DPMS Portfolio Commentary

The second quarter of 2022 proved to be as volatile as the first, with equities and bonds alike suffering declines as inflation soared to record highs across the globe, above almost all economists’ forecasts. Interest rates also began to see increases in an attempt to combat inflation but did little to curb mammoth increases in the cost-of-living, deepening the risk of recession across global economies. The start of Q3 has proved slightly more positive than expected due to better-than-expected Q2 earnings reports from larger US companies, such as Meta, Twitter and Tesla, and President Biden’s announced Infrastructure plans to help the US adapt to climate change.

The Vizion Wealth Investment Committee has decided to, in light of the above, continue to bolster the defensive nature of our portfolios with a focus on UK, Europe and North America due to their increased risk of recession. This comes in the form of further reductions of our exposure to traditional corporate and high yield bonds in favour of absolute return and short-dated US dollar bond funds. As with previous changes, the reason for this is to help avoid the negative impact of rising yields on the capital value of our fixed interest holdings. The allocation towards absolute return continues to provide additional diversification and downside protection, whilst the allocation towards US dollar bonds allows us to capture the strength of the dollar whilst retaining a short duration and higher credit quality bias, to minimise the impact of rising interest rates from the Federal Reserve.

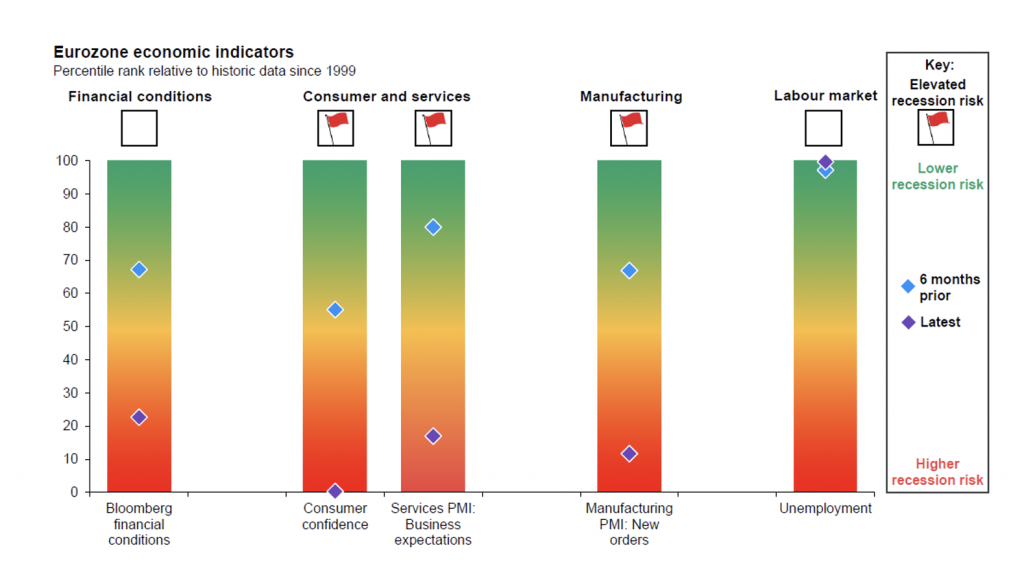

Our equity position continues to retain a neutral approach to investment style, but now bringing more focus towards larger market capitalisation and quality companies that would limit the potential downside in the event of a recession. This comes in the form of a few more defensively focused funds in the UK, Europe (ex-UK) and North American equity sectors and a reduced allocation towards mid and small cap companies in the UK and Europe. We do have a slightly more optimistic approach in the US due to historic support we have seen for the nation’s economy from the Federal Reserve so are not quite as defensively positioned. However, with the ongoing war in Ukraine, the October energy price cap removal pending and struggling economic growth, we predict a higher risk of recession on the horizon for many parts of Europe and the UK. While the markets have already absorbed these risks and projections, we remain more defensively positioned on our portfolios until we expect a greater appetite for risk to prevail.

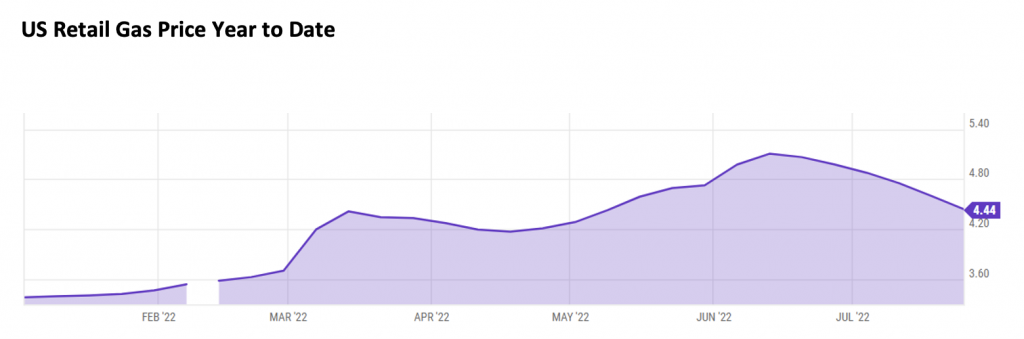

China is still a key area of analysis for the committee as we are keenly watching how their zero-COVID strategy develops. There will be bumps along the road for the region as we expect periods of outperformance and underperformance in line with the strictness of the lockdowns. The US has also come to the fore as a key area of analysis as we are waiting for key economic measures that inflation has come to a peak in the region. Lowering gasoline prices are certainly aiding this, with the gasoline accounting for 5% of US GDP, but there may still be the threat of a recession on the horizon with lower economic growth and inflationary pressures seen since the start of 2022.

We are still anticipating an extended period of market volatility, as recessionary warnings start to blink and interest rates continue to rise; however, we are encouraging clients to continue to be patient as our portfolios weather the storm. History tells us that market drops tend to be followed by subsequent significant recovery periods which offer an opportunity not only to recover short-term losses, but also to take advantage of new opportunities to help protect and grow your wealth.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

DPMS Portfolio Commentary August

The second quarter of 2022 proved to be as volatile as the first, with equities and bonds alike suffering declines as inflation soared to record highs across the globe, above almost all economists’ forecasts. Interest rates also began to see increases in an attempt to combat inflation but did little to curb mammoth increases in the cost-of-living, deepening the risk of recession across global economies. The start of Q3 has proved slightly more positive than expected due to better-than-expected Q2 earnings reports from larger US companies, such as Meta, Twitter and Tesla, and President Biden’s announced Infrastructure plans to help the US adapt to climate change.