Market Update: Markets Bet on a Perfect Landing

Bad news filled the airwaves last week. Faltering global growth, higher inflation forecasts and rising interest rates set a dour tone – capped off by a geopolitical crisis in Taiwan. UK investors were struck by the Bank of England’s dire warnings: a 13% inflation peak and a protracted recession are now in store for Britons, according to Governor Andrew Bailey. Predicted to last for five quarters, the looming UK recession is set to outlast the one following the global financial crisis in 2008/09.

For global investors, the more pressing issue is China’s military bravado across the strait of Taiwan. Experts largely agree escalation is in nobody’s interest, but is still very possible. On Friday, Chinese officials announced an end to military and climate cooperation with the US. Further such moves would be damaging – particularly against the backdrop of a weak global economy.

With all that gloom, it might come as a surprise that capital markets are in good spirits. Since the start of July, equity prices have rallied and bond yields have fallen. Markets have more or less recovered all of their June losses. As we cover in our July review, almost all major stock indices we track had a positive month – with some seeing very substantial gains. So, why are investors so unfazed by the current bad news?

Judging from bond markets, the feeling is that we have reached peak global inflation, and consequently peak interest rate pressures on central banks. Oil prices have started falling and, as we cover in a separate article, the actions of oil producers themselves point to a belief that current prices are unsustainable. Supply chain bottlenecks clogged by the pandemic are also improving, while consumer demand has clearly taken a hit from the cost-of-living crisis.

The thought is that this will cause a reversal of central bank policy sooner than previously expected with implied US rates peaking by the end of this year. Investors have essentially given central banks – particularly the US Federal Reserve (Fed) – a vote of confidence. Its policies are expected to prevent a dangerous wage-price spiral while maintaining the economy at a decent level. What’s more, middle-class consumers still have considerable savings to fall back on, while jobs remain plentiful and businesses are more financially sound than in previous downturns. Recessions in most regions are expected to be shallow and brief, while the US might avoid one altogether.

The problem with this view is that it contradicts what central bankers themselves are saying. Fed Chair Jerome Powell’s speech last week was gained praise for its seemingly dovish tones, but he still committed to raising rates and crushing inflation at all costs. The disparity is even more apparent in the UK, where Bank of England Governor Andrew Bailey and his team issued warnings as dire as they come.

We suspect that the alarmist lingo is more a warning than a genuine prediction. Monetary policy works on a very long lag, meaning that tweaks to interest rates now will only have an effect a year or so down the line. But if bond markets are to be believed, inflation will already be largely under control by then – meaning further tightening would be overkill. Central bankers want to tame inflation right now, and the only way they can think to do that is by affecting consumer and business behaviour. They will hope that pessimism will stop employees pushing for higher wages, bringing down cost pressures.

That is the best-case scenario, and the one markets are currently betting on. Such optimism in bond markets was the main reason for July’s uptick in equity prices – as falling yields made stocks comparatively more attractive. But that positivity is itself a little concerning, as it makes asset prices vulnerable to worse-than-expected news.

There are still many risks to the overall outlook, which are arguably not properly priced-in. Europe is particularly at risk, facing energy shortages and sharply higher costs this winter. This should bring consumer demand down further and eventually cool inflation, but that could take some time. The main source of Europe’s woes is gas supplies, which are very hard to adjust in the short-term, and are highly susceptible to Russia’s war in Ukraine. European businesses could be the hardest hit, as they have less sway over electoral outcomes and are therefore lower down on politician priority lists.

Markets nevertheless seem to think the inflation battle is already won, and there is a clear path to economic recovery. But none of that is certain, and there are many political obstacles that could get in the way. Governmental paralysis in Britain and Italy could prevent decisive policy action (Conservative MPs have already questioned the Bank of England’s independence in response to its dire forecasts), while US-China tensions over Taiwan are a serious and perhaps under- appreciated risk to global growth. Negative news flow, particularly around energy supplies, could severely dampen market sentiment.

At the same time, the huge uncertainty around energy means things could turn out better than currently expected. Elevated gas prices in Europe have become the main concern to the global outlook, but there is very little information on when they might subside. Since it is purely a supply-side issue, we know that it will not last forever (as US gas costs are a fraction of Europe’s) but is just a question of how long.

Broadly, we agree with the prevailing market sentiment that things are not as gloomy as central bankers would have us believe. At the same time though, policymakers have every reason to sound the alarm, as there are significant risks to the outlook. Given those risks do not seem to be fully understood or appreciated, we cannot yet assume that July’s upswing is anything other than a temporary reprieve. We will be hoping it proves to be something more, but will be watching company earnings closely from here. Cautious optimism seems the best approach.

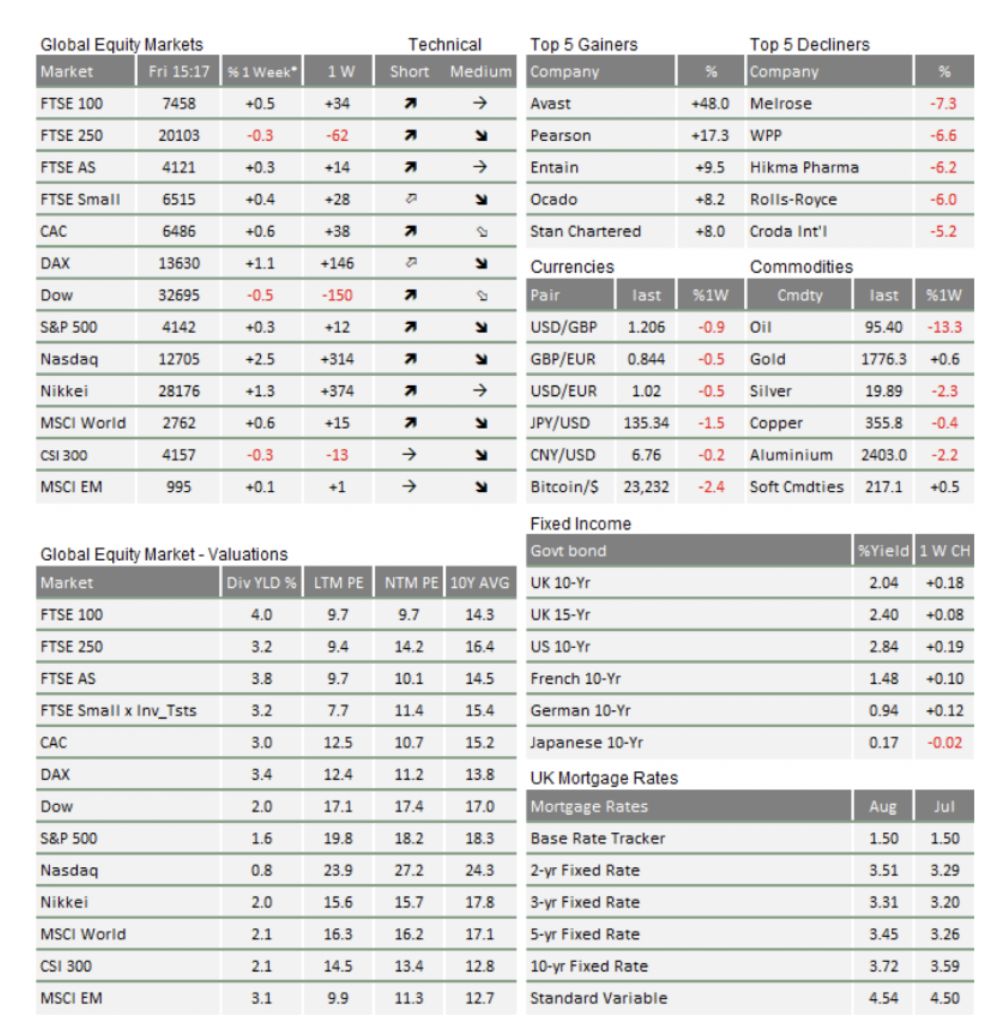

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.