to rise through this year to 4% before dropping quickly in 2022, as the right-hand chart below from the report shows:

As the report notes: “The rise largely reflects the impact of the pandemic as the economy recovers. This has led to higher energy and goods prices, which in turn reflect rising commodity prices, transportation bottlenecks, constraints on production, and strong global demand for goods”.

Unlike previous inflation bouts, this one seems driven more by domestic shortages. Despite difficulty in getting deliveries, the import price data up to June suggests prices have not increased particularly. This is a positive sign. Any final price rises will be added profit for someone in the UK – either employees or companies – which should help generate more growth.

We have pointed out before that policy support has been crucial throughout the pandemic. The BoE underlined the importance of the government’s fiscal stimulus as the nation went through three lockdowns. But the monetary policy that the BoE itself provided has also been substantial. As most readers will suspect, both of these supports have their limits, either from planned expiries or from the law of diminishing returns while negative side effects increase. Even so, the BoE seems in no hurry to change its rate policy and its £895 billion bond purchase target is expected to remain in place until the end of the year.

However, the absolute limit on bond purchases effectively amounts to a tightening of policy. The BoE has changed its guidance on how it would reinvest the coupons received on its holdings of government debt, stopping a reinvestment when short-term rates reach 0.5% from the current 0.1%. The trigger to start selling these bonds has come down from 1.5% to 1.0%.

Perhaps surprisingly, BoE governor Andrew Bailey indicated that should policy need to be eased, negative interest rates would be the preferred tool used – instead of further quantitative easing (QE) through buying up government debt.

Of course, the BoE does not currently expect negative rates will be needed. Indeed, it now expects rates to start moving up next year, although only towards 0.5% by 2024. Bailey also said; “If we had stuck at 1.5% [as the short-term rate threshold for unwinding QE], that would be tantamount to saying we would never reduce the balance sheet.”

Does that mean Bailey expects short-term rates will never rise above 1.5%? If the BoE is successful in achieving its 2% inflation target as an average rate, this would make it very unpopular, given it would ensure a constant loss of purchasing power for long-suffering savers. We suspect the governor was merely slightly imprecise with his choice of the word ‘never’.

Despite this all leading to the perception that monetary policy will become less supportive, the “reaction function” framework is really designed to make central bank policy more predictable. Whether it succeeds in doing that is another matter, but it at least lowers the chance of a policy shock. The same cannot be said about fiscal policy, where we believe the bigger danger lies.

Now that COVID legal restrictions have been lifted, Chancellor Rishi Sunak will be reluctant to extend furlough payments or emergency loans. Should these dry up before the economy has found its feet, growth will take a hit. Stamp Duty relief is already set to end, and the government is likely to try reducing the deficit unless restrictions come back. The Office for Budget Responsibility will provide updated forecasts to the Treasury at the end of October, and it is likely to report significant negative impacts on the government’s finances.

The government recently delayed announcing its plans for social care after significant political pushback. This illustrates the difficulties facing the Treasury, with spending demands set to stay high for years to come against their reluctance to increase the deficit further or raise taxes in the short term. As a result, there is not much leeway for public spending, meaning that fiscal policy is unlikely to be an additional positive for growth as the recovery continues.

The return of the hospitality industry has lessened the number of workers on furlough, but there are still 1.9 million people signed up for the scheme. The strong labour demand we are seeing in the data is encouraging, although the BoE had expected around 500,000 to remain on furlough throughout the third quarter. Only a small fraction of these work in sectors still affected by restrictions, but the fact that so many are still reliant on a scheme that will run out sooner rather than later is a cause for concern.

Research from US bank Citi suggests UK unemployment will rise to 6.1% as furlough comes to an end. This contradicts the BoE, which now expects a level no higher than 4.9% (as Chart 1.3 shows). This is in part due to many people deciding not to re-enter the workforce, and the disparity between the two forecasts highlights the risk and uncertainty.

Consumer spending has also eased off in recent weeks, despite the usually supportive summer season. Some of that could be down to a post-football hangover, and the data does not cover much of the period following the lifting of lockdown restrictions.

The end of the Stamp Duty holiday is expected to impact housing activity substantially, but for consumers this is likely to be offset by the recent fall in mortgage rates. UK banks have seen £370 billion of net inflows in cash deposits since the start of 2020, with loans growing only by £100 billion over the same period. This has led to a substantial increase in excess deposits, which has pushed down mortgage pricing. That is bad news for banks, but should be a positive for house buyers as Stamp Duty returns.

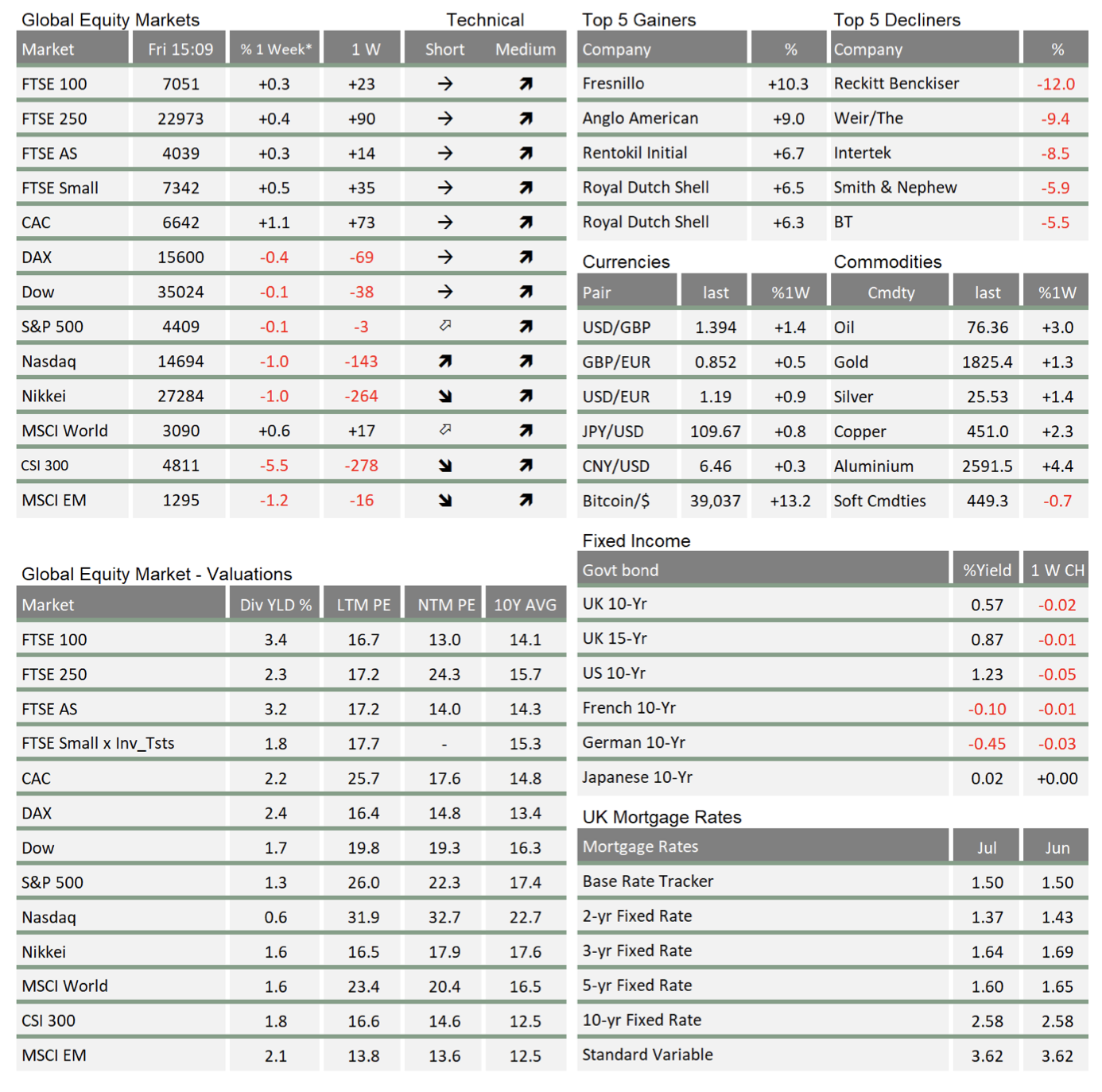

Despite the challenges ahead, the British recovery is undeniably underway. This, together with a rapid vaccination programme, has been a key support for UK equities in recent weeks. But the solid performance of British stocks has been proportionally less than the improvement in analyst UK earnings expectations. The equity market has not kept pace with the improving earnings picture, nor have prices properly adjusted for the fall in bond yields (which make equities more attractive by comparison). This means UK equities have become cheaper in terms of price-to- earnings ratios.

This is partly due to the makeup of Britain’s stock markets (12% of which comprises unloved BP and Shell) and is not unprecedented. But it does make the UK cheaper than its global peers. By our calculation, British stocks offer a 2% extra risk premium compared to the US (that’s adjusting for the different sectoral compositions), with a smaller advantage over European equities. This suggests investors do not fully believe in the UK growth story, and are expecting the economy to disappoint in the coming months. The market may be pricing in a sharper fall in UK earnings than elsewhere in the world.

That is certainly possible, with pandemic scarring and the after-effects of Brexit still weighing down the economy. The positive, though, is that this is effectively priced in already, and so would not significantly impact British equities if it did really happen. On the flip side, if markets are wrong and UK earnings improve, it would make UK assets look significantly cheaper than other major markets. That would be a boost for UK equities, which could deliver strong returns.

We will have to wait and see, but already we are seeing significant interest in British companies, both as M&A targets (such as the Parker-Hannifin/Meggitt proposal) and from private equity groups (Morrisons, etc.). After a period of introspection and isolation on the global stage, things could be about to change for the currently unloved UK market. There are pre- and post-pandemic challenges facing the UK economy, but it is at least on the right track.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.