Market Update: Data vs Davos

Bob Rich, 18 December 2023

Data vs Davos

Was it the latest market data making early and substantial interest rate cuts unlikely, or the latest ‘news’ from leaders gathered in Davos, that caused bond yields to rise once again?

Understanding national debt and deficit’s sustainability limits

Borrowing parameters at the national level differ vastly from a private household, understanding the difference offers perspective.

US deficit position and challenges

Even the almighty US can create a national debt and deficit challenge – at some point, either taxes have to rise or spending has to fall.

The European Monetary Union’s new deficit management framework

Europe’s deficit framework is more solid than before but fiscal inflexibility and political stalemate remain familiar economic risks to keep in mind.

Data vs Davos

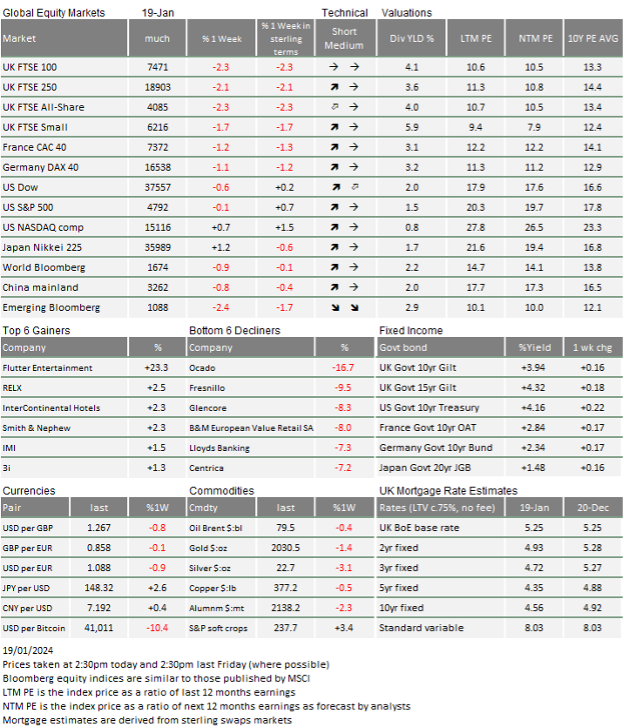

Last week, global capital markets resumed their volatile path of last year, as the positive sentiment, driven by expectations of an imminent and significant onset of rate cuts, began to wane somewhat. The combination of a distinct slowing in the downward trajectory of inflation, paired with increasing confirmation that economic conditions are more on the up than down (at least in the US), have made it even less probable that rates will be cut soon and fast. As a result, some investors have begun to face up to the very distinct possibility that bond yields may have undershot during the end of 2023 euphoria, and that rates may only begin to be cut later and then more slowly. In other words ‘lower, slower’ seems to be replacing last October’s ‘higher for longer’ narrative.

Consequentially, bond yields have risen again last week, led by more rises in the US Treasury market. In the US, in another replay of 2023, US mega-caps were notable performers and the Nasdaq Composite regained the 15,000 level. However, equities overall have generally drifted downwards with smaller caps under pressure. Non-US markets also declined.

Those that follow financial media channels may suspect these changing expectations may be a result of chatter emerging from the Davos World Economic Forum – the annual gathering of the global political and business elite. Well, when nobody had heard of the annual Davos meeting, this small group of incredibly influential investors, experts and politicians indeed mattered. Now it has become way too visible to be important. The gathering has journalists all over it and (almost) every utterance is communicated to us immediately. Therefore, nothing new of any great value can be said. Last week, central bankers were in full view, telling audiences that rates will be cut but not to expect too much and too quick. There was a general sense of a mildly hawkish conservatism, driven by a view that not too much was wrong with the world just now. Meanwhile, various business leaders said it is tough out there but we should be optimistic.

In the world of facts and figures, JP Morgan Research tells us global companies are reporting lacklustre results for the last quarter of 2023 and giving similarly tepid forward guidance. It’s still the early stages of the reporting cycle, with just 6% of S&P 500, companies having reported, mostly banks, consumer and industrials. The usual majority (66%) are beating analyst expectations on earnings, but only 50% are beating on revenues and stocks are underperforming after reporting. Bank results have been mixed, while consumer names are seeing less US spending power as households’ cash savings decrease.

Revenue ‘beats’ may be not as positive as hoped, but expectations for US companies are still strong, driven mostly by US domestic demand. Even now, revenue expectations for the next 12 months are climbing from one month ago, at a pace which – if sustained – would deliver a 7.3% annual rise. That’s still in excess of the long-term (20-year) average of 5.3% per year.

Higher US income brackets are still outspending the lower ones, but results from other important global companies which rely on demand beyond the US borders, such as FedEx (logistics) and Delta (airlines), are challenging the notion that there is a global upswing in the business cycle.

JP Morgan expects decelerating growth in Asia/China to remain a risk for global high-end consumer brands (they point to companies such as LVMH, Kering, Burberry, Swatch and Nike). And, whereas revenue expectations are strong in the US, Eurozone-listed company revenue expectations are now declining relative to one month ago at an annualised -7% pace. That’s a stark difference.

Over the longer term, tech and artificial intelligence (AI) stocks are at risk of unwinding last year’s rise in valuations if the costly capital investments do not yield the promised incremental earnings stream or productivity boost in coming quarters. However, these stocks are currently still outperforming and that’s most apparent in the mega-cap Nasdaq names.

So, investors are reasonably confident about US economic growth remaining robust. but are less certain anywhere beyond North America, and the data appears to back this up. For example, last week’s release of December’s US retail sales data showed higher-than-expected spending value of +0.6% versus November. The opposite happened in the UK where the seasonally-adjusted value of goods showed a fallback of -3.6% from November. The downbeat sales activity seems to be at odds with the inflation data. Consumer price inflation rose 0.6% month-on-month, which surprised economists.

We have noted previously that the job of seasonal data adjustment has become increasingly difficult in the past few years. This may be due to the pandemic and its impacts, but the variability of data has increased. Changes in retail habits seem to have accelerated, driven by new norms in online shopping such as Black Friday offers (which appear to have driven a lot of November’s UK retail sales).

We talked about this apparent divergence last week, and there seems little to stop the trend. At its heart is the success of the ‘America First’ policies conducted by both Trump and Biden. Global companies like Microsoft, Alphabet (Google), Apple and Amazon have reaped the profits of access to the global markets, but have been encouraged to move their capital and the majority of investment in new production back to the US, while purchases of goods and services from outside the American continent has been discouraged.

This protectionist agenda has been accelerated by the (almost certainly correct) perception of security risks from China, Russia, Iran, and other bad actors. However, it has had significant direct and indirect impacts elsewhere, with Europe (including the UK) clearly suffering. As this year progresses, the noise from the US election will raise prospects of even more of the same types of policy given the perceptions of near-term success.

Yet, the US is not immune to the negative potential impacts of protectionism. While its current account balance has decreased relative to gross domestic product (GDP), it continues to consume more than it produces, and requires foreign investment to fund that balance. The US government also operates with a large funding deficit, larger than all major areas except for Japan, and one that is set to grow, whereas others are likely to fall in the next decade.

The US cannot continue indefinitely to expect others to fund its lifestyle without an equalisation in approach at some point. Failing that, there is a growing danger of more overt protectionist policies spreading across the world, and not just from China. The current divergence in economic fortunes is likely to clash with the US election agenda, where neither side has any incentive to extol the virtues of internationalism and free-trade. Commentators tend to give opinions on Biden and Trump’s potential impacts on US assets but Europe could be the most affected. This is especially so if US overseas defence spending is cut hard at the same time as US companies are given another tax boost.

While clearly a concern for investors for the medium to longer term, last week’s return of seemingly indecisive markets while yields began to rise again had little to do with that but all with the observation expressed at the top. Namely, there is a creeping realisation that the inherent impatience of markets has once again led to expectations of unrealistic timeframes and dimensions around the potential rates ‘reward’ on falling inflation. Does that indicate that market sentiment has reversed and investors are no longer looking optimistically into the future? No, not at all from what we can see and have hopefully laid out above. A dose of realism into how long it may actually take for economic and market fortunes to be sustainably positive again may well offer up some short term investment opportunities, particularly while markets have re-entered range-bound terrain.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.