Market Update: Tech stocks back under bond pressure

Source: Morten Morland, 16 August 2023

Bonds are back

August has undone much of what July brought to equity investors, yet the latest correction looks more technical than fundamental.

Sterling too strong

The UK’s specific inflation pressures have driven up £-sterling’s exchange rate. It’s not helpful for the economy and seems to be because of higher rates. Does this mean the Bank of England is being overly aggressive?

Russia struggling to shift supply

Russia’s rouble hit a low while the oil price has hit a temporary high. There may be more causality between those two than meets the eye.

Bonds are back

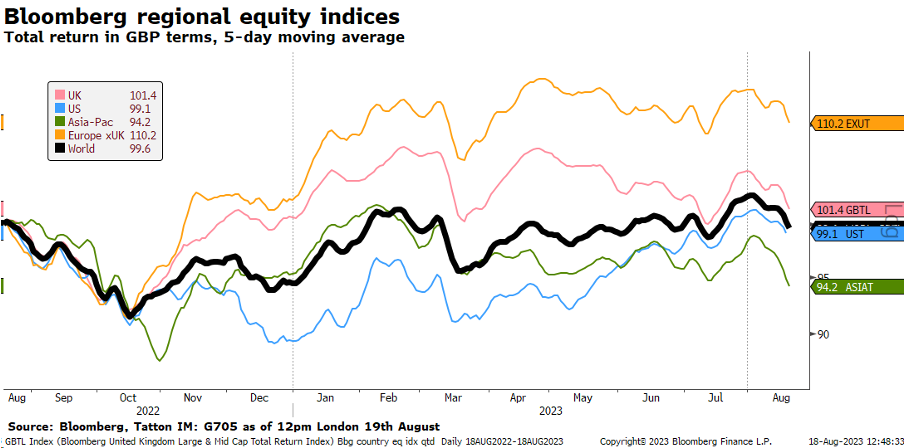

Both equity and bond markets had another rather difficult week and with it August has mostly erased the positive returns of July. From the medium-term perspective, UK-listed equities are nearly back down to the level at which we started the year. Asia, pressured by Chinese stocks, is about 1% below its January starting point. Overall, world markets are largely unchanged from a year ago.

Perhaps the conclusion one might draw is that markets have not really been doing much. For those of us involved in capital market investment on a day-to-day basis, it can feel as if we are lurching between positive and negative extremes all the time. However, when putting the current moves into a longer timeframe, one can see that moment-by-moment emotions can be misleading.

Nevertheless, last week saw a downturn since our World equity index in the chart above reached its high point at the end of July. Many commentators have pointed to the rise in global bond yields as a big driver of the reverse in sentiment, or at least as the underlying cause of this technical correction on the basis of a renewed re-rating of equities on the back of higher bond yields. The US 10-year bond yield has risen to a 4.3% high, higher than at any point going back to July 2008. The UK 10 year gilt yield has risen to 4.7%, the highest since June 2008.

At first glance, investors may think the rising yields are building in higher long-term inflation expectations, but this current move does not appear to have been spurred by a worsening inflation backdrop. Inflation expectations – as implied by the pricing of inflation-linked bonds – for the next two to three years seem to have actually fallen back a little.

Therefore, what has changed is the ‘real’ yields, or what is left of a nominal yield of e.g., the 10 year 4.3% after subtracting the expected rate of inflation. These have become more positive after spending many months (even years) near or below zero. While the topic may sound a little niche to many readers, the level of real yields does matter and so we look at the recent movements in real yields and currencies, especially as reflected in the exchange rate of sterling.

Rising long-term real yields can be associated with strong growth. The rationale is that an economy that is productive and expanding will provide lots of opportunity, and that will mean companies wanting more capital in order to take advantage of the opportunity – demand for capital that in turn drives up the cost of capital. One can possibly see some evidence of a stronger demand for capital in the US, where bond issuance has increased after a slowdown through last year. At the same time, the US government has stepped up its borrowing programme following the debt ceiling problems earlier this year.

However, this increase in issuance has arrived after institutional investors had already bought a lot of bonds in the first quarter of the year in the expectation that the US Federal Reserve (Fed) would shortly begin to ease monetary policy, therefore locking in what was seen as rates as high as they would probably get during this cycle.

Indeed, since the US regional bank wobbles in March, many investors have thought that an easing of policy was imminent. ‘Imminent’ is only a short period and we are now quite a long way on from there. The release of the minutes from July’s Federal Open Markets Committee meeting last week made it clear that, while they may not tighten for much longer, the next move would probably still be to raise interest rates.

Oddly, the short rates (i.e., on cash) have hardly budged since that July meeting, perhaps not surprising because not much has really changed. Rather, the unwinding of over-extended expectations of what and when the first rate cuts may come after the last rate rise seems to be at play. This rise in US real yields has come at a point when US economic data suggests ever more strongly, reasonable and persistent growth – rather than looming recession which may force rate cuts. That has shifted longer yields to a more normal relationship with shorter rates (although the yield curve which plots this relationship along the maturity band is still inverted) and that in turn has undermined the basis for expensive equity valuations. The longer duration tech stocks in the NASDAQ have been harder hit than most (although the mega-cap ‘Magnificent Seven’ are still holding up, relatively).

So, capital markets appear to be undergoing a rather technical shift, based on the described re-rating on the back of higher-for-longer bond yield expectations, making recently extended expectations untenable, even if the earnings outlook has marginally improved. Given that August is a month with low trading volumes, it could continue to be negative, especially if the momentum trading funds start to add to the flows. However, a little bit of valuation adjustment would be a good thing in the medium term, as it would lower the recent market nervousness as expressed in the continuous up and down since the start of the year.

Turning to the situation at home, at first glance, last week’s UK data was unhelpful. The sharp rise in wages (+8.2% annually when including bonuses, using the rolling three-month averages) looked awfully inflationary, given it is not underpinned by similar levels of productivity improvements. However, just as in the US bond market, the UK inflation expectations component hardly shifted. The employment component in the data showed some unexpected weakness and this is probably a better indicator of the current situation because it is more indicative of what lies ahead, rather than the rise itself, which reflects the past. Changes in wages are very historical whereas jobs are timelier (even if the whole data set is not a good indicator of current activity). The retail sales data showed weakness which may have been related to wet summer weather but, equally, was in line with recent months when adjusted for inflation.

The two-year rate is about 0.4% below the peak of early July (although it is admittedly still up about 0.3% on the week) while the 10-year rate has regained its early July level. However, UK yields at all levels may be peaking given that financial conditions are tighter here than in the US and so the backdrop to rising UK yields is arguably less positive than across the Atlantic. The US real yield levels may be sustainable given the investment boost follow-through of the Biden fiscal packages, but there is no comparable fiscal stimulus here. While the UK fiscal deficit is nevertheless set to expand because of the rising interest rate burden, the medium-term fiscal outlook is quite contractionary or we might even call it austere. That means relatively less issuance and relatively less growth, a situation which may prove to be the healthier policy choice but one which argues for lower bond yields.

UK equities have been hurt both in absolute and relative terms by the outsized rise in yields, but without the US perspective of an improving growth picture – so an end to this difficult situation would be welcome.

As we said earlier, the US rise in yields is at least partly a reflection of an economy which has resilient drivers of growth. So far, despite wobbles, households and businesses have seen rises in income which are not much different to current interest rates. However, some of that resilience may be a result of overconfidence. Markets currently reflect that positivity and it is possible we could see consumer and business confidence also decline if markets wobble more than currently. If that were to happen, there is the risk the recent virtuous circle environment of resilient growth turns into a vicious circle where a fall in financial risk appetite provokes a fall in economic activity. This ‘wealth effect’ has happened before, most notably in the early part of this millennium. It remains an outside probability, but one which should warn us about being complacent.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.