Market Update: Capital markets and war

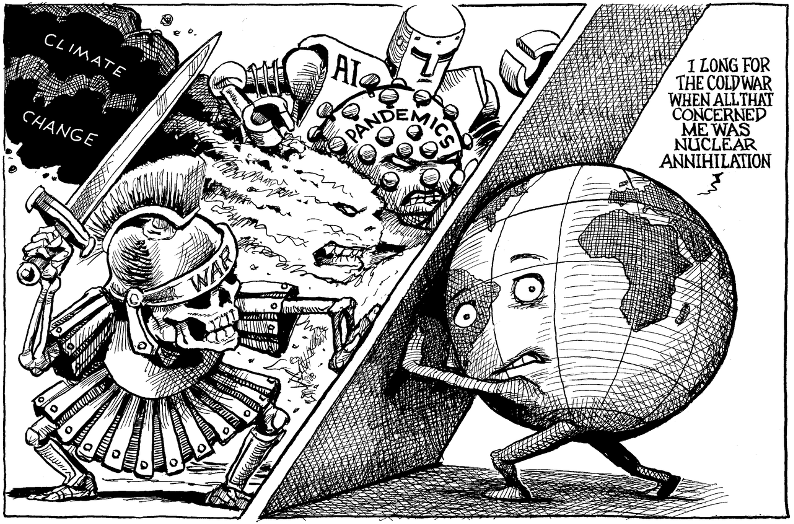

Source: KAL, 12 October 2023

Capital markets and war

If the attack on Israel last week felt as epoch changing as 9/11, then markets seemed to show determined apathy – or did they?

Bank of England winning against inflation expectations

Its steadfast approach to the UK’s stubborn inflation is showing signs of success, despite gloomy predictions from the IMF.

Argentina back in crisis

Perpetual debt crises, a declining currency, political instability and dependency on external support – Argentina has much to learn from Brazil.

Capital markets and fear

This past couple of weeks saw the world most certainly taken a turn for the worse from a humanitarian point of view. Pictures of the atrocities committed in the Middle East, and indeed the timing, drew immediate parallels with the Yom Kippur War of October 1973, and the oil crisis that followed.

At this point, it is important to note that the movements of capital markets – and short-term impacts on investors – are of trivial importance compared to the loss of life and the immense human suffering the terrorists of Hamas have brought upon the civilian population of the region of Israel and Gaza. Commenting on the potential economic impacts triggered by Hamas’ actions should only be a small side story to the events of the week.

Anyone expecting markets to react adversely in recognition or sympathy will have been – as so many times before – disappointed. Markets react to immediate measurable impacts (Russian gas, for example) and longer-term changes to the status quo. But, as we have written before, human suffering is not part of markets’ pricing parameters and indeed as many commentators remarked last week, capital markets are not known as good predictors of changes to the geopolitical risk framework.

At the beginning of last week, the oil price rallied predictably by around 4% before falling back towards the end of the week and the price move felt somewhat irrelevant following the previous week’s 12% fall. Perhaps this was not overly surprising after all, given the unfolding tragedy seemed to remain confined to Israel and Gaza, rather than spreading to Iran and other Arab states, as many commentators suggested the main destabilisation aim of the terrorists had been. This may have been a contributor to the stability and even upwards trend in equity markets during most of the week. Overall though, and in comparison to historical precedent of stock market reactions to major geopolitical upsets (see the table below), the up-trending of markets seemed somewhat counterintuitive.

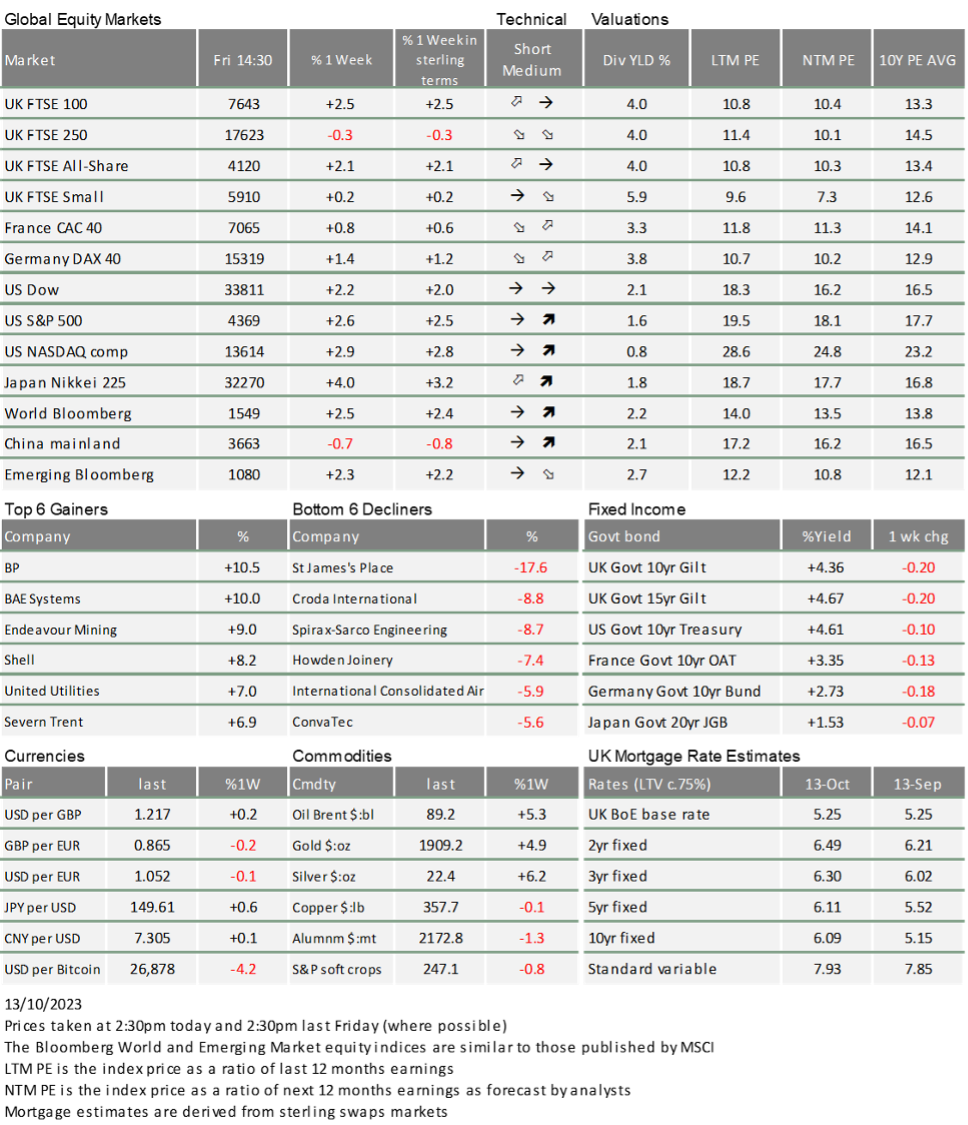

Source: George Smith, LPL Finance, 11 Oct 2023

A more plausible explanation is that beyond the lack of an immediate economic impact as Putin’s invasion of Ukraine had on natural gas supply, in this instance investors made different choices in their search for save haven – or at least less risky – assets. At a time when up-trending bond yields make the usual haven assets of US bonds more at risk to capital losses, the US mega-cap stocks rose as some investors appeared to prefer them to government bonds. Perhaps because they seem to have just as little credit default risk, but better upside potential – maybe even comparable to the characteristics of inflation-linked bonds.

And bonds, which last week were such a problem, have rallied. We made the point then that rises in yields were tightening financial conditions significantly. This week, several members of the US Federal Reserve (Fed) said the same thing, and that this actually reduced the likelihood of further short rate rises. Benchmark US 10-year government bond yields helpfully fell back, at one stage almost to 4.5%. They pushed back up after September’s US inflation numbers on Thursday came out higher than expected, suggestion a slowing of the recent downward inflation trend, but are still below last Friday’s level.

So at the end of last week, which for many felt as paradigm-shifting as the week of the 9/11 attacks, capital markets look as if they have already returned to being driven by the shift parameters we have discussed here over the past weeks. However, it would be wrong to conclude that markets are telling us that risks will remain contained. As said at the beginning, markets have very limited ability to price longer-term changes to the prevailing risk framework from geopolitical action. As the fourth column in the table above also shows, the initial, benign market reaction was in a few cases utterly mistaken, as the long period until recovery is testimony.

The coming days will be crucial in this respect. Should global political forces thwart the terrorists’ intention of seeding short and long-term destabilisation in the wider Middle East, then focus will remain on the wholly unjustifiable human suffering their actions caused. If they succeed, then markets will have second thoughts. For the time being, our thoughts and prayers go out to all that have been affected by the violence and counter-violence, while we also observe that while there are certain parallels to 1973’s Yom Kippur War, oil reserves and regionality of sources 50 years later are on a much more diversified and far more stable footing.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.