Market Update: Goldilocks in the Air

Recent macroeconomic data releases across the western world report declining rates of inflation and no longer overheating (but nevertheless still positive) economic growth. In the US, the important milestone of the rate of personal consumption expenditure inflation falling below the interest rate has been reached. Perhaps unsurprisingly then, the term ‘Goldilocks’ (not too hot, not too cold) has returned to the market narrative.

Still, following the last ten weeks of uptrend, capital markets had already priced in the good news and trended quite calmly but more or less sideways. Reassuringly, this comes despite further impending rate rises from central banks this week. But on the back of the ‘Goldilocks’ data picture, markets now price in for the US Federal Reserve (Fed), to further reduce the size of this rate rise from 0.5% to just 0.25% – and only for a further one or two more hikes to follow before then reversing quite quickly to rate cuts again later in the year.

Meanwhile, employment remains strong everywhere and even those laid off by the US mega-tech companies are finding new jobs quickly. Other early warning signals for recessions, such as elevated junk bond yields, are likewise not flashing red either. On the back of all this, the soft-landing narrative of central banks’ – for the first time in history – being able to reverse inflation without causing a recession, continues to gain momentum among the market commentariat.

The sidewards trending markets tell us, however, that the current balance between the market bulls and bears remains fragile, because there are still major contradictions to the Goldilocks narrative beyond the next two calendar quarters. This is because pessimists can point at almost as many indicators for the likelihood of a distinct downturn as the optimists have in petto for a soft landing. This particularly relates to soft factors such as continued negative business expectations and negative revenue and profit guidance coming from companies currently reporting their Q4 2022 earnings. Most damning perhaps are the bond market signals themselves, which – as mentioned above – are expecting central bank rate cuts towards the end of the year, which together with an inverted yield curve have historically been quite reliable early warning signs for recessions ahead.

Instead of a sustained Goldilocks period, at Vizion Wealth we see the current environment more as a temporary market truce, or period of ‘wait-and-see’ as the economic reality unfolds. This should provide evidence to tilt the balance of arguments in one direction or the other. In this respect, central bank actions and (just as important) their accompanying comments will be very closely observed this week, as will be further inflation figures and the full picture of Q4 2022 company earnings trends. As always, we monitor these signals very closely to decide when the time has come to steer portfolio compositions in one direction or the other.

Turning to a brief update of notable changes we observed over the past week, positive signals outweighed negative ones, but we would not yet speak of a clear trend in that direction: JP Morgan noted on Thursday night “data is consistent with the view that the global economy lost some momentum late last year, but that the risks of a near-term recession have diminished”. US fourth quarter real GDP (adjusted for inflation and seasonally adjusted) grew +0.7%qq (+2.9% annualised, the basis which US analysts always use), slightly above the consensus forecast of 2.6% annualised.

An inventory build-up pushed growth higher but may mean slower growth now. The US sold more goods abroad, which may signal global growth resilience, which is useful for the US as its domestic demand will continue to decline as higher rates start to bite. Domestic private sector purchases rose a tiny 0.2% annualised (0.05% qq) in Q4, the weakest in the post-pandemic period.

However, disposable income has started to rise again, strongly on a nominal basis at 6.5% annualised. The GDP measure of inflation (the Personal Consumption Expenditure Deflator) has fallen back to +3.2% annualised. With domestic spending growth as weak as stated above, but disposable income rising strongly, this indicates consumers have returned to building up financial savings – as we suspected from the flow of money into both bond and equity markets. Good income growth and slower price rises helps consumer confidence, which started to pick up into December.

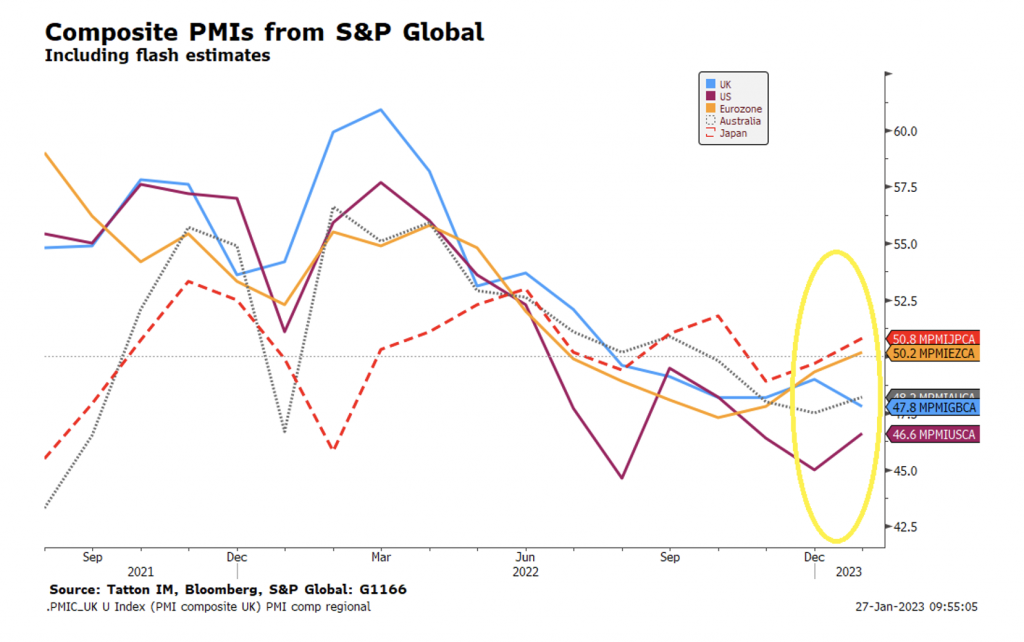

As we reported before and above, business confidence slid globally throughout the fourth quarter, especially in the US. However, this week’s ‘flash’ PMI data showed at least a levelling off, albeit still at weak levels below the neutral 50:

The global composite calculated by JP Morgan will be released when the final data comes out at the end of the month and, on Friday’s data, it should rise from 48.2 to above 50 – back in growth territory.

The key component will be from China and indications are that things will be strong. Last week China celebrated the start of the Lunar New Year, and there are many stories of people desperate to travel to see their extended families but unable to get tickets. Like us, they worked during the lockdowns but were not able to have much of a personal life. There will be a lot of catching up as the Spring ensues – a positive for economic growth as we will all remember well.

Auto sales are as key a part of Chinese economic data as it is in the West. Here though, after a bit of a bounce in 2022, things have looked weak if not absolutely dire. Final demand in the sector is short-term interest-rate-sensitive and that has been a problem. However, both new and used car prices have been falling as supply chains have eased considerably, most notably around semiconductor chips. The US GDP data contained a welcome indicator, a rise in real auto spending. The sector will be very important over the next few months if the slide in growth is to be reversed.

The auto sector is also very important for the UK. The news that car production has declined to the same levels as in the 1950s is not one that speaks of UK economic vibrance. This week, we have more rail strikes amid cutbacks in rail timetables and infrastructure disruptions that has put a halt to the recent ‘return to working in the office’ trend. Expect the UK public mood to be downbeat once more.

As has been the case over the past few months, the UK is somewhat trailing economic trends elsewhere in the western world, and consumers and private investors can be excused for not sharing in the more upbeat sentiment elsewhere. However, the more positive economic picture emerging in some of the most important markets for UK multinational companies, bodes well for the still comparatively cheap UK large cap stocks. The UK government clearly has a substantial to‑do‑list in its in-tray for those trading opportunities to materialise. So, the next stage of post-Brexit trade normalisation will be a key area to watch here, beyond the inflation, labour market and company earnings briefings elsewhere.

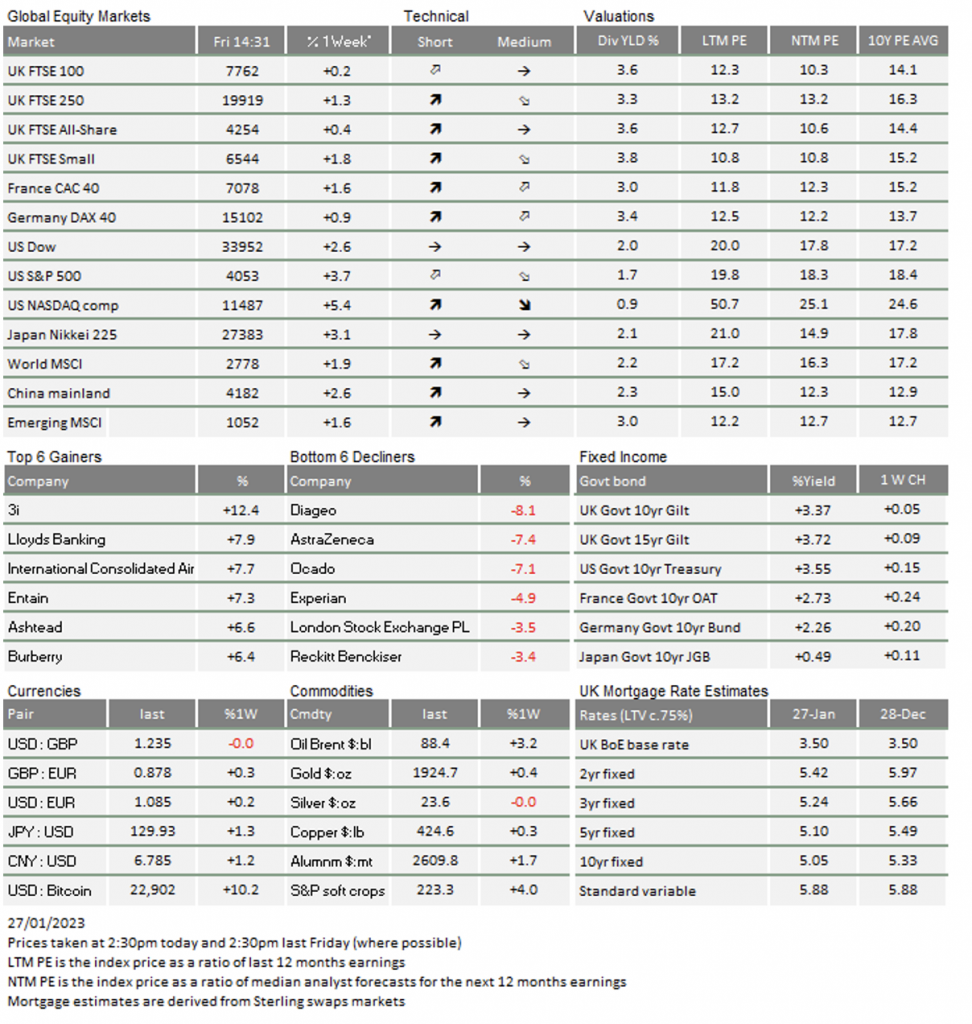

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.