Market Update June: Moderating Expectations…

The seemingly never-ending pandemic-induced restrictions and uncertainty is making the forward planning of summer activities quite precarious and frustrating at times. That capital markets have recently borne fewer surprises than the planning of our summer holidays is a rare event and should be cherished – assuming it is not simply the calm before the next storm. Following last week’s short-lived stock market sell-off – a reaction to the apparent acknowledgement from the US Federal Reserve (Fed) that the US economy may not require ‘emergency-room’ level interest rate suppression support for years to come – this week’s main discussion point centred on whether and how much the US rate setters were divided in their outlook. The less debated point was the undeniable turning point of US central bank monetary policy. It changed direction from ‘easing/dovish for the foreseeable future’ to ‘eventually tightening/hawkish perhaps as early as next year’ and this did not cause similar capital market stresses as in 2013, when the Fed last signalled a medium-term change in direction which triggered the ‘taper tantrum’ market upset.

The seemingly never-ending pandemic-induced restrictions and uncertainty is making the forward planning of summer activities quite precarious and frustrating at times. That capital markets have recently borne fewer surprises than the planning of our summer holidays is a rare event and should be cherished – assuming it is not simply the calm before the next storm. Following last week’s short-lived stock market sell-off – a reaction to the apparent acknowledgement from the US Federal Reserve (Fed) that the US economy may not require ‘emergency-room’ level interest rate suppression support for years to come – this week’s main discussion point centred on whether and how much the US rate setters were divided in their outlook. The less debated point was the undeniable turning point of US central bank monetary policy. It changed direction from ‘easing/dovish for the foreseeable future’ to ‘eventually tightening/hawkish perhaps as early as next year’ and this did not cause similar capital market stresses as in 2013, when the Fed last signalled a medium-term change in direction which triggered the ‘taper tantrum’ market upset.

For investors, the stabilisation after last week’s turbulences will in all likelihood mean their portfolios will end another month in 2021 with a positive return contribution.

Fed Chair Jerome Powell’s very dovish remarks during his testimony to Congress suggest that regardless of what the Federal Open Market Committee may have discussed – and almost no matter what happens in the near term – the doves will hold sway for a long time yet. As we said last week, the market will now wait for late August for news on possible reductions in central bank bond purchases.

In the UK, the messaging from the Bank of England was also as dovish as could be, in light of recent inflation surprises. There was much talk – like in the US – that current price rises were simply inflation of a transitory nature and, after a long period of undershooting rates of inflation, nothing to worry too much about. However, given the media obsession with inflation of late, we felt compelled to provide an inflation ‘explainer’ article this week, exploring why economists and central bankers are less worried than the wider public about inflation spiralling out of hand.

Compared to a few months ago, central bankers are in a better position now to defend their continued unconcerned stance. While the global recovery is still showing all signs of remaining on track, there are now far fewer likely surprises that could stoke fears of overheating. This is not hurting markets on average, but the more cyclical sectors have ceded ground again to the secular growth winners at the top of the NASDAQ. The tech-heavy US index edged to new highs almost every day this week, ensuring US markets are again outperforming global counterparts.

For us, the debate revolves around whether the economic growth story can move from the COVID rebound into an extended run of investment. This would require sustained public investment but, we need to see private sector credit demand start picking up first, given how long public projects tend to take to get underway. There are small signs among consumers of increased borrowing, but companies are still lagging after last year’s forced borrowing. Business investment intentions (capex) remain high across the world, constrained perhaps by supply limits rather than lack of confidence in the sustainability of the recovery.

Public spending would still be a massive positive economic force. The European Union (EU) now has nearly all individual nations’ spending plans for the huge ‘Next Gen’ €750 billion deal, with Italy’s plan (under which it receives €191 billion) signed off this week. Funding the deal began in earnest last week with a successful raising of €20 billion with a ten-year bond.

Speaking of public funding and new investment assets, the drive to deliver substantial CO2 reductions to stem global warming is making the market for carbon pollution certificates increasingly significant, while also creating some headaches for global trade. We include a separate article on the subject this week.

Back to fiscal stimulus, in the US, an infrastructure bill finally achieved bipartisan support on Thursday night which should see it being passed by Congress. With a total of $973 billion over five years and $1.2 trillion if it can be extended to eight years, the agreement will mean new investments in the electrical grid, transit, roads and bridges and other forms of infrastructure.

It leaves other softer components of President Biden’s initial ($2.3 trillion) proposals (such as training) to be put in a separate bill, which Biden wants to be twinned with this bipartisan proposal. Funding will come from repurposed existing federal funds, public-private partnerships, stronger enforcement at the Internal Revenue Service, oil sales from the strategic petroleum reserve and radio spectrum auction sales. We suspect that the biggest source would probably be the enforcement side, which may hurt some companies and high earners, but should help neutralise inflationary pressures at the same time.

Looking ahead to the rest of the summer, our expectation is that little market-moving economic news will come through. This would mean markets broadly trading sideways, but interspersed with the odd bout of worry as well as hope about what the post-pandemic world will look like and bestow on investors.

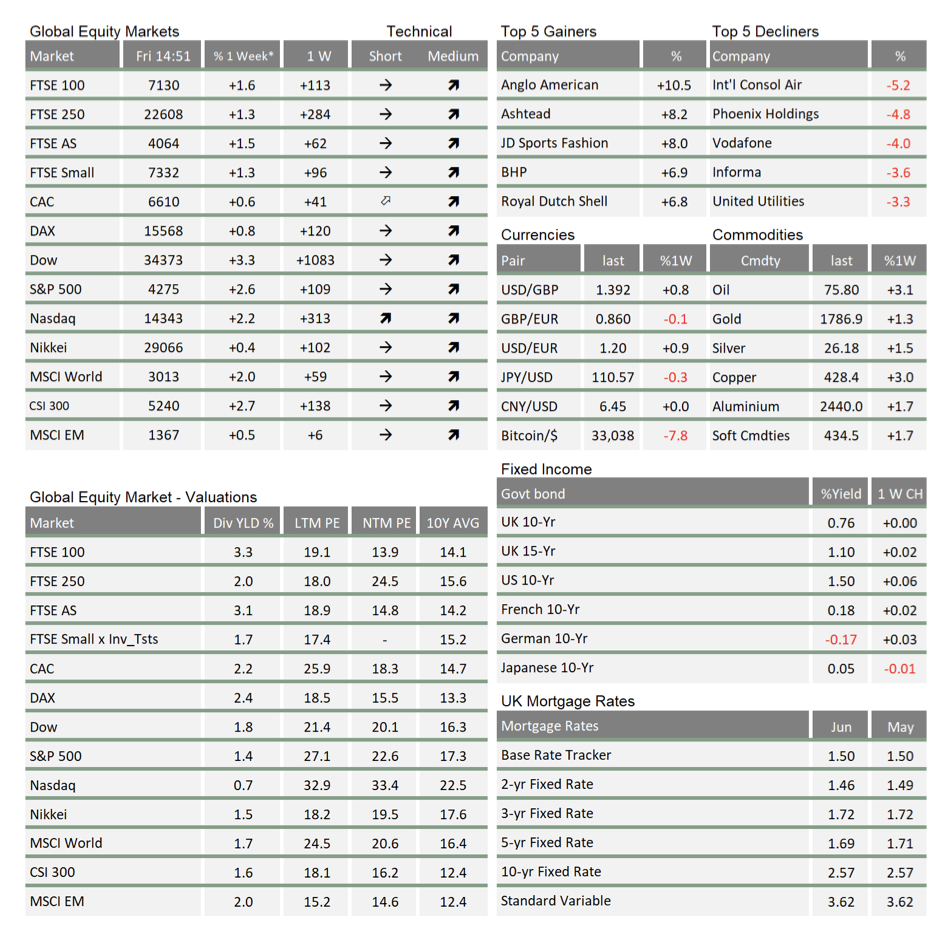

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.