Market Review May 2019

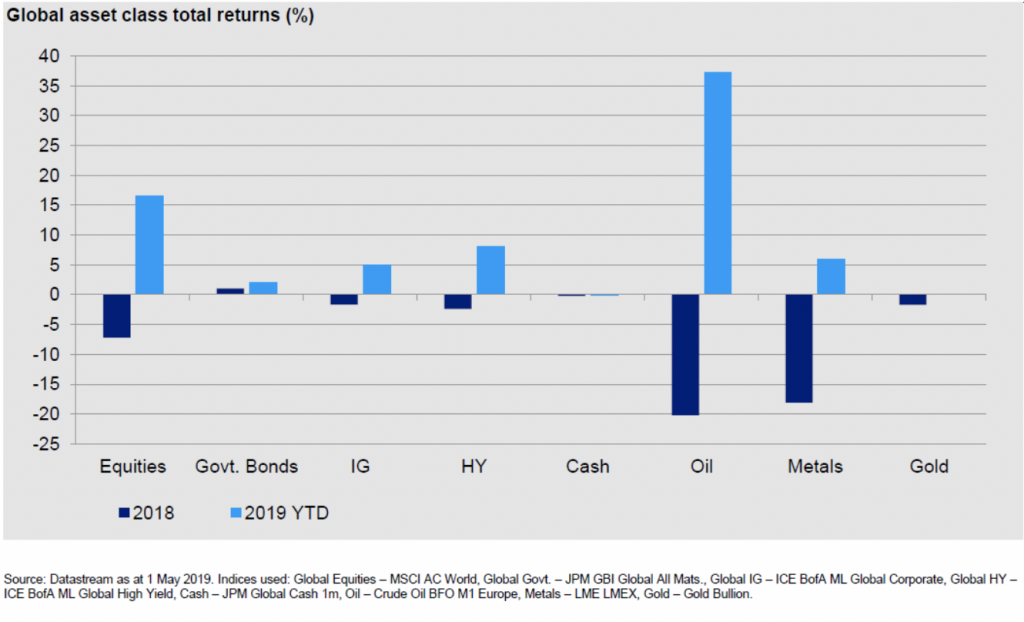

For much of this year, equity markets have enjoyed a healthy climb, assisted by a dovish tone from central banks, as well as the possibility of a trade deal between the US and China.

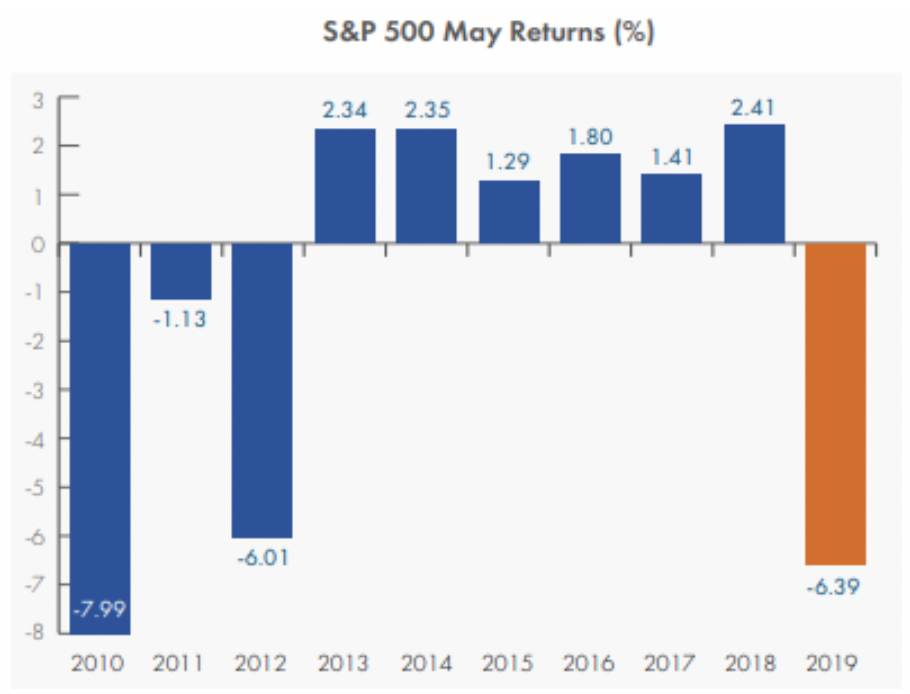

As we entered May, the S&P 500 was at an all-time high. However, just six days into the month, investors were tested by the announcement that the US would be moving ahead with tariff increases on US imports from China. Equity markets performed poorly over the month, with Asia ex-Japan, emerging markets and the S&P 500 all losing more than 6%.

United Kingdom

On Friday 7thJune, Theresa May ended her almost 3 year-long struggle as Conservative party leader. The market appears to have interpreted the news as increasing the likelihood of either a hardline Conservative Brexiteer leading the UK towards a “no deal” exit from the European Union (EU), or a general election that could pave the way for a potentially less market-friendly Labour government.

With various candidates throwing their hat into the ring to succeed Theresa May; eleven to date, it remains clear that the UK population remains just as divided on Brexit as it was during the referendum in 2016, with neither the leave nor the remain camps gaining any significant ground during the most recent round of polling.

Markets remain cautious as the political uncertainty caused sterling to fall 3.3% vs the US dollar over the month causing the FTSE 100 to outperform the FTSE 250.

America

May has typically been a good month for stocks, especially in recent years for the US stock market, but this May was certainly an exception as trade tensions escalated once again.

For more than a year financial markets have focused on US trade deals with Europe and Asia. The consensus has always been that deals would be reached with each region. In May, Chinese trade talks not only collapsed but existing tariffs were increased and both countries appear to be targetting each other in a continuation of the tit-for-tat tariff war.

For more than a year financial markets have focused on US trade deals with Europe and Asia. The consensus has always been that deals would be reached with each region. In May, Chinese trade talks not only collapsed but existing tariffs were increased and both countries appear to be targetting each other in a continuation of the tit-for-tat tariff war.

In positive news, US Federal Reserve Chairman Jerome Powell suggested that the central bank is watching current economic developments and will do what is needed to maintain the strong labour market and keep the near-record expansion going.

Europe

Eurozone data in May was somewhat mixed. The flash manufacturing PMI fell to 47.7, indicating contraction but there were some positive signs as new export orders picked up and Eurozone consumer confidence reached its highest level this year. The initial estimate for Q1 GDP also beat expectations, with annualised growth of 1.6% over the last quarter.

The concern in Europe, much like the US, is that trade uncertainty filters through to the labour market and starts to hurt the service sector, which has so far proved more resilient. The latest employment growth numbers in Europe have been strong though. The first estimates of employment growth for Q1 show a pickup to 1.4% quarter on quarter, annualised.

Stimulus in China could help Europe in the second half of this year, and another positive factor for the region is that the US has put the discussion over global auto tariffs on hold for up to six months. European indices fell by 4.8% over the month.

Asia

The re-emergence of trade tensions is likely to have economic and policy implications for China as failure to agree a trade deal with the US increases the risks to the growth outlook. With the introduction of further tariffs, the renminbi fell against the US dollar by 2.5% in May.

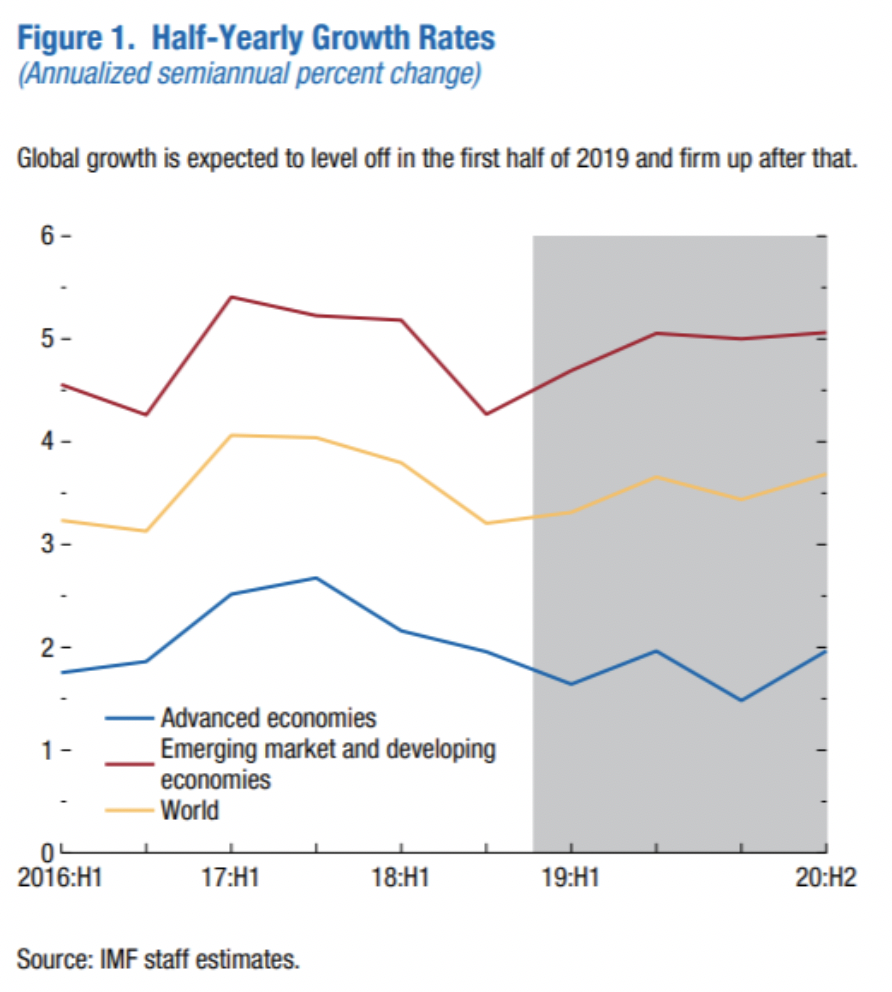

With slowing Chinese growth concerning Chinese policy makers, May saw further reserve requirement ratio cuts, albeit on a smaller scale than those made earlier this year. The announced tax cuts on personal and corporate incomes also show the appetite from the authorities to help stabilise growth. While, more recently, it looked like these stimulus measures were beginning to take hold, the latest data was much weaker than expected as retail sales and industrial production (IP) declined. The weaker data does mean that, against a backdrop of increased trade tensions, the Chinese authorities are likely to continue to increase stimulus measures. The extent of the stimulus delivered will, of course, be important for the Chinese economy, but also for broader emerging markets and Europe.

Elsewhere in the emerging world, India saw the conclusion of its six-week long general election, with Narendra Modi’s Bharatiya Janata Party (BJP) winning an absolute majority in the lower house. This provides some clarity on the policy outlook, and focus will now shift to unlocking the potential for long-term growth in India, which will be one of the key challenges and priorities for the BJP.

Conclusion

Despite all the trade tensions, the recent global growth forecasts from the IMF remain robust with Global GDP forecasted to remain over 3.5% as we move into 2020.

Investors will be watching how trade negotiations develop, with a close eye on the G20 summit at the end of June. Beyond politics, we should remember to focus on the economic fundamentals. China is aiming to steady the ship with its stimulus, and success here could provide a tailwind for growth elsewhere in the world.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.