DPMS Portfolio Commentary

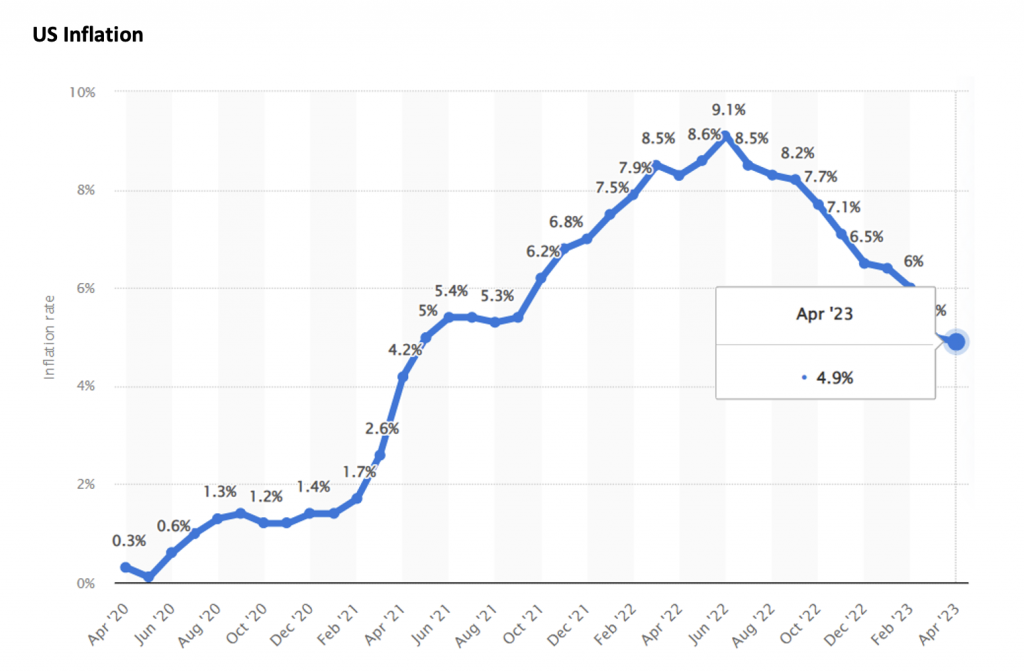

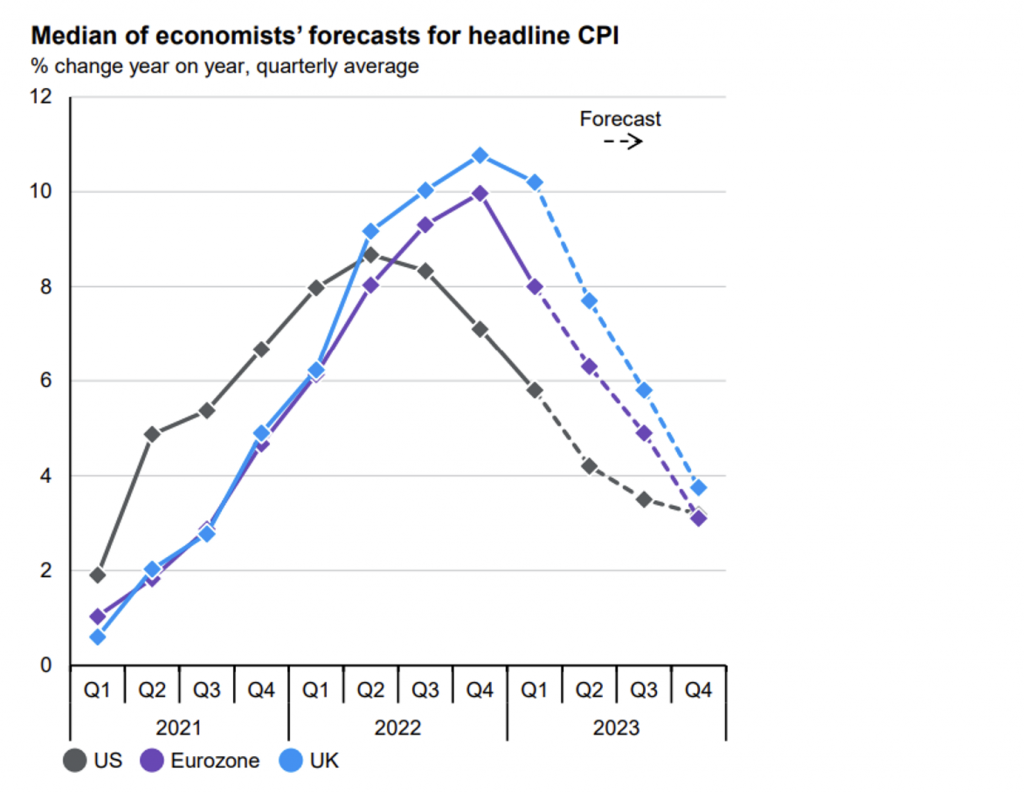

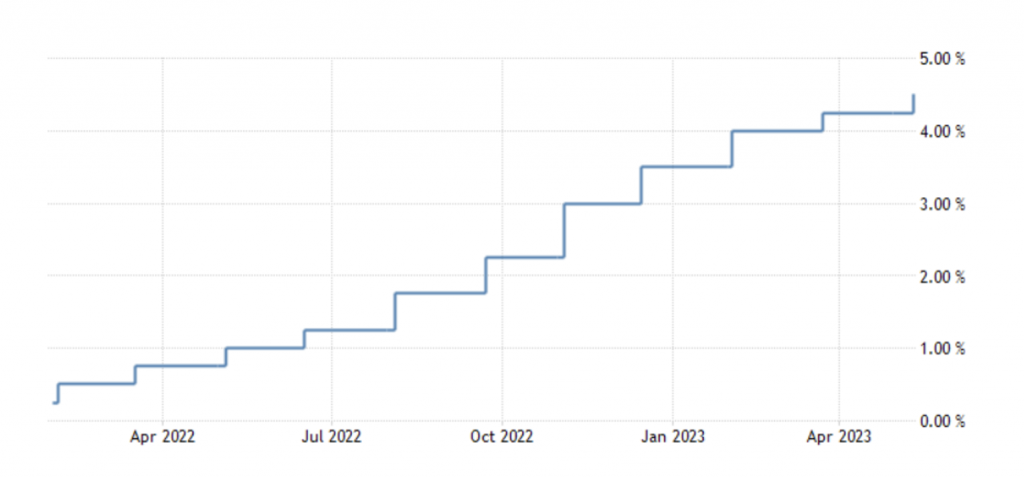

After a frustrating Q1 2023, with a sustained market recovery derailed by banking failures, Q2 2023 has been a generally more positive quarter. This comes despite continued nervousness in the market related to the US debt ceiling being called into question (and swiftly resolved), sticky inflation in the UK, US & Europe and possible further interest rate hikes and China’s sluggish economic recovery. Despite this, corporate earnings and jobs reports have remained strong in the US, giving rise to a strong rebound in Growth equities across the globe. Vizion Wealth remains cautiously positive on our outlook for the remainder of 2023, continually looking towards China’s eventual economic recovery, the expected end of the increasing interest rate cycle in the US and Japan’s possible rising popularity in the investment universe. The previous changes made in May have had a positive impact on portfolio performance with the introduction of the US Investment Grade Credit bond fund and US Growth equity fund, having benefitted from reducing US inflation and the associated future expectation on interest rates and yields. Given this expectation, the Vizion Wealth Investment Committee have agreed to start transitioning towards a slight growth bias in North American equities, which have historically outperformed during periods of interest rate reductions, although further confirmation of inflation being brought under control will be required before the risks for further hikes is alleviatedWe also introduced a new US Investment Grade Bond fund which similarly seeks to benefit from levelling and falling interest rates and the positive impact this is likely to have on bond capital prices. Finally, currency hedged share classes have also been added to the portfolio as the US Dollar could come under pressure if US interest rates start falling first and investors look towards other higher yielding currencies.

Given the events of the Silicon Valley, Signature & First Republic Bank collapses and subsequent spill over into the European markets in March, financial conditions appear to have tightened recently with significant strain placed on mid and smaller-cap companies. Central Banks will likely maintain a balanced approach in future interest rate decisions to ensure economies continue to grow while aiming to curtail inflation. The general consensus is there is a high possibility the Federal Open Markets Committee (FOMC) could implement base rate reductions for the US before the end of 2023 subject to inflationary data. This could prove to be favourable for North American Growth equities as reducing rates leads to fall in re-financing costs and positive earnings reporting. These decisions will remain driven by inflationary data, which has continued to remain sticky for a prolonged period.

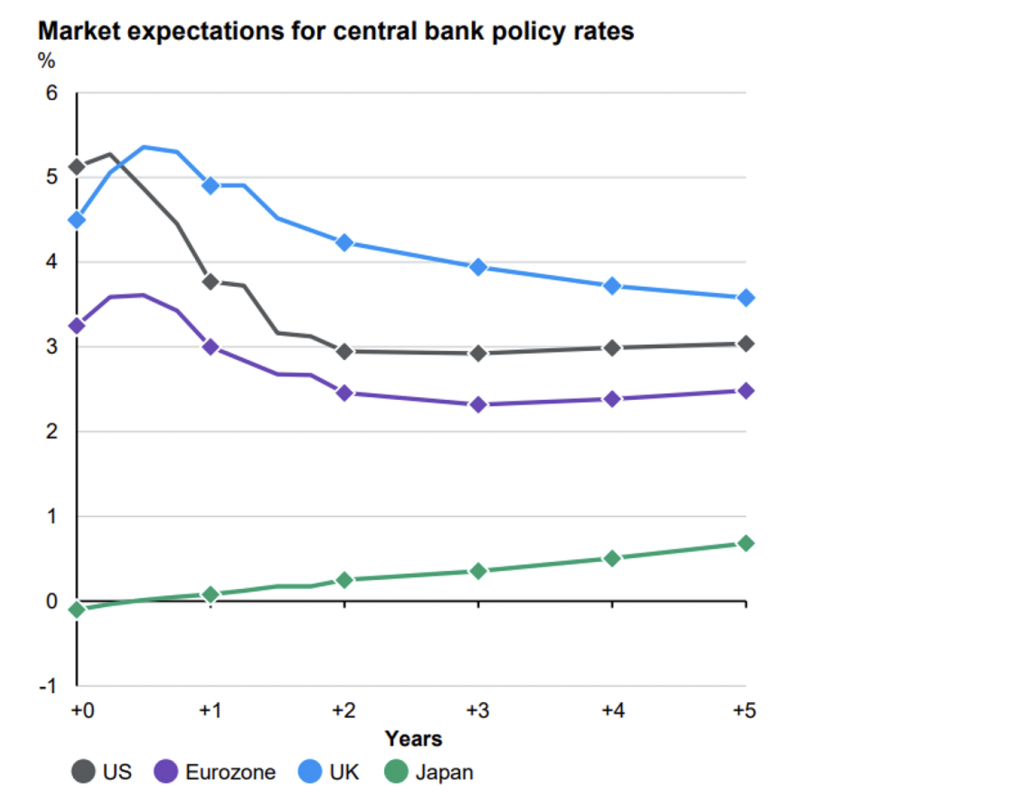

Expectations remain that the US will have one further, smaller rate rise followed by a pause in hikes to assess the impact. Europe is also starting to benefit from reducing inflation but is still expected to continue with one or two interest rate hikes. The UK is in a more difficult position with supply-side issues and sticky inflation caused by difficulties with labour, wages and prices so we may see a longer period of rate rises. The Bank of England has a difficult job on their hands to try and tame inflation whilst not spiralling the UK economy into a deeper-than-expected recession through increased costs, particularly for mortgage debt. This could favour Value equities despite the above issues and troubles in the banking sector. The general consensus is we are not expecting the Financials sector to suffer similar troubles to those seen in 2008/09, due to stronger balance sheets and stricter capital adequacy regulation. There is a strong expectation banks will remain highly profitable due to increased margins on lending against deposited funds.

China continues to struggle with its economic re-opening as sub-par data continues to mar the country’s performance. There are pockets of opportunity to be found in certain sub-sectors of its economy, including travel and luxury goods, as its citizens adjust to life after lockdown. Recent upturns in the region have come from speculation that its government will provide stimulus towards its struggling property market, following the collapse of Evergrande in 2021/22 and its subsequent aftermath. Perhaps an unlikely benefactor of China’s re-opening has been Japan, who have seen a surge in tourism alongside a more business-friendly approach from its newer government. Having seen growth stagnation for the last couple of decades in the ‘Abenomics’ era of Shinzo Abe, a recent overhaul of corporate governance rules has compelled executives to improve shareholder returns. This alongside cheaper valuations, compared to historic averages, and Japan’s position as a ‘safe exposure to China’s growth’ (as they benefit from geopolitical tensions between China and the US) have propelled recent returns and may continue to do so into 2024.

Whilst bonds have continued to struggle recently as interest rates have continued to be hiked, they still remain a key part of our portfolios with capital growth prospects still remaining for 2023 into 2024, assuming yields eventually start to fall (in line with interest rates) and capital values start to rise. The US is still likeliest to benefit from rate reductions first in the developed economies whereas Europe and UK may take a while longer to reap benefits in capital price increases. We currently favour Investment Grade debt as it is expected to remain stable enough to withstand any possible recessions whilst generating capital value increases from reducing yields. Cash investments also remain attractive over the short to medium-term as rates continue to rise with banks now offering competitive savings of around 3.8% for instant access accounts and 5% for 1-year fixed rates.

Overall, the changes to the portfolios maintain a cautious level of optimism for both stocks and bonds for the rest of 2023, with tactical biases towards the strengths in each geographical region. The portfolios remain well positioned for long-term growth by focussing on potential opportunities in both the equity and bond sectors.

As always, if you would like to talk to us about any aspect of your investment portfolio or risk profile, feel free to contact your financial adviser.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

DPMS Portfolio Commentary June 2023

After a frustrating Q1 2023, with a sustained market recovery derailed by banking failures, Q2 2023 has been a generally more positive quarter. This comes despite continued nervousness in the market related to the US debt ceiling being called into question (and swiftly resolved), sticky inflation in the UK, US & Europe and possible further interest rate hikes and China’s sluggish economic recovery.