Market Update: To yield or not to yield

Liz Truss defines her Premiership, Source: Morten Morland, 19 September 2023

Trojan Horse tech

Tech innovation is not as straightforward as the current Generative AI craze makes it seem.

Oil rises; markets slump

Energy price shock 2.0 or self-defeating supply side market manipulation?

To yield or not to yield

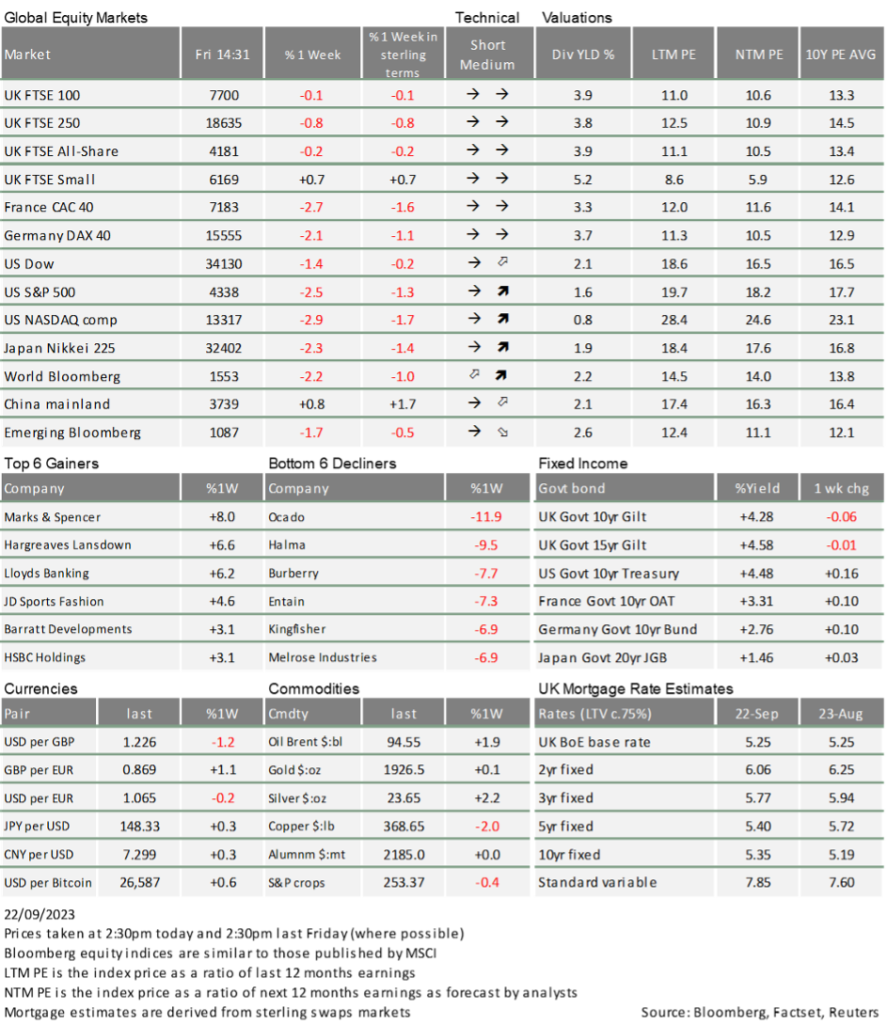

Last week, risk assets (stocks et al) are still bruised from the ‘hawkish pause’. The US Federal Reserve aka the US central bank announced on Wednesday that it would hold interest rates steady at 5.25-5.5%, but threw in some stern forward guidance to dispel any doubts it might be easing off. Chair Jay Powell’s talking points were much the same as they have been for the better part of two years: the US economy is still strong, inflation is too high, and consistently tighter monetary policy will be needed for the foreseeable future. The central bank backed up its words with a “dots plot” projection that showed another rate rise this year and holding steady in 2024. It was a reaffirmation of Powell’s commitment to keeping rates higher for longer.

Bond yields spiked on the back of the news. Ten-year US treasury yields touched above 4.5% during Friday trading – the highest level in 16 years. The move up in risk-free rates naturally makes equities look less attractive by comparison, sparking a sharp drop off in the S&P 500. There are concerns that equity valuations in terms of price-to-earnings multiples look vulnerable, especially after such strong performance for most of this year. Longer-term growth assets – typically more sensitive to interest rate moves – are therefore under threat again. With sluggish global growth all limiting the upside of company earnings and a ‘higher for longer’ monetary policy, investors are starting to wonder whether fixed income assets like bonds with their now attractive yields are better value than stocks.

As ever, there are both positives and negatives to draw from this. The pressure on equity valuations last year was an overheating inflation story, whereas this year the issue is more precisely real (inflation-adjusted) bond yields. Central banks move these up to compress growth potential and cool the economy – as the Fed has made clear they are doing – and so they can obviously be hard to cope with in the short-term. On the other hand, real yields moving so high and staying there suggests that the ‘equilibrium rate’ at which growth is neither helped nor hindered has increased. That effectively means markets or the central bank expect stronger growth and dynamism over the long-term.

The Fed clearly feels it underestimated the equilibrium rate in the past, backed up by the surprising resilience of US businesses and consumers. It is now apparent that companies can generate higher medium-term returns in this tight financing environment than anyone previously thought, which justifies keeping borrowing rates high. But at the same time, higher rates inevitably hurt those that rely on financing – as happened for firms with lower credit ratings last year, and as anyone having to remortgage soon will be keenly aware.

US tech stocks embodied this mixed outlook. As long duration assets, it is no surprise that tech valuations would be knocked by a move up in forward rate expectations, especially considering that they were arguably already stretched. But the AI investment craze is predicated on the longer-term earnings potential that comes from innovation and productivity enhancements. Those themes are unaffected by short-term yield moves which is why, despite a noticeable pull back in tech this week, stock prices are still comfortably up year-to-date and well above the depths of 2022.

That is a sector-specific story, but the take home message applies to all risk assets. Even though, in the current environment, it looks like bonds offer equal returns with fewer risks than equities, ultimately the long-term earning potential – and specifically above-inflation returns – will always be skewed toward riskier assets. Moreover, judging when things will turn is practically impossible to call, particularly in the unchartered waters of post-pandemic monetary policy. The prudent thing to do in these cases is usually to just focus on the long-term.

That being said, there is certainly a short-term case to be made for bonds. Having gone through the sharpest rate rise cycle in a generation, it is incredible how many market players have been able to keep going despite the negative returns on carry trades (coming from the inverted yield curve – short rates being higher than long rates). But this becomes less sustainable the longer ‘higher for longer’ goes on. That could spell trouble for borrowers and volatility down the line.

Then there is the fact that oil prices have increased so sharply, rising above $90 per barrel in the last few weeks. When crude shot up last year, higher prices were sustained by the fact there was so much capital around – pushing up inflation in the classic sense of lowering the value of money. The current oil spike, on the other hand, is very clearly a case of supply manipulation and producer pricing power. In that sense it acts as a tax on growth – as we discuss in a separate article below. Over the medium-term, we should expect higher oil prices to have the same effect as rate rises.

In which case, we would expect yields (and oil) to come down – thereby making the current low bond prices look attractive. This is already happening in the UK, where inflation is finally on a clear downward path and growth prospects are dwindling. The Bank of England also opted to hold interest rates steady, but unlike the Fed there was no real suggestion of further tightening ahead. Sterling sank to a six-month low which, together with higher oil prices, will boost headline inflation in the short-term. But gilt yields continue to fall back, a recognition that core inflation (stripping out volatile elements like food and energy) will likely be pressed down by these developments.

Britain’s bond and currency movements have meant its stock market has actually led the way this month. Returns are less impressive when we take currency effects into account, but overall things look stable for sterling investors, with less pressure on equity valuations. Lower yields are of course a consequence of lower growth prospects, but they will be a big help for businesses and consumers. The US, by contrast, faces tighter conditions but better economic prospects. Each case might will be unpleasant for some, but neither should cause panic.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.