Market Update: At least currency markets notice the budget

Rabbit out of hat – retired on inflation grounds, MATT, 6 Mar 2024

At least currency markets notice the budget

Currencies proved to be the one mildly exciting market dynamic in a week otherwise shining more with what did not happen, rather than with what did.

Tight might soon feel tighter

Money supply has been key for stock market growth, so what will the effects be as the US central bank looks to squeeze it?

Returning M&A returns?

As merger and acquisitions pick up speed we examine why market confidence is turning into action, and which sectors and regions will see the most activity.

At least currency markets noticed the budget

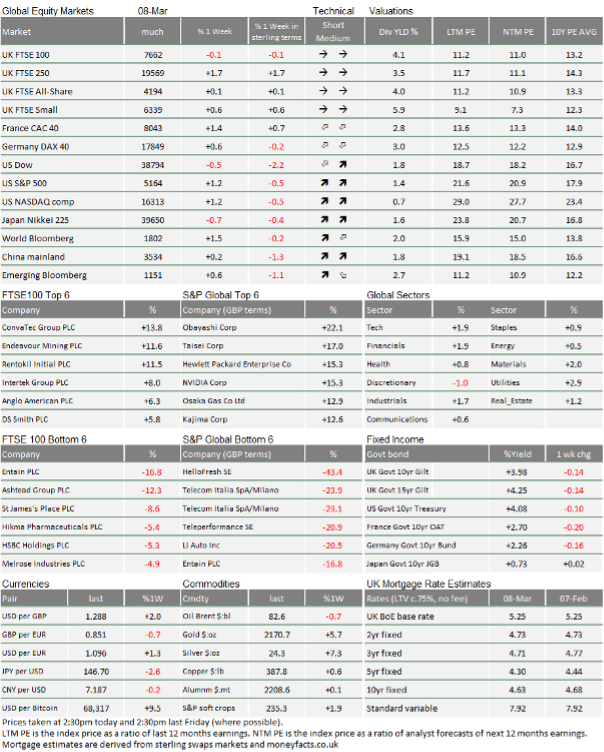

Last week saw global markets showing gains again. The FTSE 100 is a little lower but the US S&P 500 hit another all-time high, driven by renewed interest in megacaps. Bond prices rose and sterling is stronger against the US Dollar. And yet, if you look at our data table, it shows negative equity index returns. So, what is going on?

When Sterling strengthens, it means that, for us, assets priced in other currencies weaken – and Sterling has risen by about 1.5% against the US dollar during last week. That strength may be partly down to the budget.

Jeremy Hunt and Rishi Sunak did not announce a great deal, despite engineering a lot of press interest in the weeks leading up to the budget. The Office of Budget Responsibility did what it should, telling the Chancellor of the Exchequer that he had no room for largesse if he intended to keep to his own rules. To his credit, Hunt took it seriously and gave little away.

The cut to National Insurance Contributions is welcome and marginally improves the growth potential for the economy. The freezing of fuel duties was mildly political and ultimately will be lost on the target voter base. The extra British ISA allowance is seen by most in our industry as an extremely disappointing response to the obvious domestic investment problems; a sop, rather than a step in the right direction.

And yet, even this small offering has been a factor in last week’s Sterling appreciation. There appears to be a growing optimism among foreign investors that domestic Sterling assets offer reasonable returns. And after the previous week’s disappointing performance in UK small caps, the FTSE 250 has handily outperformed the FTSE 100.

Rishi Sunak does not look likely to remain as prime minister, but overseas perceptions about the UK have improved substantially since he acceded to the post, following the Liz Truss economic debacle. Indeed, conversations with contacts abroad revolve around the likelihood of a relatively smooth transition from one centrist government to another, with the current administration doing little to make life too difficult for a new one.

Seen through that lens, the budget was a success. Jeremy Hunt did not do anything to raise the cost of borrowing, for which mortgage holders and the Labour Party will thank him. The Labour Party will probably borrow more to invest if the cost of borrowing is not exorbitant and he has not done anything to change their calculations.

Another factor in Sterling’s appreciation against the US dollar is that the European Central Bank (ECB) left short-term rates unchanged last week. The Euro also rose, though not quite as much as Sterling. There was little in ECB President Christine Lagarde’s post-decision comments to suggest anything other than a rate cut by the Summer. She is much more a political animal than her predecessor, Mario Draghi, and so it is less obvious how much debate is happening within the council. But the markets sense a continued hawkishness and a reluctance to be first among the developed nations in cutting rates. Wage rises are holding them back and the ECB can clearly see that global growth prospects have warmed a little. The February and March inflation data points will be key and we – along with most other investors – expect them to be low enough to warrant an ECB move.

Of course, the reality is that currency moves are not directly linked to the words of central bankers. We might think the ECB was being a little hawkish but the same could be said about the chair of the US Federal Reserve Jerome Powell’s testimony to Congress, in which he also suggested little room to cut rates.

Investors suspect that a cut is closer at hand, amidst less vibrant US economic data. Friday’s release of the February employment report was a case in point. January’s release had been a staggering gain of 353,000 and February’s rise was almost as high at 275,000. However, the data is highly suspect and the revisions keep offsetting the gains. Revisions to December and January data have removed 167,000 jobs from the initial reports, with January being marked back to 229,000. That’s much closer to what the market had expected.

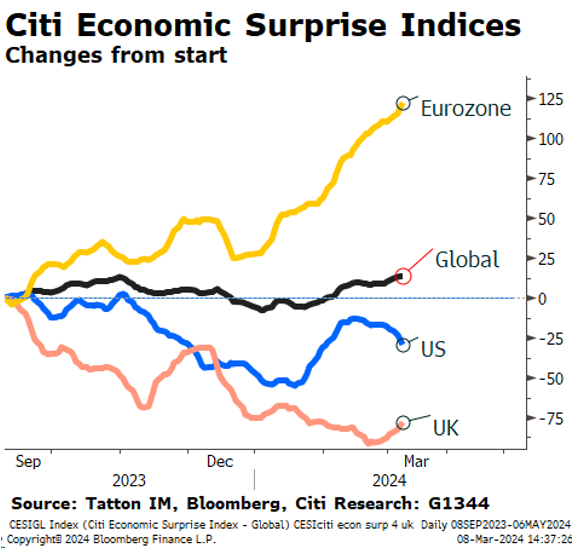

Data from the US is not bad, but it is now less surprising in its strength. We use Citi Research’s Economic Surprise Indices to track how regions are performing relative to consensus and the chart further down shows the US trailing off compared to the rest of the world.

Europe has been in a clear recession over the past six months, with the UK almost as weak, whereas the US was very strong in the Autumn, and has been seen as strong throughout. However, the chart shows that the US has not beaten the admittedly lofty expectations for a while, and is now underperforming them. In the UK, we have seen disappointment but our data has begun to be less disappointing. Meanwhile, the Eurozone has actually been rising compared to economist expectations. Even though data can be soft, a region’s markets and currency can perform well if the data is better than more downbeat expectations.

Because we write every week, there is an inevitable tendency for us to focus on the things that change. We do think that the US dollar’s softness is noteworthy. However, while the shifts in currency may mark a change in trend, they are not especially large. Indeed, what is most notable is the lack of change across many markets – bonds, equities, currencies and commodities. Volatility has declined to the levels seen before the pandemic and is running below that level in a number of cases. Low volatility is often associated with markets that have strong savings inflow and that also goes with expensive valuations. That appears to be the case now, with low credit spreads in bond markets and relatively high price-to-earnings ratios on stocks (after adjusting for the rise in bond yields since 2022).

High valuations can be seen as signalling investor expectations of reasonably strong and consistent growth. They also tend to go hand-in-hand with periods of mild capital gains rather than strong ones. The outlook remains generally beneficial, but we are likely to see a lot of weeks similar to last one; small gains for investors and thankfully without much drama.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.