Market Update: Positive Returns Amidst Negative Sentiment

For a second consecutive quarter, the US economy shrank in real terms. Yet the US Federal Reserve (Fed) raised interest rates by another 0.75% on Wednesday because the US economy is too strong.

For a second consecutive quarter, the US economy shrank in real terms. Yet the US Federal Reserve (Fed) raised interest rates by another 0.75% on Wednesday because the US economy is too strong.

The most usual narrative we hear among the contributors to our research process is that US inflation is sticky. Steven Bell is now Chief Economist of Columbia Threadneedle (after the old Foreign & Colonial investment house was sold by Bank of Montreal) and has been a well-respected City economist for many years. He sees that the drivers of inflation in the US are different to Continental Europe and Asia – the labour market is fundamentally tighter. This viewpoint is shared by Freya Beamish at TS Lombard. Both of them see that a “proper” recession is most likely; a bout of labour market weakness during the next few months.

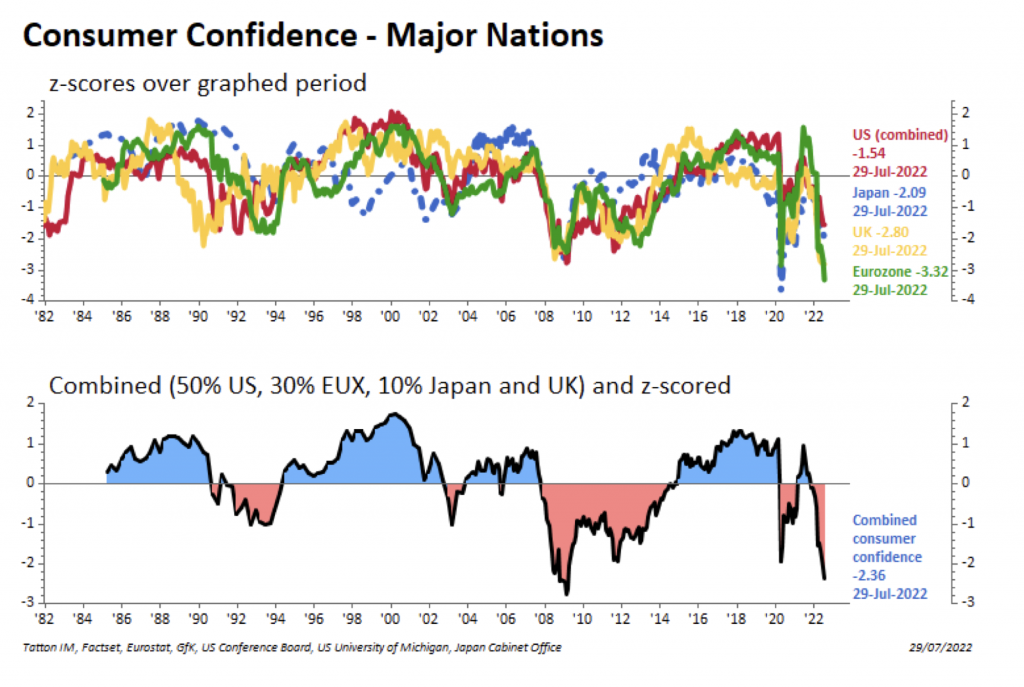

Steven Bell thinks that might be towards the end of this year, Freya Beamish sees it more in 2023.Their bearishness seems aligned with consumer confidence measures which have been awful across the world – in a way that is comparable to both the 2008-9 period and worse than the onset of the pandemic:

Europe is clearly in a worse dilemma than other areas and much of the news worsened this week. Eurozone inflation for June was higher (marginally) than expected at 8.9% year-on-year. It will be even worse next month because energy prices just keep rising. Russia, via Gazprom, did exactly what was feared and came up with an excuse to not deliver as much natural gas to Germany as was promised. Gas prices went up to new records. We are undoubtedly in a ‘cold’ war again.

Europe’s ‘plan’ to cut gas use by 15% until 2023 is important. But, as we said last week, the strategy is leaving it to individual nations to find ways to implement the target. As of now, no concrete plans have been proposed by any country. We only know caps will focus the reduction on industry, and that households will not face cuts, even if they are not shielded from price rises.

Until we see how businesses can be protected for this winter, investors will be worried about the potential for unbearable costs. And, as small businesses across Europe found during the pandemic, there will be no comfort for them if aid is made in the form of loans since it will not be possible to make up for lost revenue from foregone sales and production.

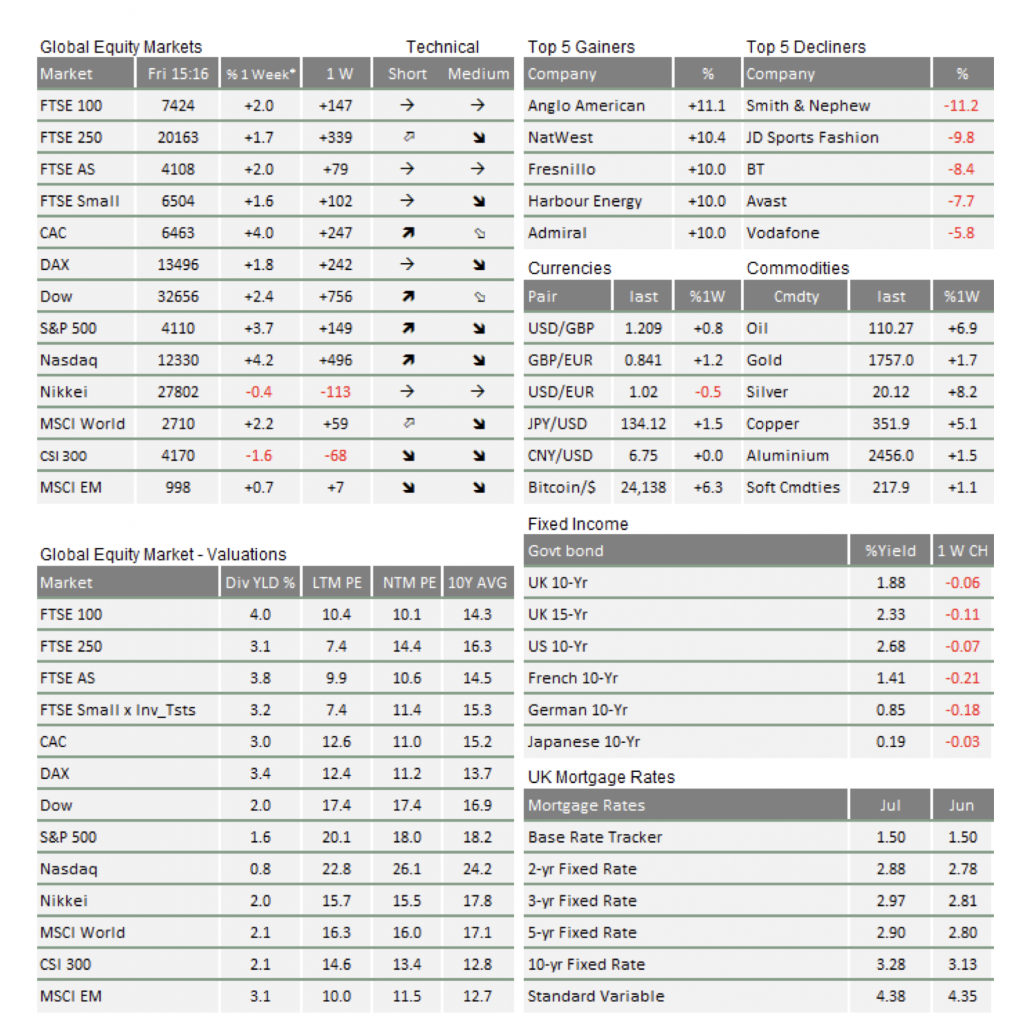

Yet, despite all of the bearishness, markets put in a stonking performance this week. Pretty much all equity and bond markets ended with asset prices at higher levels. In particular, corporate bonds did well, even in Europe. Given that much of the fear in markets revolves around a potential credit crunch through Europe’s winter, many commentators have seen this as probably only a temporary respite.

What is interesting in this week’s price action is that when uncertainty in markets is at fairly extreme levels (we would definitely say that is the case now), price action can become more important in investor decision-making.

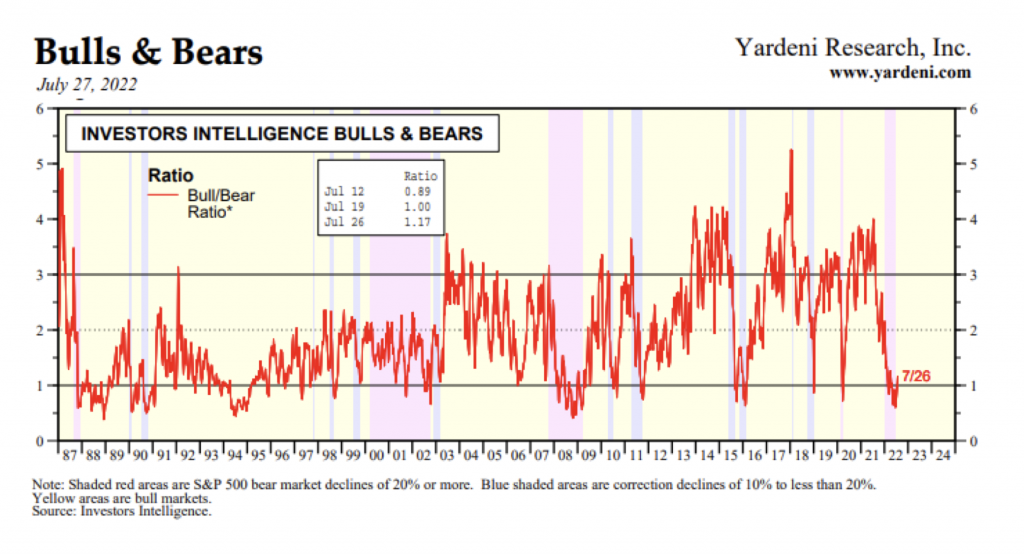

At no point do we, as individuals, know everything. According to the efficient markets theorem, the price of any asset is the sum of all of the knowledge about that asset. However, we can’t be sure how much we personally know. When the world is getting riskier, it’s natural for investors to want to have less risk exposure. The chart below is taken from Ed Yardeni’s work, showing his calculation of the ratio of Bulls to Bears in the US equity market as defined by Investor Intelligence:

When investors get bearish, they end up with fewer risk assets in portfolios than normal. Thus, when prices start to improve, they are left wondering whether other investors know more than they do. Some institutional investors are measured on their quarterly or even monthly performance, and can end up having to go back to a more neutral position even though they have no new information other than the price.

Investors have been both bearish and uncertain for a long time, even though valuations on many assets have become substantially cheaper, perhaps it’s not surprising that we end up in what looks like a classic ‘short squeeze’.

When investor sentiment is poor, it can be quite difficult for markets to fall further without the news getting much worse. So, while there were stories which worried us, much of it told us essentially what we already knew (like the inflation data and the US GDP data) or had good reason to expect (such as the slow Russia gas supply). On the positive side, Jerome Powell sounded less hawkish than expected after the US interest rate rise. Meanwhile China’s politburo pressed for more support for their economy.

A bull market isn’t likely to set in anytime soon and, almost certainly, not until the energy price squeeze dissipates. Nevertheless, perhaps last week, it felt like it wasn’t getting worse.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.