Market Update: Competing Policy Measures Leave Markets Worried

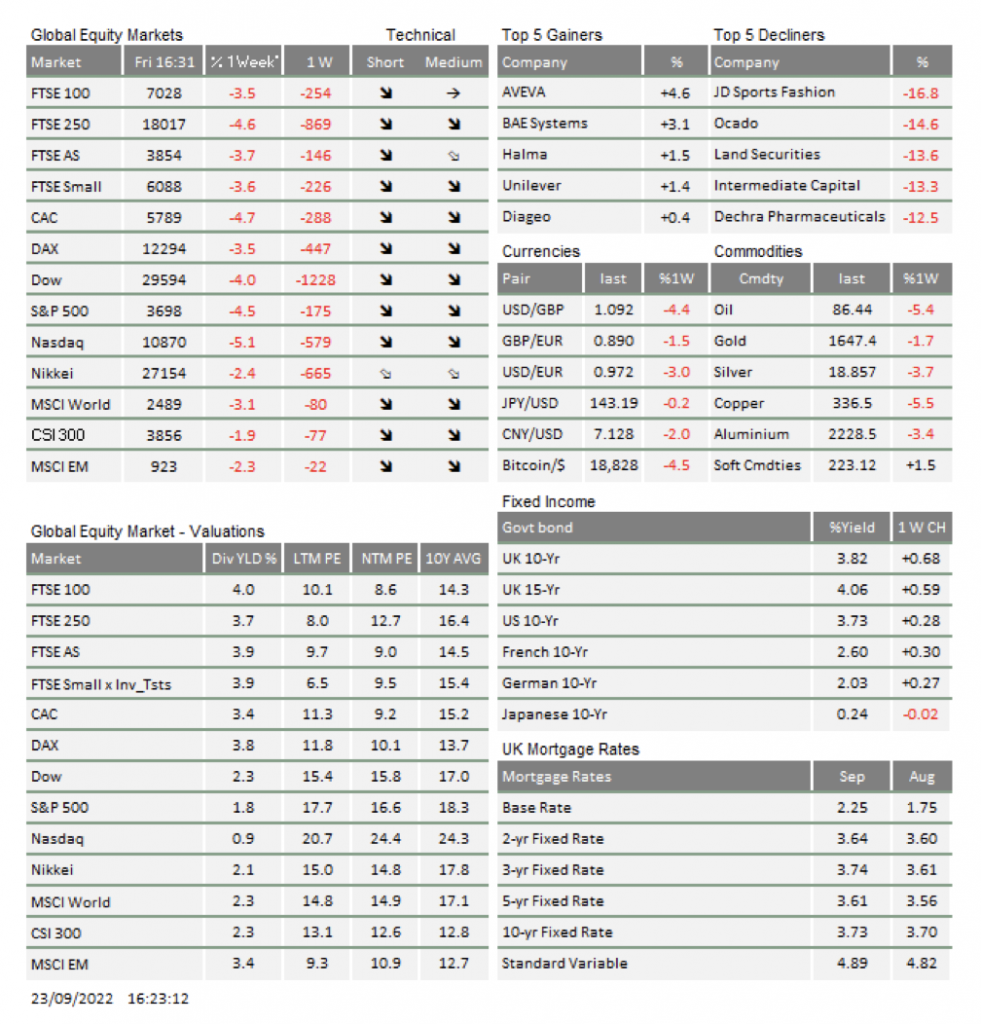

The last two weeks have been sobering for investors world-wide, with all major markets (including bond markets) falling between 5% and 10%. This has come after an encouraging recovery rally over the summer that was driven by falling oil prices, which fuelled expectations that the worst of the inflationary headwinds were behind us, allowing central banks to pause their aggressive monetary tightening course, and that a turnaround in economic fortunes was therefore imminent.

However, following the late-August Economic Symposium meeting of central bankers held at Jackson, the realisation has set in that such hopes were premature and the summer rally proved no more than a bear market rally (see also our separate article that discusses the timing of recovery rallies). Since then, central bankers have resumed their aggressive rate hiking, taking us back to interest rates between 2.5% and 3.5% (UK, US) that we have not had to contend with for 15 years. On top of this, markets have also had to come to terms with politicians’ actions to counter rising economic headwinds that have been at complete odds with the decades-long preceding era of fiscal prudence. If that was not enough, a cornered Vladmir Putin cranked up his war rhetoric, with his retreating troops increasingly making him look a loser, thereby increasing the likelihood of much longer-lasting geopolitical uncertainty.

When there is a meaningful shift in those parameters market participants have grown accustomed to over significant time periods, it is perhaps not surprising they feel uncertainty rising and as a result are inclined to reduce their market risk exposures.

Taking a step back, it is undeniable that this downcycle has likely not reached its trough yet. Therefore, hopes for the usually very rewarding recovery rally have proven premature. On the other hand, it appears that a number of elements that made up the cocktail of formidable downdraft headwinds have gone beyond their lows and indeed point toward markets reaching the capitulation level sooner rather than later. The energy price shock is receding as the price of oil continues to fall, and is now trading a good 40% lower than at its peak, while fiscal countermeasures announced across wider European markets should soften the blow, not only for consumers but also businesses.

Whether the aggressive fiscal counter cyclical measures announced by the UK’s new Chancellor – the most generous consumer and business energy support subsidies across Europe and the largest package of tax cuts in 40 years – will arrest the UK’s current decline toward recession is questionable. However, we note that this fiscal largesse also stands in stark contrast to the austerity that followed the Global Financial Crisis (GFC) recession which led to a decade of subdued growth. One consequence from it is all but certain though: the feared decline in corporate earnings, and thus the running dry of stock market ‘fuel’, should now be smaller than had been feared.

Where does this leave us (and fearful investors) of what may lie ahead? Markets are right to accept that we are not out of the woods yet, but at the same time we suggest this latest bout of downdraft is getting us increasingly closer to where markets may be pricing in more bad news than actually lies ahead – in other words what is also known as capitulation and usually the turning point. As outlined in the second article this week, the ongoing economic downturn has the format of a classic, relatively short cyclical one, with few elements that would make us fearful it will turn into a long- lasting structural recession.

Against this backdrop, it is essential for investors to hold their nerve and not risk missing the onset of the recovery rally, which in such cases has historically front-loaded much of the returns available from the ensuing bull market period. This time, being ‘in the market’ may be even more crucial given higher interest rates and bond yields may well lead to overall lower average return levels during the next cycle.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.