Market Update: Central banks challenge Goldilocks assumptions

Bear commiserates Bull over the latest central bank announcements, Bob Rich, 1 February 2024

Central banks challenge Goldilocks assumptions

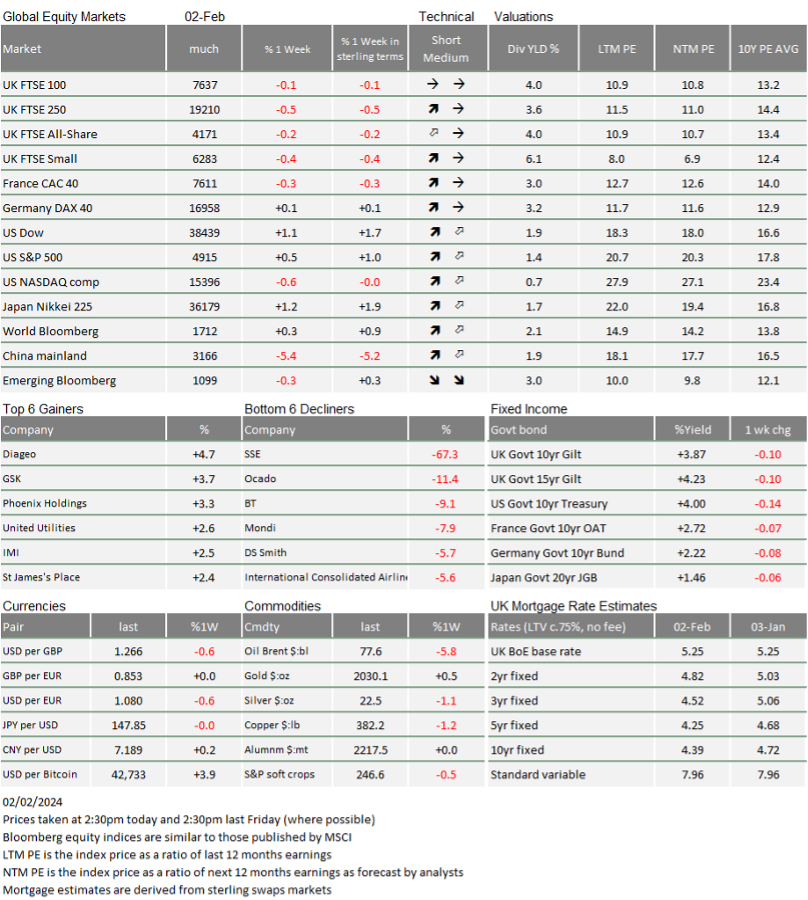

The apparent acceptance of later rate cuts kept markets going during January, but may be put to the test in February as US regional banks creak, once again, under the increased cost of refinancing.

January 2024 asset returns review

After starting with a hangover, January ended well for most markets, even if the US Tech Mega caps once again dominated market action.

Central banks confirm ‘lower, slower’

Rate setters delivered the consensus ‘no change’ and confirmed that the next move should be down – the ‘when’ though caused some ripples.

Central banks challenge Goldilocks assumptions

The first month of the year is behind us and, despite what many expected, returns were positive for most investors. Following the initial hangover from last year’s tremendous Santa Rally, risk asset markets continued on their upward trajectory. That was until the last day of the month, when the US central bank (Fed) dampened the mood by repeating the message that rate cuts will begin later than markets anticipate.

It was slightly surprising that this reiteration led to a short, sharp stock market sell-off. Surprising, because over the course of the month it appeared that market participants had already grudgingly accepted that rate cuts would be coming through later than they hoped in late 2023, when central bank interest rate pivot euphoria peaked. Surprisingly resilient Q4 growth – especially in the US – made those previous hopes unrealistic. The argument why markets had continued their upward trend had been that, as a consequence, earnings growth could outweigh the headwinds from continued high rates.

It is therefore reasonable to assume that last week’s temporary cooling of stock markets and decline in long bond yields was driven by more than just central bank press conferences. In particular, bond yields had started to fall from their recent rebound levels much earlier in the week. The usual suspects are therefore China, fears over banks and uninspiring company outlook statements in the current quarterly earnings season.

In China, the long faltering property giant Evergrande was finally forced into liquidation by a Hong Kong court. This could spell further short term trouble for the property-heavy Chinese economy, even if it may spur the Chinese regime to properly address the property crisis. To deflate the bubble, leaders need to create an environment that allows prices to clear. This will inevitably lead to some painful losses from the supply overhang, but will eventually reallocate capital towards gainful purposes. This is the remedy prescribed by historic precedence and academia, but not necessarily always followed by those in charge (It was applied successfully to remedy the US Savings and Loan Crisis of the 80s and 90s, but Japan in the 90s and the US in 2008/2009 waited with forcing clearing prices for far too long).

If China’s procrastination on its property issue is a medium term issue to watch, the return of banking concerns in the US are of far more immediate market concern. We all remember last March’s crisis amongst US regional banks, and last week’s sudden 40% share price collapse of the New York Community Bancorp (NYCB, which took over one of last year’s falling banks, Signature Bank) on funding pressures arising from its commercial property loan portfolio certainly made headlines in the financial media.

The downbeat earnings outlook statements of US companies from the start of last week, seemed quickly forgotten, when some of the major US Mega Tech companies reported much stronger Q4 results than anticipated and much better than expected figures were also reported by global oil majors like Shell and Exxon. This was topped on Friday when the number of newly created US jobs for January came in at 353,000, more than double what was expected.

That markets initially traded sideways, rather than rallied on the news, takes us back to what we discussed at the top. The US economy remains so strong that a tight labour market is almost inevitable and the wage pressures this brings will quite possibly re-ignite second round inflation dynamics later in the year. Central banks’ incentive to lower rates in the near term may therefore be quite limited, as they do not want to be caught out by inflation again.

With signs of renewed pressure in the US banking and commercial real estate sector, January’s narrative – that resilient economic growth will overcome and counterbalance the re-financing pressure headwinds of high interest rates and loan yields – may well be tested. We expect that the US banking authorities will once again deal swiftly to squash any bank sector weakness – possibly through another shotgun bank marriage and this time with one of the national champions. However, the continuation of plateauing rates is likely to exert both renewed valuation pressures on risk assets as well as cost of (re-)financing pressures on businesses.

For investors this is likely to mean less vibrant markets and a longer wait for interest rate normalisation. When that comes, it should bring a widening of investment opportunities, as positive growth dynamics trickle down to mid- and small cap companies, while previously unloved sectors have the potential to rebound. We got a glimpse of this late last year, when stock market positivity broadened in the hope of a cyclical rebound. But until there is more clarity around the actual timing of rate cuts, we have to expect more of the same: China is out, US powers ahead, with its Mega Tech market darlings in focus, while the rest of the economy is hoping for more sympathetic central bank rates sooner rather than later.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.