DPMS Portfolio Commentary

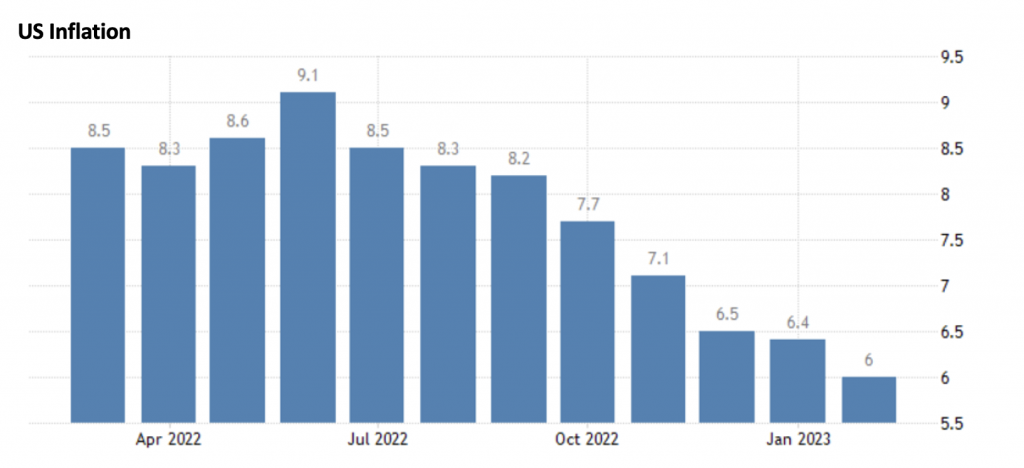

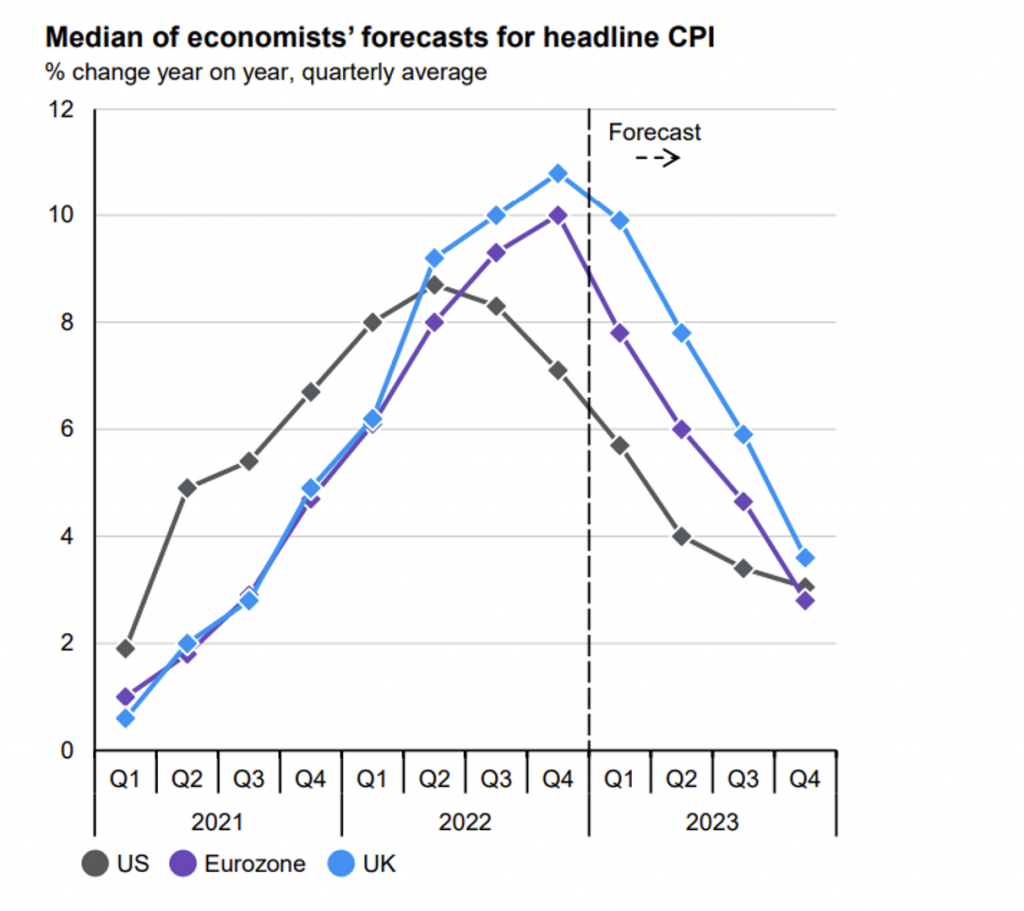

March 2023 has been somewhat of a rollercoaster ride as investors have processed a variety of information, led by markets absorbing news of a number of bank bail outs started with the run on Silicon Valley Bank (SVB) and smaller New York based Signature Bank and the impending impact on interest rate policy led by the US Fed. The outlook for peaking of global interest rates and the subsequent reduction in interest rates initially looked positive at the start of the year but then wavered as US business surveys came back better than expected and certain elements of American inflation remained ‘sticky’, including food, shelter and electricity prices. This prompted consideration that the Fed would delay reducing rates until the end of 2023/start of 2024, 3-6 months later than previously expected.

However, we have recently seen a heavy equity market sell off and significant market volatility following the events with SVB, which in part are a consequence of a struggling tech sector, winding down of its crypto bank division Silvergate Capital, the bank being overweight in long-duration US treasuries and the impact of rising yields on the value of these ‘secure’ investments resulting in a run on the bank. Understandably this is cause for concern, however the consensus is that this is not a systemic issue due to a number of factors. Firstly, SVB specialised in working with the tech sector, which saw difficulties throughout 2022, particularly with cashflow. Secondly, the bank’s government bond exposure was very overweight towards long-dated US Treasuries which also struggled throughout 2022 and saw yields soar (and capital values fall) in tandem with interest rate and inflation rises, calling into question the competency of the bank’s risk department. Finally, lots of depositors wanted to withdraw funds at the same time. For larger banks, they will typically have diversified their bond exposure without the overweight exposure towards long-dated bonds and therefore should be able to pay back all withdrawal requests.

However, we should take heart from the quick intervention of central banks to avert any banking disasters as shown when Credit Suisse came under pressure from the markets after poor results over the last few years. Despite a different set of problems to SVB, Credit Suisse was a major counterparty in the global banking sector and therefore the swift intervention of the Swiss National Bank and its competitor UBS was much welcomed by the markets.

Whilst this recent news has had a relatively severe impact on markets, particularly Financials, we do not think this will lead to a ‘Credit Crunch’ situation as seen in 2008-09 and it could lead to future buying opportunities. Given the stress applied to a small number of banks based on the recent rapid rises to interest rates, central banks are likely to reconsider their approach to further interest rates rises, given the tightening in financial conditions, and look to reduce the severity of rising rates in the near future.

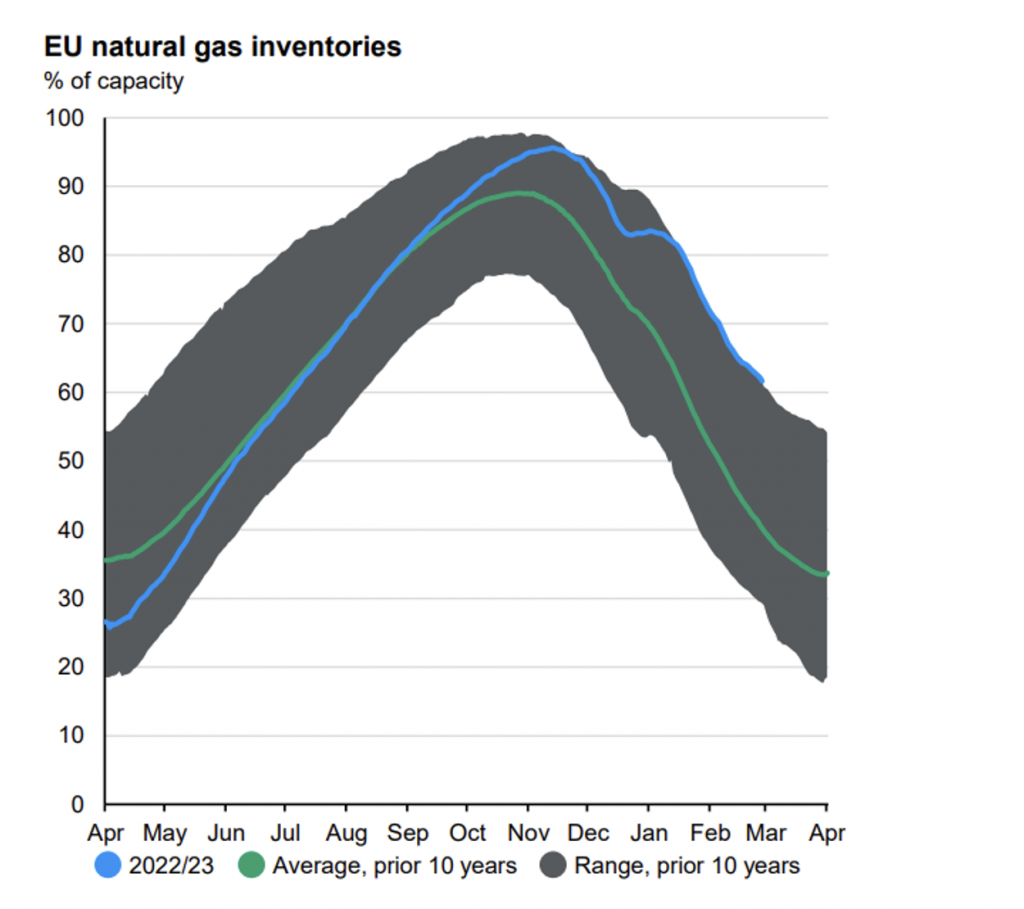

Looking towards our own continent, Europe and UK had seen steady equity market growth up until quite recently, mostly driven by Value-led sectors such as Financials and Industrials but also from a milder Winter, reducing energy consumption. Higher interest rates for longer periods of time tend to benefit these sectors as profit is gained through the higher rates (eg. Banks) or raised costs can be passed on effectively to consumers (eg. Energy, Industrials). Given the recent bout of selling in the market, particularly financials and insurance companies, valuations remain lower than longer-term averages after a poor 2022 due to the Russia/Ukraine war, global supply chain issues, increasing interest rates and high inflation. Following such a year, investors will be eyeing up long term investment opportunities in the markets, even in the face of a fairly benign global growth environment. Whilst the Financial sector has seen difficulties in March from SVB’s collapse and the Credit Suisse troubles, we expect the sector to present attractive buying opportunities in the near future.

Our alternative equities have had mixed performance of late, sustainable energy remains a key driver towards Net Zero targets and the move towards self-sufficient energy, particularly in Europe. Infrastructure as an asset class has struggled on the whole as investors have flocked towards less defensive investments as funding cancellations and gas & oil price reductions have affected profitability.

Asia and Emerging Markets initially had a positive run in early 2023 as China’s economy started to re-open but this has since been thwarted with lower than expected economic activity as the country continues to assess the impact of COVID on its population and how this continues to affect business volumes. Japan steady market return in 2023 has been attributed to the Bank of Japan appointment of a new governor with a radically different way of thinking compared to ‘Abenomics’, prompting hopes that the country can turn around its stale economy. Japan has also largely been insulated from the impacts of rising global inflation due to Government price controls, an ageing population and a negative interest rates.

Fixed Interest, has also had its performance driven by The Fed’s interest rate hikes but has only seen yield rises, pushing prices mildly down. Global bonds have held up better than Sterling bonds due to slight increase in the value of USD against GBP. Both continue to look towards indications that rates, and therefore yields, will fall before prices will rise. Yields currently offered across our portfolios now look favourable which are expected to benefit client portfolios through 2023. Our alternative fixed interest has also seen mixed success, outflows from Absolute Return funds towards traditional bonds have resulted in a small price reduction. Our new Emerging Markets bond fund has struggled similarly to Asian and Emerging Market equities in its expectation for a Chinese recovery but has recently seen an upturn as key countries, such as Thailand and Philippines, reported lower than expected inflation rates. We expect the current environment of slowing interest rate increases and the prospect of possible interest rate reductions in the not too distant future, could result in an extremely positive year for fixed interest instruments.

We continue to expect Value to outperform Growth based on the evidence to hand and our approach remains cautiously optimistic, an approach which has been rewarded in 2023 to date up until the recent banking sector sell off. The Vizion Wealth Investment Committee has decided on two fund switches, replacing a Growth-focused global equity fund with a more balanced fund driven by ESG characteristics and the replacement of the ClearBridge Infrastructure fund that has a reasonable element invested in Gas & Oil exposed equities with a fund that has a broader Infrastructure remit that attempts to generate a more stable return whilst outperforming its benchmark.

The Vizion Wealth portfolios remain well positioned to benefit over the long-term with exposure to a variety of areas, including a bolstered traditional fixed interest allocation and blend of Growth and Value sectors. We continue to expect this year to provide a more positive outcome for well-constructed and diversified portfolios as we progress through the economic cycle and more from contraction to expansion.

As always, if you would like to talk to us about any aspects of your investment portfolio or risk profile, feel free to contact your financial adviser.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

DPMS Portfolio Commentary March 2023

March 2023 has been somewhat of a rollercoaster ride as investors have processed a variety of information, led by markets absorbing news of a number of bank bail outs started with the run on Silicon Valley Bank (SVB) and smaller New York based Signature Bank and the impending impact on interest rate policy led by the US Fed.