Market Update: Energy in focus – oil prices up and an ill wind for renewables

UK’s infrastructure challenges, Source: MATT, 2 September 2023

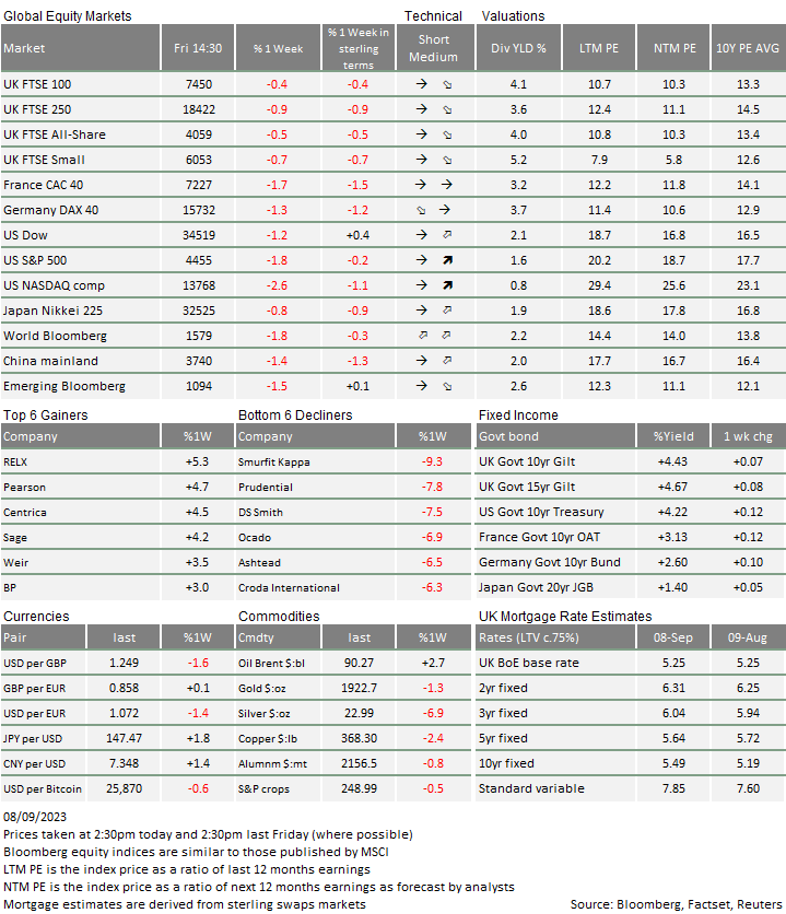

Last week, government bonds took a hit from oil price rises and new wind projects were left flapping as US plans for renewables create a strong, if not long term, imbalance in global wind power development.

August 2023 asset returns review

Persistently high interest rates and a sluggish global economy pulled August markets back from July’s gains.

It’ll cost an Arm and an IPO

Arm, one of Britain’s biggest tech companies is being listed on the New York Stock Exchange. With a valuation of $52 billion, the listing will provide a indication of investor confidence in the tech sector following its AI boost.

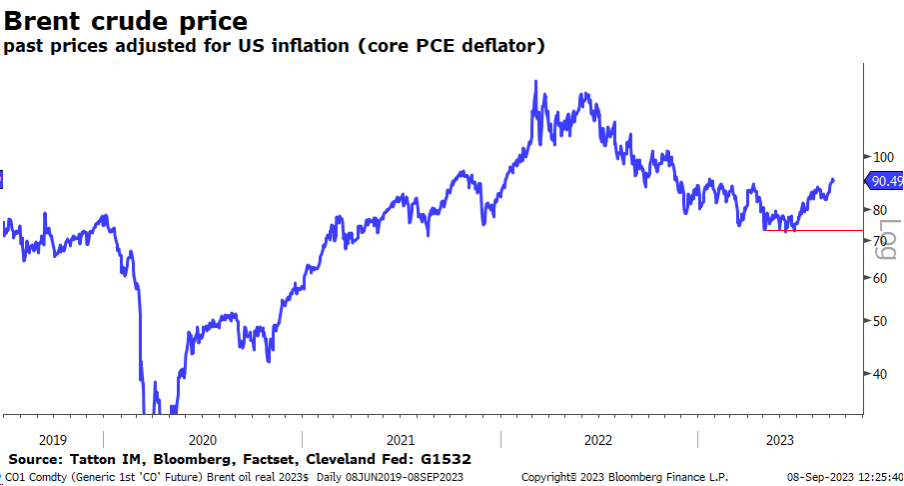

Markets have been generally quiet at the start of September but energy is again becoming an issue for equity and credit markets. Oil prices have risen since the start of the summer, with Brent crude having bounced along a bottom of $73 per barrel for the first half of 2023.

Compared to the wild swings of 2019 to 2022, it doesn’t feel like much and it has only affected market-based inflation expectations marginally. However, it has been a factor in pushing bond yields back above 4.2% in the US and German yields to 2.6%.

For Europe and for the UK, we are affected more by the swings in natural gas and electricity prices, both of which rose in August supposedly because of strikes by liquid natural gas workers in Australia. However, much of the rise in near-term prices is driven by the seasonal variation in prices, with the passage into autumn meaning the nearer contracts now cover cooler months.

The ‘inflation is over’ narrative has been running for some time and appears to have stopped having an impact on bond yields some time ago. Now, the question for investors revolves around the reasons for a pick-up in oil prices. Is it just about a supply squeeze? If OPEC+ is manipulating prices higher but nothing else is changing, demand will swing down and there will be little inflation impact. Central banks will do what they have done in the past and pretty much ignore it.

But is it also an increase in global demand? After the week before last’s somewhat negative economic data, last week painted a rosier picture, especially in the US. The Institute of Supply Management’s diffusion indices were much better than expected across the board, rising to more positive levels against the expectation of falls to tepid levels.

In addition, China has continued to roll out policy announcements which suggest quite a marked response to the slowdown, albeit with a focus on detailed monetary easing and macro-prudential policies rather than on actual government spending.

Chinese export numbers have started to improve – possibly because of better global final demand, and possibly because stocks have been run down after having been overly built up when supply chains were at risk of disruption. China also appears to have run down some of their own stocks of inputs, so there are some signs of a pick-up in imports. The government will be looking for the turn in the external conditions to add to their internal policy measures. A meaningful rise to consumer confidence would boost not only goods and services, but bring housing market stability. The timing would be good as September and October are usually strong months for housing transactions in China.

The rise in oil prices is not enough to seriously create disturbance by itself, but US government bond yield levels are close enough to their recent highs to suggest a build-up of market tension.

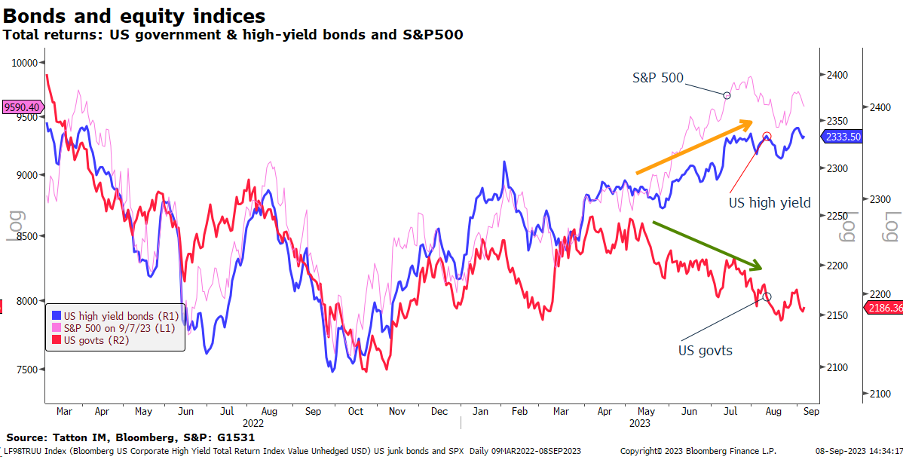

In a sense, the risks for government bonds are higher because risks are lower elsewhere. Credit spreads rose slightly last week but the extra return from higher coupons allows higher yielding bonds to outperform. The chart below shows how equity and higher credit risk have moved closely with each other and that their returns have been positive while government bonds have fallen back:

The improvement in risk appetite has spurred a flood of both equity and bond issuance in the US, although this is less apparent in Europe and the UK. Part of the reason, of course, is that companies we once thought of as domestic now see that US investors are offering them a lower cost of capital.

Returning to energy, no offshore wind projects won contracts in this year’s annual auction for government subsidies last week, a significant setback for increasing capacity to 50 gigawatts by 2030. The Financial Times reported that Keith Anderson, chief executive of offshore wind developer Scottish Power, said the “economics simply did not stack up” and the results were a “wake-up call for the government”.

It’s not just the UK. There has been a marked change in sentiment towards the developed world’s renewable energy companies. Orsted, (previously Danish Oil and Natural Gas) which is a leading player in wind power development, announced it was seriously considering abandoning its US wind power development projects unless the US government guarantees more support.

The Biden administration’s clean-energy subsidy programme, which is part of the Inflation Reduction Act (IRA) is targeting wind electricity generation to go from nothing to 30 gigawatts by 2030. But developers needed to ensure that most components are US-made to take full advantage of the incentives, and that’s proving hard to achieve.

Bloomberg reports that the firm “had a turbulent few months, with supply-chain glitches and soaring interest rates… Shares fell 8.3% Tuesday, bringing the year-to-date decline to 37%”.

Offshore farms may be critical to environmental goals but are capital and labour-intensive. Mads Nipper, Chief Executive of Orsted said that future projects need consumer prices for energy to increase. He said. “And if they don’t, neither we nor any of our colleagues are going to build more offshore. It’s very simple”, sounding just like Keith Anderson.

At the same time, input costs have shot higher, partly because of the large size of the IRA. Similar large projects run by Vattenfall AB and Iberdrola SA have also been scrapped. This is putting some supply chain companies under substantial pressure.

The Wall Street Journal ran a sniffy opinion piece saying how government-led programmes like the IRA are a terrible idea, and that the companies involved have already received vast amounts of payouts. Of course, the WSJ is in the climate-change agnostic camp.

But they do have a point. Despite the IRA’s enormous size and currently positive impact on US growth, if there is no political capacity to follow through in the face of difficulties, the wider environmental aims will not be achieved. Indeed, it may lead to the thought that they are unachievable, especially when its opponents are so numerous.

And one of the potentially difficult consequences is that the companies that now face problems are the ones widely owned by climate-change-focused ESG investors. Many recognise that their ESG principles are more important than any near-term investment return problems but many also thought that the tide of history would ensure that these companies would always be winners. ESG investors, perhaps more so than others, will need to be prepared to stick it out for the long term.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.