Market Update June: Hazy as Carbis Bay

The G7 meeting in St. Ives’ Carbis Bay was rightly the centre of attention in the UK this week and looks to centre on Europe’s leaders cosying up to a much more loveable US administration, at the same time as trying not to mention Brexit too much.

The G7 meeting in St. Ives’ Carbis Bay was rightly the centre of attention in the UK this week and looks to centre on Europe’s leaders cosying up to a much more loveable US administration, at the same time as trying not to mention Brexit too much.

For markets, on the other hand, the big meeting happened last week, with G7 finance ministers the key participants. Top of the agenda was the Global Minimum Corporation Tax. The headlines talked about agreement on a 15% minimum tax level, but there was (and is) too little detail to know how directly this will affect the after-tax profits of the major global companies in the near or even medium-term. Therefore, the news had little impact on share prices, with European markets hitting new highs over the week. Indeed, the market narrative reversed from “it will be very important” to “this is just another damp squib”.

It may be that in the world of global politics, big initiatives are always swallowed up by domestic short-term needs and little of importance happens in the end. However, our suspicion is that the Global Minimum Tax is something that will grow rather than die. It is important to note that before Biden it did not even feature on this G7 summit’s agenda, even if it has been one of the major areas of focus for most countries. Biden cannot hope to get any US corporate tax rises through without non-US taxpayers helping to close loopholes and thereby foot some of the bill. With everybody else keen on getting a tax share of the US-centred digital economy, the announcement means incentives are firmly aligned in pushing this forward.

There are additional European incentives where reducing tax competition within the block is a big gain. Even in the UK, Chancellor Rishi Sunak needs to find revenue. If concerted action can be established, he can join the initiative without damaging UK competitiveness. It is still likely to feel slow but corporate tax rises for those multi-nationals that have been best at avoiding tax do not look like going away.

Beyond the G7 excitement, market attention is now trained on monetary policy as we head into another round of important central bank meetings – just as investors have been revising growth expectations slightly downward, while inflation readings have been ramping up – as expected.

The European Central Bank (ECB) met yesterday and increased the pace of bond purchases although it did not go so far as to tell us actually what that meant (“flexibly” and “with a steady hand” apparently). The market is pretty sure quantitative easing volumes will be increased only for a short period, probably slowing into the Autumn. While the ECB’s decisions were described as unanimous, we suspect that the discussion may have been not so straightforward.

The 2023 increase in the core CPI (consumer price index, excluding the more volatile food and energy price movements) projection was at just 1.4%, still below the ECB’s loose target of not quite 2%. When asked “why not get even more aggressive?”, ECB president Christine Lagarde spun a story about how it has been revising projections up – an indication that it sees the balance of risks being towards marginally higher inflation.

However, it appears that all central banks are now focused on employment and wages, especially in service sectors. Here, the ECB and the rest are in no doubt – labour needs to have more pricing power – most likely in order to stimulate and stabilise broad consumer demand.

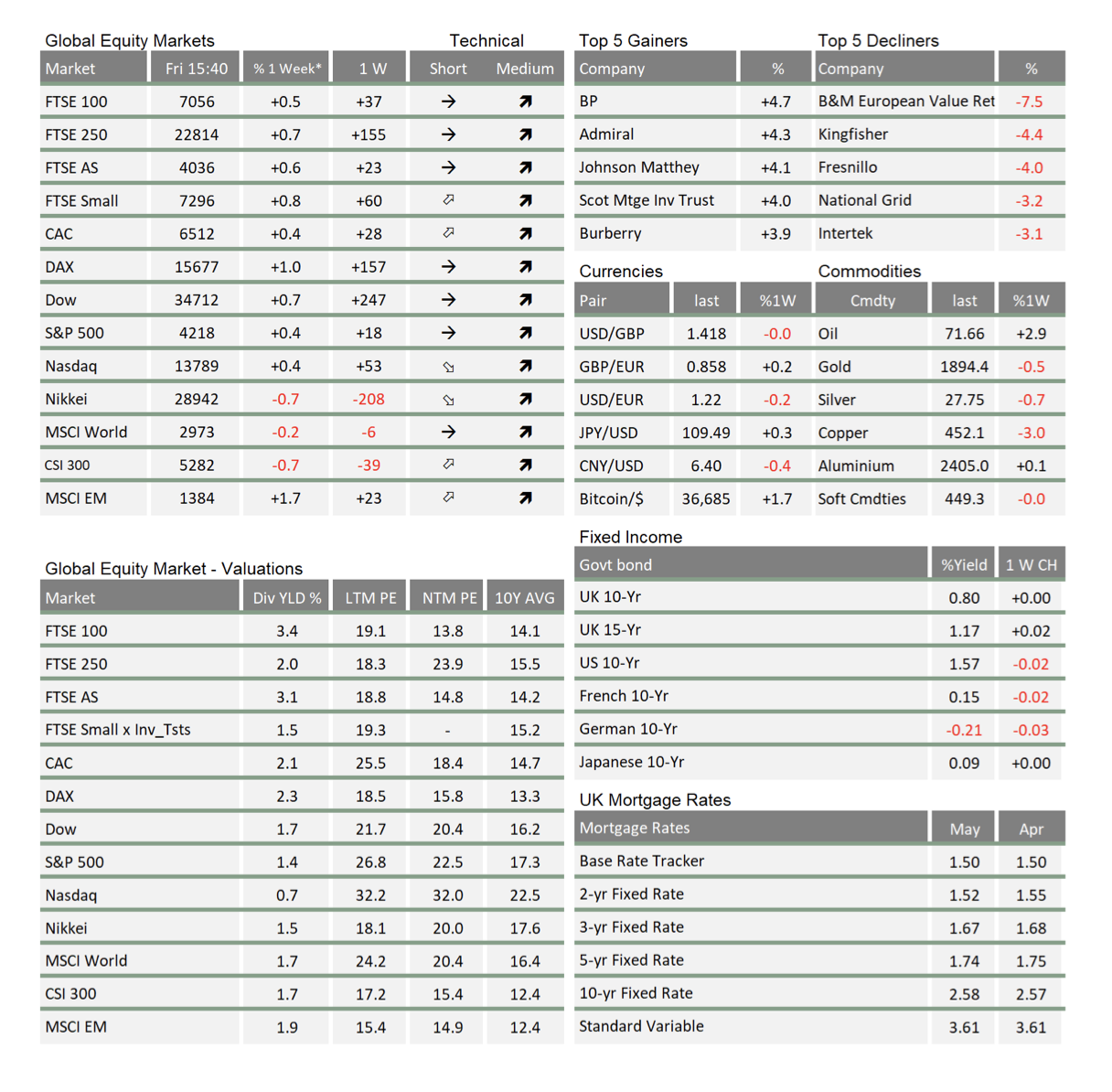

Meanwhile US core CPI stepped up to 3.8% year-on-year, 0.3% more than anticipated. Bond yields rose briefly to 1.53% after the release and then pushed down again to today’s 1.45%. In the table at the end of the last Tatton Weekly, the US ten-year yield was 1.57% and so US yields have been sliding since peaking on the penultimate day of March at 1.76% – despite inflation readings rising significantly since.

It would appear investors are toning down their rocket-like previous economic growth expectations, amid discussions about smaller infrastructure fiscal packages, as well as further delays to general post-pandemic ‘demob happiness’ due to the Delta variant of COVID. In this context, it is also notable that real wages growth has gone from very positive after last year’s artificially pumping-up, to slightly negative since the start of the year. Meanwhile some US states are pulling back on unemployment payments even before the federal government takes them away.

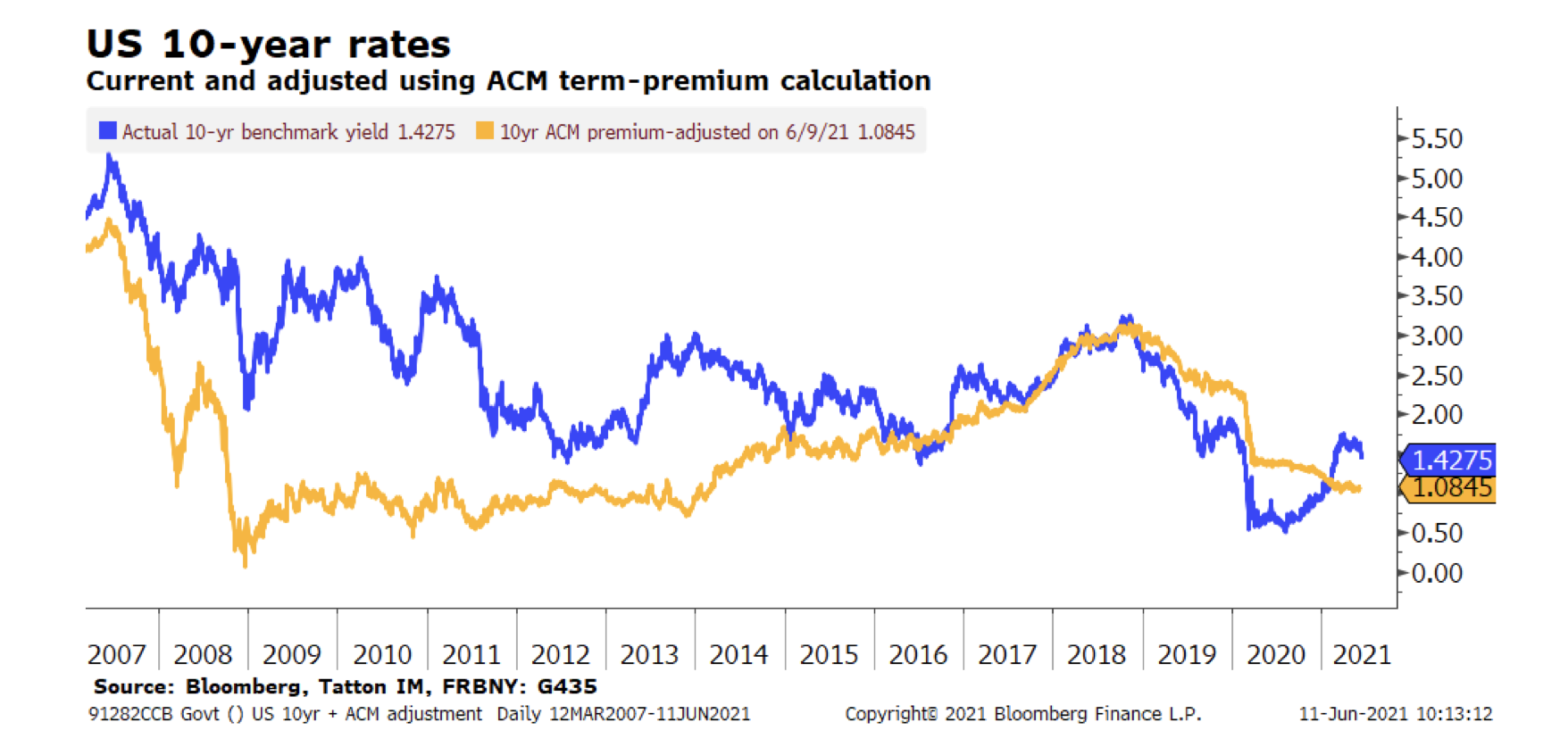

However, most of the US bond yield decline may just be attributable to a decline in “term-risk premium”, the estimated excess return in holding ten-year US Treasury bonds in comparison to cash. The term-risk-premium seems to have come down mostly because investors have become less worried about US Federal Reserve (Fed) losing control of inflation – and thus future bond yield increases – and have decided to go back to a more neutral duration. It also goes hand-in-hand with decline in current risk asset (equities) volatility.

There is a useful measure of that term-risk premium done by the Fed. If the ten-year rate has the premium knocked off, it has been around 1.1% and stable for since January.

It has not changed much, and that accords more with economic fundamentals, and with a very steady Fed, which is unlikely to upset the economic growth recovery path through pre-mature rate hikes. This does not mean the bond market is wrong in thinking that the economic fundamentals would justify somewhat higher interest rates than they are right now, but it does mean that, without a change in Fed rates, it is difficult for longer yields to sustain higher levels as were reached in March.

That is pretty good news for risk assets, up until the Fed changes things. It might do so next week, of course, but the market now seems to be thinking the timing for any early signal is more likely to be around the August Jackson Hole meeting.

With the threat of higher yields having dissipated for now, markets may well stay as calm and Goldilocks-like as they have been since mid-May. But at the same time, the growth fantasy rocket fuel that propelled them upwards since the autumn of 2020 is likewise dissipating. It would take a meaningful change in the economic recovery narrative or central banks’ stance to upset this ‘wait- and-see-but-remaining-quietly-confident’ market attitude.

Interestingly, one of such change catalysts may be developing right under our eyes in the UK. No other nation with a similarly high rate of vaccination among its adult population has come under ‘attack’ of a more aggressive COVID-19 variant as the Delta mutation is proving to be. Should only infection rates among the net-yet-vaccinated younger population increase, but hospitalisations remain at levels comparable to conventional flu pandemics, this would give growth expectations another boost. The next few weeks will be crucial in this respect, so despite the warm weather’sdistraction potential, we will keep a very close eye on the implications of the latest virus developments in the UK to global growth projections.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.